An unnoticed narrative that you can catch now to make your next 400x

LSD perpetual products will be the next evolution for LSDfi and projects in this arena is on my radar 👀

What you need to know for its IDO in 2 days🧵👇

Introducing @Mori_Finance, giving users the option to create a twined LSD asset .

1️⃣LSD perpetuals

2️⃣About Mori

3️⃣Risk Management

4️⃣Tokenomics/IDO

5️⃣Roadmap/Team

6️⃣Conclusion

1️⃣LSD perpetual

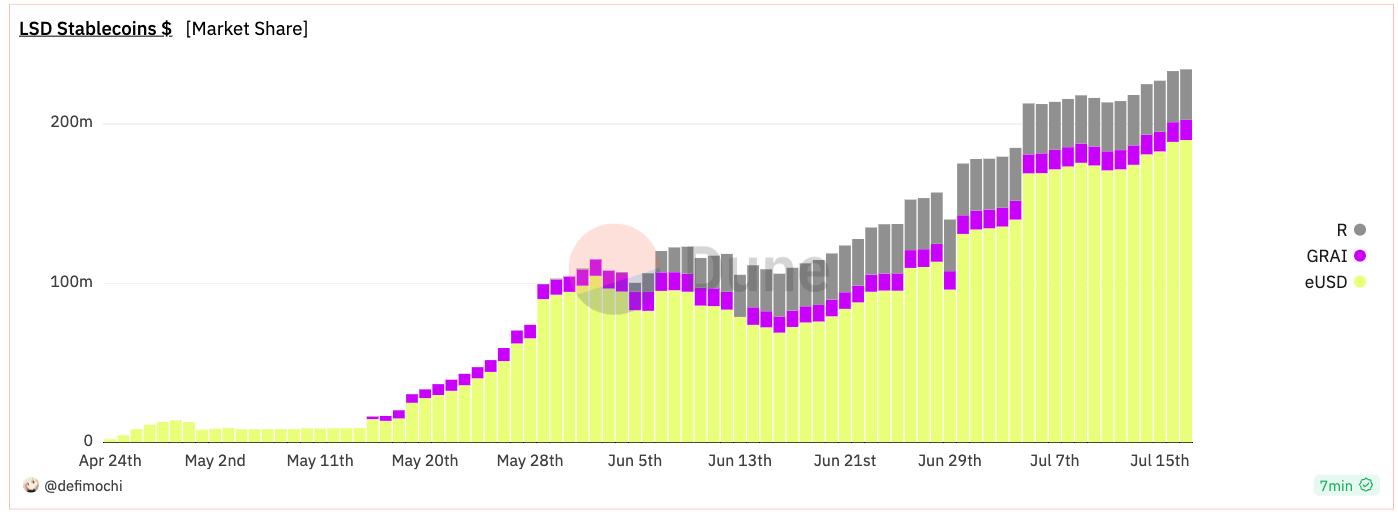

What is commonly known to many is the LSD stablecoins with @LybraFinanceLSD taking the first mover lead

Till date it has raked ~$190m of TVL. Its competitors like @raft_fi @gravitaprotocol slowly catching on

i.e. $eUSD $GRAI $R are backed with overcollateralized LSDs.

