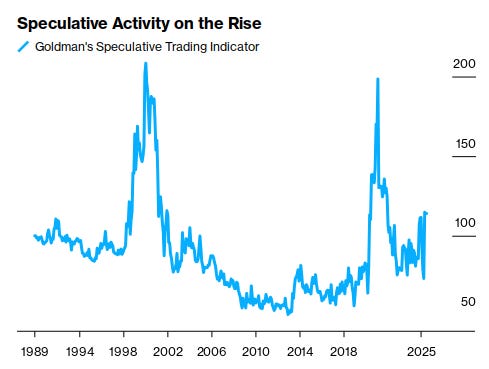

We’re in the late innings of a hyperfinancialized cycle.

An altcoin can 10x in a month and still retrace 20% in a day and CT will act surprised. We’re in a frothy market, but the froth is just a surface indicator. The deeper story is liquidity, distortion, and a civilization slowly cracking under the weight of its own contradictions.

The S&P 500 hit new highs, and people cheer. But if you step back, the so-called all-time high is just a liquidity illusion, measured in a currency backed by nothing, inflated by everything. Inflation-adjusted, the SPX hasn’t gone anywhere since the 2000s. It’s not “growth,” it’s a money supply chart.

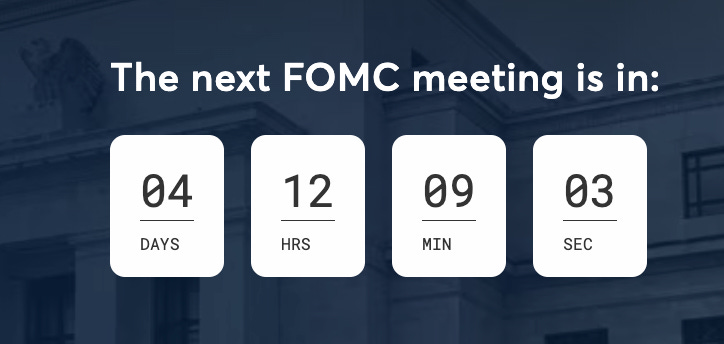

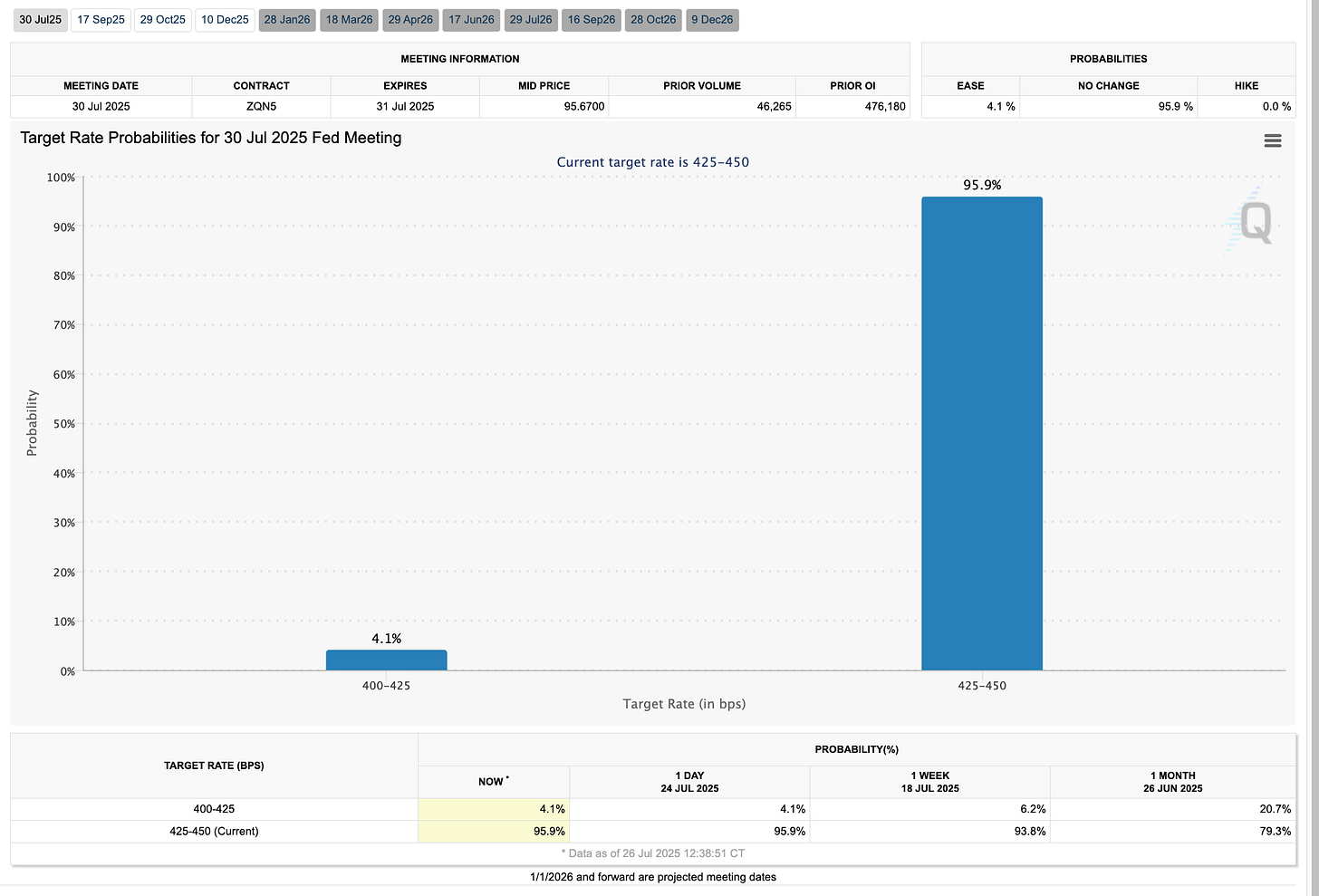

And the Fed isn’t cutting next week. Best case: September. Maybe one more in December if the wheels come off. But we’re past the point where interest rate tweaks fix anything. What we’re looking at is structural and there are only three real things that matter now:

I. The Slow Demolition of the Debt Regime

The modern monetary order is terminal. Built on a foundation of expanding debt, it now faces internal contradictions it cannot resolve. The old playbook, stimulus, bailouts, policy pivots, relies on a critical illusion: that more debt equals more prosperity.

But that illusion is crumbling. Productivity growth has stalled. Demographics have turned against the system. The working-age base is shrinking, the dependency ratio ballooning, and consumption is increasingly supported by credit rather than income. The machine is aging and no longer self-repairing.

Soros’ Super Bubble thesis, often misinterpreted as market analysis, was really a critique of epistemology—of how false narratives sustain false systems. 2008 should have collapsed the myth. It didn’t. COVID did, because the cost was moral. Governments proved they could not protect their citizens in the most literal, biological sense. And many decided that survival wasn’t evenly distributed.

The result is legitimacy decay. Institutions now resemble facades, propped up by surveillance, subsidies, and psy-ops. The Epstein case was not an aberration, it was a brief reveal of the real architecture: a system where criminality, governance, and capital intersect. The state no longer masks its corruption. It monetizes it.

