We are in a “Goldilocks” senario

$BTC kissed $38k, $ETH held up at $2.2k

I uncover 4 factors that will lead us into economic recovery👇🧵

Macro Pulse Update 25.11.2023, covering the following topics:

1️⃣ Macro events for the week

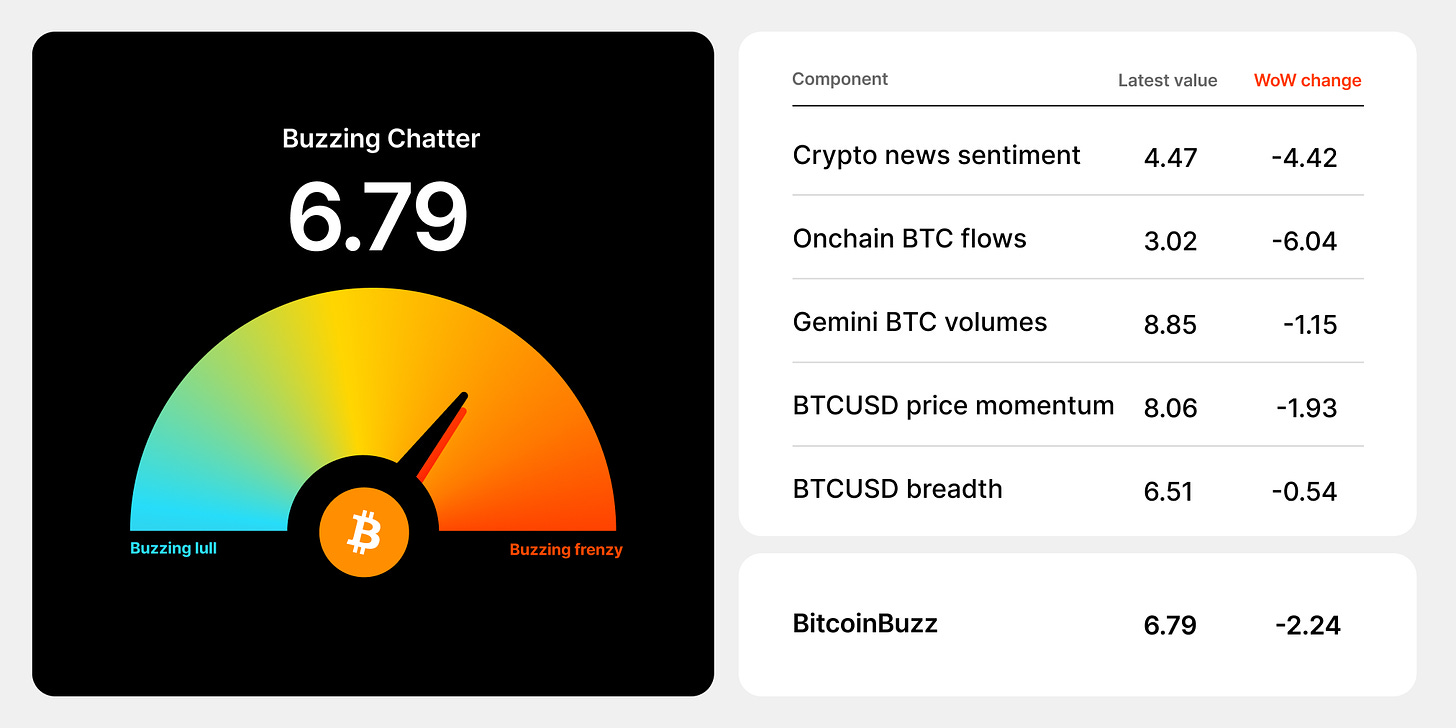

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ China Spotlight

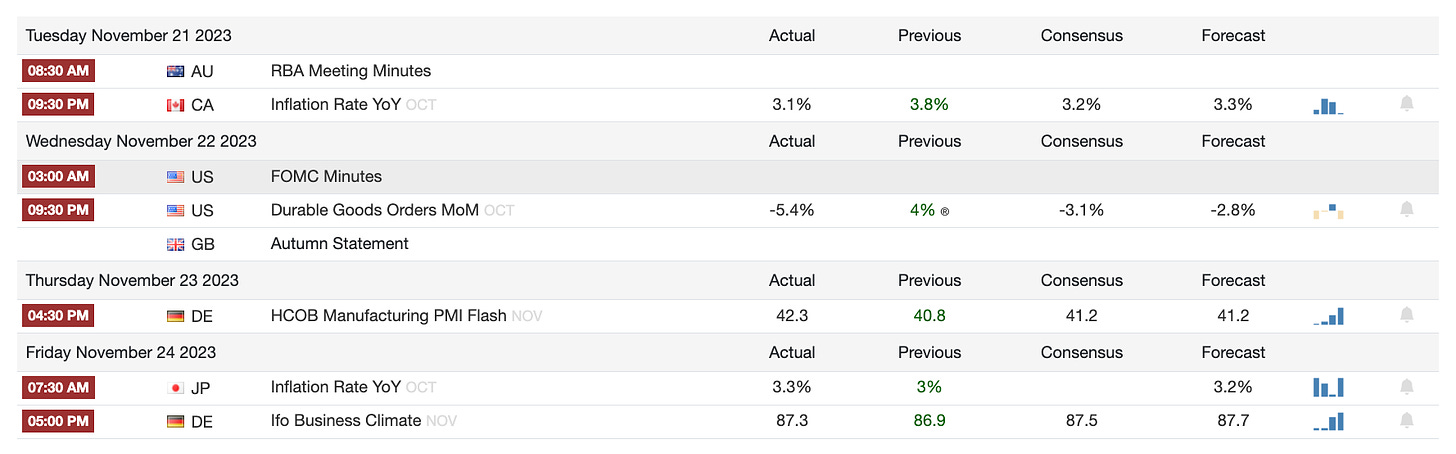

1️⃣ Macro events for the week

Last Week

Next week

2️⃣ Bitcoin Buzz Indicator

Regulatory and Compliance Issues

Binance Settles for $4.3 Billion Over Violations

SEC Sues Kraken Over Unlicensed Securities Trades

Tether Freezes $225 Million in USDT for Legal Issues

Security Breaches and Crypto Heists

Heco Chain Bridge Hack Leads to $97 Million Loss

KyberSwap Suffers $46.5 Million Crypto Heist

dYdX Loses $9 Million in Insurance Fund Attack

Legal Battles and Extraditions

Legal Battles Surround Terraform Labs and Do Kwon

Token and Exchange Dynamics

Worldcoin Market Shifts Amid OpenAI Leadership Changes

FTT Token Fluctuates Amid FTX and OpenAI Dynamics

BLUR Token Surges 88% Amidst Market Changes

Repayment and Settlement Announcements

Mt. Gox to Repay Creditors in Massive Settlement

Blockchain and Network Growth

Avalanche's C-Chain Hits Transaction Record Highs

NFT Market Developments

Cool Cats NFT Joins Macy's Thanksgiving Parade

Altcoins

Poloniex confirmed hacker's identity, offered final $10M bounty.

Osaka Digital Exchange in Japan set to initiate digital securities trading.

Mastercard and AI firm Feedzai partnered to combat crypto fraud.

Atomic Wallet sought dismissal of $100M hack lawsuit, citing no U.S. connections.

AI Tokens surged on Musk’s X Corp's xAI shareholding and OpenAI incident.

Kronos Research suspended trading during $25M API key hack probe.

