$SD backed by Coinbase, Paradigm, Jump, Over 225% growth each quarter, Burns 20% of supply

I see ETH betas are catching up ahead of ETH ETF launch

$LDO surged +40% while $ENA revamped tokenomics and did +20%

@StaderLabs backed by Coinbase, Paradigm, Jump saw a growth of over 225% each quarter

How the $SD tokenomics revamp removing 20% of supply will send it 🧵👇

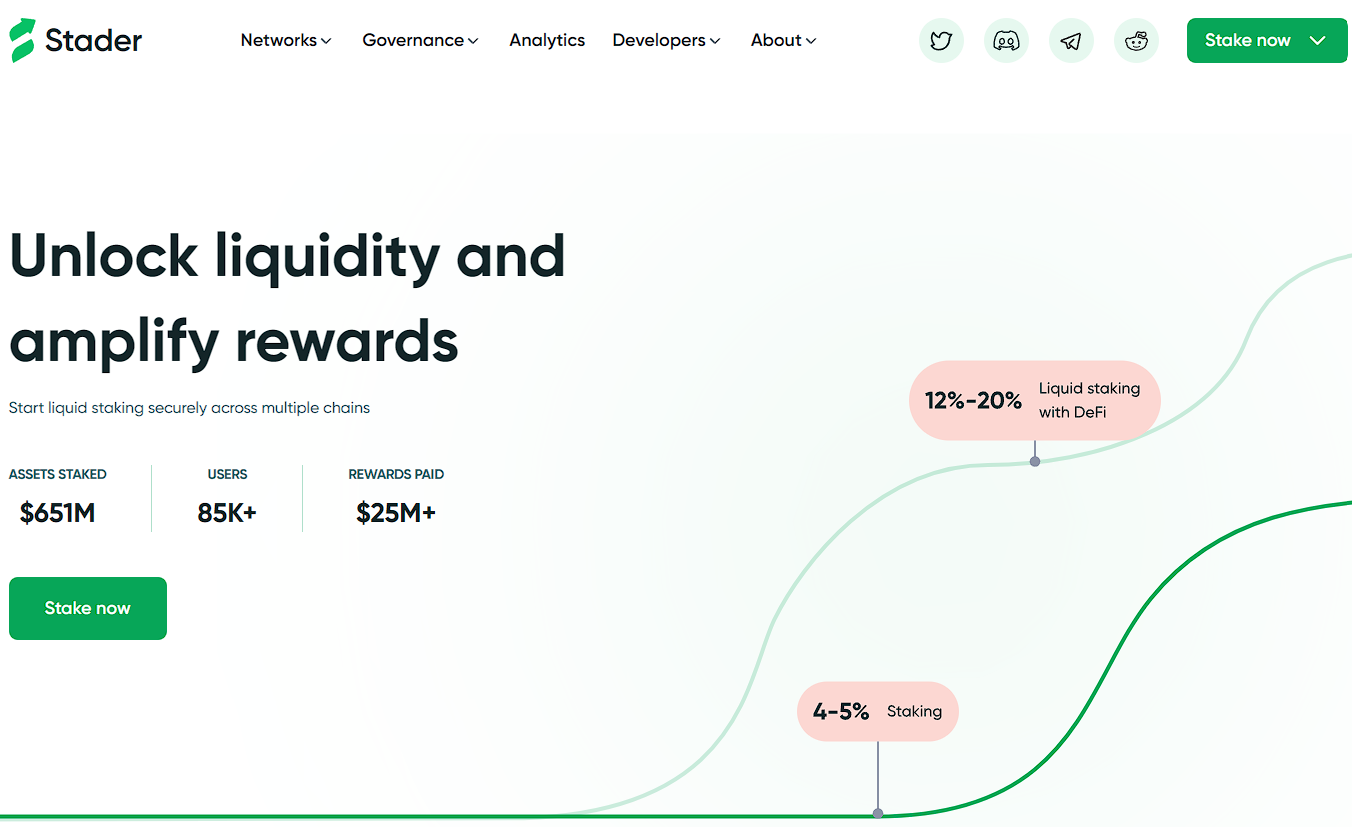

I'm talking about @staderlabs the largest LST on Polygon and Hedera with more than 85,000 stakers.

