$OGV overlooked gem 💎 in DeFi

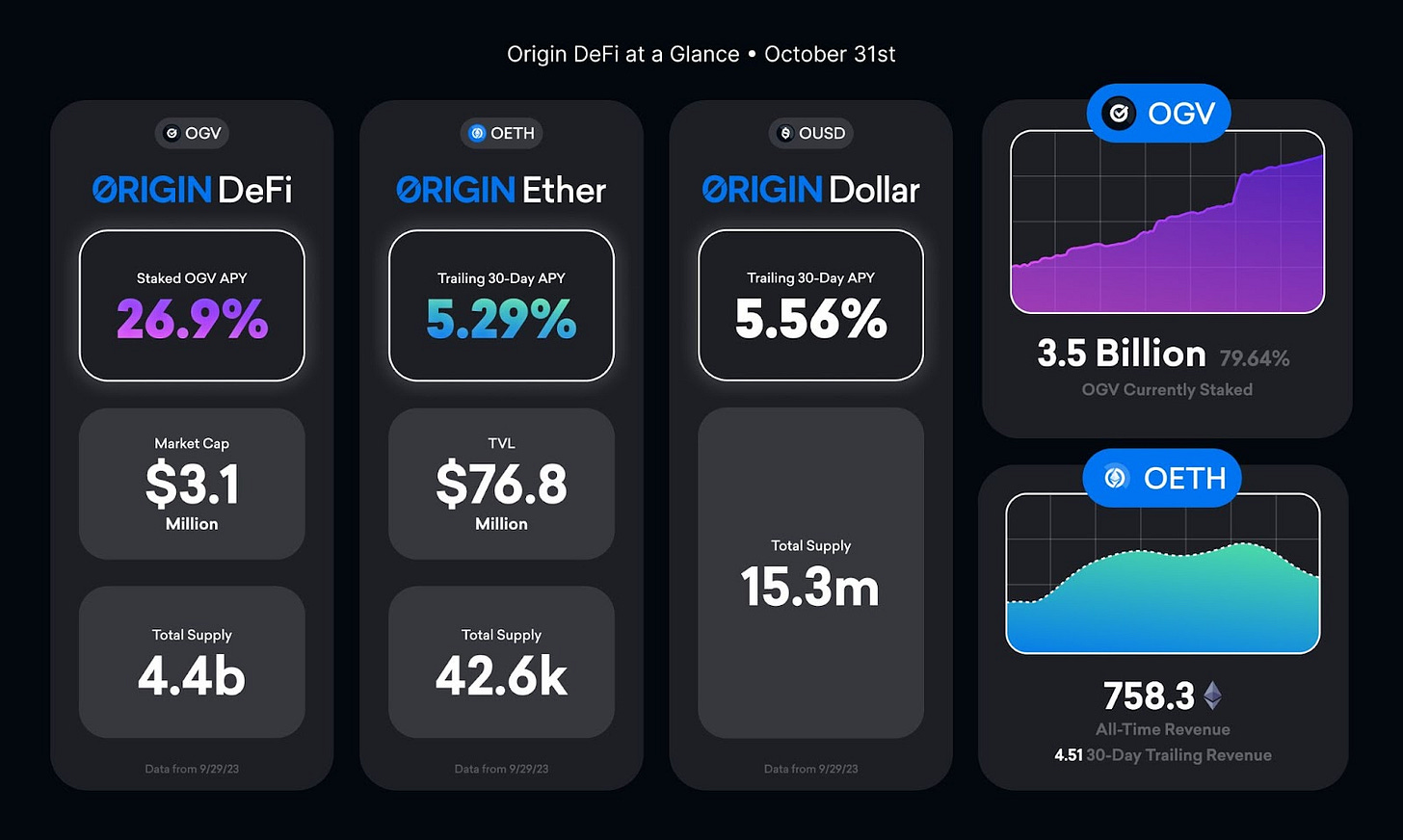

With over 80% staked, TVL of ~$100m, $OGV recent updates bring even more value to holders.

How has $OGV (<$5M MC) position itself for more upside potential 🧵👇

🔷 About Origin 🔷

@OriginProtocol products are built with the vision to be fastest growing verticals in crypto and this gave birth to:

Origin DeFi - supercharge yields with interest bearing stablecoin and liquid staking solution

Origin Story - building the tools for NFT creators and builder to accelerate their NFT ecosystem

With Origin’s recent updated plans in Nov to build value accural mechanisms around $OGV, I thought it would be timely to look at $OGV and its ecosystem around Origin DeFi.

Within the Origin DeFi ecosystem, we have 3 tokens: OGV, OETH, OUSD.

OGV is Origin’s value accrual and governance token for OUSD and OETH.

OETH is pegged to ETH rather than USD and uses ETH/LSTs as collateral.

OUSD was launched in September 2020 as a stablecoin pegged to the US dollar. It has been live for over 2 years now and has had hundreds of millions in circulating supply.

