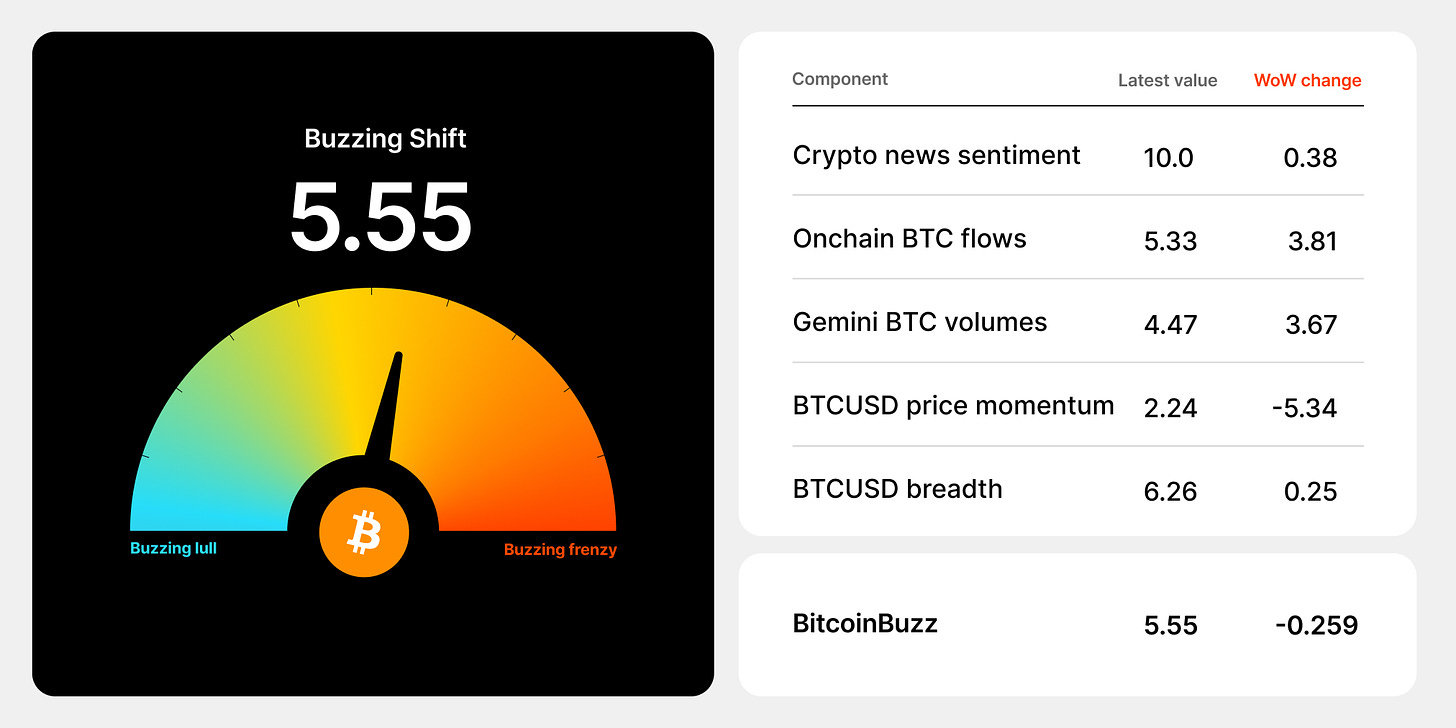

Alt index in monthly bull flag

In hindsight it will be so obvious

3 indicators pointing towards a money printer 👇🧵

Macro Pulse Update 28.10.2024, covering the following topics:

