Vitalik's latest tweet on interoperability could be the next game-changer, much like when $SOL skyrocketed from $8 to over 20X.

The Interoperability narrative is set to drive massive growth with Maia DAO's Hermes V2 launch.

Concentrated liquidity, ve3,3, and more 🧵

Vitalik recently emphasized what could be the most crucial challenge for the Web3 space in the coming years: Cross-L2 interoperability.

Projects tackling fragmentation issues like these provide a massive opportunity for the future.

@MaiaDAOEco is just exactly that.

https://x.com/VitalikButerin/status/1820404774493110309

What is Maia?

The Maia Ecosystem is a collection of DeFi tools that offer a suite of protocols for yield optimization and cross-chain liquidity management.

It’s been live since 2022 and initially began as a yield optimizer and DEX, but now has expanded into a multi-chain powerhouse with a wide array of dApps.

Maia stands out as a community-driven ecosystem with a robust suite of open-source components and decentralized protocols.

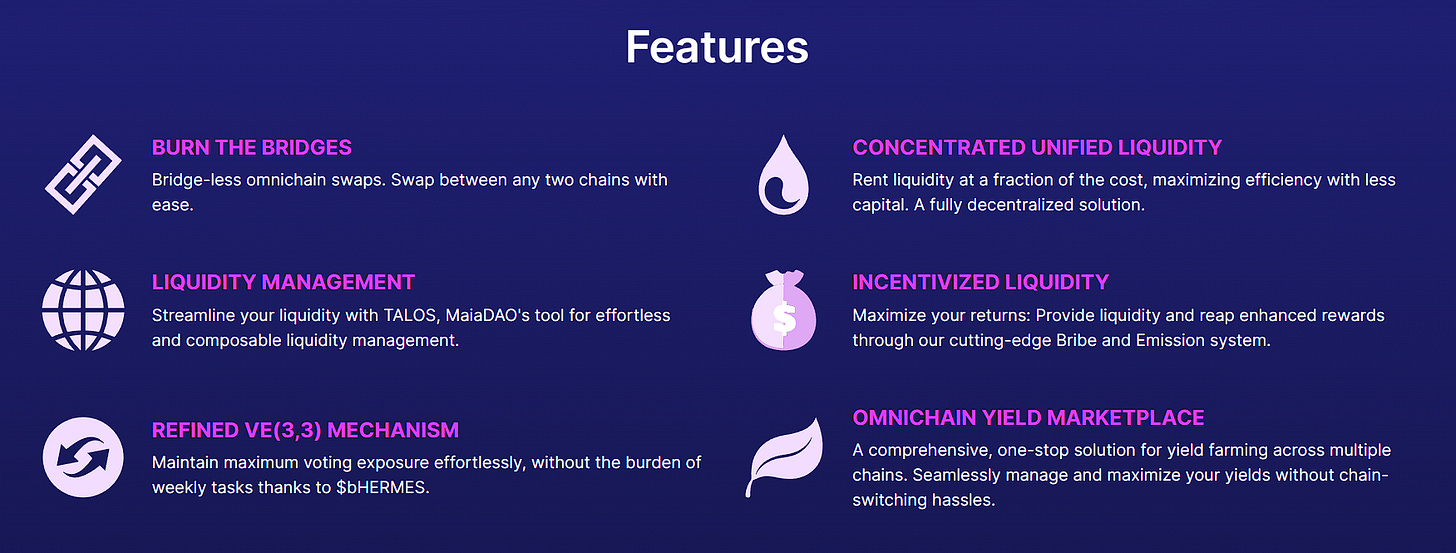

The ecosystem has an impressive lineup including -

Hermes: An omnichain AMM and Yield & Liquidity Marketplace.

TALOS: Transparent Automated Liquidity Omnichain Strategies.

Maia: Decentralized Strategy Vaults.

Ulysses: An omnichain Liquidity Protocol

Hermes V2

The launch of Hermes v2 was announced recently.

