My Biggest Bet $VKA - Perp DEXes Explode While CEXes Face Regulatory Headwinds

You don't want to miss out on $VKA

$VKA remains my biggest bet for a Binance labs investment

It fundamentals remain rock solid:

🔥 250% growth in TVL over the last months

🔥 True circulating MC is only at 160k

Here’s my thesis, looking over bullish metrics and regulatory narratives 🧵👇

If you enjoyed the read, please RESTACK, LIKE and COMMENT on what you like to hear next. It will be super helpful!

🔷 Narrative 🔷

Throughout 2H 2023, Perp DEX see a massive volume in the month of Dec and this is is an parabolic growth.

This also means that several protocol have benefitted a lot from it.

Perp DEXes market size is growing massively now.

Its now at $3.1B.

Market leaders have held their place like @GMX_IO @GainsNetwork_io @dYdX @APX_Finance

Growth seekers continue to expand their presence @muxprotocol @OfficialApeXdex @vegaprotocol @HyperliquidX @vertex_protocol

I foresee that this market will get bigger because of regulatory concerns.

Particularly CEXes are under increased scrutiny by the SEC. Capital will turn away from these centralized platform into those on-chain and Perp DEXes will benefit the most.

That said, its not without evidence that the crypto landscape is getting tighter.

One of the significant developments is the SEC's proposal to amend Rule 3b-16, which defines certain terms used in the definition of "exchange" under the Securities Exchange Act of 1934. This amendment is seen as potentially broadening the scope of regulation to include crypto trading platforms. The SEC's approach suggests that these platforms might be considered as exchanges if they facilitate trading in crypto assets that are deemed "securities".

The SEC's actions have raised concerns about the feasibility of registering crypto trading platforms as exchanges, citing uncertainties in the costs of compliance, particularly for crypto asset securities. There are also broader market implications beyond financial costs, with fears that such regulations could stifle innovation and competitiveness in the digital asset space.

Coinbase has been denied by the SEC in its request for new rules for the digital asset sector. This denial points to a larger trend of regulatory challenges faced by CEXes.

Additionally, the SEC's focus has extended to crypto staking programs, especially those offered by centralized exchanges. This move signals a potential regulatory impact on cryptocurrencies utilizing proof-of-stake (PoS) consensus mechanisms. The SEC's actions suggest a disconnect between their expectations and the practicality for crypto firms and consumers, with the overarching concern of investor protection driving their regulatory approach.

🔷 Metrics 🔷

Staking

Staking ratio have been massively strong.

If you have followed the previous Vaultka threads and deep dives, it has been steadily growing from 78%, to 80+% and just about 24 hours ago it was at 87%.

Now I am seeing 92%.. Very healthy staking numbers!

Market Cap

A 2mil MC is an overstatement.

If you consider the 92% staking ratio, true circulating MC is only 160k.

TVL

TVL has been consistently growing grew by 30% in less than 24 hrs.

And just yesterday i was watching it at only $20M and today its at $26M.

I have full confidence that TVL can easily 10x from here in peak bull.

Circ MC:TVL

0.08 is an overstatment.

Consider this:

true circulating MC at 160k

TVL 26M

Growing Perp DEX and on-chain focus

Increasing institutional inflow into active chains like Arbitrum

This metric will only balloon

The current real MC:TVL is 0.006

Bribes

Bribes has growth by more than 3x since my las coverage

@Vaultkaofficial partnered with @APX_Finance to join the bribe war

Really juicy yields here that will only get larger with perp DEXes growth

You get 42% for lending your ETH

You get 30% on leveraged VLP

You get 15% on your stable USDC

More TVL will come → More perp DEXes will be integrated → Bribe wars intensify → Token holders benefit!

Weekly bribes have been so juicy. Its free money!

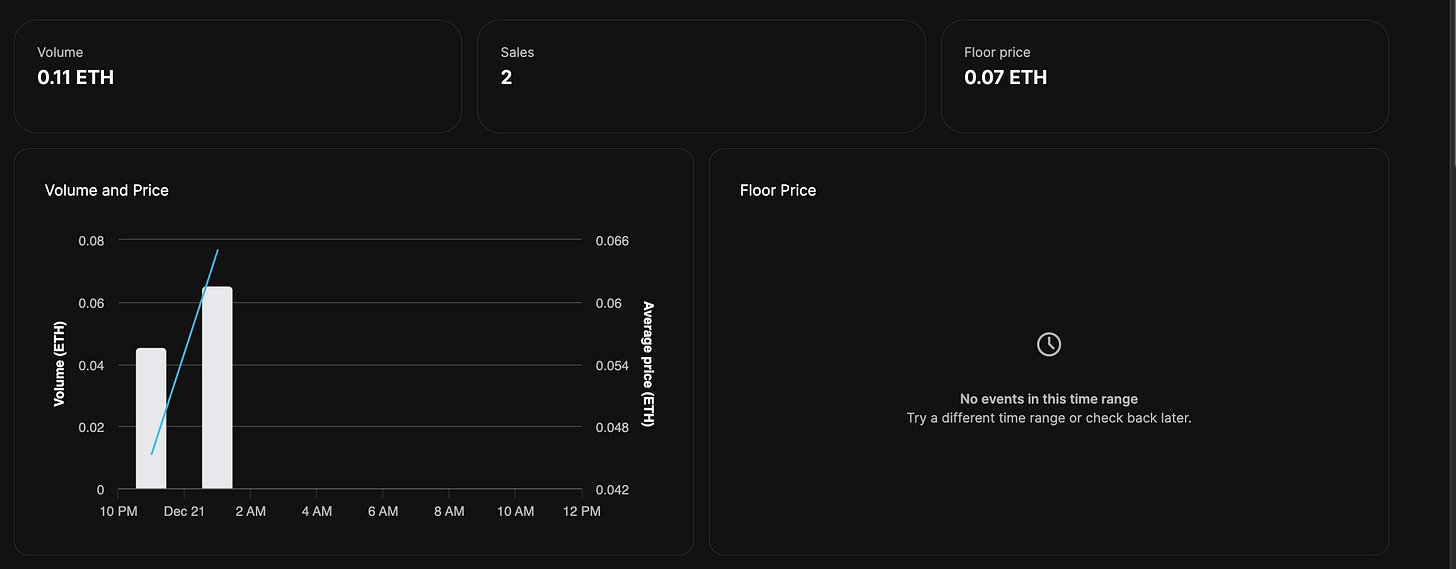

🔷 NFTs 🔷

They have just launched their NFT with loads of benefits:

Booze NFT: Daily reward of 25 points per NFT held, encouraging multiple NFT holdings for multiplied rewards.

Spirit NFT: One-time reward of 1000 points for minters (one mint per user).

Despite the dry NFT market with inscription and memecoin taking away all the attention, the Booze NFT has seen sales at 0.07ETH

🔷 Conclusion 🔷

As investors seek lower regulatory risk and institutions pour more capital into Arbitrum and decentralized platforms, Vaultka looks poised to exponentially increase adoption and market share into 2023's eventual return to a bull cycle.

Key metrics around staking ratios, TVL growth relative to market cap, and bribe incentives paint an optimistic picture for Vaultka's continued expansion.

The true circulating market cap to TVL ratio of 0.006 signals substantial room for upside when paired with surging perpetual swap volume across leading protocols.

Twitter: https://twitter.com/arndxt_xo/status/1737793845507891380