Did you know that on June 25, 20% of $SD token supply will be burnt, reducing the total supply from 150 million to 120 million?

Discover how this strategic move could send $SD 👇

What is Stader Labs?

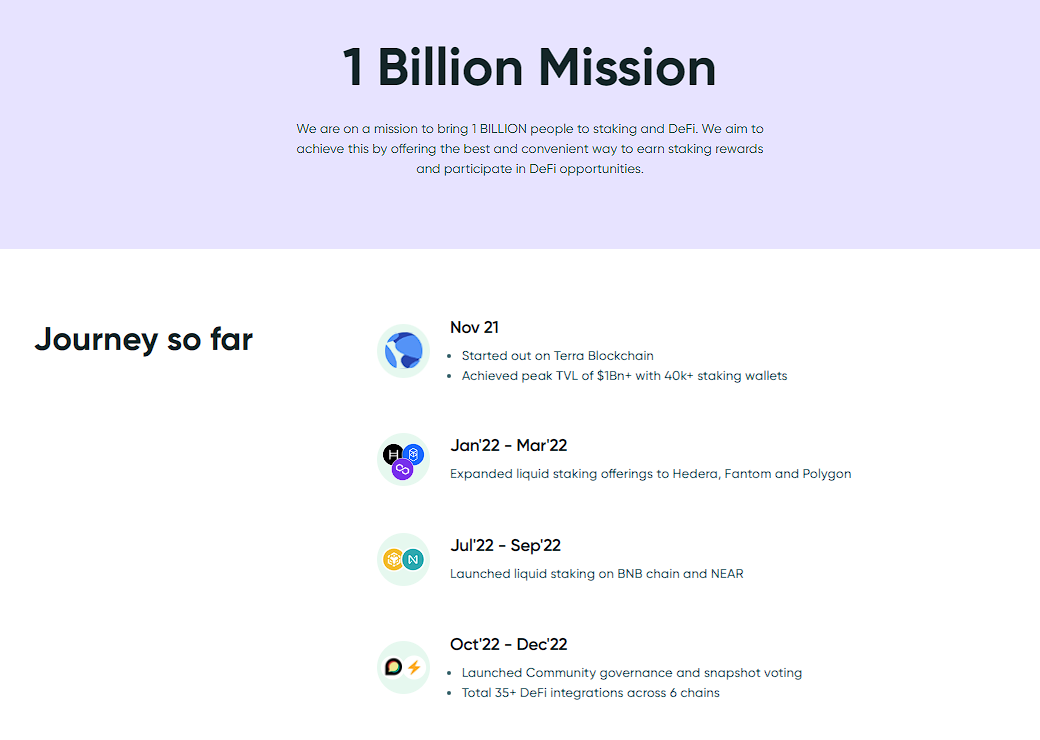

Stader is on a 1 BILLION mission

They are a premier multi-chain liquid staking solution, enhancing both security and accessibility for liquid staking.

