Faded a $30B valuation at its peak

Game theory was a concept pioneered by Olympus DAO

A derivative protocol built on the economics of game theory + RWA 🧵👇

In this thread, I will cover the following topics:

Dilemma

About PEX

Product Features

AEE Mechanism

Tokenomics

Revenue Model

Upcoming Catalyst

Conclusion

If you enjoyed the read, please RESTACK, LIKE and COMMENT on what you like to hear next. It will be super helpful!

🔷 Dilemma 🔷

The main issues are around misaligned incentives, imbalance in positions, and a disconnect between the governance token value and ecosystem growth.

So perp dexes face a lower participation, instability, and reduced value capture for key stakeholders like LPs and token holders.

LP Inefficiency

High liquidity provision but low trading volume leads to inefficient use of capital and lower returns for LPs

Unpredictable and uncertain returns deter LPs from participating

Death Spiral

Conflicting interests and incentives between traders and LPs

Overall net long position in market increases one-sided exposure risk and instability

Disconnect Between Governance Token and Ecosystem

DEX growth not fully reflected in token price reduces incentives to hold token

Lack of involvement and fair rewards for token holders despite their contributions

🔷 About PEX 🔷

@pex_exchange aims to be the fairest decentralized spot and perpetual exchange through game theory implementation. They will have synthetic assets and RWA such as commodities, real estates available for leverage trading.

They improve upon existing PerpDEX primitives and incorporate an Auto-Equilibrium Engine (AEE) for better incentives for various market participants.

Perp DEX Dilemma:

Existing platforms face a zero-sum competitive dynamic between governance token holders, liquidity providers, and traders

This misalignment of incentives can lead to a "death spiral" over time

PEX is also known as Perpetual Equilibrium Exchange bringing unique solutions to the table

Unique AEE system aligns incentives among parties

Shifts from Nash equilibrium to collective best-payoff for a win-win

Core motto: "Trade Fair, Gain More"

🔷 Product Features 🔷

Synthetic Trading

Allow trading of synthetic assets like stocks, commodities, forex pairs without holding the underlying assets

Create synthetic tokens that mimic real-world assets using smart contracts

Oracle feeds for price data to enable accurate valuation of synthetic tokens

RWA Trading

Trade asset-backed tokens collateralized by real-world assets held in custody

Tokens reprsent ownership of underlying assets like commodities, real estate

Auto Equilibrium Engine

Smart contract based engine to dynamically adjust liquidity provider rewards

Algorithmically sets reward rate based on changing trade volumes to maintain target liquidity levels

