During bull, investors go all in for the next narrative

Institutions invests heavily in RWA infrastructure

An easy 10x from here, with already more than 15+ projects that will be deployed

First RWA + DA Modular + Based team from Binance, Coinbase, LayerZero 🧵👇

If you enjoy the read, please RESTACK, LIKE and COMMENT on what you like to hear next. It will be super helpful!

🔷 Narrative 🔷

The traction that @plumenetwork gained is massive and its network effects will be huge.

More than a dozen projects already deploying on testnet @silverkoix, @libertum_token, @Farmsent_io, @buktrips, @DeFi_credit

In conversations with 50+ more projects

Grew from 6k to 24k followers in 3 days after @CelestiaOrg and team announcement

They are actively looking through ambassador applications as they increase their marketing footprint so I would expect to see more activities happening around them

Furthermore, @plumenetwork is riding on a multi-narrative hype:

L2 narrative: They are built on @arbitrum Orbit

$TIA Data availability narrative: Integrating with @CelestiaOrg

RWA: Building innovative tech optimized for RWA operations

🔷 RWA insights 🔷

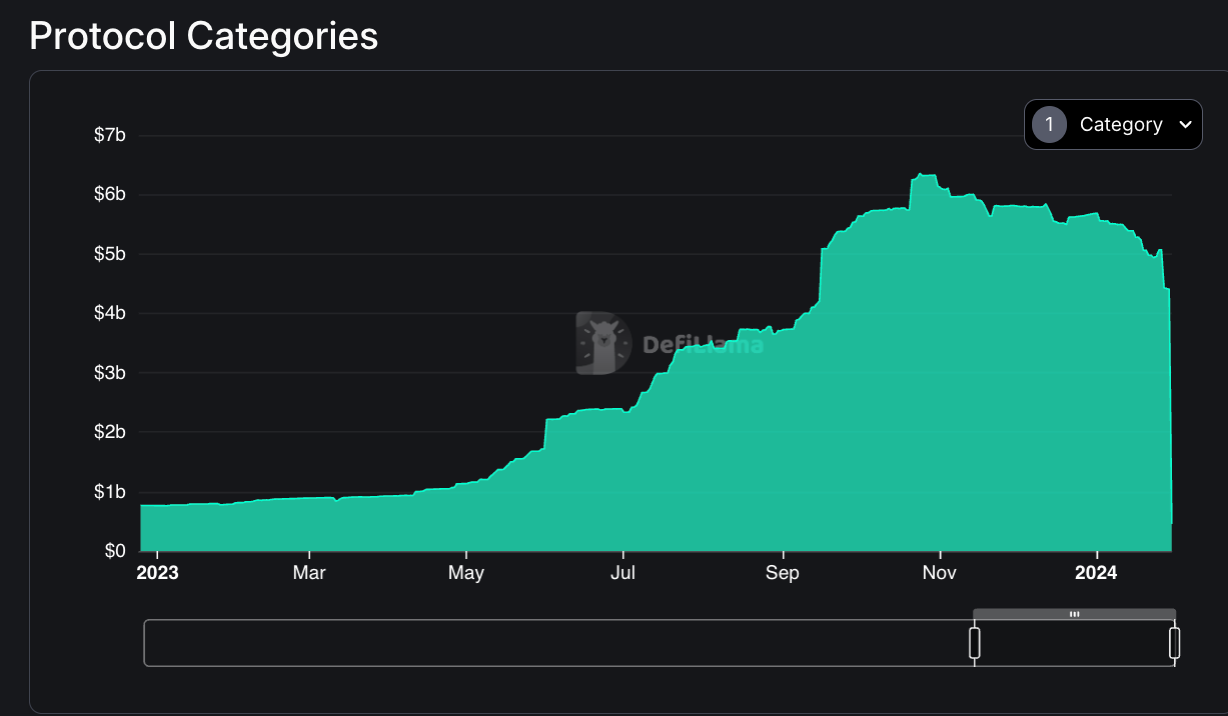

In the RWA market, there are huge opportunities with a market size of $5B and it has been growing rapidly in 2023.

For just active loans alone, it was a total market size of $1.5B. Currently, it only stands at $500M. It has at least 3x the potential from here.

And in terms of treasury products, its a pretty new addition and we are at $870M.

In essence, these insights tell us that they RWA market has lots of room for growth.