II. The Encapsulation of Intelligence

The conversation around AGI remains stuck in naive optimism. Most people still believe AI will be distributed like Excel or AWS, a productivity tool, monetized via subscription.

That’s delusional.

If machines gain the capacity to self-improve, model complex systems, and design novel weapons, biological, chemical, informational, it will not be open-source.

Nuclear technology wasn’t democratized. CRISPR isn’t casually deployed. Every powerful technology eventually becomes an instrument of statecraft, and superintelligence will be no different.

What Sam Altman hints at and what Jensen Huang is quietly signaling by courting synthetic biology is not about consumer productivity, it’s about control over post-human trajectories. Moderna was a case study. What comes next will not be sold at CVS.

The public will not access AGI. They will interact with lobotomized fragments of it, wrapped in UX. The real systems will be hidden, gated, and trained to serve strategic ends. That won’t stop most people from believing otherwise. But belief is no match for infrastructure.

III. Time as the New Currency

Until now, money could buy comfort, security, and social access, but not time. That’s changing. With AI decoding the genome and synthetic biology accelerating, we are approaching the era where longevity becomes a domain of engineered advantage.

But don’t confuse this with a public health revolution. True life extension, cognitive enhancement, and embryo optimization will be prohibitively expensive, tightly regulated, and politically radioactive. Governments already groan under the weight of aging populations. They will not incentivize immortality.

So the rich won’t just be richer, they’ll be biologically distinct. And not metaphorically. The ability to alter the human blueprint will create a new economic class: those who can exit the mortality curve, in biotech patents.

This future won’t scale. It’s a cul-de-sac of privilege. Longevity will be the ultimate luxury good, priced for access. That’s why most “longevity funds” perform poorly. The payoff is survival. And survival isn’t scalable.

