Oversold Conditions, Liquidity Pump Signals, TGA Drawn Down

Macro Pulse Update 15.03.2025

We are in extreme oversold conditions in history, and it got worse on Friday.

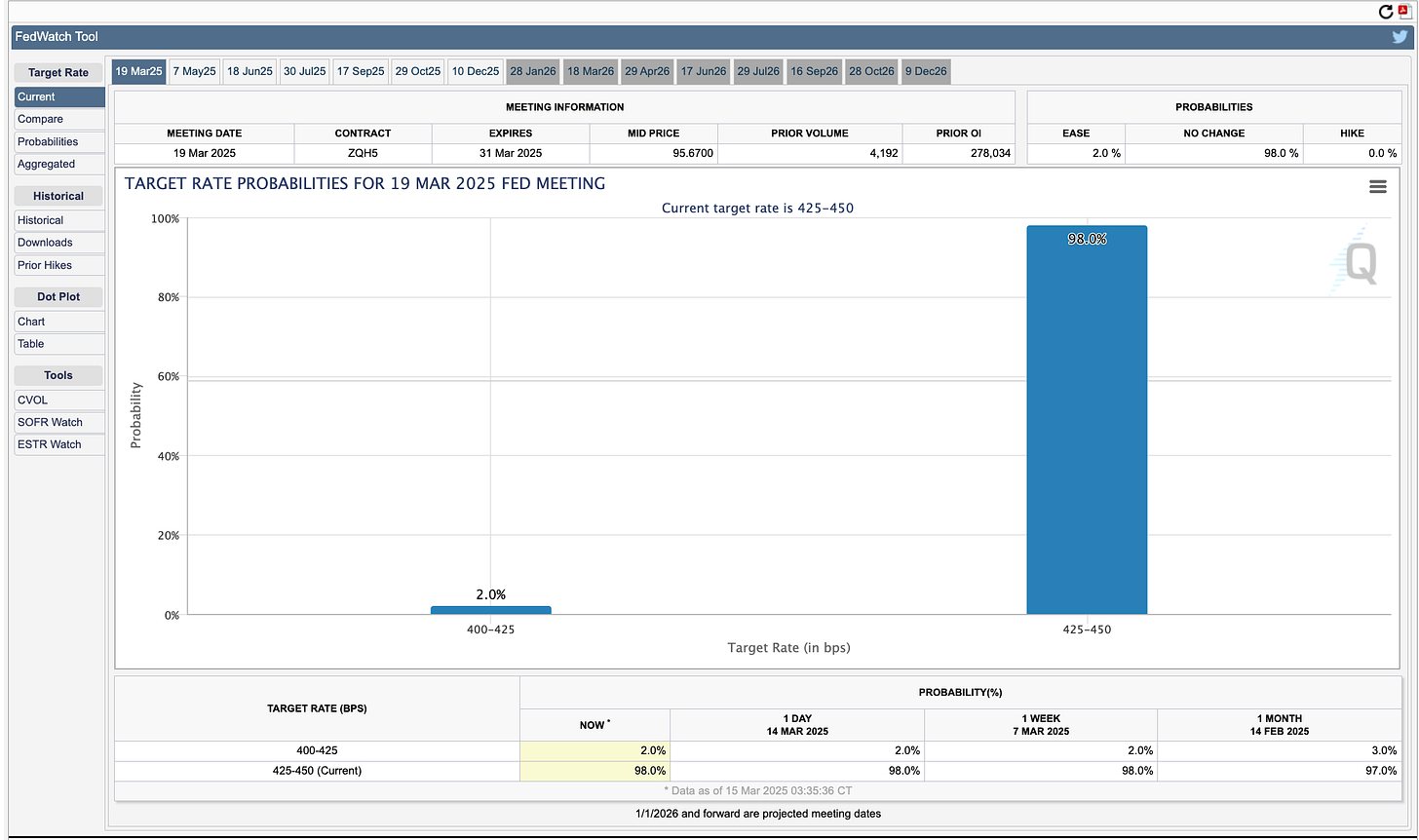

Rate cuts could be sooner than expected with increased frequency in 2025.

