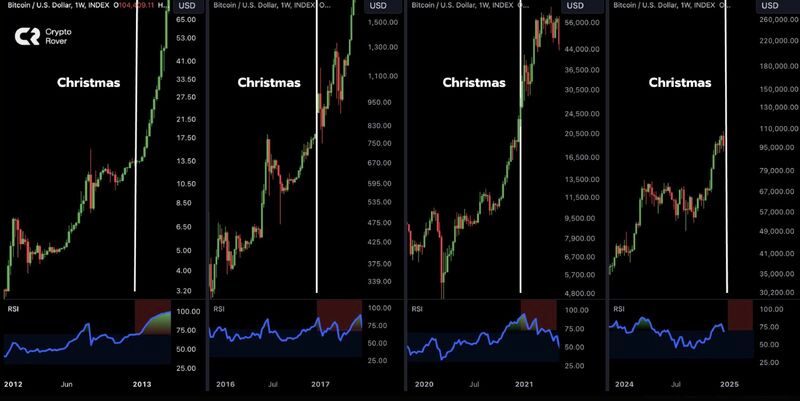

Year-end quiet is deceptive.

Funds are marking books and preparing for taxes, but the most bullish phase of the 4-year cycle is just ahead.

MicroStrategy hits 444,262 BTC holdings while TRON whales signal liquidity moves

End-of-year rally or just a teaser? 👇🧵

Macro Pulse Update 28.12.2024, covering the following topics:

1️⃣ Macro events for the week

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ China Spotlight

1️⃣ Macro events for the week

Last week

Next week

2️⃣ Bitcoin Buzz Indicator

Major Crypto Market Trends

Top 12 Crypto Headlines of 2024

MicroStrategy's Bitcoin Holdings Reach 444,262 BTC

Bitwise Proposes Bitcoin Standard Corporations ETF

Country-Specific Developments

Russia Legalizes Bitcoin for Global Trade

Regulatory and Legal Updates

IRS Sets New DeFi Tax Rules

Crypto Exchanges and Platforms

Bitget Combines Tokens to Boost Ecosystem

Hyperliquid Faces Security Breach by Lazarus Group

OpenSea Teases OCEAN Token Launch

Industry Insights and Adoption

Women Lead Blockchain Gaming Revolution

Altcoins

Michael Saylor published Bitcoin and crypto framework for U.S. government.

Binance Launchpool introduced Bio Protocol (BIO), allowing users to farm rewards by staking BNB and FDUSD. Trading began January 3, 2025.

Tether planned to launch its AI platform in 2025, said CEO Paolo Ardoino.

Israel approved its first mutual funds tracking BlackRock’s Bitcoin ETF.

Thailand considered a Bitcoin payment pilot in Phuket’s tourism sector to attract tech-savvy visitors.

Russia used Bitcoin for foreign trade despite crypto mining restrictions, said the finance minister.

Robinhood maintained its crypto push but did not invest in Bitcoin, according to its CEO.

Trump appointed Bo Hines, a former college football player and GOP House nominee, to lead the crypto council.

SBI VC Trade completed the acquisition of hacked crypto exchange DMM Bitcoin's assets.

Securitize proposed using BlackRock’s BUIDL fund as collateral for Frax USD.

SEC fined Jump Crypto $123 million for manipulating Terra Luna’s UST peg.

Uniswap announced plans to launch its Unichain mainnet by early 2025.

Over 40% of Binance Alpha tokens dropped in value after a major announcement.

NFT promoters faced fraud charges over an alleged $22M rug pull.

MultiversX launched Growth Games, offering $1.5M for blockchain and AI innovation.

Coinbase and Kraken each donated $1M to the Trump-Vance inaugural committee, while Ripple gave $5M in XRP.

Telegram achieved profitability for the first time in 2024.

Grayscale submitted an 8-K form for its Horizen (ZEN) trust to the SEC.

Usual raised $10M in a Series A round led by Kraken and Binance Labs.

Hyperliquid Labs denied DPRK hacking claims after record outflows and confirmed funds were safe.

Nokia patented an encryption system to address rising crypto asset vulnerabilities.

Aave explored integrating Chainlink’s oracle to mitigate MEV issues.

MoonPay reportedly planned to acquire Helio for $150M.

Crypto.com launched a crypto custody trust service for US and Canadian institutions.

IOTA unveiled a new sustainable tokenomics model.

37% of UAE retail investors planned to increase crypto investments in 2025, according to an eToro survey.

Binance and CZ filed a motion to dismiss the US SEC lawsuit.

Ripple’s RLUSD stablecoin debuted on Singapore’s Independent Reserve Exchange.

PancakeSwap achieved a record $310B year, up 179%, driven by L2 and DeFi growth.

Aave and Lido surpassed $70B in net deposits in December, reported TokenTerminal.

Crypto.com launched a sports prediction market ahead of Super Bowl LIX and US digital asset custody services.

South Korea’s crypto investors exceeded 15.59M, holding $79B in assets.

Turkey introduced stricter AML regulations for cryptocurrency.