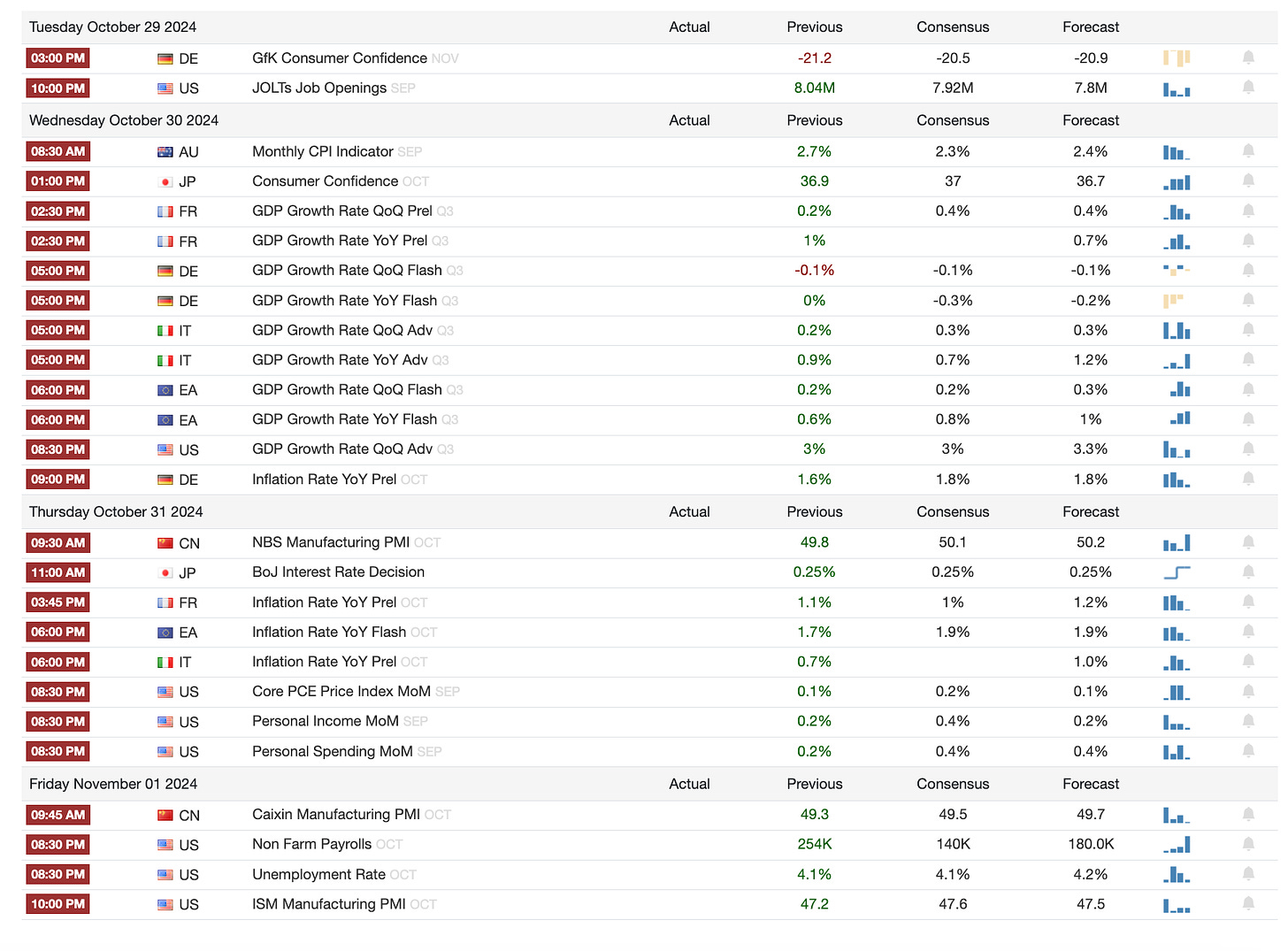

1️⃣ Macro events for the week

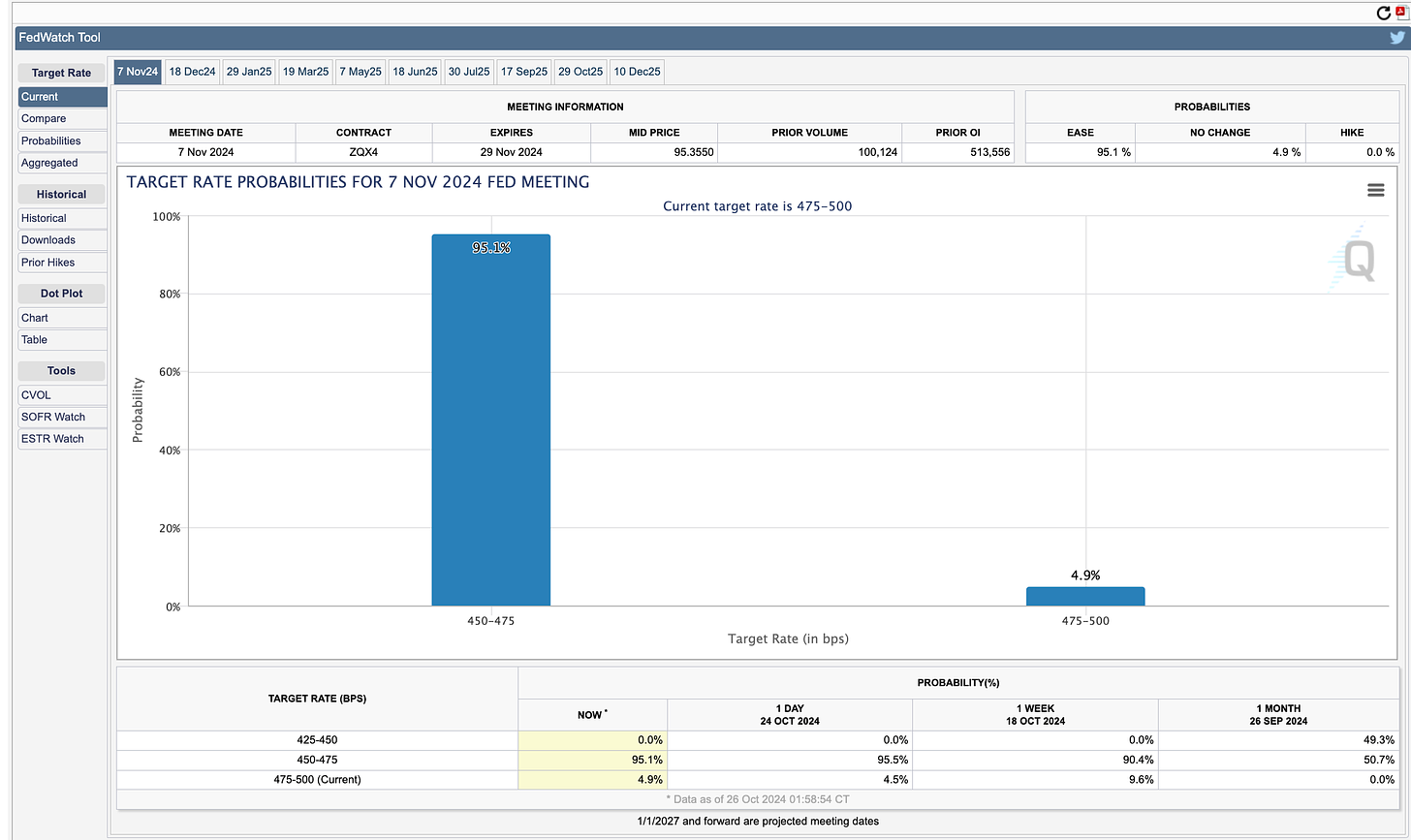

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ China Spotlight

1️⃣ Macro events for the week

Previous Week

Next Week

2️⃣ Bitcoin Buzz Indicator

Corporate and Investment Developments

Microsoft Faces Bitcoin Investment Proposal at December Assembly

Stripe Buys Bridge in $1.1 Billion Stablecoin Push

Security and Wallet Developments

U.S. Ethereum Wallet Hacked, Millions Recovered

Layer 2 and DeFi Innovations

Kraken's Ink Layer 2 to Debut in 2025

Token Launches and Allocation Issues

Scroll's SCR Token Launch Sparks Allocation Debate

Cross-Chain and Bridging Advancements

Uniswap Introduces Permissionless Cross-Chain Bridging

NFT and Retail Partnerships

Pudgy Penguins Partner with Walgreens for Retail Expansion

Multi-Chain Integrations

Magic Eden Expands with BeraChain and ApeChain Integration

Altcoins

New Visa card by Avalanche Foundation enabled crypto payments worldwide.

Aurum's $1B fund launched, focusing on tokenizing data centers on XRP Ledger.

Mantra's mainnet went live, aiming to tokenize real-world assets on-chain.

GnosisDAO allocated $40M for investment in RWA and crypto infrastructure projects.

Fault proofs to launch on October 30 for Base blockchain, advancing decentralization.

Solana ETN staking by VanEck was introduced to European investors.

AI bot's fortune soared after gains in 'Fartcoin' holdings, hitting millionaire status.

ApeCoin's Apechain mainnet launched, driving APE price up over 100%.

Transak's data breach exposed nearly 100,000 users, with Stormous ransomware involved.

Metaplanet raised $66M through its stocks acquisition rights program.

Pump.fun hinted at token and Solana airdrop amid a record-breaking week.

Sky considered rejoining MakerDAO amid plans for brand changes.

Buenos Aires integrated ZK proofs in its app to improve privacy for residents.

Magic Eden expanded, adding BeraChain and ApeChain, with Monad Testnet in view.

Denmark weighed 42% tax on unrealized gains/losses for cryptocurrency holdings.

Synthetix and Kwenta introduced v3 perpetuals on Arbitrum's network.

EURC stablecoin supply hit a record high as market cap neared $100 million.

Base blockchain exploit resulted in a $1M theft, according to Cyvers Alerts.

Netherlands sought feedback on crypto tax laws to match EU standards.