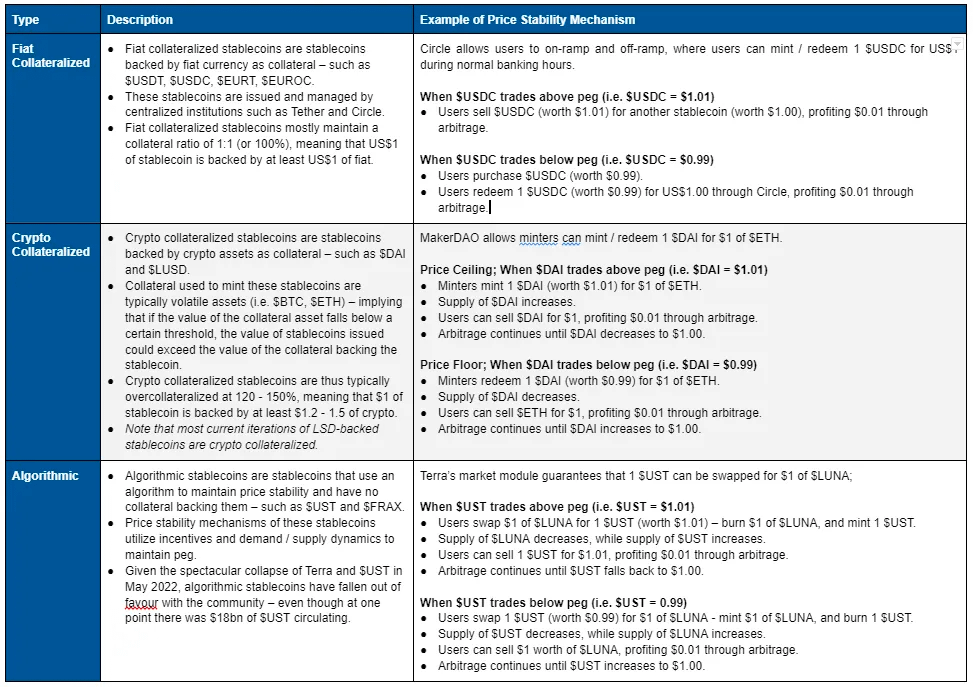

Generally, following the framework of stablecoins

However, I believe LSDfi will continue to push the stablecoins development with LSD perpetual products by @Mori_Finance.

2️⃣About Mori

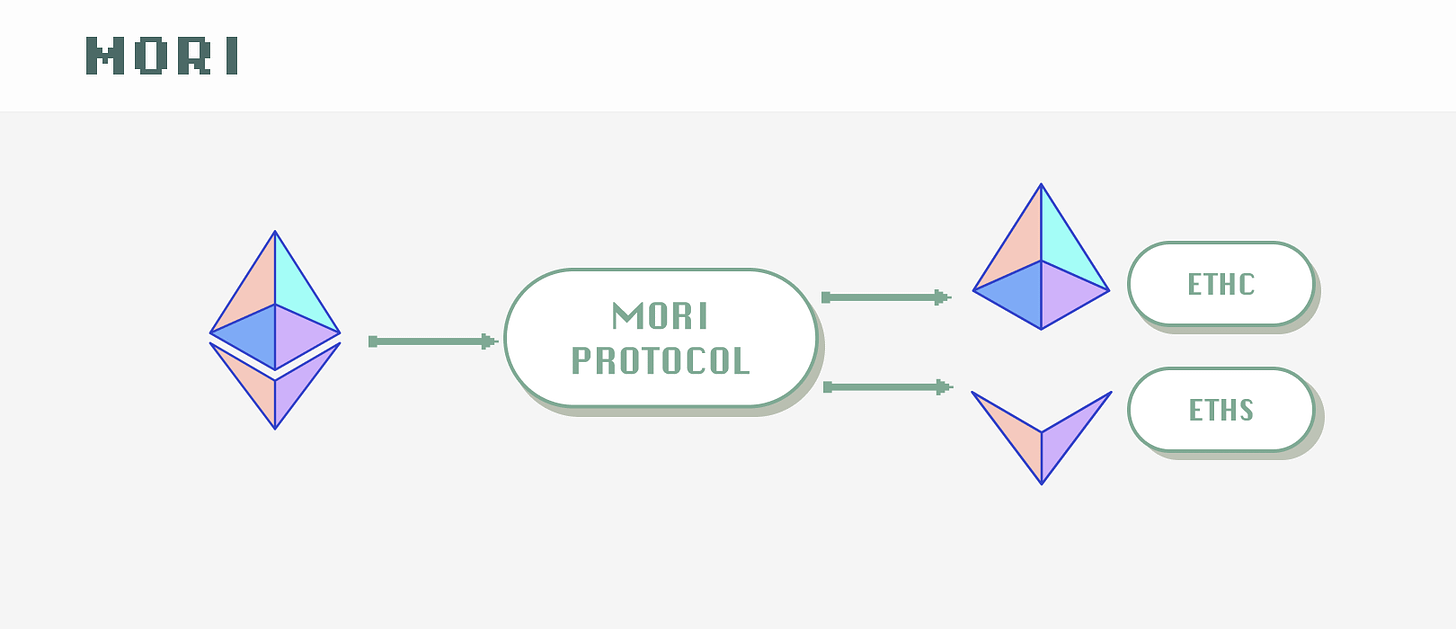

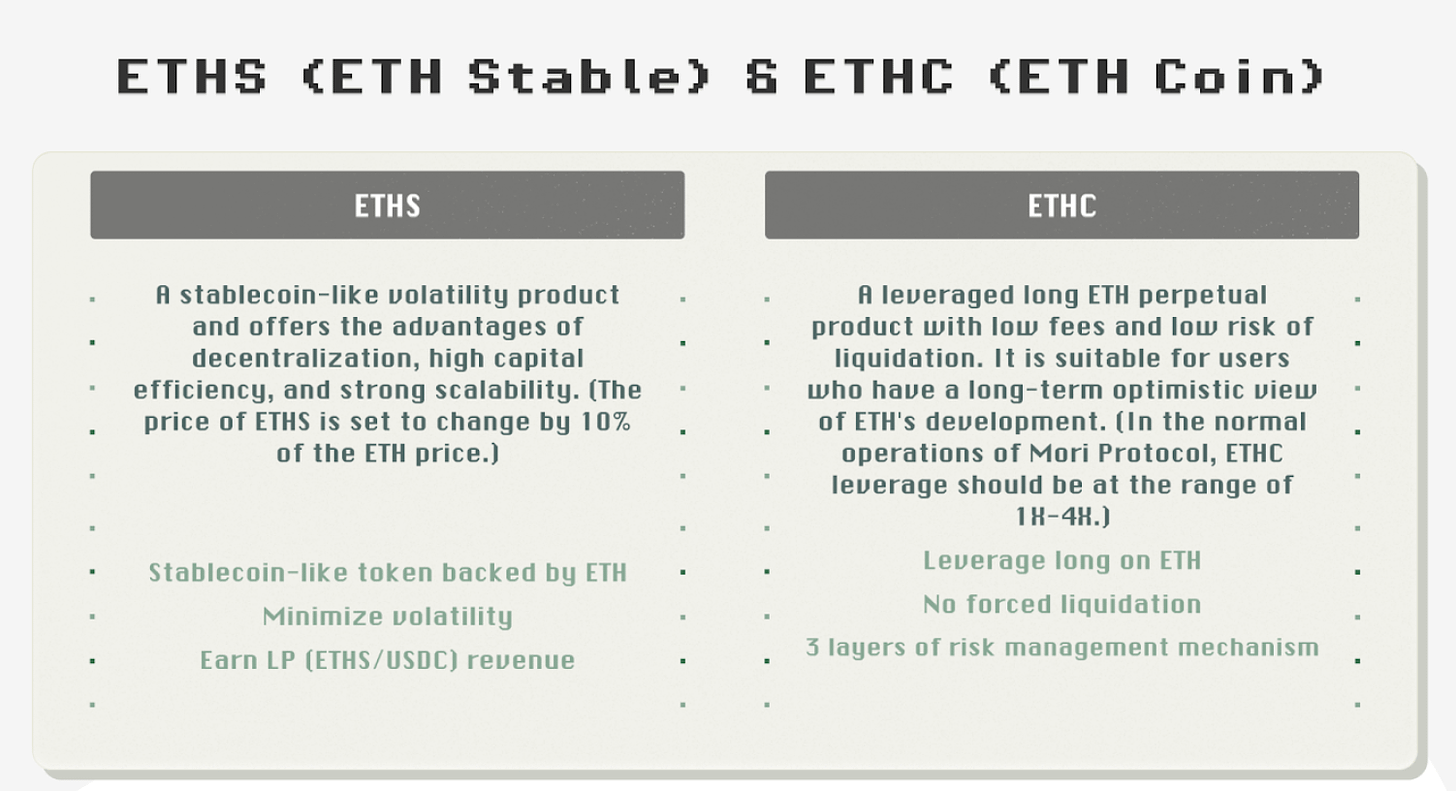

Mori Finance allows users to collateralize LSDs, and splitting the volatilty into:

▪$ETHS stable asset

▪$ETHC volatile leverage long asset

This provide users with a powerful hedge against ETH price fluctuations; zero cost long positions, no liquidation risk

ETHS as a low volatility token:

• Stable asset backed by ETH

• Minimizes volatility

• Earn additional LP (ETHS/USDC) revenue

ETHC as leveraged long ETH perp token:

• Leverage long on ETH

• Liquidation free

• Emergency control mode to reduce the leverage of ETHC

These twined assets complement each other:

• ETHS is a stable asset which only reflects 10% of eth price change.

• ETHC absorbs most of the ETH price change.

Based on market conditions, users can choose to mint/redeem ETHS or ETHC according to their strategy.

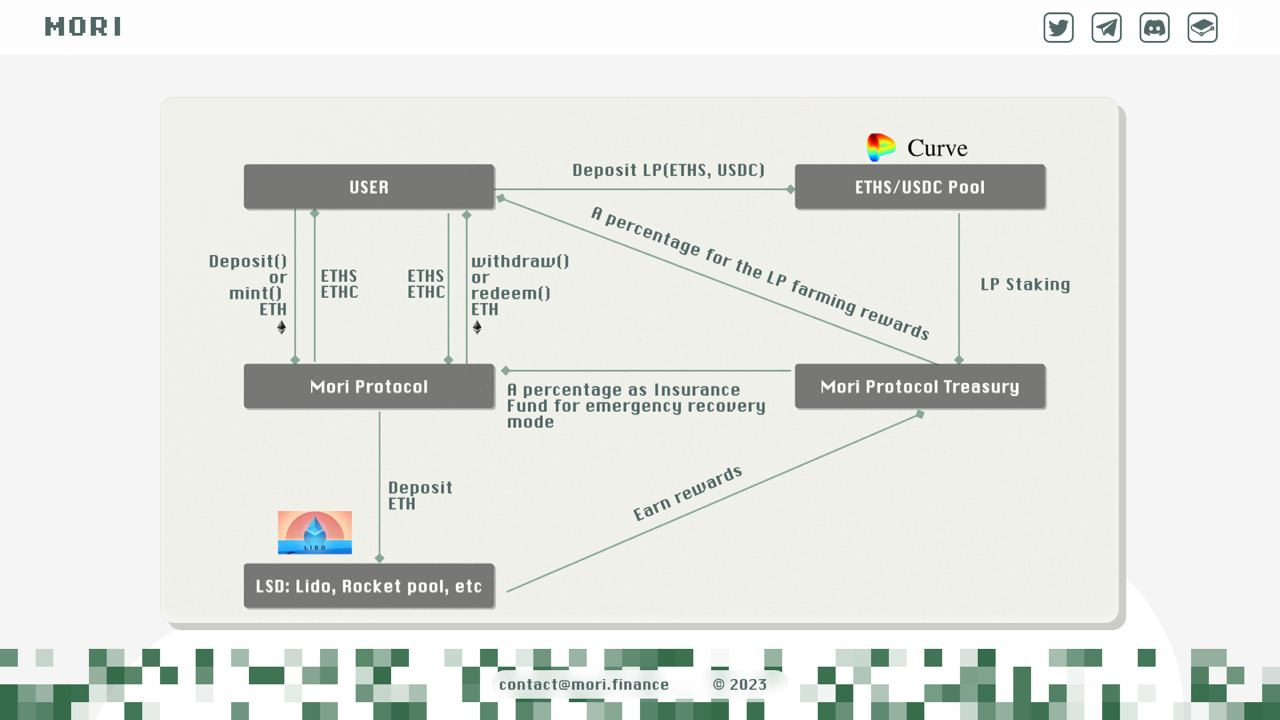

It would flow like this:

Users deposit ETH

Gets ETHS and/or ETHC

Deposit into ETHS-USDC LP

Deposit into ETHC-USDC LP

User earns a portion as LP farming rewards

3️⃣Risk Management

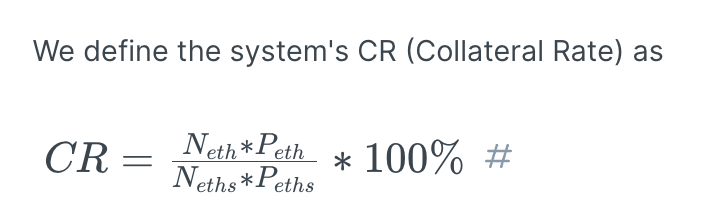

The risk management module is in place to ensure the stability of ETHS and that ETHC can absorb the price impact when ETH price changes.

When the CR value is too low, it can prevent ETHS from absorbing only 10% of the ETH value fluctuation.

CR< 130%

• Disable minting ETHS from ETH;

• Set redemption fee as zero for ETHS;

• Set mint fee as zero for ETHC;

• Increase redemption fee for ETHC;

CR< 120%

• Disable minting ETHS from ETH;

• Set redemption fee as zero for ETHS;

• Set mint fee as zero for ETHC;

• Increase higher redemption fee for ETHC;

• Utilize the insurance fund to buy ETHS in secondary market and then redeem to ETH.

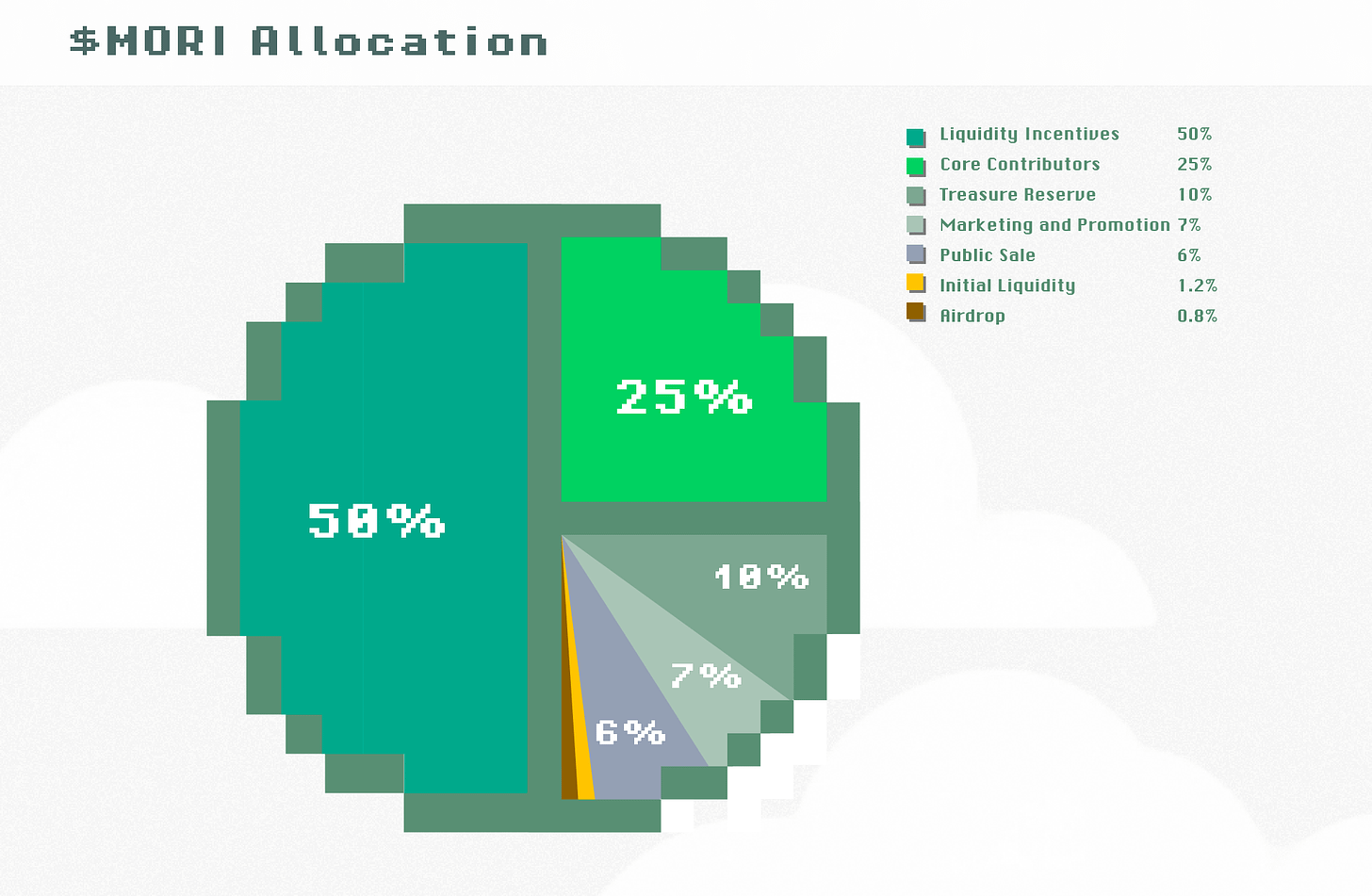

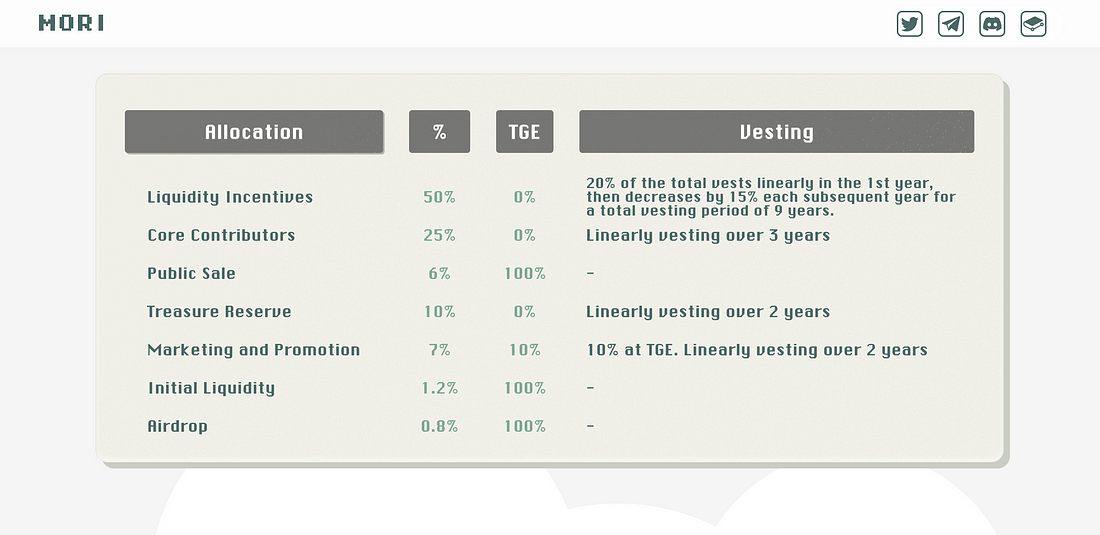

4️⃣Tokenomics/IDO

$xMORI usecases:

• Staked $MORI

• Protocol revenue sharin

• Yield booster

• Governance

It will take place over 2 rounds.

1st round - 20th July 1pm UTC

Who can participate? OGs, Testoors, Public

1% for WL, 2% for public = 30,000 $MORI

Price: 1 MORI = 0.005 ETH

FDV: 10m

Raise amount: ~300k

2nd round - around the launch of Mori mainnet

There is still time to join the Testnet as the snapshot will be taken on the 19 Jul (before the sale)

There is a love hate relationship for their vestings since there are no vesting for this IDO.

100% will be unlocked at TGE. 🧐

Please exercise your DD here.

Though what I like about @Mori_Finance is:

NO presale

NO VC

NO team allocations

Audit with @peckshield before they go live

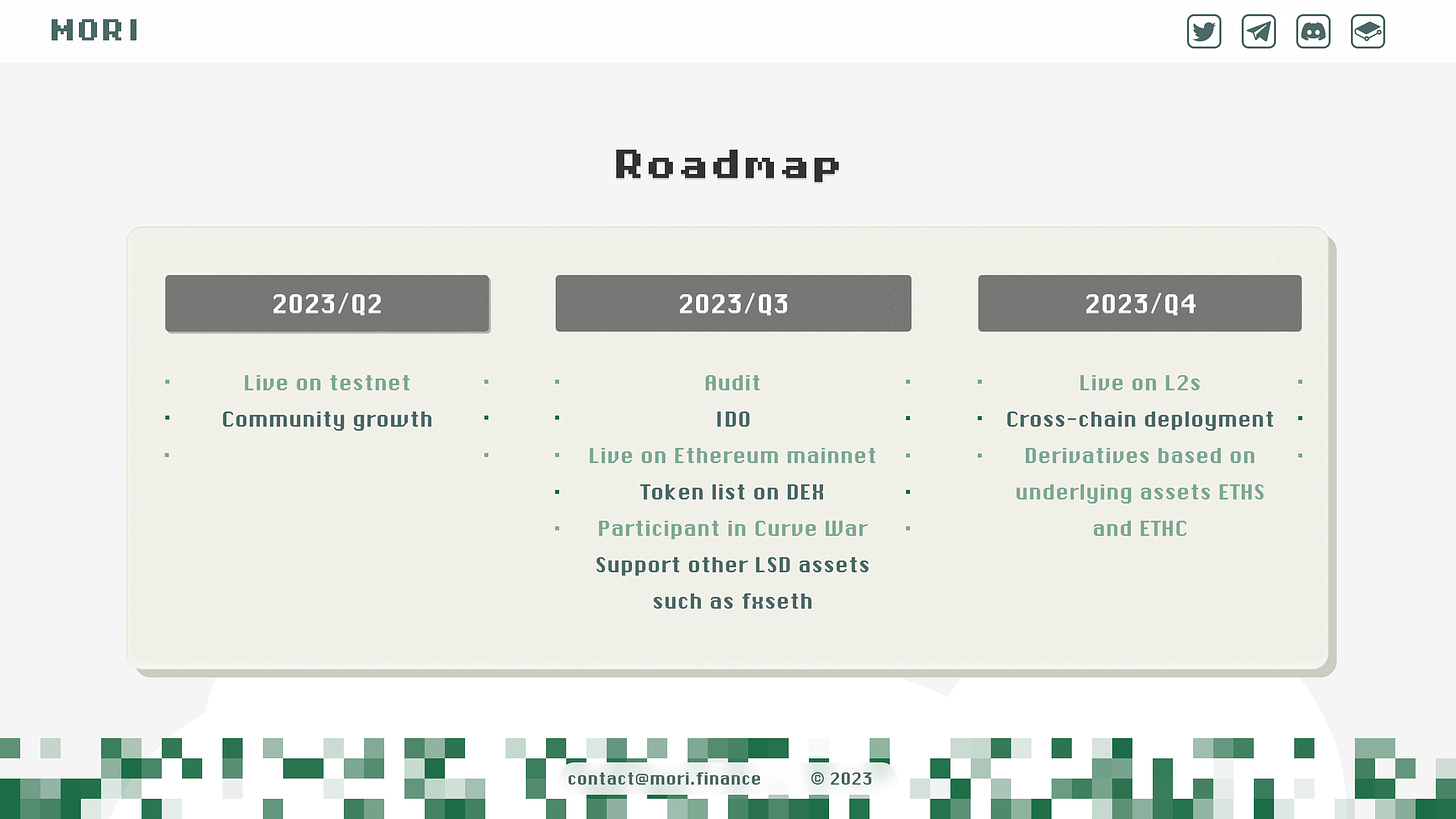

5️⃣Roadmap/Team

They would go live on Ethereum in Q3 2023 and then expand into other L2s in Q4.

Likely TGE is around Q3.

Team is anon but the lead devs are very experienced seeing how quick to market they go.

Mori sees @protocol_fx more as a co-builder rather than a competitor.

Mori made their own innovations as well.

6️⃣Conclusion

Mori supported LSDs first since the beginning of their Testnet and since then f(x) followed suit.

The support for LSDs just gone live in f(x) recent testnet, which launched a few days ago.

Though I do like both @Mori_Finance and @protcol_fx tokenomics, the one that launches first will have an advantage.

I do have faith that given Mori's speed to market, they can be the one that launch first.

Keeping a close eye on their developments

Twitter: https://twitter.com/arndxt_xo/status/1681264568805511168