DYDX V3 faced targeted attack, YFI price manipulation allegations, and criticism for centralized response.

SingularityNET and DFINITY Foundation collaborated for AI models on smart contracts.

Pyth Token launched with nearly $500M valuation, airdropped to 90,000 wallets.

Celsius's recovery hindered by SEC's request for more asset details.

Apple faced lawsuit over restricting crypto in P2P payments.

dWallet Labs identified validator flaw risking $1B in crypto.

Fantom Foundation awarded $1.7M bounty for averting $170M loss.

Bittrex announced closure by Dec 4, advised user withdrawals.

Aragon DAO voted to fund legal action against its founders.

PancakeSwap suggested veCAKE launch to enhance governance and liquidity.

Circle introduced 'bridged USDC standard' for new network deployment.

Lugano city integrated Polygon into its crypto payment system.

Genesis filed $689M lawsuit against Gemini for alleged misconduct.

UNI's price surged 20% as Uniswap Governance sought increased voting power; DeFi market value reached 14-month peak.

Raiffeisen Bank in Austria planned crypto trading for retail customers.

Singapore's central bank issued regulations to curb crypto speculation.

Lido's node operator InfStones decided to rotate validator keys post-vulnerability.

Dutch exchange Bitvavo received authorization to operate in France.

UK investment funds approved for tokenization.

3️⃣ Market overview

US jobless claims have declined more than expected, signaling a gradual slowing in the labor market as higher interest rates reduce economic demand. However, the market remains strong. This aligns with the Fed's view of easing conditions but not enough to consider rate cuts soon.

Business spending struggling in early Q4, indicating broader economic slowdown. Rate cut potentially anticipated by 2024 amidst mixed inflation signals.

