Whales just offloaded $1.2B, but MicroStrategy bought $786M more!

$500B liquidated in 24hrs while Deutsche Telekom entering mining

Here are 6 indicators about whales dumping and institutions loading👇🧵

Image credits to @Cryptollica

Macro Pulse Update 22.06.2024, covering the following topics:

1️⃣ Macro events for the week

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ China Spotlight

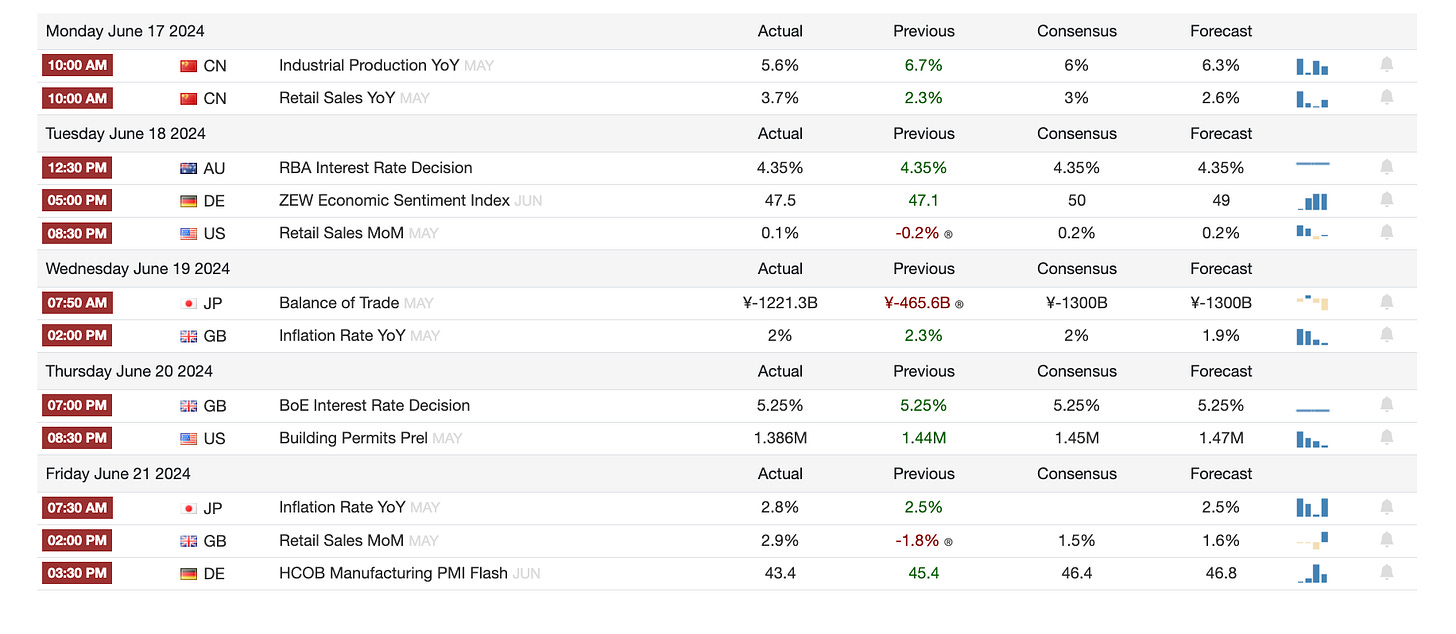

1️⃣ Macro events for the week

Last Week

Next Week

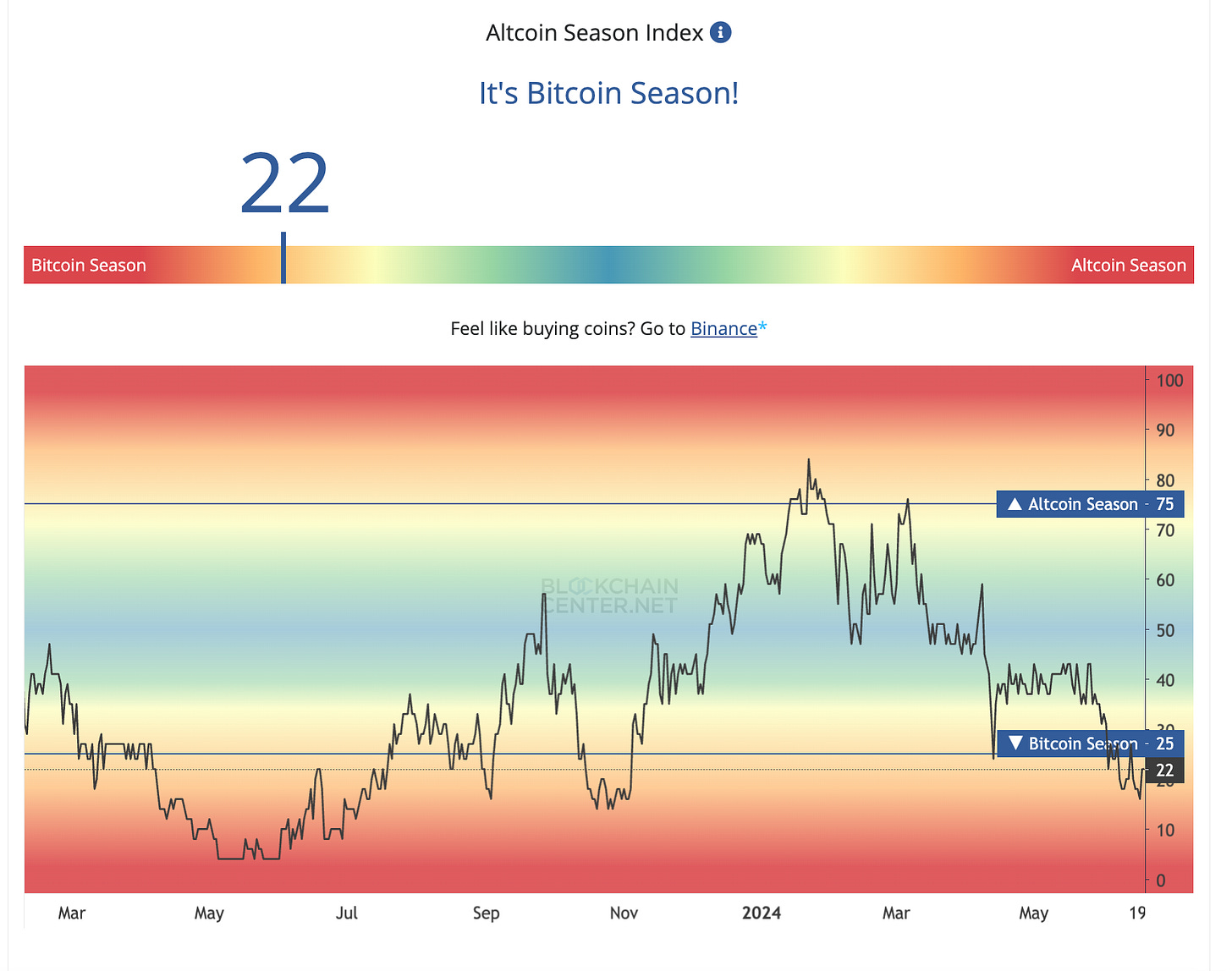

2️⃣ Bitcoin Buzz Indicator

Crypto Market Updates

SEC Affirms Ethereum as Commodity, ETH Price Surges

Kraken Faces $3 Million Bug Exploit, Recovers Funds

LayerZero Launches ZRO Token with Proof-of-Donation Airdrop

zkSync Token Launch Faces Trading and Network Challenges

Regulatory and Legal Developments

CFTC Investigates Jump Trading's Crypto Activities

Ripple Faces SEC Challenges, Plans Stablecoin Launch

Financial Services and Investments

Standard Chartered to Launch Spot Bitcoin and Ethereum Trading Desk

3iQ Applies for North America's First Solana ETP

Ethena Labs Introduces New Tokenomics Rule

Binance Navigates Regulatory Fines, Expands Services

Crypto Platforms and Projects

Bitwise Ethereum ETF Ad Now an NFT

Doodles Shifts Stoodio Platform to Coinbase's Base Network

Azuki Appoints New COO to Expand Beyond NFTs

Konami Launches "Resella" NFT Solution on Avalanche

Altcoins

Crypto startup funding eclipsed $100B.

The crypto sector secured $317M in venture capital deals in early June.

A new South Korean law required exchanges to review token listings regularly.

Waka Flocka Flame's token launch faced insider trading allegations.

