Ecosystem stealthily grows its TVL war chest by 4x

It boasts the LOWEST gas fee at $0.007 USD while generating healthy volume

I discovered a GEM that is the only first mover 🧵👇

Here, I will go into a deep dive of this gem that I find:

4x Ecosystem

About Mu

Differentiating Features

Staking Vault

Tokenomics

Roadmap

Conclusion

If you enjoyed the read, please RESTACK, LIKE and COMMENT on what you like to hear next. It will be super helpful!

🔷 4x Ecosystem 🔷

@gnosischain recent traction cannot be overlooked. It will be one of the thriving ecosystems built around stables and stable yields.

Gnosis Chain is the associated execution-layer EVM chain for stable transactions. It uses the xDai stablecoin for transactions and fees.

Gnosis has been onboarding several major DeFi partners in 2022, including @Balancer, @aave, and @spark_protocol_ from @MakerDAO.

The integration of these partners has helped drive strong growth in total value locked (TVL) on Gnosis from $70M in Oct to $300M currently, an over 4x increase in just two months.

It has a TVL of 300M up by 50% in the past 30 days

A key driver of the TVL growth is the yield that can be earned on $sDAI, a stablecoin pegged to the US dollar, on Gnosis. The yield on sDAI is a strong incentive for users to supply assets and hence boosting TVL.

Currently, its ecosystem is built around stablecoin yield and payment through Gnosis Pay. The idea is to create a more robust DeFi environment for safe yields but at the same those people looking for degening opportunities can find them as well.

Perp DEXes has been on an uptrend in terms of volume and if using the amount of Open interest as a gauge, this sector is an ever growing one.

So you might like @muexchange_ which lets you earn stablecoin yield while perp trading.

You can start trading now here

🔷 About Mu 🔷

@muexchange_ is the first Perp DEX that allows users to trade with leverage while continuing to earn yields on their collateral.

Unlike other platforms, Mu Exchange accepts $sDAI as collateral - the yield-bearing version of the popular DAI stablecoin.

This means that even after opening a leveraged trading position, your $sDAI collateral continues generating returns at the DAI Saving Rate. So not only do you benefit from the upside of your trades, you also earn passive income on your collateral during the entire lifetime of your positions.

Mu is also the first where users can earn 3 types of yields:

Earn fees as a market maker: By depositing sDAI into the msDAI Vault, users provide liquidity to the Mu perp dex and earn a share of the trading fees based on their share of the pooled liquidity. This incentivizes providing liquidity.

Earn trading yield: Depositing sDAI not only makes you a market maker, but also earns you additional trading yield from Mu's overall trading volumes. This provides a second source of variable income.

Earn DAI savings rate: The sDAI deposits continue earning the DAI savings rate yield even while deposited in the vault and put to work as market maker liquidity. This provides a steady and reliable yield on top.

🔷 Differentiating Features 🔷

Unlike its counterparts of perp DEXes, it boast some very unique features which are worthy of mention:

The only Perp DEX that allows users to earn yield while they are trading

Built on @gnosischain, which is creating a robust defi environment and yet users can express the degen side of them

500x lower gas fees than $ARB @arbitrum ~$0.007 USD per transaction

Mu does not require a high minimum collateral; users can get started easily with 10 $sDAI

Full focus on value-adding back to token holers with 100% distribution of trading revenue back to the vaults. This is even better than @GMX_IO, which only gives back 70% of the revenue and way better than @GainsNetwork_io which controls their APR.

The are making great progress in terms metrics. While their airdrop campaign is live, they have cross the $1M trading volume, which is extremely commendable!

🔷 Staking Vault 🔷

The $msDAI Vault allows stakers to earn a portion of exchange fees and trader losses, in exchange for providing liquidity. Returns rely on the profitability of the exchange and protection systems.

The $msDAI Vault receives a portion of @muexchange_ trading fees and serves as the counterparty to all trades. It earns fees when traders lose and pays out when traders profit.

By staking $sDAI into the vault, you receive $msDAI tokens representing your share of the vault assets and fees.