The Forking Path: Three Civilizations Ahead

We are bifurcating into distinct tracks, each with its own political economy:

Sedated Populace (Digital Fentanyl)

AI-generated dopamine loops, social media, virtual porn, infinite scroll. Hyperstimulated, undernourished, politically irrelevant. This is the majority experience. Cheap, scalable sedation.

Cognitive Caste (Biological Ascension)

A biologically and mentally enhanced minority. Not seeking financial returns, but dominion over biology and mortality. They will be fewer, richer, and increasingly untouchable.

Neo-Amish (Conscious Rejection)

A third path of opt-outs: those who disconnect, seek meaning outside the machine, and try to preserve human experience in a world designed to erase it. Spiritually rich, strategically doomed.

The first group funds the second. The third resists both.

Most people will float downstream, heads barely above water, unaware they’ve become product rather than participant. But for those who see what’s coming, opting out is no longer neutral, it’s resistance.

Strategic Clarity in a Broken World

Markets are noise. Crypto, stocks, yield games, they’re instruments of optionality, not salvation. The real game is existential. It’s about who escapes the collapse and on what terms.

The monetary system is degrading by design.

Superintelligence will not be your productivity assistant.

Biotechnology will segregate time itself.

COVID cracked the illusion of institutional protection.

Epstein proved power is insulated, not accountable.

If you grasp this, the question isn’t how to “beat the market.” It’s how to position for asymmetry in a system that no longer serves its participants.

You won’t find that clarity in price action. You’ll find it in systems thinking.

Most won’t look up. Most won’t believe it until it’s too late. Even if it costs everything. Because dying wondering would be worse than dying broke.

👇🧵

Macro Pulse Update 26.07.2025, covering the following topics:

1️⃣ Macro events for the week

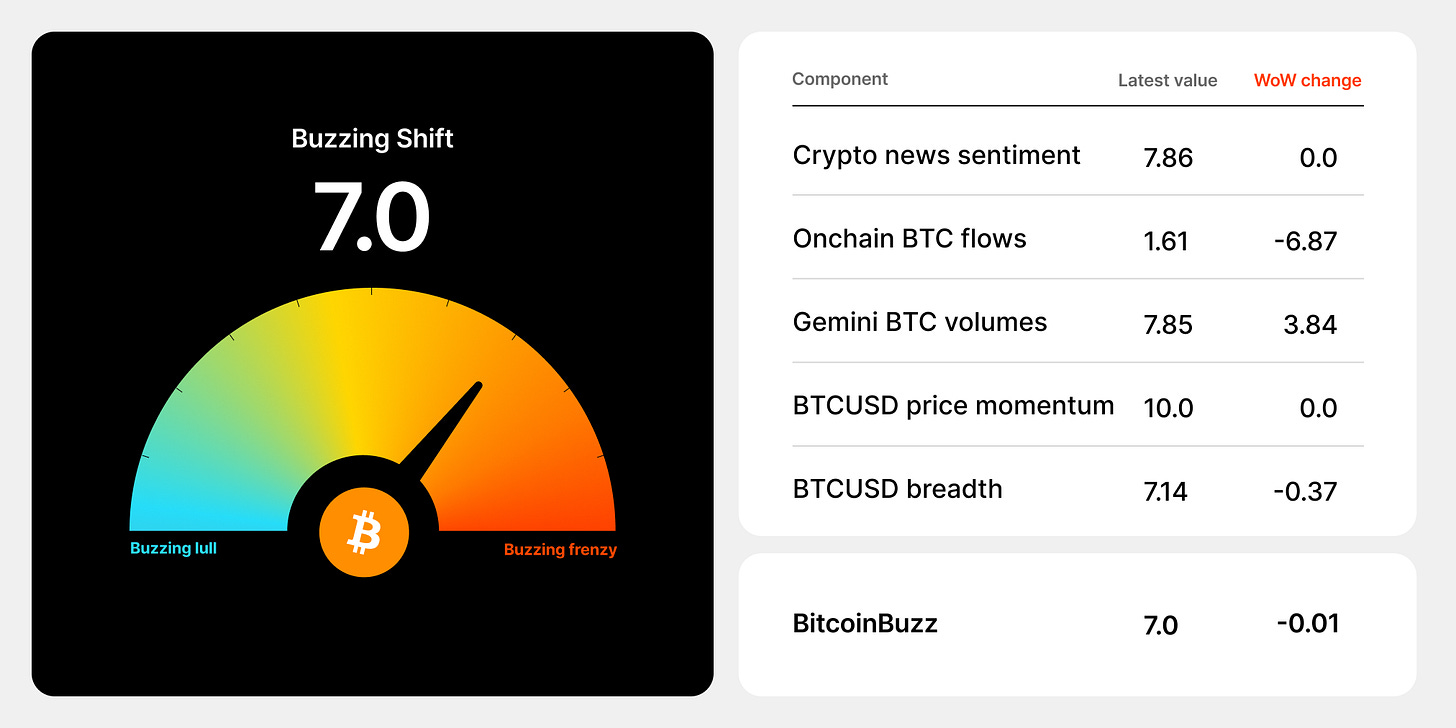

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ China Spotlight

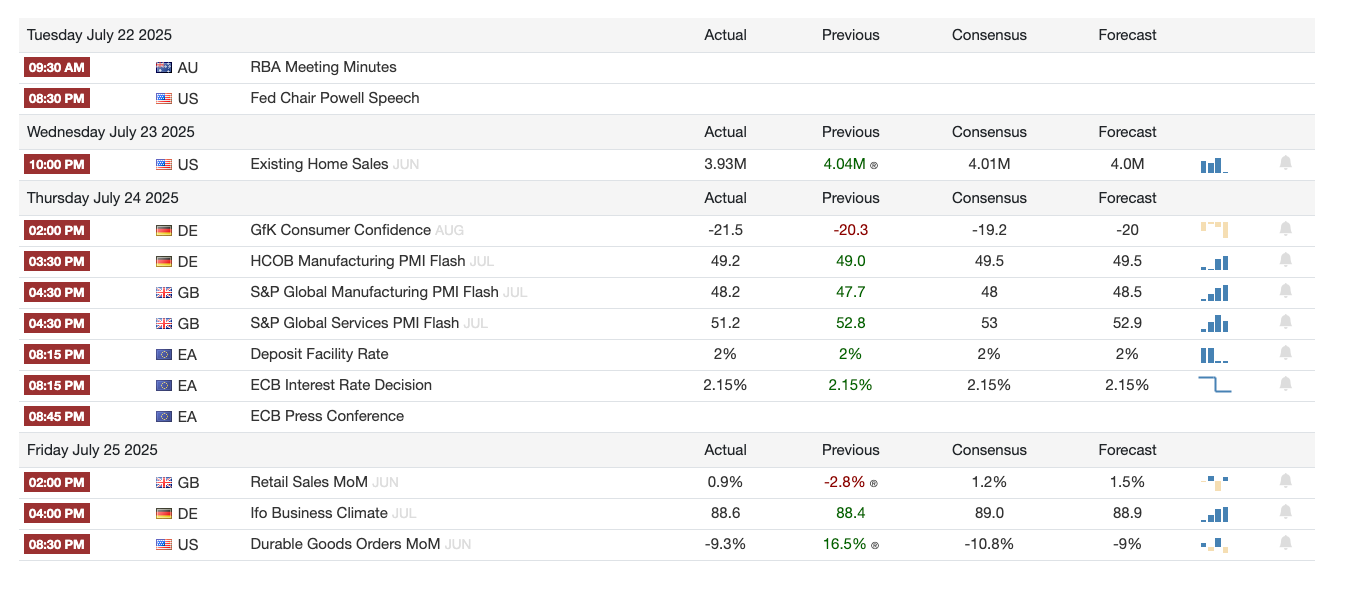

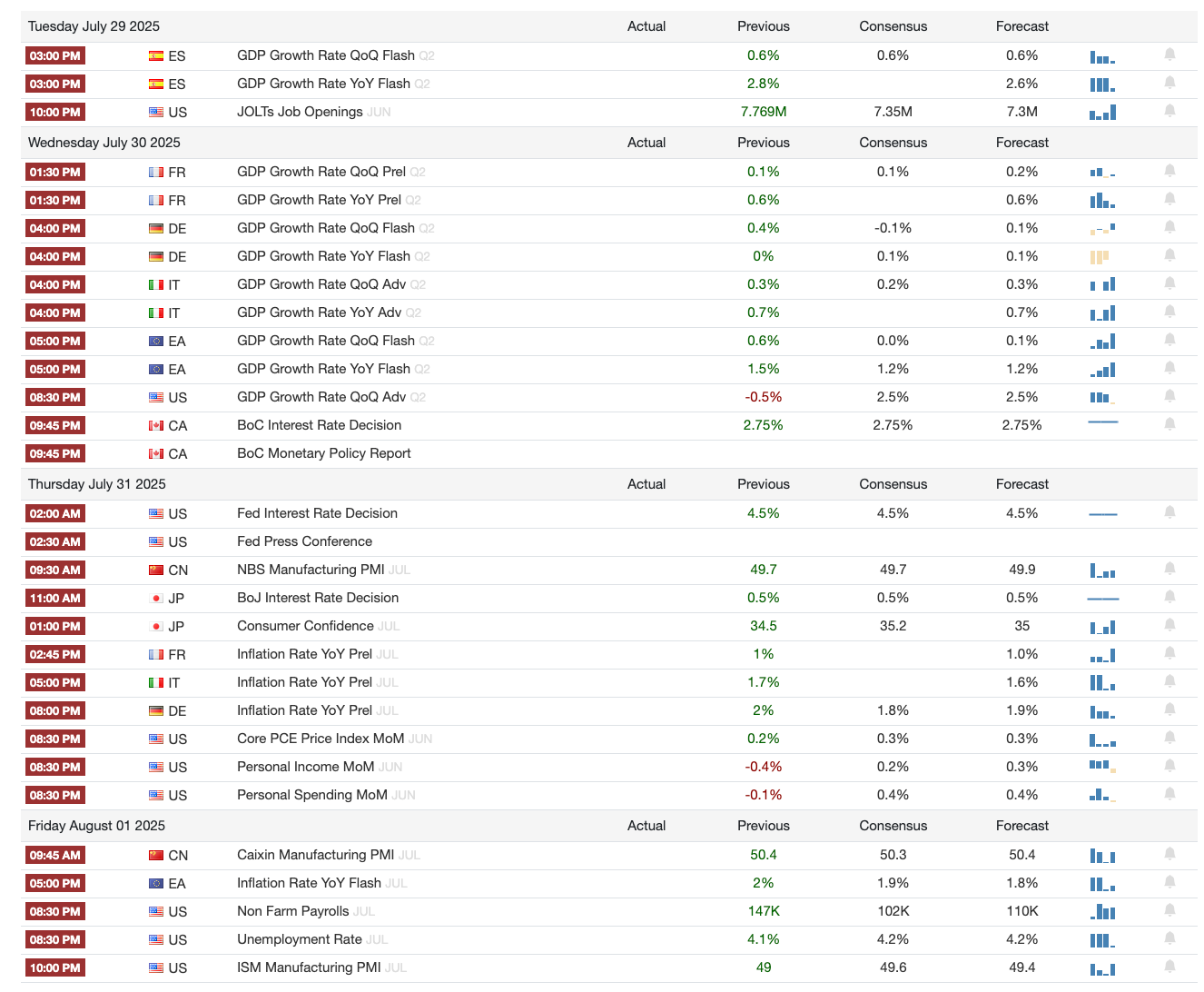

1️⃣ Macro events for the week

Last Week

Next Week

2️⃣ Bitcoin Buzz Indicator

Launches

@SolvProtocol just dropped something big called: Bitcoin Unbound with consistently month on month revenue printing

Centrifuge V3 launched on 6 chains with cross-chain fund management via Wormhole and modular asset tokenization tools.

Dexari is now live on iOS/Android—40x leverage, TradingView charts, no KYC, with ongoing referral and social campaigns.

f(x) Protocol launched sPOSITIONs: 0% funding, no margin call short ETH trades using fxUSD.

Aave’s Umbrella staking module now on DeFi Saver, offering yields up to 7.84% on stablecoins with safety net coverage.

Fluid DEX Lite launched as a gas-efficient, credit-based AMM with a bootstrap USDC-USDT pool.

Fogo launched testnet with 40ms blocks and Solana wallet support; dApps include perps and DEXs.

Strata Season 0 pre-deposit phase now live for USDe/eUSDe with 30x+ point multipliers.

Project X launched a new HyperEVM DEX with no VC funding and daily point rewards.

Ramses deployed on HyperEVM with RAM-to-xRAM and RXP points.

Nerite live on Arbitrum with streamable, overcollateralized stablecoin $USND.

Cashmere Labs devnet launched with one-click cross-chain transfers across 5 testnets.

Boundless Mainnet Beta launched on Base, featuring ZK-powered Ethereum state verification.

Kinetiq launched kHYPE, a liquid staking token for HYPE, with integrations across Hyperliquid projects.

Plasma testnet launched: stablecoin-focused L1 with Bitcoin bridge and PlasmaBFT consensus.

ReyaChain launched as a trading-focused L2 rollup—perps, gasless trades, RCP rewards.

Catex launched as a Uniswap v4 MetaLayer for hooks, ve(3,3), and LP automation.

Curve on TON and Euler on Telegram now live via mini apps for swapping and lending.

