Altcoin market cap chart looking primed for massive Q4 altseason.

Giving major 2020 vibes.

Here is all that you need to know the the incoming bull run👇🧵

Macro Pulse Update 24.08.2024, covering the following topics:

1️⃣ Macro events for the week

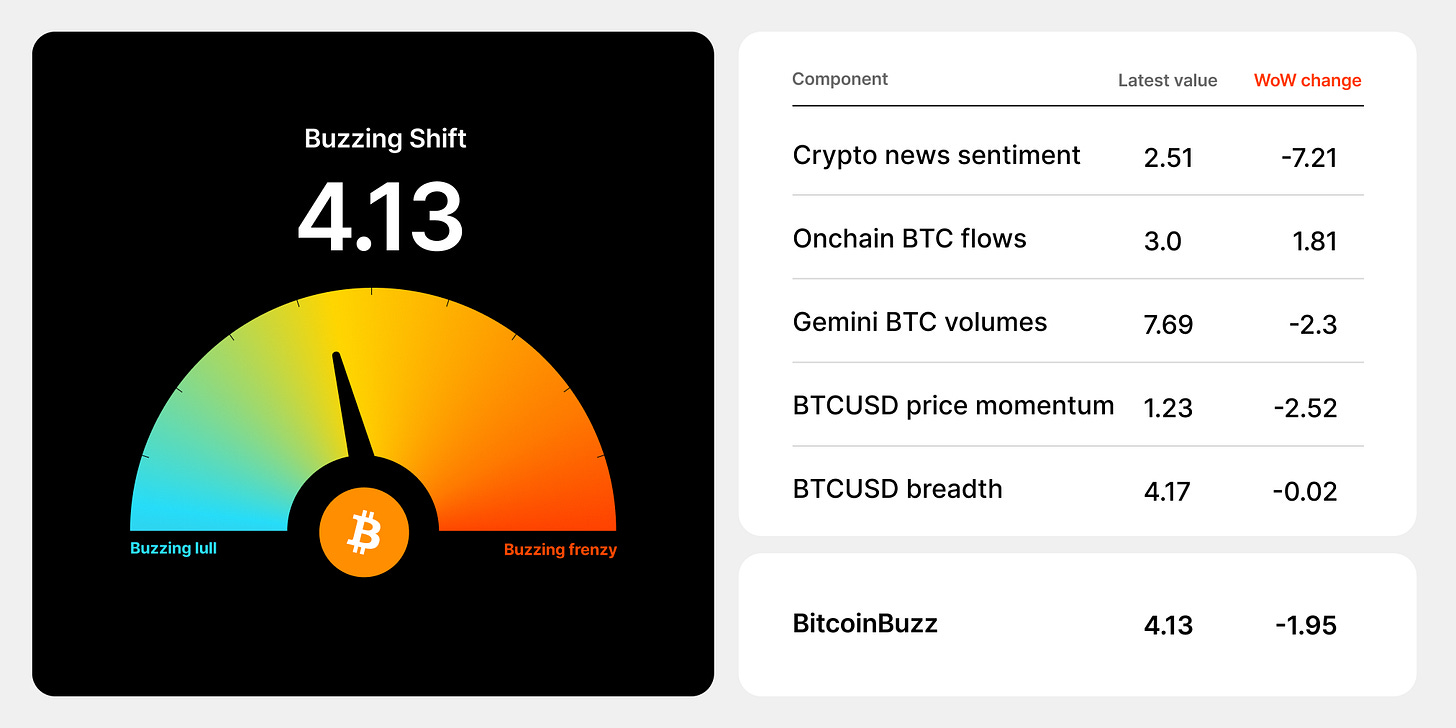

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ China Spotlight

1️⃣ Macro events for the week

Last week

Next week

2️⃣ Bitcoin Buzz Indicator

Market Surges and Blockchain Developments

Tron Surpasses Ethereum and Solana in Daily Revenue Surge

Grayscale Launches Avalanche Trust for Accredited Investors

Sony to Launch Ethereum Layer-2 Blockchain Soneium

Regulatory and Legal Updates

Solana ETF Plans Stalled Amid Regulatory Scrutiny

Trump's Pro-Crypto Stance Boosts Support, Fuels Meme Coins

Terraform Labs Faces Pivotal Bankruptcy Hearing

Crypto Exchange and Platform Strategies

Coinbase Announces Strategic Moves with Polygon and Solana

Justin Sun Defends Bitcoin Removal from USDD Collateral

WazirX to Gradually Resume Rupee Withdrawals Post-Hack

Mergers, Acquisitions, and Market Trends

Bitwise Acquires ETC Group, Expands European Presence

Sotheby’s CryptoPunk Sale Reflects NFT Market Downturn

Innovative Use Cases and Partnerships

Federal Authorities Use NFTs to Inform CluCoin Scam Victims

Stepn Go Partners with G-Shock to Release NFT Sneakers

ME Foundation Introduces ME Token for Cross-Chain Trading

Altcoins

Prometheum labeled Uniswap and Arbitrum tokens as securities.