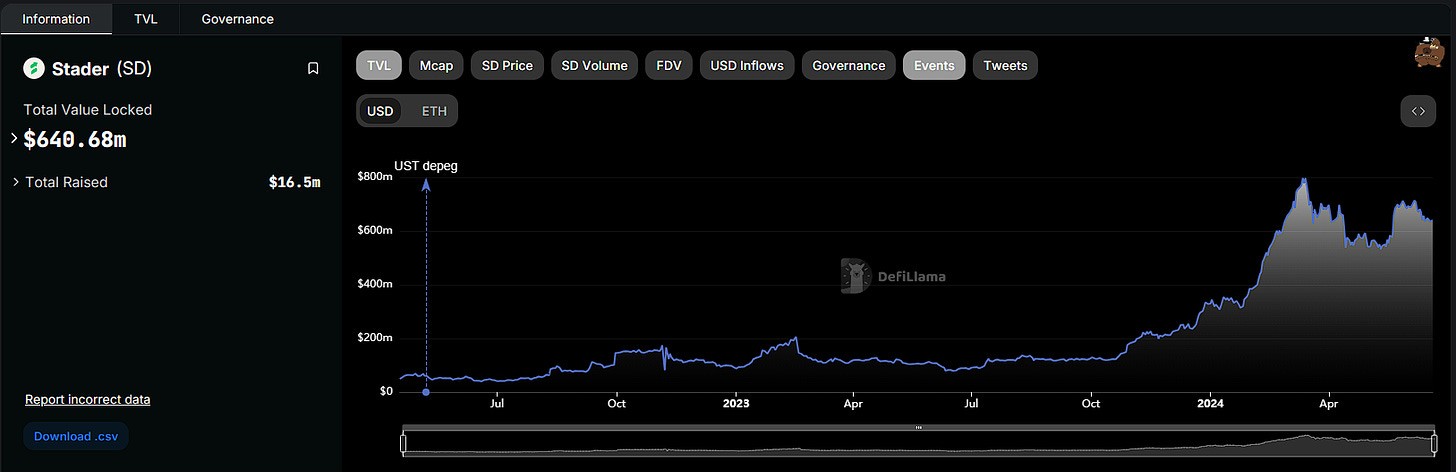

It’s currently active on four PoS blockchains—Ethereum, Polygon, BNB, and Hedera—with a TVL exceeding $700M

Their platform simplifies the staking process for delegators and validators alike, making it easier to participate in the staking economy.

The project has a experienced team and is already growing at the rate of 225%+ quarter on quarter

Stader's mission is to onboard 1 Billion people into staking and DeFi.

They aim to accomplish this by providing the most efficient and user-friendly methods for earning staking rewards and engaging in DeFi opportunities.

In just three years since its inception, Stader has witnessed remarkable growth, positioning itself to embark on the next phase of its success story.

Central to this progression is the alignment of its tokenomics, reward mechanisms, and SD token utilities.

$SD Tokenomics Reboot

Stader's ecosystem is governed by its native SD token, which allows holders to vote on governance decisions and benefit from the platform's growth.

It’s currently listed on multiple exchanges such as OKX, KuCoin, Bybit, HTX, and others.

SD token holders have increased by 65% year over year.

This isn’t a surprise since the token brings alot of value to the holders:

Governance Influence: SD holders vote on project development.

SD is used as a collateral for ETHx Node operators

SD can be delegated to the SD Utility Pool with which users delegating can earn upto 20% rewards on their SD. This SD is utilized by Node Operators to give them an only-ETH exposure while running validators.