M2 global liquidity, TGA drawn down, altseason indicator at ATL

What you need to know to frontrun the liquidity pump 👇🧵

Macro Pulse Update 15.03.2025, covering the following topics:

1️⃣ Macro events for the week

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ EU Spotlight

1️⃣ Macro events for the week

Last Week

Next Week

2️⃣ Bitcoin Buzz Indicator

General Updates

Berachain enabled Boyco rewards claims.

Sui introduced passkey integration for transactions.

EigenLayer launched ETH restaking on OKX Earn.

Elixir Network is now fully decentralized.

PancakeSwap burned 9.58M $CAKE ($15M), reducing supply by 19%.

Osmosis burned ~80,000 OSMO tokens as part of its monthly token burn.

Hyperlane enabled bridging on SonicSVM.

Aave added Circle’s EURC stablecoin to its Base market.

Mezo launched mUSD, a Bitcoin-backed stablecoin.

Bungee enabled chain-abstracted swaps to scUSD on Sonic.

Resolv Labs joined the Superstate Industry Council (SIC).

Braavos enabled Bitcoin Lightning payments on Starknet.

Infinex integrated 1inch Fusion for optimized trading.

Launches

Penpie went live on Sonic Labs, integrating vePENDLE strategy.

DeFi Saver launched as a non-custodial DeFi management platform.

Curve Finance introduced new crvUSD minting markets.

Movement Network launched its Public Mainnet Beta.

LayerZero became the official interoperability provider for Movement.

Truemarkets launched on Base for real-time on-chain information aggregation.

Berachain launched Bepolia, its canonical testnet.

GMX expanded to Solana from Arbitrum and Avalanche.

Bullet launched its testnet as Solana’s first network extension for trading.

Biconomy introduced its new application layer with 'Supertransactions'.

Issues & Controversies

1inch Settlement vulnerability led to an exploit, draining funds from market maker TrustedVolumes.

Gauntlet's Compound-Morpho lending vault proposal sparked governance concerns.

Hyperliquid margin system concerns addressed after liquidation controversy.

Upcoming Announcements & Integrations

Movement Network teased a major announcement.

MYX Finance preparing for its Token Generation Event (TGE).

Mitosis launching its Matrix campaign with Theo Network.

Sui partnered with Merkle Science for real-time transaction monitoring.

Solv Protocol launching SolvBTC.BNB on March 12.

3Jane unveiled its whitepaper for a capital-efficient money market.

Lido outlined its CSM V2 scaling vision.

Napier V2 set to launch on March 14.

Starknet outlined a roadmap for Bitcoin integration, aiming for full decentralization by 2026.

Axelar integrating with Sui for universal interoperability.

Resupply outlined its rollout roadmap.

Berachain’s airdrop claim deadline approaching (March 20).

Airdrops

AO’s Protocol Pioneers campaign began on March 8.

Peaq’s Get Real Season 1 reward claiming is live (2.1M $PEAQ allocated).

Shardeum’s Phase 1 Airdrop deadline was March 10.

Vertex launched Sonic Fusion: Part Three for $S trading and quests.

Nillion enabled $NIL allocation checking.

Pell Network’s Epoch 1 airdrop went live on March 13 (first 8 hours for OKX Wallet users).

Vest launched Vest Points, a user rewards system.

Farms & Yield Opportunities

Lombard’s LBTC liquidity pool is now live on AftermathFi.

Ethena Labs introduced USDe as a reward-bearing stable margin collateral.

Pendle launched new PT markets on Silo Finance, enabling 7.7x leveraged yield.

Contango launched a 25,000 $OP incentive program on Optimism.

Pendle introduced a new aUSDC pool on Sonic Labs.

Silo Labs launched a PT-wstkscUSD-frxUSD loop with Frax.

Drift introduced the FuelFlow Vault, amplifying airdrop rewards up to 15x.

Spectra launched an sUSN pool from Noon Capital, offering leveraged exposure and multiple yield streams.

DGI Rewards Program allows APR earnings by simply holding $DGI (no staking required).

3️⃣ Market overview

Bitcoin Dips Below $80K Amid Recession Fears – A broad sell-off hit the crypto market as concerns over rising tariffs and economic downturn weighed on investors. The Dow and S&P 500 also posted their worst days of the year.