The smart contracts underpinning OUSD have been thoroughly audited by leading firms like Trail of Bits and OpenZeppelin.

OETH launched more recently in May 2023 using the same core smart contracts as OUSD.

The main difference is OETH uses ETH and liquid staking tokens (LSTs) as collateral rather than stablecoins.

OETH normalizes the accounting across different LSTs so 1 OETH is always worth 1 ETH. Users don't need to worry about the underlying math.

🔷 Value Accural, Metrics 🔷

Improvements to Origin's tokenomics, the successful/timely launch of OETH, and growing TVL are driving significant value accrual to OGV.

With substantial revenue distributed to OGV stakers, the token would continue to accrue value relative to its fundamentals. Such continued growth could provide +EV for OGV holders over time.

Origin governance token $OGV has seen its value increase substantially in 2023 due to improvements in tokenomics.

With over $90m in total value locked (TVL) between OUSD and OETH, OGV's relatively modest $4 million market cap appears undervalued compared to similar protocols.

OGV accrues value primarily through performance fees generated by OUSD and OETH. In Oct 2023, OGV stakers passed a proposal to use 10% of fees earned by OETH to buy back and distribute OGV tokens to stakers. OUSD fees are already used for OGV buybacks and yield distribution.

The launch of OETH in May 2023 caused Origin's TVL to triple. With its larger TVL, buybacks from OETH fees are approximately 3x previous buybacks. OETH was also launched with a 20% performance fee, up from 10% for OUSD. Half of all fees go to buying CVX to further boost yield on OTokens.

OETH, which pegs to ETH, optimizes yield across liquid staking tokens and DeFi strategies. This simplifies ETH staking and stacking for higher yields. OETH's $75 million TVL since launch demonstrates product-market fit and will be a strong player for the LSD narrative.

Fees averaged out to around 400k a month and market cap is sitting at only 3m, which looks prime as a token that have legs to run more in the coming bull

This was their recent update in Oct 2023 with very attractive metrics as a value token.

🔷 Token 🔷

With OUSD, OETH, and OGV, Origin Protocol is quickly building a diverse yet interconnected DeFi product suite for stablecoin and ETH yields. The launch of OGV and fees being routed back into the DAO makes the ecosystem self-sustaining and community-focused.

OUSD, launched in 2020, was the first yield bearing stablecoins in DeFi. It is backed 1:1 by major stablecoins like USDC, USDT, and DAI. Users can deposit these stable assets into OUSD to earn a yield without having to manually compound rewards or pay gas fees. OUSD uses DeFi strategies like lending and liquidity mining to generate returns.

Building on OUSD's success, Origin launched OETH in May 2023 - its first product in the LSDfi space. OETH lets users deposit ETH and other LSDs (or ETH-pegged assets like stETH, rETH, and frxETH to earn higher risk-adjusted yields compared to simply holding ETH. OETH targets yields 1.5x higher than stETH by utilizing strategies like leverage and derivatives.

Both OUSD and OETH use an elastic supply, meaning the token balance rebases upwards daily as yield is accrued. This innovative mechanic does away with the need to manually harvest rewards.

OGV is Origin's new value accrual and governance token that allows holders to govern OUSD and OETH strategies and parameters. For example, OGV holders can vote on target collateral allocations between ETH, stablecoins, and other assets.

OUSD and OETH have a 20% performance fee on yields generated. This is routed back to the Origin DeFi DAO treasury, governed by OGV stakers. 10% of the fee is used to buy back and distribute OGV tokens to stakers, while the other 10% buys CVX to further boost yields.

🔷 Notable Highlights 🔷

Origin offers staking rewards, protocol buybacks, and untapped potential at a modest valuation. For DeFi investors looking under the hood for an undiscovered gem, OGV checks all the boxes.

The various tailwinds could propel significant price appreciation if its fundamentals receive wider recognition. Here are some of the factors that make $OGV an undervalued pick:

Increased Value for Stakers: OGV stakers recently received a boost through a new proposal that passed to buy back OGV tokens using fees earned from OETH. These buybacks will be redistributed as extra yield to OGV stakers, increasing the return for holding the governance token.

Reduced Sell Pressure: OGV rewards used to incentivize CRV voting power have been reduced now that the OETH is more established. This reduction in OGV emissions should ease downward price pressure going forward. Additionally, OGV emissions recently halved on 4 Oct, reducing supply inflation for holders.

Small Circulating Supply: Over 80% of the total OGV supply is currently staked. This constrained float makes OGV more sensitive to increases in demand and considering the positive market sentiment

High Protocol Revenue: Origin DAO is earning substantially higher fees from the growth of OETH, which now has over $15m in total value locked. 10% of yields from OETH will fund OGV buybacks, providing continuous support.

Low Market Cap: Despite its high revenue and TVL, OGV still has a relatively tiny market capitalization of around $4m. This means there is lots of room for upside if DeFi investors start to value OGV more in line with other top governance tokens.

Twitter: https://twitter.com/arndxt_xo/status/1722210140739580304