Returns depend on the profit/loss of Mu Exchange traders overall. If traders lose overall, the vault earns more fees. If traders profit, returns depend on fees earned still exceeding payouts.

There are systems in place to protect the vault from excessive losses, by limiting open interest.

To earn from the vault, stake $sDAI and receive $msDAI tokens. There's no lock up period, but a 24 hour withdrawal cooldown.

Returns accrue automatically into the vault and are reflected in the value of your $msDAI tokens.

Entering and exiting the vault at different NAVs affects your position. If NAV rises due to trader losses, stakers profit.

🔷 Tokenomics 🔷

@muexchange_ currently has no token. Any token claiming to be Mu's governance token is invalid. When a token is released in the future, details will be shared publicly.

Open/Close Position Fees are currently 0.08% for both sides.

The fee distribution is:

With referral: 10% to referrer, 90% distributed as 35% to keepers, 35% to msDAI vault, 30% to Mu treasury.

Without referral: Distributed as 35% to keepers, 35% to msDAI vault, 30% to Mu treasury.

Liquidation Fees (5%) are distributed as - 35% to keepers, 35% to msDAI vault, 30% to Mu treasury.

🔷 Roadmap 🔷

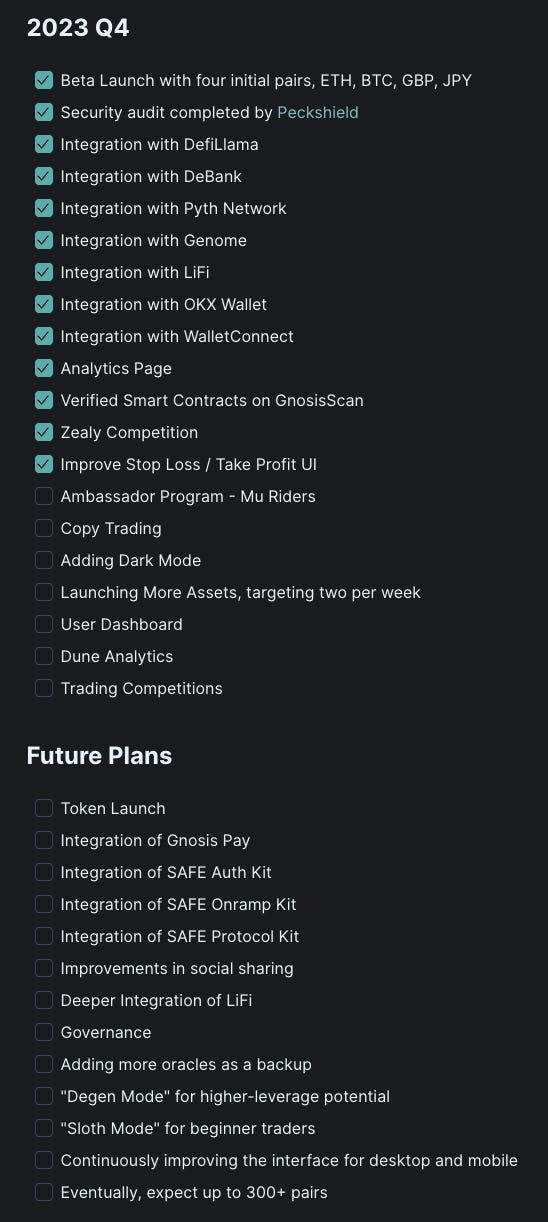

Mu is has plans to be shipping out features very aggressively with more than 300 trading pairs, 2 new asset integration weekly, and user-beginner friendly interface.

🔷 Conclusion 🔷

@muexchange_ is a first perp DEX built on Gnosis Chain. It has seen strong growth recently, with over $1M in trading volume.

In conclusion, Mu Exchange is bringing some innovative features to the perp DEX model by enabling yield earning on collateral while trading perpetuals. With ultra-low fees on Gnosis Chain and a focus on value distribution to users, Mu Exchange aims to capture market share in the growing perp DEX sector.

Its progress and growth in early stages has shown promising traction already.

Twitter: https://twitter.com/arndxt_xo/status/1729112551722774994