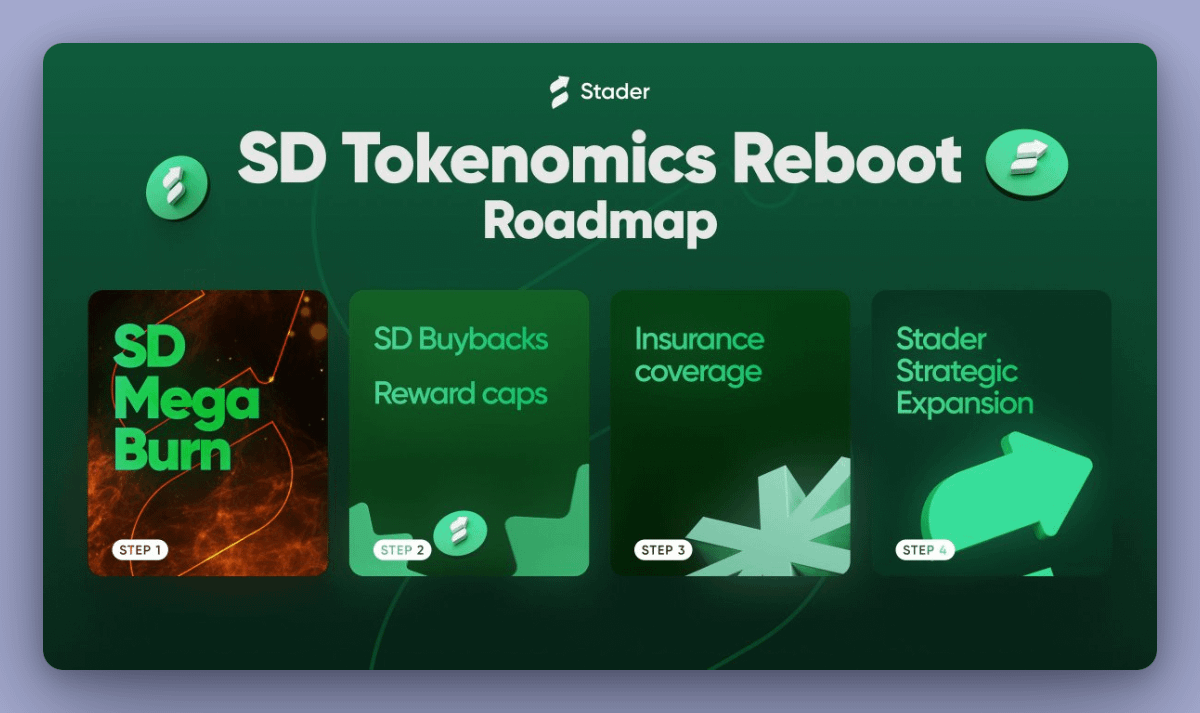

They are currently planning to reboot the tokenomics to pave the way for a more optimistic future for the token.

The SD Tokenomics Reboot will target these key areas:

Resolving the challenge of low floating capital and high FDV

Optimizing the circulating supply

Enhancing the token's utility

Let’s delve deeper into the roadmap 👇

Major Token Burn

Stader will start off the reboot with a major token burn of 20% next week.

Thi substantial reduction in circulating supply will create scarcity, impacting the demand for and value for $SD tokens.

https://x.com/staderlabs/status/1795525089297142051

This will also eventually address the concerns of a low float and high FDV and get more investors on-board.

It was a much needed step.

Revenue-Based Buybacks

Stader will implement revenue-based buybacks, committing to using 20% of its revenue for quarterly SD token buybacks.

This strategy ensures consistent buying pressure, gradually decreasing the circulating supply.

Additionally, as Stader's revenue and Total Value Locked (TVL) expand, the buyback amounts will also increase, influencing the market cap positively over time.

It is important for long-term sustainability of its tokenomics.

Sustainable Reward Emissions

Controlled reward emissions will be implemented as well by calibrating them to ensure TVL growth surpasses the scaling of rewards, maintaining a healthy balance.

These emissions are governed by the DAO, ensuring a harmonious blend of incentives and sustainable tokenomics.

Increased Utility & Insurance Coverage

Expanding SD token utility with new use cases like insurance for ETHx nodes increases demand by locking up more tokens, reducing supply, and boosting intrinsic value.

Ultimately, this enhanced utility directly contributes to increasing the intrinsic value of SD tokens, aligning with the broader goal of creating value for stakeholders.

Strategic Expansion

Stader is not only expanding its presence in the LST ecosystem but also exploring new avenues for growth in emerging sectors.

This includes exploring opportunities in RWA and the Bitcoin staking space, aiming to enhance market presence and foster business expansion.

Stader's FDV to TVL ratio of 0.15 suggests the SD token is undervalued, offering a very attractive investment opportunity.

The SD Tokenomics Reboot focuses on sustainable growth via optimized supply, increased utility, and revenue-based buybacks.

These strategies aim to attract more users, enhance liquidity, and build market confidence, fostering a bullish outlook for the protocol.

The project has already received funding worth over $16M from top VCs like @PanteraCapital , @cbventures, @jumpcapital , @HuobiGlobal and is rapidly expanding which will attract more investors.

I am confident that we will see an attention shift towards ETH betas and the liquid staking sector will be a huge beneficiary of it.