Ripple escalated its legal battle with SEC, filing Form C in appeal over XRP sales.

Polymarket denied manipulation, attributing US election bet issues to liquidity.

Cardano entered the Bitcoin ecosystem via the BitcoinOS Grail Bridge.

Prominent Listings:

Scroll (SCR): all popular exchanges (Spot), Coinbase International (Futures)

Cat in a dog's world: MEW: Upbit (add new trading pair)

Simon Cat (CAT): Binance (Perpetual), OKX (Spot)

Safe (SAFE): Upbit

Goatseus Maximus (GOAT): Binance (Futures)

Moodeng (MOODENG): Binance (Perpetual)

3️⃣ Market overview

Crypto Markets

US Bitcoin ETFs Face $79M Outflows, Reversing Gains: After a $2.6B inflow streak, US spot bitcoin ETFs saw a $79M outflow on Tuesday, led by Ark's ARKB fund, losing $135M. Despite this, BlackRock’s IBIT saw $43M in inflows, hinting at selective investor confidence.

Bitcoin Briefly Touches $70K as Futures Interest Surges: A spike in futures open interest above $40B propelled Bitcoin near $70K. However, mid-week profit-taking trimmed gains, reflecting cautious optimism as the market navigates pre-election regulatory uncertainty.

Tether’s $120B Market Cap Fuels Bullish Sentiment: USDT’s all-time high market cap suggests fresh liquidity entering the market. Historically, such increases have preceded Bitcoin rallies, raising hopes for a strong “Uptober” finish.

Bitcoin Hashrate Hits 703 EH/s Amid Rising Profitability: The hashrate's 6% rise to 703 EH/s signals network strength as higher transaction fees boost miner rewards. Major players like MARA and Riot Platforms now account for nearly 29% of this surge, while smaller miners face profitability pressures.

Binance Exec Freed Amid Health Struggles: Tigran Gambaryan’s release from a Nigerian prison marks a turbulent chapter for Binance, highlighting the complex regulatory challenges facing crypto firms. His deteriorating health prompted international intervention and eventual release.

Macro Markets

U.S. Labor Market Strains: Initial jobless claims fell, but continuing claims hit a 3-year high, signaling tough job prospects for displaced workers amid layoffs and strikes. The Fed remains cautious, with recent rate cuts boosting home sales—though rising supply and mortgage rates could cool the market.

UK Confidence Hits Year-Low: Consumer and business confidence dropped ahead of the October 30 Budget. Fear of tax hikes and a £40B budget gap loom large, even as inflation eases to 1.7%. Business sentiment reached an 11-month low, with firms starting to cut jobs in 2024.

Nasdaq Rises on Tesla’s Rally: Tesla surged nearly 22% on strong earnings, lifting the Nasdaq by 0.76%. IBM struggled, down 6.2% after a revenue miss, despite its AI focus. Boeing's recovery hit a snag as a machinist strike continued, extending challenges for its turnaround efforts.