Binance revealed FTM to S swap and its rebranding.

ZachXBT exposed a $500K scam targeting Solana meme coin investors on X.

Swiss-based Hashgraph Group secured a license to launch a $100M Web3 fund.

Hilbert Group integrated Liberty AI with its core services to lead asset management.

Floki DAO voted on allocating treasury funds for a future memecoin ETP in Europe.

Agridex completed its first on-chain coffee transaction on Solana’s platform.

PENGU overtook BONK as Solana’s leading meme coin.

The MIRA token, created for four-year-old Mira Chen, reached an $80M market cap within hours.

Vitalik Buterin adopted Moo Deng and donated 88 ETH to a zoo.

Jupiter Exchange announced a 700M JUP airdrop worth over $590M for 2.3M wallets, reserving 75M JUP.

StakeStone’s Berachain Vault TVL exceeded $130M in 24 hours.

Solana’s Jito staking pool generated over $100M in monthly tips, said Kairos Research.

BONK completed BURNmas, removing $51M in tokens from circulation.

Kyrgyzstan’s cryptocurrency mining tax revenue fell 50% year-on-year in 2024.

Cambodia’s central bank approved compliant stablecoin services but banned unbacked assets like BTC.

Montenegro’s justice minister signed Do Kwon’s extradition to the US.

3️⃣ Market overview

Macro & TradFi

China's GDP Revision: 2023 GDP revised upward by 2.7%, adding ¥3.4T ($17.73T). Focus remains on 2025 economic stimulus with a 5% growth target amid property sector challenges.

U.S. Labor Market: Jobless claims slightly dipped to 219,000, while continued claims rose to a 3-year high of 1.91M. Labor supply constraints keep layoffs low.

Markets: Dow extended its winning streak to 5 sessions; S&P 500 and Nasdaq edged lower due to rising 10-year Treasury yields.

DeFi & CeFi

Strive’s BTC Bond ETF: Strive filed for an ETF targeting Bitcoin bonds issued by crypto-invested companies like MicroStrategy, tapping into the $56B corporate BTC market.

Hong Kong Stablecoin Bill: Proposed legislation advances in the Legislative Council, aiming for a robust licensing and consumer protection framework akin to Europe’s MiCA.

TRON Activity Surge: Average transfer size increased. Whales unstaked $3.17M ENA, depositing into Binance, signaling potential liquidity moves.

4️⃣ Key Economic Metrics

🔴 Federal Reserve Policy

Rate Cut & Slower Reductions Ahead: The Fed cut the benchmark rate by 25 bps, signaling a slower pace of rate cuts in 2025. Median projection for 2025 rates increased to 3.9% (up from 3.4%), tied to higher inflation expectations.

Inflation Outlook: Median 2025 inflation projection (PCE-deflator) revised to 2.5% (up from 2.1%), despite slowing wage growth. Strong economic performance and expected policy changes contribute to higher inflation risks.

Labor Market Commentary: Chair Powell noted progress in labor market normalization but emphasized that wage increases and job openings haven’t fully stabilized, delaying the anticipated "soft landing."

🟢 Global Dynamics

Bond & Equity Impact: US bond yields rose, equities declined, and the USD strengthened sharply. Futures markets now show a 91.4% probability of rates holding steady in January.

Currency Markets:

Brazil: Fell 23% this year, hitting a record low against the USD. Central bank interventions included selling $6B last week and raising the Selic rate to stabilize the currency.

China: The PBOC ramped up interventions to stabilize the renminbi amidst concerns over US tariffs and expected Fed rate hikes.

Brazil’s Fiscal Challenges: Persistent currency depreciation pressures inflation and equity underperformance. Fiscal reforms are critical but face political resistance.

China’s Currency Goals: Stabilizing the renminbi aligns with inflation control, trade tension management, and long-term aspirations for global reserve currency status.

🔴 Economic Uncertainties

Productivity Growth: Fed Chair Powell remains uncertain about sustained productivity gains, acknowledging generative AI’s potential but only in the long term.

Policy Implications: Shifts in US economic policies (tax cuts, tariffs) could further reshape inflation and global economic dynamics, with significant uncertainty on Congressional support and timing.

5️⃣ China Spotlight🔴

Economic Concerns

Persistent Weakness in Domestic Demand: Declining household wealth, weak consumer spending, and private sector investment remain key challenges. Residential property market issues and unfavorable demographics further exacerbate the situation.

Export Constraints: While exports show recent strength, this is partly due to tariff anticipation. Protectionist measures and excess capacity may limit future growth, compounding deflationary risks.

Government Response

Fiscal Stimulus: Efforts have focused on boosting equity prices and resolving local government debt, with limited direct household support.

Economic Strategy: Calls for expanded domestic demand and stabilized expectations remain vague, with no clear plans announced.

Global Spillover Effects

Resource-Rich Economies: Weak Chinese demand has impacted commodity-exporting countries like Canada and Brazil, leading to currency depreciation.

US Trade Dynamics: Rising US bond yields and potential tariffs further strain these economies.