Tether introduced a Dirham stablecoin with UAE partners.

Ledn secured a $50M Bitcoin-backed syndicated loan.

Gate.io launched a $100M innovation fund in Abu Dhabi.

Telegram game Catizen partnered with HashKey Group for an airdrop.

ParaSwap launched an intent-based protocol to reduce MEV attacks.

Messari reported Covalent rebranding, AI modular data, and CXT buy-back.

EigenLayer’s EigenDA reduced data prices by 10x.

BadgerDAO founder proposed an Ethereum Layer-2 using Bitcoin as gas.

Curve’s founder requested 21M CRV for development funding.

Solana DeFi users were targeted by a malicious Bull Checker extension.

SushiSwap added DCA and limit orders using Orbs' technology.

Linea welcomed Status as a contributor to its L2 rollup project.

Galxe launched the alpha mainnet of its Layer 1 Gravity chain.

Clearpool unveiled an RWA yield chain on Optimism.

MangoDAO’s SEC settlement faced scrutiny for investor impact.

Drift Predictions Market BET attracted $3M in liquidity at launch.

Starknet sought community approval to launch STRK staking.

Flamingo Finance detailed recovery efforts after a $5M Poly Network exploit.

Binance blocked $2.4B in potential crypto scams in 2024.

Space and Time rebranded Cenit Finance as Space and Tokens.

Xai tapped Gauntlet for DAO governance and treasury strategy.

DePIN Media Network PTK launched on Coinbase’s Base for movie transparency.

Aave launched on ZKsync-powered Era mainnet to maximize its potential.

McDonald's Instagram account was hacked to promote Solana token Grimace.

YieldNest built a liquid restaking token on EigenLayer.

DEXScreener earned over $1M in weekly fees.

Binance and CZ faced a new lawsuit over alleged laundering.

The notorious MEV bot jaredfromsubway returned with new attacks.

Binance added DOGS to Launchpool; airdrop delayed due to 8M requests.

Blast Network saw a severe drop in TVL and user activity.

SafePal Wallet launched a new staking Dapp called SFPlus.

Nym released NymVPN beta featuring zk-nym registration.

ENS Labs teamed with Dentity to advance real-world credentials.

Aptos Foundation partnered with a Web3 streaming platform.

ZKsync Era's daily revenue plunged post-airdrop, showing L2 market struggles.

Conflux partnered with China Mobile’s Migu to launch blockchain video ringtones.

A crypto whale lost $55.47M in DAI to a phishing attack.

Anchorage Digital launched a PYUSD reward program after reaching $1B.

Near Protocol deployed the Nightshade 2.0 upgrade on mainnet.

TON Society launched to deepen community-based decentralization.

Binance founder CZ moved to a halfway house, still not free.

Floki DAO invested in a new meme coin as Binance extended airdrop support.

Conduit launched a marketplace to boost rollup scalability.

Fetch.ai opened a new AI lab in San Francisco, committing $10M annually.

SEC opposed Richard Heart's motion to dismiss the Hex case.

Return Entertainment used Aethir’s DePIN for smart TV gaming.

Worldcoin faced scrutiny in Colombia for alleged privacy violations.

China extradited a $14B crypto pyramid scheme mastermind from Thailand.

Kraken blamed unclear regulations for a court loss in Australia.

Turkish authorities arrested a crypto founder for a $4B pyramid scheme.

DWF Labs dumped 12.5M Curve DAO tokens at a 17% loss.

MakerDAO planned to convert 1 MKR into 24,000 NGT tokens.

Tokenized RWA market hit $10B, attracting major institutions.

AAVE whale buying led to 45% outperformance over the broader crypto market.

Binance Futures announced a SYS 50x leverage perpetual contract.

Binance supported the Frontier token swap and rebranding.

Across Protocol surged 14% as Coinbase announced ACX listing.

Binance announced futures listing for Voxies, causing a 75% price surge.

Coinbase launched perpetual futures for Render, Saga, and Threshold.

Fabric raised $33M for a new data privacy chip.

YeagerAI secured $7.5M in a seed round led by North Island Ventures.

Soulbound raised $4M for Web3 social gaming.

BSX raised $6.2M ahead of its token launch.

A16z Crypto led an $80M Series B for Story Protocol.

A16z led a massive funding round, valuing PIP Labs over $2B.

Paradigm led a $7.5M seed round for Sorella Labs to solve MEV issues.

Binance Labs invested in a Bitcoin yield network, Corn.

SatLayer raised $8M in pre-seed funding for its Bitcoin restaking platform.

3️⃣ Market overview

Harris Adviser Signals Crypto Support: Kamala Harris’s policy adviser, Brian Nelson, stated at a Bloomberg roundtable that Harris will advocate for policies fostering the growth of crypto and other emerging technologies. This marks the first public acknowledgment from Harris’s camp on digital assets, signaling a potential shift in the political landscape regarding crypto regulation.

Spot Bitcoin ETF Holdings Surge to $4.7 Billion: Goldman Sachs and Morgan Stanley have significantly increased their investments in spot Bitcoin ETFs, particularly BlackRock’s iShares Bitcoin Trust. This massive $4.7 billion allocation highlights growing institutional confidence in Bitcoin as a mainstream financial asset.