Soaring Xai adoption propelled L2 and L3 TVL to all-time highs.

Rocket Pool (RPL) experienced a high-volume rally.

Solana’s Raydium DEX displaced Uniswap as a leading activity hub.

Tether introduced its new gold-backed digital asset called Alloy.

Crypto chief bid SEC farewell after 9 years of service.

Malaysia tightened the noose on crypto taxation with a nationwide initiative.

TON Blockchain’s TVL doubled in three weeks, reaching a record high.

Velodrome (VELO) price increased as a US lawmaker disclosed a stake.

RISC Zero launched ZkVM 1.0 for DApp development.

FTX debtors sought SBF’s seized assets, customers filed a counterclaim.

Uphold delisted several stablecoins ahead of EU’s crypto regulation.

Aave’s parent firm Avara sought $50M for Lens Protocol, the token plunged 8%.

Transak listed Paypal’s PYUSD for easier crypto access.

Harbour partnered with Aleph Zero to launch Magic Ramp.

Renzo capitalized on the restaking frenzy to raise $17M from Galaxy, Brevan Howard.

Cosmos Hub (ATOM) launched a new cross-chain protocol dubbed Valence.

Fox, Time used blockchain to combat fake news.

Ronin launched zkEVM to enhance blockchain gaming.

Sonic secured $12 million to boost Solana’s gaming ecosystem.

Brazil’s tax authority called on foreign crypto exchanges for information.

USDC issuer launched Circle Credits to combat AWS dominance.

Helium Mobile’s developer licensed its tech stack.

The crypto community backed Tornado Cash devs with a $2.3M legal fund.

Mode integrated Chainlink CCIP as a cross-chain interoperability standard.

dYdX got isolated margin, isolated markets, and Raydium support in its latest upgrade.

Sandbox invested in meme coins like PEPE, SHIB, and DOGE to strengthen Web3 influence.

The Montenegrin PM’s hidden investment in Terraform Labs was revealed.

SynFutures TVL hit $62 million amid Base expansion.

Binance Labs invested in Rango, a cross-chain DEX aggregator.

Frankfurt Exchange welcomed the first HBAR ETP by Valour Inc.

Bitstamp listed BONK amidst Robinhood's acquisition plans.

DeFi Technologies slammed a report that tanked its stock 28%.

Manta Network launched a $10 million meme grant for ecosystem growth.

Fuse Network launched a second airdrop with 2.5 million FUSE tokens.

Io.net explored new partnerships with OpSec.

Singapore flagged digital payment tokens as high-risk in the AML landscape.

EigenLayer launched claims for the second phase of Season 1 airdrop.

Stablecoin issuers became the 18th largest holder of U.S. debt.

Italy increased surveillance of the crypto market with fines as high as 5M euros.

BNB Chain activated a hard fork and reduced fees.

Japanese exchange BitFlyer acquired FTX Japan.

Donald Trump’s former advisor cleared the air about Trump's involvement with DJT Meme Coin.

Blast readied to airdrop tokens next week.

1inch partnered with Blockaid to combat DeFi fraud and cyber threats.

Polkadot proposed to slash unstaking time to 2 days.

Worldcoin token surged after Ecuador expansion and Kenya probe closure.

Floki Inu smart money staked 14 billion tokens.

Elon Musk confirmed his son 'Lil X' still holds Dogecoin.

Modular blockchain Particle Network raised $15 million in a token round.

A new AI portfolio management tool came to PancakeSwap.

FCA busted suspects in a $1.2B illegal crypto asset business.

Arthur Hayes bought Pendle.

Fantom launched a $120 million crypto fund to support migration to the new Sonic blockchain.

Arbitrum's daily revenue soared to a record $3.4 million amid LayerZero token claims.

Cosmos DEX Osmosis' DAO voted to adopt a 'fee-free' bitcoin bridge via Nomic.

Winklevoss Twins donated $2 million in BTC to Donald Trump's campaign.

3️⃣ Market overview

Major liquidations, new entrants into Bitcoin mining, regulatory developments, and issues with a newly launched memecoin. It touches on market volatility, institutional involvement, regulatory scrutiny, and the ongoing evolution of the crypto ecosystem.

Market Volatility and Liquidations:

Nearly $500 million in crypto positions were liquidated within 24 hours, primarily affecting long positions.