Jupiter launched JLP Loans (up to 86% LTV) to borrow USDC while earning yield.

Updates

Resolv introducing 10% profit fee by Aug 21 with future $stRESOLV governance.

Celestia Foundation bought back 43.45M TIA from Polychain to reassign via unlock schedule.

Stake DAO V2 launched on Curve with boosted Fraxtal rewards and no dilution.

Theo’s thBILL, tokenized short-term Treasuries, now live on 4 chains via LayerZero.

deBridge DAO disclosed $28.65M in assets generating DAO revenue.

USDC + CCTP V2 now live on Sei with gaming and payments integrations.

Berachain added Reward Vault Utilities for on/off-chain activity rewards.

Bungee supports RWA swaps on Plume via wallet-free, gasless UX.

Revert Lend live: borrow against Uniswap v3 LPs with Revert Points.

Rabby Wallet now supports EIP-7702 revocation.

Lombard’s LBTC now auto-yielding BTC rewards via Babylon staking.

Liminal opens to public with 30% rev-share referrals and $50M+ TVL.

Folks Finance launched lending/borrowing on Sei with $50K incentives.

Circle Gateway testnet live for cross-chain USDC dev access.

EigenLayer Redistribution live—slash funds redirected instead of burned.

Origin Buyback Blitz doubled to $200K/week through Aug 1.

xStocks now live on Kamino and usable as collateral.

YO Smart Lending vaults live with 4x YO points via Fluid.

USDT0 launched on Rootstock with unified liquidity.

Aave on Sonic Labs now supports swap-adapters for simplified operations.

Neutrl added USDe to treasury for risk-managed DeFi-native yield.

GMX recovered $40M exploit funds, will distribute based on AUM snapshot.

infiniFi launched USDC vault on Morpho for looping strategies.

Lido V3 stVaults live on Holesky testnet—modular, customizable staking.

Kamino incentives updated on Maple market to optimize stablecoin yields.

Felix integrated kHYPE for leverage-looping and CDP functionality.

Hamilton Lane’s $SCOPE expanded to Optimism + Ethereum with tokenization by Securitize.

PayPal’s PYUSD now live on Arbitrum.

Kamino’s zBTC Market live, offering BTC-backed credit/yield with $20K+ monthly rewards.

Bungee now supports Katana chain swaps with 25+ chain access.

Kai Finance rolled out new vaults, UI upgrades, and LP analytics.

PancakeSwap added ZKsync + Linea to Crosschain Swap for seamless multichain trading.

Airdrops

Threshold x Galxe campaign for tBTC-to-BUCK quest runs until Aug 6.

0G Labs testnet campaign now live via Galxe quests.

Sonic Labs distributed 49M $S with 30M more via Sonic Gems (builder-led).

TAC x Merkl: rewards claimable for Curve/Morpho LPs of tacUSD/tacBTC/tacETH.

PancakeSwap x Coinbase One airdrops $4.2K CAKE every 2 weeks.

Strata Season 0 gives up to 60x point multipliers for pre-deposits.

Farms

Hyperwave’s hwHLP on Pendle offers 4x points and high yields via LayerZero.

siUSD on Pendle now yields up to 14% APY with no leverage needed.

vyUSD market live on Pendle with 193% APY and 5x points.

Dolomite integrated BYUSD (fiat-backed stablecoin) for lending on Berachain.

Bunni’s new weETH/ETH pool on Unichain earns UNI, swap, lending, and restaking rewards.

WBTC earns 11% APR on Echelon at 70% LTV.

Morpho USDC incentives boosted by 50% on Base.

Issues

Kinto $K exploit via proxy attack drained $1.55M; team to relaunch v2 and reimburse users.

Safe experiencing UI outages due to indexing issues; fix in progress.

Arcadia Finance exploited for $2.5M via Rebalancer; users urged to revoke permissions.

Phantom had temporary outage; swapper back up, Trending Tokens pending.

Katana bridge withdrawals delayed to 12h due to congestion.

BigONE hack cost $27M due to supply chain attack; user funds safe, recovery underway.