Mt. Gox Moves $905M in Bitcoin – The defunct exchange transferred ~11,500 BTC to an unknown wallet, raising speculation about upcoming creditor repayments. The payout deadline has been extended to October 2025.

HUD Evaluates Blockchain Integration – The US Department of Housing and Urban Development is exploring blockchain solutions for monitoring grants and streamlining payments but has not committed to implementation.

El Salvador Expands Bitcoin Reserves – Despite IMF restrictions, the country continues accumulating BTC, reaching 6,111 BTC in total holdings. President Bukele remains committed to bitcoin as a national reserve asset.

Cantor Fitzgerald Launches $2B Bitcoin Financing Venture – The Wall Street giant partnered with Anchorage Digital and Copper.co to offer leveraged bitcoin access to institutional investors, further bridging crypto and traditional finance.

4️⃣ Key Economic Metrics

🟢 US Trade Policy Impact on Financial Markets

Equity Markets React Negatively to Tariffs – Initial post-election optimism over tax cuts and deregulation has given way to fears over tariffs, leading to declines in US stock indices. Automotive companies, in particular, have seen sharp drops due to anticipated supply chain disruptions.

Rate Cut Expectations Have Shifted – Despite previous predictions of limited rate cuts in 2025, futures markets now expect up to three cuts due to economic slowdown concerns, as reflected in a sharp drop in the US Purchasing Manager’s Index (PMI).

US Dollar Strength Faces Uncertainty – While tariffs typically boost the dollar by reducing import demand, investor fears of a weakening US economy and potential Federal Reserve rate cuts have kept the dollar's rise more muted than expected.

Global Trade Shifts Affect Currency Markets – Germany’s decision to increase borrowing for defense and infrastructure has led to rising European bond yields and a stronger euro, counteracting some dollar gains.

Investor Confidence in the Dollar’s Dominance Wavers – Concerns are growing that increased trade barriers may reduce the dollar's attractiveness, though no other currency currently has the scale or liquidity to replace it as the global standard.

Flight to Safety Amid Uncertainty – The "Magnificent Seven" stocks are down 16% from their peak, and the NASDAQ has dropped 10%, as investors move funds into money market instruments, which hit record-high volumes.

Tariff Uncertainty Chills Business Confidence – Frequent policy reversals and shifting justifications for tariffs have created uncertainty for businesses, particularly in capital-intensive industries like automotive, making long-term planning difficult.

🟢 US Economic Landscape

US Job Growth Slows – The US added 151,000 jobs in February, with notable gains in construction, transportation, healthcare, and local government, while retail, professional services, and leisure industries saw declines. The slowdown in hiring fueled concerns of weaker economic growth, contributing to continued declines in equity markets.

Wage Growth Steady, Labor Market Tightens – Average hourly earnings rose 4% YoY and 0.3% MoM, slightly above inflation but unlikely to drive further price increases due to rising labor productivity. The Federal Reserve does not view this as a major inflationary risk.

US Unemployment Rate Rises to 4.1% – A significant drop in labor force participation, partly attributed to a sharp decline in immigration since the new administration took office, has led to a slight uptick in unemployment. The government reported a 93% drop in daily border crossings, impacting workforce availability.

5️⃣ EU Spotlight🔴

Germany's €900B Fiscal Stimulus Plan – Germany’s CDU/CSU and Social Democrats propose a massive €900B spending package to boost defense and infrastructure, marking a major policy shift to counter the Russian threat and address years of underinvestment. The plan requires constitutional changes to lift borrowing limits, with approval expected before the new government takes office.

Financial Markets React to Germany’s Stimulus – Investors anticipate the plan’s approval, driving Germany’s 10-year bond yield up by 38 basis points—the sharpest rise in nearly 30 years. The euro has strengthened against the dollar, and German equities are outperforming US markets as expectations of economic growth rise.

EU Proposes €800B Defense Spending Boost – European Commission President Ursula von der Leyen calls for lifting borrowing caps to allow member states to finance increased defense spending. The plan includes provisions to support Ukraine’s military efforts while acting as a region-wide economic stimulus. European defense stocks have surged in response.

Really liking these macro style write-ups!