This coincided with price drops in major cryptocurrencies like Bitcoin and Ethereum.

Bitcoin whales sold off approximately $1.2 billion over two weeks, indicating a shift in market sentiment.

Institutional Involvement in Crypto:

Deutsche Telekom, a major telecommunications company, is planning to enter Bitcoin mining.

This move could potentially increase network security but also intensify competition for smaller miners.

MicroStrategy purchased $786 million in Bitcoin, showing continued institutional interest despite market fluctuations.

Regulatory Developments:

The SEC closed its investigation into Ethereum 2.0, which Consensys claimed as a victory for the Ethereum network.

The Financial Stability Board (FSB) is increasing focus on stablecoin challenges in emerging economies.

There's ongoing debate among G7 and G20 nations regarding stablecoin regulation.

Crypto Mining Industry Dynamics:

Some Bitcoin miners are pivoting to AI computing following the halving event, which reduced mining rewards.

Deutsche Telekom's entry into Bitcoin mining highlights the growing interest from large corporations in this sector.

Memecoins and Market Risks:

The launch of FLOCKA, a memecoin by rapper Waka Flocka Flame, faced scrutiny due to suspicious wallet activity and timing issues.

This incident underscores the risks and potential for manipulation in the memecoin market.

Broader Crypto Ecosystem:

The document touches on various aspects of the crypto world, from market movements and mining to regulation and new token launches, highlighting the complex and interconnected nature of the cryptocurrency ecosystem.

4️⃣ Key Economic Metrics

Financial markets have shown volatility in response to economic data and central bank decisions. Investor expectations for Fed rate cuts have fluctuated based on conflicting economic indicators and Fed communications.

🟢 US Dollar Dominance:

Despite some pessimism, the US dollar remains the dominant global currency.

The share of central bank reserves held in dollars has declined from 70% in 2000 to about 60% today, but this is mainly due to actions by a few countries (Switzerland, Russia, China, India, and Turkey).

The global appetite for Chinese renminbi has diminished due to economic outlook and geopolitical concerns.

🟢 ECB Monetary Policy:

The European Central Bank (ECB) cut interest rates for the first time since 2019, moving ahead of the Federal Reserve.

Inflation in the Eurozone is expected to remain above the 2% target for the remainder of the year, suggesting future rate cuts will be gradual.

🟢 US Inflation and Federal Reserve Policy:

US inflation in May was lower than anticipated, with core inflation hitting a three-year low.

The Federal Reserve maintained a hawkish stance despite favorable inflation news, projecting only one rate cut in 2024.

Services inflation, especially in the shelter component, remains a concern.

🟢 US Labor Market:

The US job market remains tight, with employment growing faster than expected in May.

Wage growth continues to outpace inflation, which may influence Federal Reserve decisions.

🟢 Global Economic Dynamics:

The ECB's rate cut before the Fed could potentially depress global currency values and boost inflation.

There's growing concern about the size and trajectory of the US budget deficit, though investors remain confident in US government debt.

5️⃣ China Spotlight🔴

Not all G7 leaders agree on the approach to China. For instance, Germany's economics minister expressed caution about using tariffs, considering them a last resort. German industry is particularly concerned about potential retaliation from China in response to EU trade restrictions. The G7 summit's focus on China reflects ongoing concerns about inflation, economic growth, and geopolitical crises, reminiscent of issues that led to the first G7 summit 49 years ago.

US Focus and Geopolitical Concerns:

The United States particularly emphasized issues related to Russia, Ukraine, and US policy toward China.

The G7 summit in Italy primarily focused on geopolitical issues, with China and Russia being central topics.

The G7 identified China's non-military support for Russia as a "long-term threat" to European democracy.

Shifting Economic Relations:

There's a trend toward reducing economic interactions between G7 nations and China.

Global companies are increasingly wary of geopolitical risks associated with China, leading to shifts in production and investment strategies.

European Perspective:

Mario Draghi, former ECB President, advocated for a less "passive" approach by Europe toward China's economic policies.

Draghi suggested the potential use of tariffs and subsidies to protect European interests, marking a shift from traditional market-based approaches.

Competitiveness Concerns:

There's growing concern about China's economic practices, including subsidies and trade protection, potentially impacting employment in G7 economies.

The EU has tasked Draghi with preparing a report on restoring European competitiveness in the face of challenges from both the US and China.