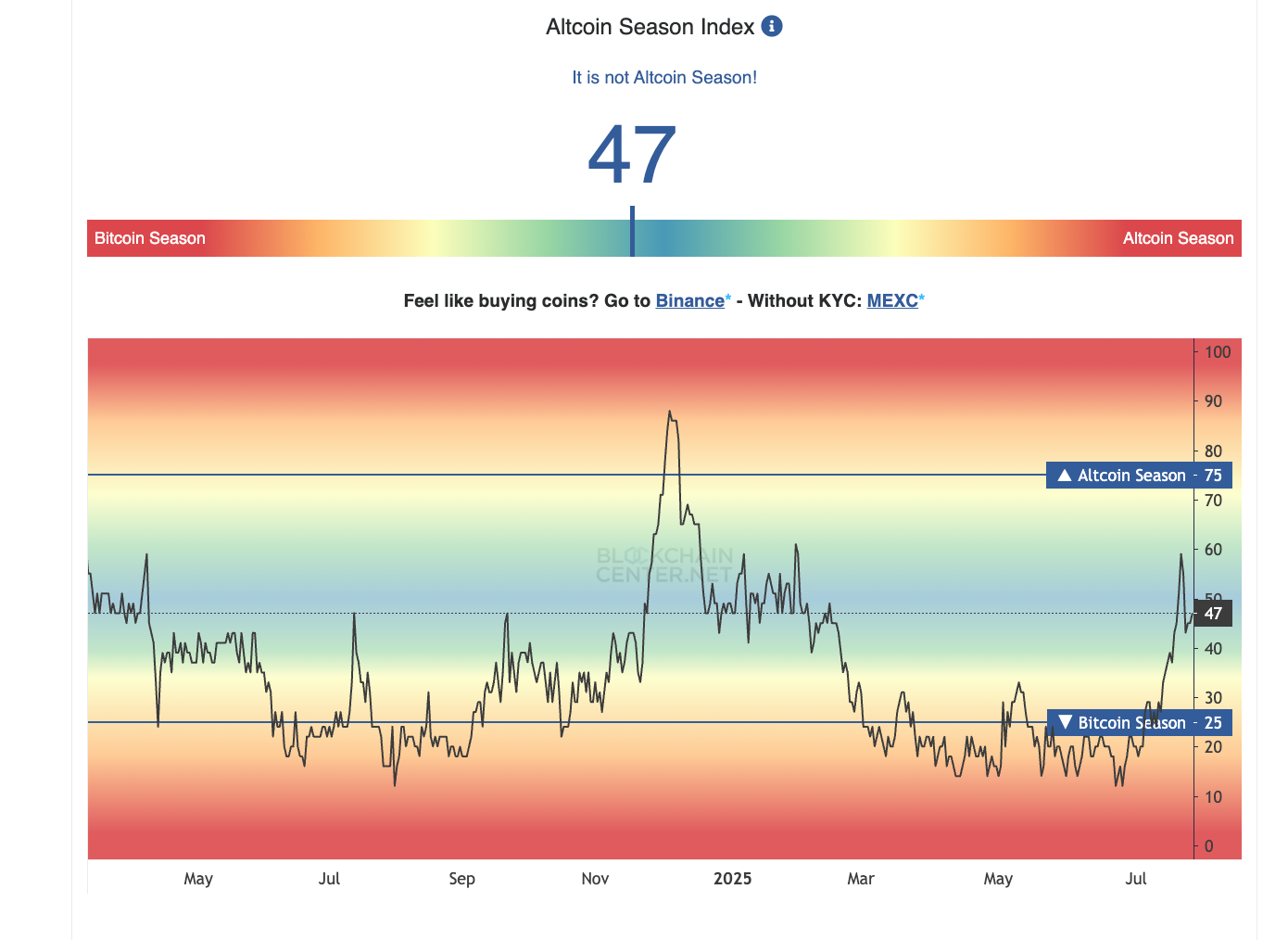

3️⃣ Market overview

Key Highlights

ETH leads flows: U.S. spot ETH ETFs took in $534M on Tuesday, July 22, 2025 (3rd-largest daily inflow since launch). Spot BTC ETFs saw $68M outflows the same day.

Prices (as of Thu, July 24, 2025, 12:43 pm ET): BTC $118,476 (+0.04% w/w), ETH $3,679 (+9.02%), UNI $10.05 (+14.10%), LTC $111.54 (+11.10%), LINK $18.16 (+7.65%).

Policy watch: The White House Digital Asset Working Group will publish its 180-day crypto report on Wednesday, July 30, 2025, including plans around a Strategic Bitcoin Reserve, asset stockpiles, security standards, and banking reforms.

Corporate treasuries: Trump Media & Technology Group reports about $2B in BTC and bitcoin-related securities (≈ two-thirds of liquid assets) and earmarks $300M for bitcoin-linked options.

Public markets: Custodian BitGo filed for a U.S. IPO after a prior $100M raise at $1.75B valuation, joining a growing list of crypto firms heading public as the total crypto market value tops ~$4T.

