Moments of labor market weakness are showing symptoms of stress.

Unemployment 🆙

Jobs added 🦥

Job postings🔬

Is the Fed's tightening cycle about to come to a stop, or is this just a small blip in the big picture?

Bumpy ride ahead in the labor market.

Hiring slows vs 2020 while initial jobless claims are increasing. Possible this could lead to the end of the Fed's tightening cycle.

Marco Pulse 11.04.2023

1️⃣ Labour Conditions

2️⃣ Economic Figures

3️⃣ Credit Market Outlook

4️⃣ OPEC cuts

It might be a little negative this time round so please bear with me as we go through the economic figures.

While, events in the week you might want to keep an eye for:

▫CPI (12 Apr)

▫Retail Sales (14 Apr)

▫Industrial Production (14 Apr)

1️⃣ Labour Conditions 🔴

Tightening grip of the labor market loosens as employers added new jobs in March but at a slower pace than in the past three months.

Improved labour supply has helped soften the trend in earnings growth.

We also saw a decline in job growth and a softening in hiring

Layoffs in manufacturing and a slower pace of hiring in services. Job openings falling to a 15-month low, and a clear uptrend in initial jobless claims revisions, all pointing towards a weakening labor market

2️⃣ Economic Figures

🔴 CPI

🟡 Retail sales

🔴 Manufacturing output

-

🔴 CPI

Feb's CPI revealed some encouraging signs, such as a little uptick in grocery store costs and a drop in used vehicle prices.

Nonetheless, core CPI inflation remains strong, with annual rates of > 5% across the board.

March CPI is likely to drop, but core CPI readings show that recent inflation patterns have not improved.

Core inflation may drop later in the year, but it is unlikely to be reflected in the forthcoming CPI announcement.

-

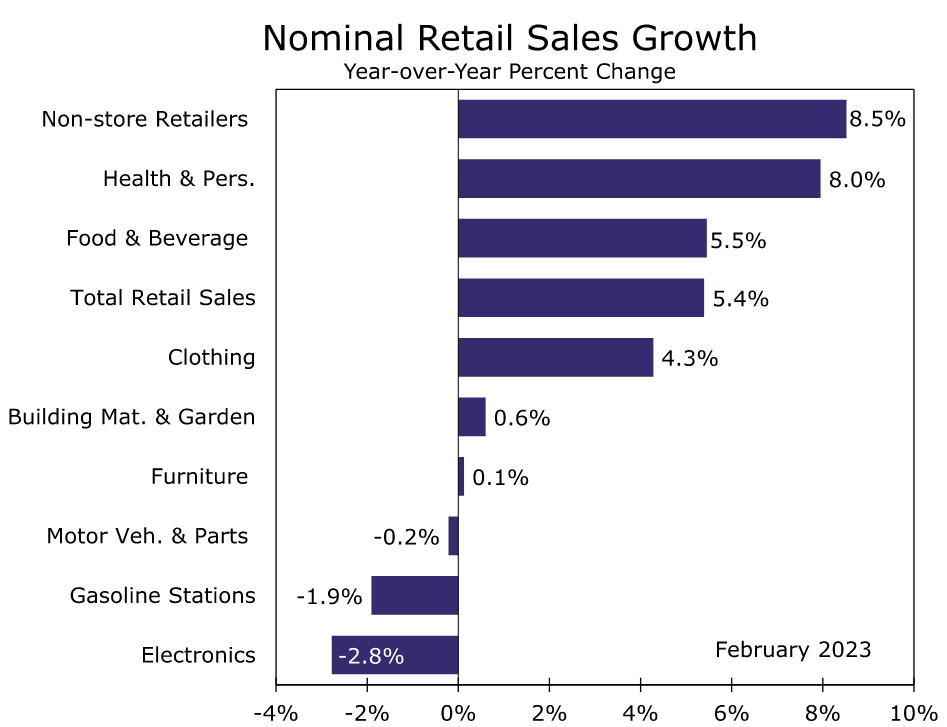

🟡 Retail sales

Likely to decline in March and from Feb could normalise the spike from Jan and decline in Feb.

Despite strong growth in Q1, outlook for consumer spending is uncertain due to factors such as credit tightening, rate rises, and a deteriorating labor market.

A deeper U.S. recession is projected to push spending growth into next year.

-

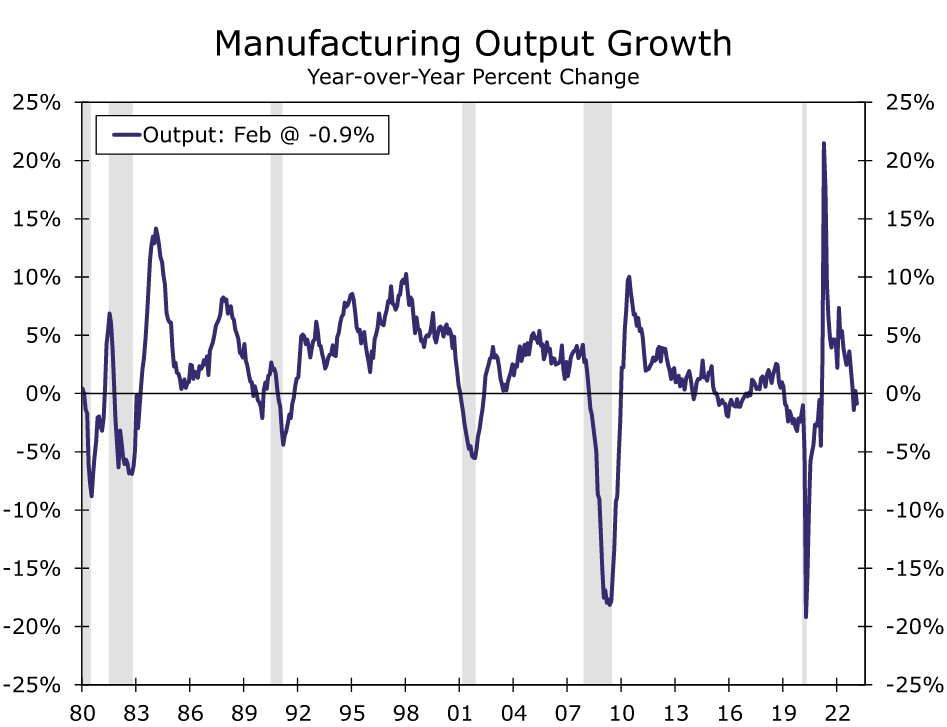

🔴 Manufacturing output

Despite a 0.1% increase in industrial production in February, manufacturing output fell 1% YoY.

Future industrial production growth could remain poor, with output expected to fall further into contraction.

-

3️⃣ Credit Market Outlook🔴

There's a pullback in home price growth expectations, while households expect financing costs to trend higher despite lower mortgage rates.

However, a majority of households still believe investing in a home is worthwhile.

4️⃣ OPEC cuts🔴

OPEC stunned the markets this week by lowering production to increase oil prices. This resulted in an 8% increase in Brent crude and WTI prices, erasing year-to-date losses.

Yet, variables like supply and demand, global economic worries, and low production levels may restrict the cartel's capacity to further reduce output.

OPEC+ output curbs may reignite inflationary pressures in the United States and others.