Israel-Hamas hostage deal confirmed with ceasefire and aid influx into Gaza. Seen as critical for reducing tensions despite complexities.

US stocks rallied, with Nasdaq, DJIA and S&P rising on Thanksgiving market momentum. Nvidia fell 2.46% on China sales concerns from export rules. Microsoft rose 1.28% on Altman's OpenAI return.

UK Treasury announced smaller bond sales target cut for 2022 in Hunt's Autumn Statement including £20B tax reduction, benefiting gilts.

4️⃣ Key Economic Metrics

🟢 October inflation report contained incrementally positive surprises that point to an improving inflation backdrop. Markets are increasingly pricing in an eventual Fed pivot, though the timing remains uncertain.

Both headline and core inflation decelerated more than expected in October. Headline CPI rose 3.2% year-over-year, while core CPI rose 4% - the lowest rates since September 2021.

There was particularly notable cooling in food, energy, durable goods, and nondurable goods prices. Food inflation hit a 17-month low and energy prices actually declined year-over-year.

Shelter inflation remains relatively high at 6.7%, but this still marked a decline from the March peak of 8.3%. Shelter inflation should continue to cool given lagging home price data.

Inflation now seems to be concentrated in a relatively narrow part of the economy - primarily services outside of shelter. This bodes well for further disinflation ahead.

Investors responded positively - equity markets rallied, bond yields declined, and the dollar weakened. This reflects optimism that the Fed may not need to tighten as aggressively as feared.

The main risk is still energy prices - a Middle East supply disruption could reverse the progress. Barring that, expectations for Fed policy loosening may accelerate, possibly beginning in 2H 2024.

🟡 While consumer spending remains relatively healthy, a moderate near-term slowdown is underway and poses risks if it becomes more severe. Moderating retail sales growth was expected but bears close watching going into 2023.

Retail sales fell slightly (0.1%) in October, dragged down primarily by weak auto, furniture, and home improvement sales. This indicates some pullback in consumer demand, especially for big-ticket durable items.

However, the slowdown is not entirely surprising given high inflation, rising interest rates, the end of stimulus checks, and other headwinds facing consumers. It does not necessarily signal an imminent recession.

Consumer spending is still being supported by a strong job market, savings cushion, and spending shifts towards services. But overall growth is expected to moderate.

Retailers appear to be bracing for a more challenging holiday season by cutting back on seasonal hiring. This could negatively impact lower-wage consumer spending if job growth slows.

Inventory issues could also hurt retailers if consumer spending decelerates further. About two-thirds of major retailers have relatively low inventory turnover, indicating potential profit squeezes.

The slowing of both consumer spending and low-wage job/wage growth will help ease inflationary pressures but also poses risks of an economic slowdown if concentrated in consumer-sensitive sectors.

🟢 Investors perceive the slight jobs cooldown as a "goldilocks" scenario - preserving the health of the economy while also helping pave the way for lower inflation and interest rates ahead. The markets are reacting optimistically to this evidence of an economic soft landing emerging.

Indicators of the US job market are showing some signs of weakening - namely an increase in initial jobless claims and continuing unemployment benefits. However, the job market remains relatively strong historically.

Investors welcomed this news of a slight jobs cooldown, as it suggests the Fed may not need to raise interest rates as aggressively going forward.

Falling bond yields and inflation expectations (measured by the 5-year breakeven rate) reflect optimism that inflationary pressures are abating amidst an economic slowdown.

The initial spark in inflation expectations following the Gaza-Israel conflict has seemingly reversed, aided by declining oil prices and most recent inflation data.

5️⃣ China Spotlight🟢

Consumer and industrial metrics are recovering gradually in China but ongoing housing and investment weakness along with risks of new capacity gluts in key industries present structural drags likely to keep growth muted relative to history over the medium term.

Targeted stimulus may help at the margins but broader reforms would likely be needed to put growth on a sustainably stronger footing.

Retail sales and industrial production showed better-than-expected improvements in October, suggesting the economy's modest recovery is continuing. However, growth remains below historical trends.

Investment, especially in the property sector, remains very weak as housing markets continue to face oversupply issues and falling prices. This is dampening consumer wealth and spending.

The government is providing some monetary and fiscal stimulus, but conditions in the critical property sector are expected to keep weighing on broader economic activity for some time.

There are signs of excess capacity emerging in certain strategic sectors like electric vehicles, where state investment and policies aimed at building global market share are not yet matched by domestic demand. This could spark trade tensions going forward.

Twitter: https://twitter.com/arndxt_xo/status/1728370960343122046

As always - great overview ser 👏🏻