NFT rebound: Total NFT market cap jumped ~17% in a day to >$6B, the best level since February, with $41M 24h volume. A single wallet bought 45 CryptoPunks (~2,080 ETH), nudging the floor to 47.5 ETH.

Insights & Implications

Rotation into ETH: The sharp ETH ETF inflow versus BTC outflow signals institutional rotation and a dip in BTC dominance. Expect follow-through if macro stays benign and Ethereum upgrade narratives firm up.

Treasury adoption accelerating: TMTG’s allocation underscores a trend of public companies using BTC (and potentially ETH) as balance-sheet assets. Watch disclosures from growth-stage tech and crypto-native firms.

Regulatory clarity as a catalyst: With the July 30 White House report and recent stablecoin legislation, U.S. policy is moving toward clearer guardrails, a tailwind for listings (BitGo, Grayscale/Bullish) and ETF product expansion.

NFTs: whale-led, needs breadth: The Punks sweep boosted caps and floors, but sustainability hinges on broader buyer depth and creator revenues, not just blue-chip bids. Monitor weekly unique buyers and secondary royalties.

Market structure maturing: Custody + ETFs + IPOs indicate institutional market plumbing is solidifying. Expect tighter spreads, deeper derivatives liquidity, and more conservative risk frameworks from allocators.

What to watch next week:

July 30: White House crypto report — details on reserves, tax-neutral acquisition paths, and banking standards.

ETF flows: Does ETH maintain multi-day inflow momentum? Track spread between ETH and BTC ETF net flows.

NFT breadth: Unique buyers, volumes beyond Ethereum (e.g., Solana) to confirm broadening risk appetite.

4️⃣ Key Economic Metrics

US inflation data hint at tariff impact

Tariff-Lag Effect: Pre-tariff inventory stockpiling delayed price hikes — but June data confirms tariffs are now impacting prices.

Consumer Squeeze Incoming: Rising prices + stagnant wages = weaker purchasing power and downside risk to real consumer spending.

Fed Caught in a Bind: Balancing inflation vs. growth slowdown; markets view inflation as tariff-driven and transitory, not policy-driven.

Political Risk to Fed Independence: Reports of pressure to remove Powell and slash rates could erode confidence, driving bond yields higher.

Markets fear Fed politicization

Short-term turmoil: Suggests investors value Fed independence, disruption could unanchor inflation expectations.

Tariff policy, not Fed policy, is key to rate cuts: Cutting tariffs could relieve inflation pressure more effectively than forcing rate cuts.

Fed sees inflation as tariff-driven, not cyclical: Rate decisions will hinge on whether inflation is seen as transitory or persistent.

Yield curve and breakeven rates send mixed signals: Rising breakevens imply markets expect inflation to stick, challenging the case for cuts.

US monetary policy is under a microscope

Domestic demand stabilization: Retail and industrial data suggest internal momentum is holding, even as exports to the U.S. decline.

Structural headwinds persist: Property sector weakness continues to weigh on investment and credit confidence.

Stimulus working unevenly: Fiscal support is lifting consumption, but monetary policy’s transmission is weak—suggesting a need for deeper structural reforms to unlock household spending.

Global trade resilience: Despite U.S. tariffs, China’s export engine remains active, helping prop up growth.

Latest Trade Rules

US Trade Policy = Mercantilist Shift:

Focus on reducing imports and boosting exports, prioritizing employment in export industries over consumer benefit.

Managed Trade Deals Dominate:

Similar deals with Vietnam, China, UK, and now Indonesia favor high US tariffs + mandated foreign purchases of US goods.

These limit free-market efficiency and risk misallocated resources.

Tariff Tensions with Allies Escalating:

Potential for transatlantic trade war, despite EU restraint—for now.

Mexico’s measured tone signals willingness to negotiate, but tensions remain.

Indonesia’s Diversification Advantage:

Although hit by US tariffs, Indonesia’s strong trade ties with China and others buffer the blow.

Commodity exports and strategic neutrality remain key strengths.

5️⃣ China Spotlight

Chinese economic data point to modest strength

Domestic demand stabilization: Retail and industrial data suggest internal momentum is holding, even as exports to the U.S. decline.

Structural headwinds persist: Property sector weakness continues to weigh on investment and credit confidence.

Stimulus working unevenly: Fiscal support is lifting consumption, but monetary policy’s transmission is weak—suggesting a need for deeper structural reforms to unlock household spending.

Global trade resilience: Despite U.S. tariffs, China’s export engine remains active, helping prop up growth.