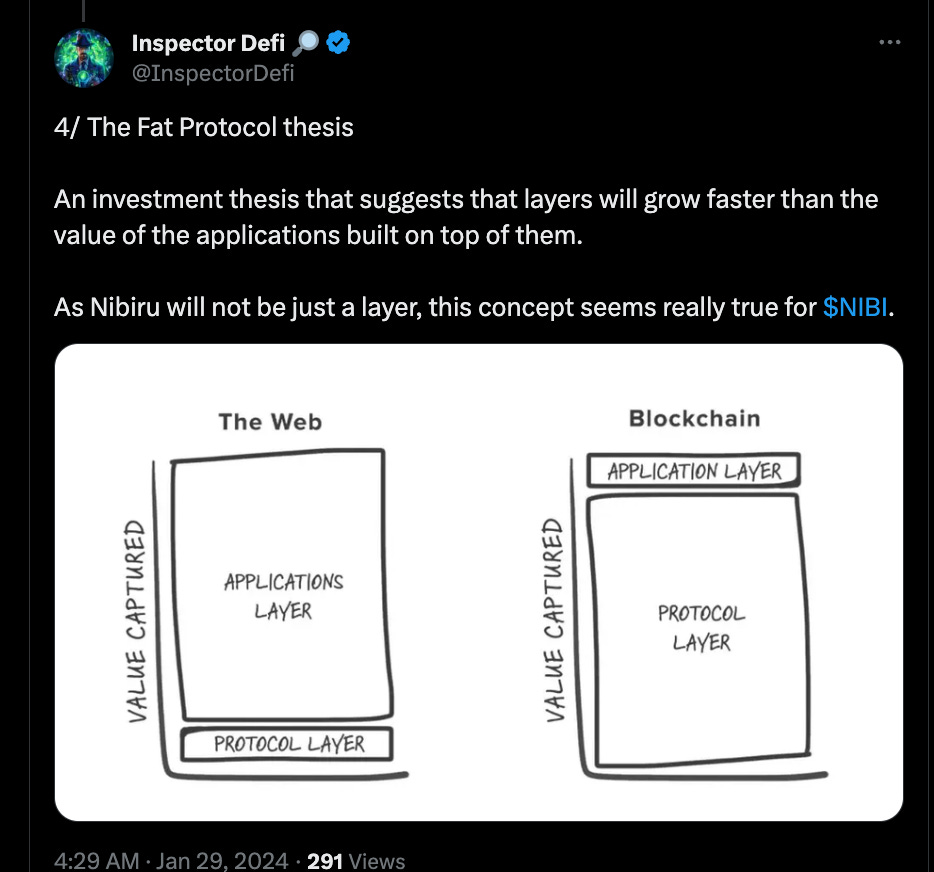

And 7 years later, the Fat protocol thesis still stands today. And given that much value in RWA, a L2 focused on that would yield a lot of +EV

L2 for RWA

Raise a healthy amount to fund the ecosystem growth and grants

Launch with a well-built ecosystem and low float

Layer success translates into projects success

🔷 About Plume 🔷

@plumenetwork represents a Layer 2 solution tailored for Real World Assets (RWA) along with new on-chain capital

It utilizes several approaches to make it possible by:

incorporating asset tokenization and capital/compliance software directly into the chain

establishing a secure and cost-efficient ecosystem

supporting the trading of RWA assets with its DeFi ecosystem

RWAs are among the hottest buzzwords in crypto fuelled by investments into this realm from instiutions and nationwide efforts like Project Guardian which surfaced in Q4 2023.

But RWA still faces major gaps in the market:

Composability

Operational efficiency of onboarding / deploying

Liquidity and finding the right buyers

So @plumenetwork aims to address all 3 and truly enable RWA mainstream adoption.

But Plume takes this onto a whole new level = RWA + Modularity

Compliance can be baked into the state machine

Modularity provides new ways for platform operators and asset issuers to monetize

Instant settlement & low fees

Plume is also a compliant L2 that many native integrations with RWA required tech making it easier for developer and investors:

Assets: transfer agents, licensed Alternative Trading Systems (ATSs), tokenization, and more.

Capital: encompassing KYC/AML processes, account abstraction, custodians, and more.

🔷 Catalysts 🔷

Plume is capable to host a any real world assets including tokenized real estate, hotel rooms, collectibles (sneakers, watches, trading cards, etc.), renewable infrastructure (solar farms, carbon credits, RECsetc.), wine & whiskey, web3 shopping/marketplaces, stablecoins, and private credit

It is building a DeFi ecosystem centered around RWA such as: AMMs, NFT RWA Perp DEXs, RWA borrow/lend, etc.

Incentives

For any new ecosystem there’s always some level of incentive to beef up the ecosystem so for any interested projects that want to build on Plume, I highly suggest chatting with the team to learn more 👀

Also, there will be an incentivized Testnet in early March just right after ETH Denver

Team

Very rarely I see dox teams and their team credentials strengthened my conviction in @plumenetwork

Cofounders are both tradfi + crypto native and have a vast amount of industry relevant experience: Coinbase, Binance, dYdX, Robinhood Crypto, Daiwa Securities, Scale Venture Partners

Core team is from tradfi, large L1s and other centralized exchanges: BNB Chain, LayerZero, Nansen, Microsoft, Galaxy Digital, JP Morgan Chase

Project Developments

Over the next 2 weeks it will be packed load of announcements on this front, so watch out.

One of the first developments is @PerperNetwork, building on Plume!

Thier Perper Euro-backed stablecoin, which enables secure, fast, and efficient transactions, fully licensed and regulated by the Capital Market Commission of Montenegro.

Twitter: https://twitter.com/arndxt_xo/status/1752328778376990752