Controlled token emissions to provide expected returns for liquidity providers

Key parameters like target liquidity range configurable by platform owners

🔷 AEE Mechanism 🔷

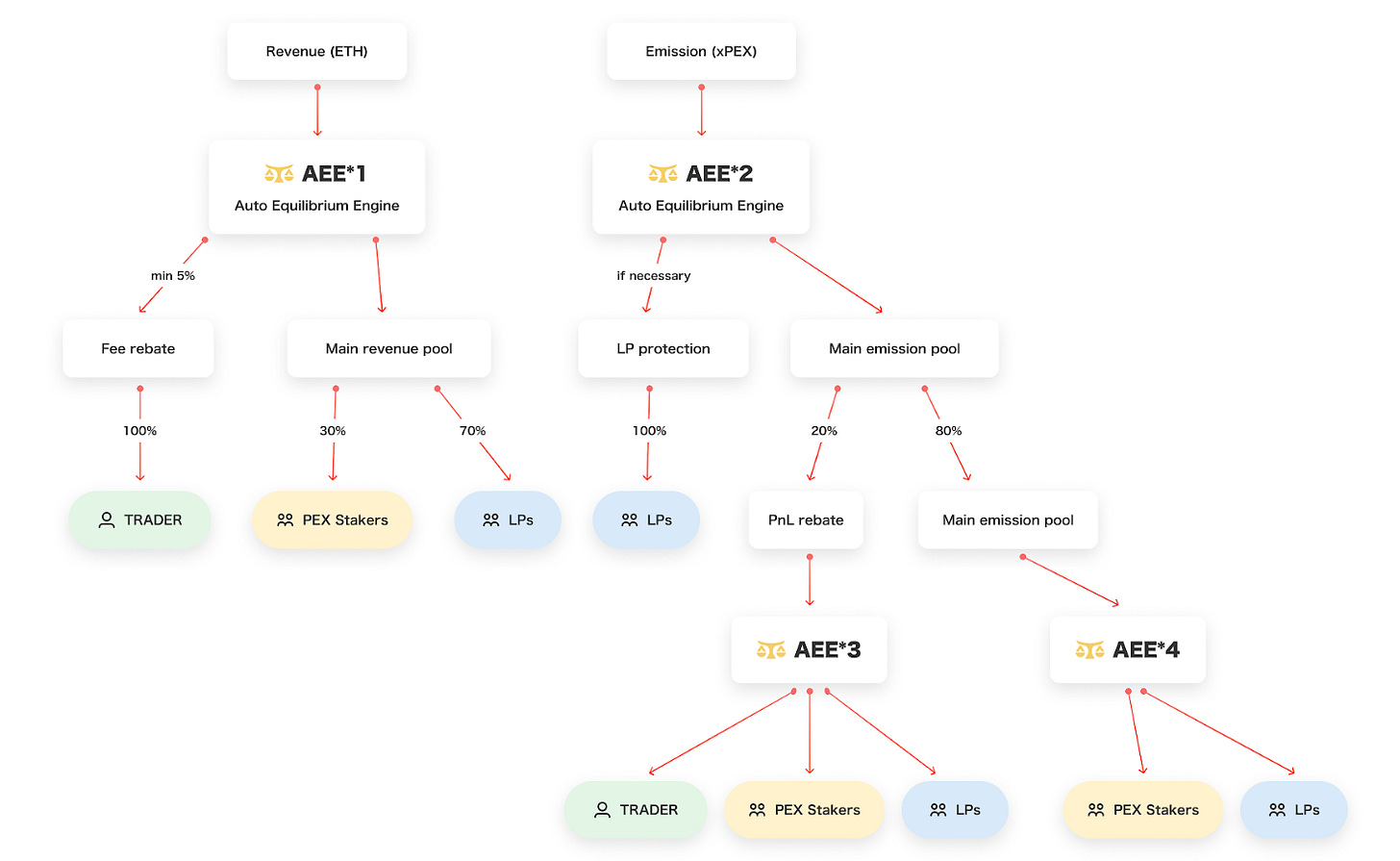

AEE leverages decentralized data and automated systems to balance stakeholder interests, align incentives, and promote efficiency and stability. This is intended to create optimal outcomes for users across trading, yields, and platform growth.

The AEE is designed to:

Balance interests between traders and liquidity providers through aligned incentives and two-sided exposure to promote stability

Connect governance tokens closer to platform growth for better holder rewards and participation

Enhance returns for liquidity providers through optimized volume and allocation, ensuring more stable and predictable yields

The AEE uses an automatic mechanism to settle market imbalances by:

Monitoring trading activity and liquidity needs

Making adjustments to trading fees/rebates to incentivize desired market behaviors

Allocating more capital to underserved markets to balance exposure

Updating system parameters mathematically using on-chain data and models

🔷 Tokenomics 🔷

Powered by a 3 token model

PEX

Governance

Hold PEX for revenue sharing

xPEX

Provided by protocol under the AEE mechanism

LP difficulty fee; xPEX will be burnt for the LP mint when the difficulty level > 0

Direct conversion to PEX with discount

Vesting to convert into PEX

PLP

PLP can be thought to be similar to GLP

PLP holders receive fee distributions, trader loss allocations, and PEX emissions through an AEE mechanism.

There is a difficulty level to control PLP minting and balance interests between new and existing investors prevent dilution from PLP inflation.

Minting, burning, or swapping PLP has fees based on if it amplifies/decreases asset equilibrium. Actions enlarging the larger asset share have higher fees.

Token weights hedge PLP holders based on traders' unsettled stakes. Longs increase token weight, shorts increase stablecoin weight.

With shorts, PLP prices may fall if underlying prices fall but rise if prices rise due to trader losses maintaining reserves' value.

🔷 Revenue Model 🔷

Breakdown of all fees incurred through platform

Open and close position fee

Liquidation fee

Funding rates

Swap fee

Minting fees for PLP & PEX

🔷 Upcoming Catalyst 🔷

Looking forward to the testnet with the trading competition already running. And I hear the word “Airdrop”

🔷 Conclusion 🔷

@pex_exchange Exchange pioneered the Auto-Equilibrium Engine for aligned stakeholder incentives. The launch of its testnet trading will be an important catalyst to drive further interest and adoption.

PEX aims to solve common issues with existing perpetual decentralized exchanges through its novel Auto-Equilibrium Engine (AEE) system. The AEE aligns incentives between token holders, liquidity providers, and traders to promote stability and growth. This is intended to prevent the "death spiral" seen in other platforms.

Key features that set PEX apart include:

Synthetic and asset-backed token trading

The AEE algorithmically adjusts rewards and parameters to balance liquidity and exposure

3-token model with PEX for governance and xPEX, PLP for incentives

Fees from trading, minting/burning, and other activities provide revenue

Twiter: https://twitter.com/arndxt_xo/status/1731998253313589625

Finally a Perp DEX doing something different