Bitcoin Breaks $60K Amid High Volatility: Bitcoin's price surpassed $60,000 this week, driven by market speculation around the upcoming Federal Reserve interest rate decision. The market remains cautious, but the surge suggests strong bullish sentiment, despite the volatility.

Tether Launches USDT on Aptos Blockchain: Tether has expanded its USDT stablecoin to the Aptos blockchain, offering lower transaction costs for users. This move coincides with Circle’s announcement that its USDC stablecoin will soon support tap-to-pay functionality, intensifying the competition in the stablecoin market.

Massive Bitcoin Options Bets Linked to US Elections: Traders have invested over $345 million in Bitcoin options tied to the upcoming US elections, with a significant portion in call options. This indicates widespread speculation that Bitcoin could reach record highs around the election period.

SEC Rejects Solana ETF Filings: The SEC has rejected Cboe BZX’s filings for two proposed spot Solana ETFs, citing concerns over Solana’s classification as a security. This rejection has put a halt to the approval process, with other issuers like VanEck still pursuing similar products.

4️⃣ Key Economic Metrics

🟢 The Federal Reserve is likely to implement its first rate cut since the early COVID-19 crisis at its September meeting. The July meeting minutes revealed that while rates were held steady, the majority of officials believe easing would be appropriate if economic data aligns with expectations. Inflation concerns have lessened, but the labor market shows signs of strain, prompting markets to fully price in a September rate cut.

U.S. Stocks Rise as Market Awaits Fed’s Next Move: U.S. stocks closed higher on Wednesday, driven by a sharp downward revision in payroll data and the Fed’s July meeting minutes, which bolstered the case for a September rate cut. The Dow, S&P 500, and Nasdaq all posted gains, with consumer discretionary shares leading the way. Target’s stock surged after raising its profit forecast, while Macy’s shares dropped following a lowered sales outlook. Trading volume was lower than average, indicating cautious investor sentiment.

Unwinding of the Massive Japanese Yen Carry Trade: The unwinding of the $2.2 trillion yen carry trade has significantly contributed to recent global market volatility.

This strategy, fueled by low Japanese interest rates, saw investors borrow yen to invest in higher-yielding assets abroad.

As the Bank of Japan signaled potential rate hikes, investors began unwinding these positions, leading to yen appreciation and global equity market declines.

Estimates suggest half of the carry trade has already been unwound, with further actions uncertain.

Impact on U.S. Tech Stocks and Global Wealth: A substantial portion of the yen carry trade was tied to investments in U.S. tech stocks, which account for about 20% of global equity valuations.

The unwinding of these positions has caused significant volatility in tech stocks, impacting global wealth.

Despite this, global equity markets have largely recovered, although bond yields have fallen due to shifting expectations for Federal Reserve policy.

🟢 The combination of easing inflation, robust retail sales, and improved small business sentiment has boosted equity prices and modestly raised bond yields. Investors are increasingly confident in a "soft landing" for the U.S. economy, with a rate cut by the Federal Reserve still expected, though likely more modest than initially anticipated.

U.S. Inflation Nears Fed Target: The Federal Reserve's target inflation rate of 2% has nearly been achieved

Consumer Price Index (CPI) rising 2.9% year-over-year in July, marking the lowest level since March 2021.

Core inflation, excluding volatile food and energy prices, is also easing, suggesting the Fed may soon cut interest rates.

However, the futures market's probability of a 50-basis-point cut in September dropped slightly after the CPI release.

Mixed Signals from U.S. Retail Sales and Industrial Production: U.S. retail sales surged by 1% in July

Driven primarily by a 3.6% increase in auto sales.

Excluding autos, sales rose by a more modest 0.4%.

Meanwhile, industrial production fell 0.6%, partly due to a hurricane, but small business optimism reached its highest level since February 2022, indicating potential resilience in the economy.

5️⃣ China Spotlight🔴

While the government is focusing on boosting investment in technology and clean energy, domestic demand remains a key obstacle to a full economic recovery. The weak consumer sentiment and declining property market continue to weigh heavily on overall economic performance.

Property Market Struggles: New home prices fell for the 14th consecutive month, down 8% year-over-year, with new home sales dropping 25.9%. Unsold home inventory hit its highest level since 2016.

Sluggish Retail Sales: Retail sales grew by only 2.7% year-over-year, with significant declines in vehicle (-4.9%) and appliance (-2.4%) sales, reflecting weak consumer demand.

Industrial Production Slows: Industrial production rose 5.1%, the slowest since March, though sectors like non-automotive transportation (+12.7%) and IT/telecoms (+14.3%) showed strength.

Shift in Investment: Fixed asset investment increased by 3.6%, driven by manufacturing (+9.3%) and utilities (+23.8%), but property investment dropped 10.2%.

Recovery Challenges: Weak domestic demand and a struggling property market remain significant obstacles to China’s economic recovery, despite government efforts to boost technology and clean energy investment.