If you’re not familiar with Hermes, it’s a (3,3) DEX inspired by Andre Cronje's Solidly model. But v2 won’t just be a Solidly fork.

As a major upgrade from v1, this version introduces omnichain functionality, enhanced liquidity and management, a streamlined user experience, and additional yield strategies.

In V2, Hermes introduces permanent token locks with liquid positions and a deposit-only ERC4626 vault.

This will aim to greatly simplify yield farming and increasing token burn rates.

https://x.com/MaiaDAOEco/status/1509150383922458633

@TalosOmnichain, or Transparent Automated Liquidity Optimization Strategies, is an omnichain protocol for managing concentrated liquidity, built on Hermes.

TALOS simplifies Uniswap v3 concentrated liquidity with:

ERC-20 Wrappers for NFT positions

Automated rebalancing strategies

Rebalancing Wrapper

Vanilla and Staked Positions

https://x.com/TalosOmnichain/status/1585989405558411264

As for the DAO, anyone will be able to suggest new features via HIPs (Hermes Improvement Proposals) or MIPs (Maia Improvement Proposals).

These proposals are voted on by token holders using their governance tokens, determining the platform's direction.

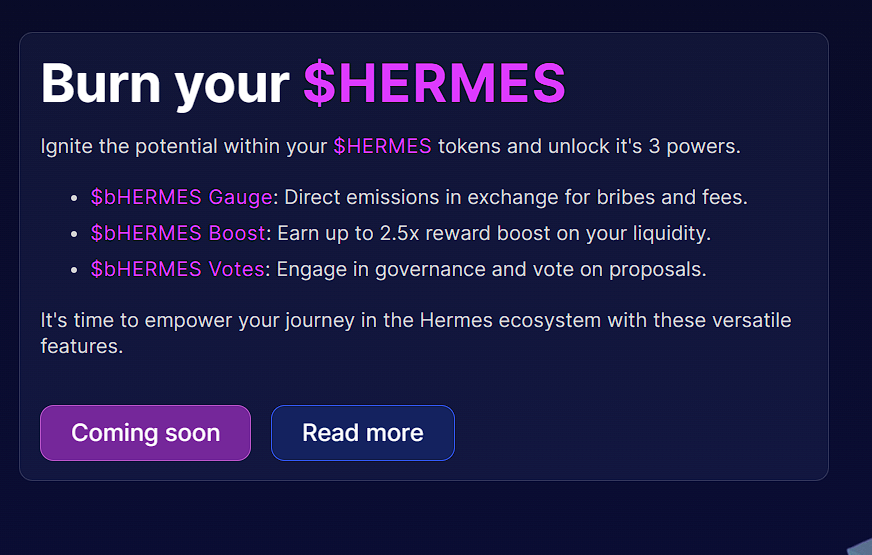

That’s not all. A revamped tri-token system has also been introduced.

Users now burn $HERMES to obtain bHERMES, which supports three utility tokens: bH-V for governance, bH-G for bribes and fees, and bH-B for boosting liquidity rewards.

Hermes v2’s public testnet went live only a few days ago.

The mainnet launch is expected to be on 21st August.

A @zealy_io campaign was announced for Hermes giving you a chance to earn exciting rewards, including a share of $MAIA and $HERMES tokens.

https://x.com/HermesOmnichain/status/1821626246176108885

Hermes and Maia will soon be expanding to Arbitrum and become cross-chain by leveraging LayerZero’s technology.

This overhaul aims to make DeFi interactions more seamless and profitable for users.

Maia has already established strong ties with major industry players such as LayerZero, Arbitrum, Revelo Intel, and Balancer.

Despite its promising potential, its market cap is currently low, and a FDV of $3.5M.

This highlights their massive growth opportunity.

@MaiaDAOeco excels with its well-structured, authentic governance and a team committed to transparency and value creation.

The potential for $MAIA and $HERMES is unmatched.