"Markets dumping, crypto dying"

If Trump reintroduces tariffs, the effects will ripple across multiple sectors, influencing inflation, supply chains, liquidity, and risk assets like crypto & equities.

Let’s examine how Tariffs (already rekted or lifted) our bags 👇

1️⃣ Tariffs = Higher prices → Sticky inflation → Tighter monetary policy

• Tariffs increase the cost of imports, making foreign goods more expensive.

• Businesses will likely pass higher costs to consumers, driving up inflation.

• Inflationary pressure could force the Fed to keep interest rates higher for longer—which is bearish for risk assets.

2️⃣ If tariffs prolong inflation, the Fed will delay easing, keeping risk assets under pressure.

• Higher inflation = Less chance of Fed rate cuts.

• A tighter Fed means higher borrowing costs, slower economic growth, and reduced market liquidity.

• Less liquidity generally hurts equities, crypto, and speculative assets.

3️⃣ Supply chain adjustments take time, and in the short term, uncertainty & inefficiencies hurt business confidence

• Tariffs disrupt global trade, forcing companies to either pay more or relocate supply chains.

• Short term: Increased costs & economic uncertainty.

• Long term: Some companies may onshore manufacturing, but that comes with higher labor costs.

4️⃣ If tariffs spook markets, risk assets like crypto may see a temporary downturn before adjusting to new macro conditions.

🔹 Equities: Higher costs = Lower corporate profits, especially for industries reliant on imports.

🔹 Bonds: If inflation rises, bond yields could spike, leading to market volatility.

🔹 Crypto: A risk-off environment and stronger dollar liquidity drain could stall crypto inflows.

5️⃣ If trade tensions escalate, global markets could see a wave of risk-off sentiment.

• Retaliatory tariffs from China, Europe, or other trading partners could escalate into a global trade war.

• If tensions rise, the USD could strengthen, which historically puts pressure on commodities & crypto.

Bottom Line: Tariffs = Uncertainty + Inflation Risk

• Short term: Market volatility, inflation concerns, liquidity tightening.

• Long term: Reshuffling of supply chains, potential slowdown in global trade.

• Crypto Impact: Liquidity crunch could stall momentum, but a weaker dollar long-term might eventually favor BTC & hard assets.

Let's take a step back...

Yes, historically, tariff introductions have caused market volatility, but the long-term effects depend on inflation, trade disruptions, and monetary policy.

Let’s examine past cases👇

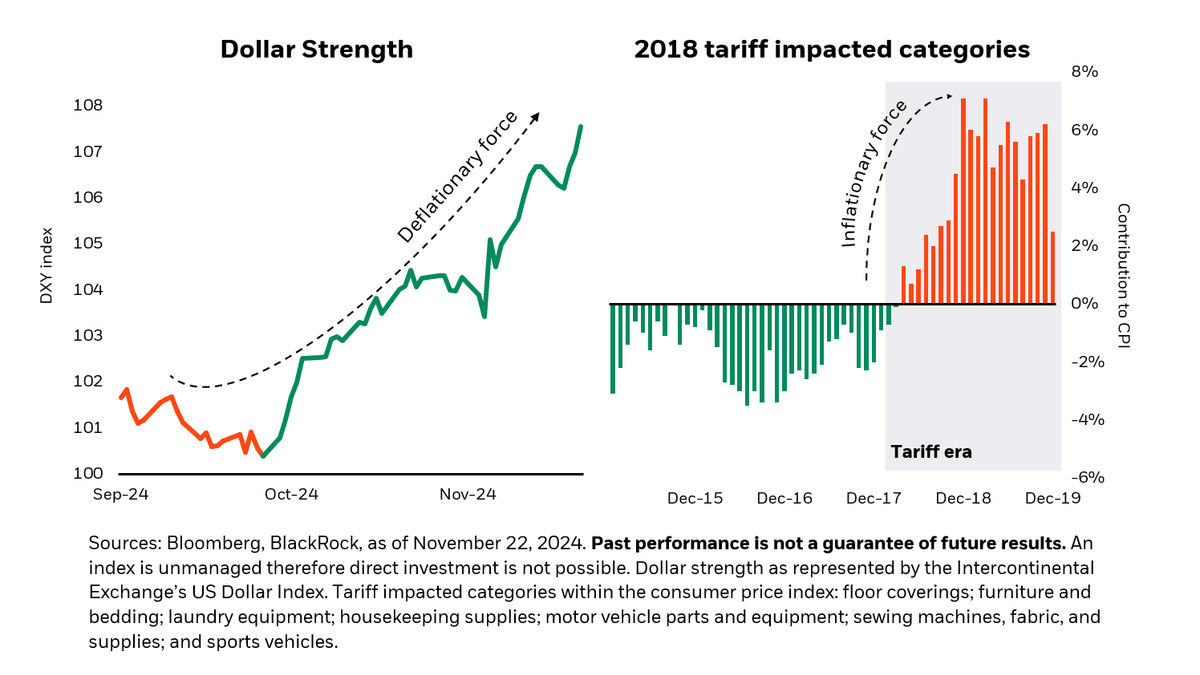

1️⃣ Trump’s 2018-2019 China Tariffs - Tariffs hurt market sentiment initially, but monetary easing helped equities recover.

• What happened? Trump imposed 25% tariffs on $250B+ worth of Chinese goods.

• Market reaction: S&P 500 dropped ~20% in late 2018 during a trade war escalation. Bond yields spiked, as markets feared higher inflation. Crypto was already in a bear market, but risk-off sentiment delayed a broader recovery.

• Fed intervention: To counter economic slowdown, the Fed pivoted and cut rates in 2019, leading to a market rebound.

2️⃣ 1930s Smoot-Hawley Tariffs (The Great Depression) - In a fragile economy, tariffs can deepen a recession rather than help recovery.

• What happened? The U.S. imposed tariffs on 20,000+ imported goods, triggering retaliatory tariffs from other nations.

• Impact: Global trade collapsed by 60%. Unemployment skyrocketed. The U.S. economy worsened instead of recovering.

• Why it was worse? The U.S. didn’t have a global reserve currency back then. No Fed stimulus options like today.

3️⃣ Steel & Aluminum Tariffs (2018) - Tariffs help specific sectors short-term, but broader industries suffer from cost increases.

• What happened? Trump placed 25% tariffs on steel and 10% on aluminum to protect U.S. manufacturers.

• Market reaction: Steel stocks initially surged, but price hikes hurt industries reliant on steel. Automakers & construction firms struggled with higher costs. S&P 500 dipped ~8% temporarily but rebounded.

Will Tariffs Hurt the Market in 2024?

When Trump reintroduces tariffs, history suggests:

✅ Short-term market volatility & risk-off sentiment

✅ S&P 500 dip as investors price in supply chain disruptions

✅ Stronger dollar = Weaker crypto initially

✅ Fed response matters—if inflation spikes, rate cuts get delayed

Most importantly, if tariffs cause inflation, markets will sell off. But if the Fed counters with stimulus, we could see a rebound like 2019.