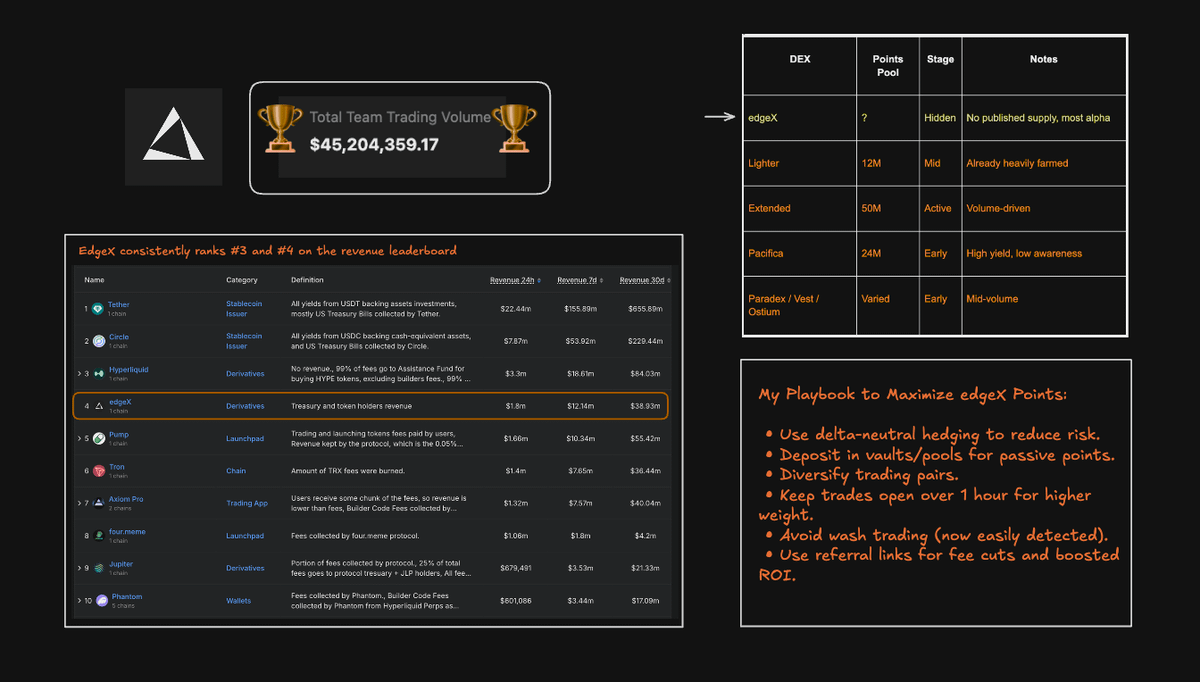

I am back to sharing my refreshed take on perp DEXes after my team did $45M in vol in less than 30days.

If 2023–2024 was the era of LSTs and RWA protocols, 2025 is the year of the Perp DEX.

We’re entering the Perp DEX Season and if you’ve been around long enough to remember the $UNI, $DYDX, $HYPE and recently $ASTER, you can feel the same heat building again.

Among the dozens of perp DEXs, @edgeX_exchange stands out:

→ with half the trading volume of Hyperliquid

→ without even having a token yet

→ consistently ranks #3 and #4 as the top rev printoor

Here I will note down my findings and some strategies to earn max airdrop points 👇

(in fact, i have an even better news, for those who signed up with my ref link, you get: 10% rebate, VIP1 privileges trading points weighting factor is increased by 10%.)

1. Perp DEXs Have Entered a New Arms Race

The new generation — @edgeX_exchange, @Lighter_xyz, @extendedapp, @tradeparadex, @OstiumLabs, @VestExchange, @pacifica_fi — are using the points tokenless period to bootstrap users, and liquidity.

This has two consequences:

• Short-term speculation on points replaces the pre-token FOMO of old airdrop meta.

• Long-term retention depends on how sustainable the incentive mechanism is (vault yields, funding rate arbitrage, LP returns).

The results in a hybrid “trade-to-earn” ecosystem where users are both speculators and investors in early liquidity depth.

2. edgeX Building in the Shadows

edgeX has been stealthily building an army of traders, particularly in Korea and Japan, while quietly doing:

• $5B+ daily trading volume, roughly half that of Hyperliquid.

• TGE rumored for Nov 2025, with trusted sources describing it as an “intensive push month.”

• Vault mechanics that reward delta-neutral participants and allow 24-hour withdrawals, despite an official “7-day” window.

In Japanese and Korean trading communities, edgeX is now considered the high-expectation play for a massive TGE airdrop — “ポイ活の神” (point farming god).

3. “Timing Alpha”

One of the more advanced discussions happening inside edgeX circles revolves around Vault mechanics.

Unlike most perps, edgeX allows strategic entry and exit before snapshot events, meaning traders can exit before volatility drawdowns or enter just before major market moves to capture market-making yield spikes.

A recent user test withdrawing $700,000 confirmed that edgeX can process large withdrawals within 24 hours, refuting the “7-day lock” misconception.

This matters for professional users who need flexibility between yield farming and delta-neutral hedging.

4. The Social Factor with Ambassador & Early Incentives

edgeX’s social distribution strategy is surprisingly elegant:

• 10% fee discount

• 10% point bonus

• Start at VIP1 (usually requires $500M volume)

This structure encourages network-driven organic growth, creating a pseudo-affiliate economy that mirrors early Binance’s referral explosion. It’s decentralized, and the rewards flow directly through the trading system, not centralized profit-sharing.

This aligns users, volume, and liquidity in a way we haven’t seen since dYdX’s 2021 token incentives.

5. How edgeX Compares

According to @prz_chojecki’s “Ultimate Perp DEX Points Calculator”, https://x.com/prz_chojecki/status/1970834991275032743

Here’s the landscape by point volume and early speculation:

• edgeX – Hidden phase; no published supply, considered most alpha.

• Lighter – Mid-stage DEX with 12M points; already heavily farmed.

• Extended – Active with 50M points; volume-driven incentives.

• Pacifica – Early stage with 24M points; high yield but low awareness.

• Paradex / Vest / Ostium – Early-stage group with varied pools and mid-volume activity.

What makes edgeX particularly interesting is its under-the-radar accumulation, traders are building massive positions before any token economics have been disclosed.

6. My Playbook to Maximize edgeX Points

For those optimizing their airdrop farming strategies, the current best practices include:

• Delta-neutral hedging across DEXs to minimize risk

• Depositing into vaults or liquidity pools for passive points accrual

• Diversifying across trading pairs

• Keeping trades open >1 hour (longer duration = higher weighting)

• Avoiding wash trading, which many protocols can now detect

• Using referral links for reduced fees and higher ROI: pro.edgex.exchange/referral/ARNDXT

7. Institutionalizing Airdrop Meta

The point systems we’re seeing now are proto-token distributions, early liquidity programs, gamified DeFi loops.

Projects like edgeX, are user acquisition engines that align real trading activity.

In other words: this is tokenomics becoming market-making.

Just as @Uniswap bootstrapped liquidity with $UNI, edgeX is bootstrapping behavioral liquidity, incentivizing consistent participation before TGE.

…edgeX might represent the next Hyperliquid moment.