4️⃣ Key Economic Metrics

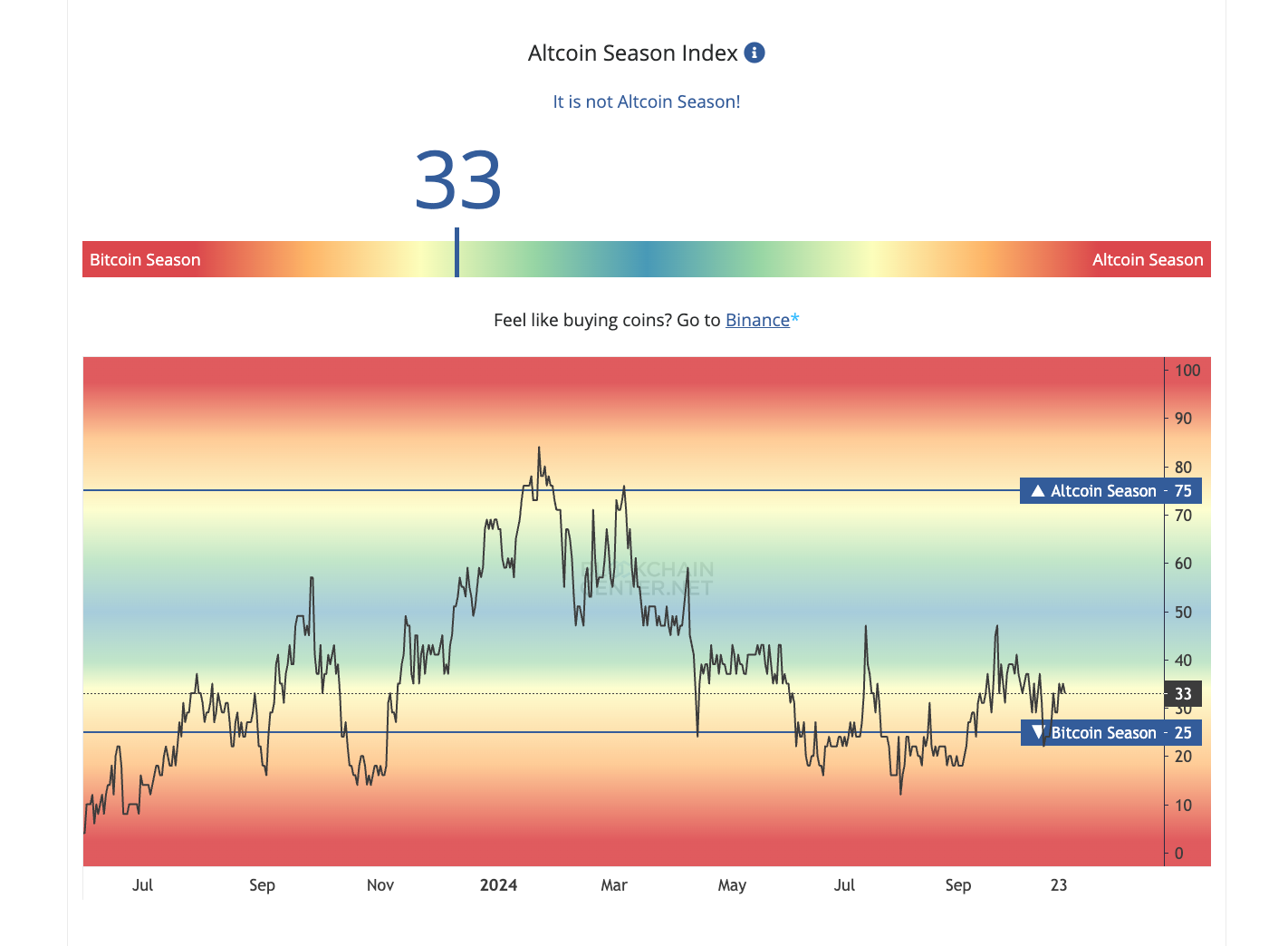

🔴 Bond Market & Fed Policy:

Yields Up Despite Rate Cuts: 10-year Treasury yields hit 4.04%, driven by rising inflation expectations, challenging the impact of recent Fed rate cuts.

Strong Economy Tests Fed Strategy: Robust job data and inflation raise doubts about the Fed’s pace of easing, suggesting potential for policy recalibration.

Narrowing Credit Spreads: Lower risk premiums boost investor confidence, opening opportunities in private equity and bond markets.

🔴 ECB & Eurozone:

ECB Eases Amid Fragile Growth: A 3.25% rate aims to balance economic support with inflation control, signaling more cuts may follow.

Export Weakness: A 11% drop in exports to China pressures recovery, with hopes pinned on Chinese stimulus.

Investor Focus: Monitor policy shifts and credit market moves for opportunities in sectors benefiting from easing and trade dynamics.

5️⃣ China Spotlight🔴

Weak Inflation Signals Sluggish Demand: China’s inflation ticked up just 0.4% in September, the lowest since June. Core inflation hit a multi-year low of 0.1%, reflecting weak consumer demand despite rising food prices. The dip in travel-related costs and energy prices points to deeper economic softness.

Government Fiscal Plans Lack Clarity: Beijing signaled intentions for fiscal support, including raising local government debt ceilings and issuing special bonds. However, vague details on a large-scale stimulus have left investors skeptical, raising concerns about the government's ability to kick-start domestic demand amid falling exports.

Slower GDP Growth Raises Questions: China’s Q3 GDP growth slowed to 4.6%, missing the 5% target but slightly beating market forecasts. While retail sales and industrial production showed signs of life, shrinking property investment (-10.1%) and weak export performance continue to drag down momentum.

Export Momentum Cools, Imports Stall: After months of growth, exports rose just 2.4% in September, the weakest since April. Imports inched up a mere 0.3%, reflecting weak domestic consumption and less demand for export-driven inputs. The slowdown, worsened by supply chain disruptions, highlights China’s fragile recovery.

Markets Buoyed by Central Bank Moves: Despite economic challenges, China's central bank boosted market sentiment by encouraging non-bank financials to invest in equities, sparking a stock market rally. Yet, the market remains on edge, waiting for more decisive fiscal action to sustain the recovery.

Twitter: