60% of the $MOVE goes to the community, impressive.

What is even better is the traction that it acheived during its testnet phase.

With over 2,100 developer teams engaged, $160M TVL secured before mainnet, and 85 groundbreaking projects advancing in the Battle of Olympus Hackathon, Movement Labs is rewriting blockchain innovation.

Backed by $38M in Series A funding led by Polychain Capital and leveraging Ethereum’s $30B+ DeFi ecosystem, Movement Labs delivers 145,000+ TPS, subsecond finality, and gas fees below $0.01.

Movement Labs is bringing the Move programming language to Ethereum, combining the security and efficiency of Move with the liquidity and adoption of Ethereum.

Compared to Aptos and Sui, Movement Labs stands out with its modular architecture, low gas fees, and high transaction throughput—all while integrating seamlessly with Ethereum’s ecosystem.

Here’s how Movement Labs compares and why it’s better👇

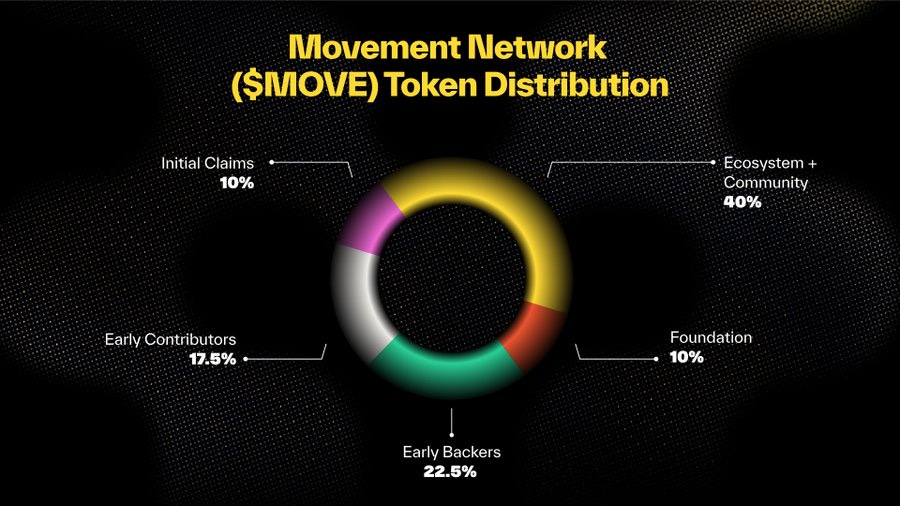

First, $MOVE Tokenomics

Key Highlights of $MOVE Tokenomics

1️⃣ Community-Centric Allocation (60%)

Ecosystem & Community Initiatives (40%):

Staking Rewards: Incentivizes validators to secure the network.

Grants: Funds innovative projects building on the Movement Network.

Liquidity Provisioning: Kickstarts the DeFi ecosystem and drives adoption.

Initial Claims (10%):

Distributed through initiatives like MoveDrop, rewarding early adopters and community engagement.Foundation (10%):

Reserved to support operations, decentralization efforts, and network growth.

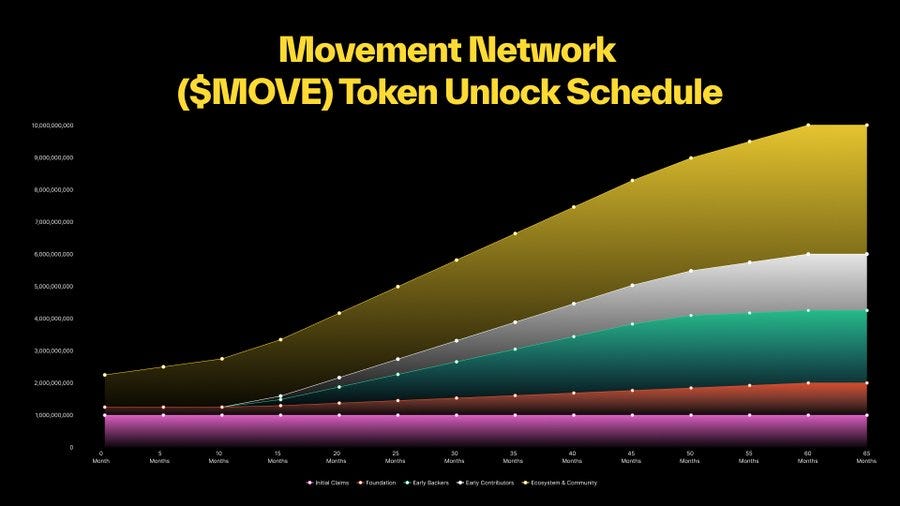

2️⃣ High Float, Balanced Distribution

Unlike the typical low float, high FDV (Fully Diluted Valuation) model prone to dumping, $MOVE features a 22% initial float. This ensures liquidity and market stability while avoiding excessive speculative pressure.

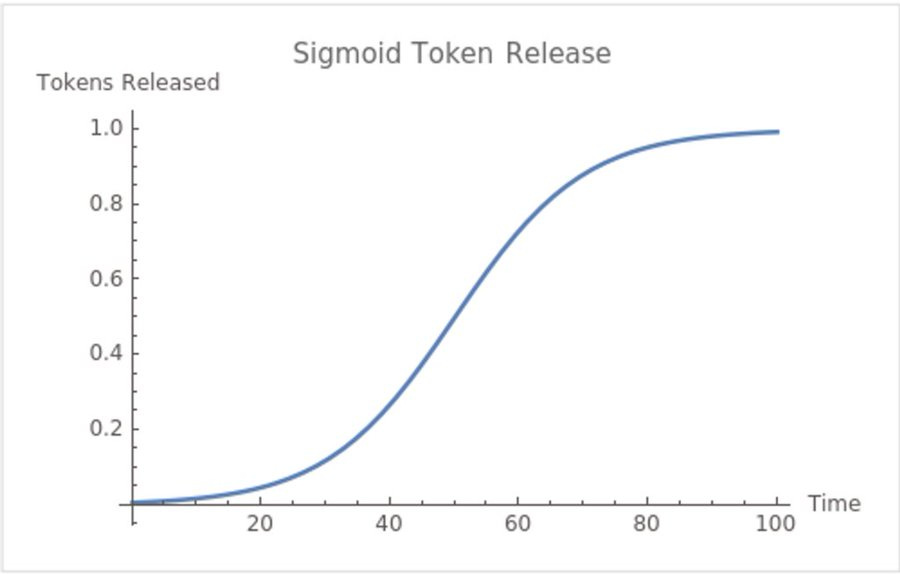

The Sigmoid Token Distribution Advantage

What Is a Sigmoid Distribution?

$MOVE’s sigmoid distribution follows an S-curve, designed to align token inflation with ecosystem growth:

Credits to @HouseofChimera for identifying it

Early Phase: Low inflation minimizes selling pressure while demand is nascent.

Growth Phase: Inflation accelerates during months 15–25, matching increased demand as the network scales.

This model ensures that token releases correspond to actual network utility and adoption, balancing supply with organic demand.

How It Works for $MOVE:

Inflation Rate Increases: Tokens unlock gradually, with a significant uptick during the growth phase when early contributors and backers receive allocations.

Mitigating Selling Pressure: As demand for $MOVE grows (via staking, gas fees, and governance), potential sell-offs are offset by buying pressure and ecosystem utility.

$MOVE Utilities: Real Value for the Ecosystem

1️⃣ Staking for Economic Security

Validators stake $MOVE to secure the network, creating a robust token sink that strengthens the blockchain’s economic and operational integrity.

2️⃣ Gas Fees

$MOVE powers all transactions on the Movement Network, offering gas fees as low as $0.01. As network usage increases, so does the demand for $MOVE.

3️⃣ Governance

$MOVE holders actively participate in shaping the Movement Network by proposing and voting on governance initiatives, ensuring decentralization and community involvement.

4️⃣ Native Asset for Applications

$MOVE is used as:

Collateral: In DeFi applications built on the Movement Network.

Liquidity: Supporting decentralized exchanges and other financial products.

Payment: Facilitating seamless transactions within the ecosystem.

Why $MOVE’s Tokenomics Are Superior

Aligned with Growth Phases: The sigmoid token distribution ensures that token inflation matches network expansion, avoiding the pitfalls of early-stage oversupply.

Stable Launch with High Float: The 22% initial float creates market liquidity and reduces speculative volatility, unlike low-float tokens that often suffer from sharp price swings.

Real Demand Drivers: $MOVE’s utilities—staking, gas, governance, and application use—create continuous and growing demand, aligning with the ecosystem’s scaling trajectory.

Incentivizing Builders and Users: By allocating 60% to the community, $MOVE prioritizes grants, staking rewards, and incentives that fuel innovation and adoption.

Movement Labs: Traction and Numbers

With a focus on delivering scalability, and developer accessibility through the Move programming language, Movement Labs is already demonstrating significant traction across many aspects.

Here are some numbers from Movement 👇

Movement Labs is scaling trust, adoption, and innovation and the traction speaks for itself:

an engaged developer base

robust funding

growing adoption before the mainnet is even live.

Developer Engagement

2,100 teams have joined the Parthenon Incentivized Testnet, showcasing massive interest from global developers with 85 exceptional projects advancing to the final Hackathon round.

Active participation in the Battle of Olympus Hackathon, incentivizing innovation across DeFi, gaming, and infrastructure.

Ecosystem Growth

A growing ecosystem of projects building with Move, thanks to the Move Open Builders Program, which connects developers, investors, and blockchain experts.

$160M Total Value Locked (TVL): Achieved on the Parthenon Testnet even before the mainnet launch. This reflects strong confidence in Movement Labs’ platform.

Investment Backing

$38M Series A Funding: Led by Polychain Capital with participation from top-tier investors like Hack VC, Placeholder, and Robot Ventures.

$3.4M Pre-Seed Funding: Backed by notable players like Varys Capital and dao5, ensuring early-stage innovation.

Community and Ecosystem Impact

Movement Labs’ initiatives have already engaged thousands of developers and enthusiasts worldwide. The testnet incentives and airdrops further demonstrate the team’s commitment to community-driven growth.

Move Open Builders Program: Cultivating a thriving network of builders, innovators, and visionaries.

Performance Metrics

Transaction throughput exceeding 145,000 TPS, with gas fees as low as $0.01—a cost structure that sets a new benchmark in blockchain.

Subsecond finality, delivering the responsiveness needed for real-time applications like gaming and DeFi.

Why Movement Labs Stands Out: Key USP

Ethereum Integration: Movement Labs bridges Move to the world’s most used blockchain, unlocking Ethereum’s $30B+ DeFi ecosystem and liquidity pools. Aptos and Sui remain isolated ecosystems, limiting their adoption potential.

Superior Developer Accessibility: Movement Labs’ SDK enables seamless migration of Solidity-based projects to MoveVM, making it easier for Ethereum-native developers to onboard. Aptos and Sui lack similar developer-friendly migration tools.

Modular Design with Scalability: Movement Labs leverages Celestia’s data availability layer and zero-knowledge (ZK) proofs for efficient scalability. Aptos and Sui follow monolithic designs, which may limit flexibility.

Cost-Effective Transactions: With gas fees below $0.01, Movement Labs achieves unparalleled cost efficiency compared to its competitors.

Comparison Table: Movement Labs vs. Aptos vs. Sui

Why Movement Labs Outperforms Aptos and Sui

1️⃣ Ethereum Liquidity vs. Isolation

Movement Labs: Directly taps into Ethereum’s liquidity and DeFi ecosystem, making it attractive for developers and users already active on Ethereum.

Aptos/Sui: Standalone Layer 1 ecosystems that require developers to build communities from scratch, facing barriers in attracting Ethereum-native projects.

2️⃣ Scalability Beyond Monolithic Architectures

Movement Labs: Modular design allows for enhanced flexibility and scalability, leveraging Celestia’s data availability and ZK technology.

Aptos/Sui: Depend on monolithic architectures, which may struggle to adapt to diverse use cases without significant upgrades.

3️⃣ Lower Barriers for Developers

Movement Labs: Features a Solidity-to-Move SDK, enabling Ethereum developers to transition easily.

Aptos/Sui: Require developers to learn Move from scratch, posing a higher barrier for onboarding.

4️⃣ Transaction Cost and Speed

Movement Labs: Achieves subsecond finality with gas fees under $0.01, ideal for DeFi, gaming, and micropayments.

Aptos/Sui: Competitive but slightly slower and costlier due to standalone infrastructures.

Conclusion: Movement Labs’ Competitive Advantage

Movement Labs surpasses Aptos and Sui by unlocking Ethereum’s ecosystem while maintaining the security and efficiency of Move. Its low fees, modular scalability, developer tools, and Ethereum integration position it as the superior choice for builders and users alike.

While Aptos and Sui focus on high throughput and asset management, their isolated nature limits their growth potential. Movement Labs, by bridging to Ethereum, offers developers the best of both worlds: Move’s security and Ethereum’s liquidity, ensuring a stronger adoption trajectory.