Smart money’s Rotates into Bitcoin as Dollar Fragility Deepens

Macro Pulse Update 31.05.2025

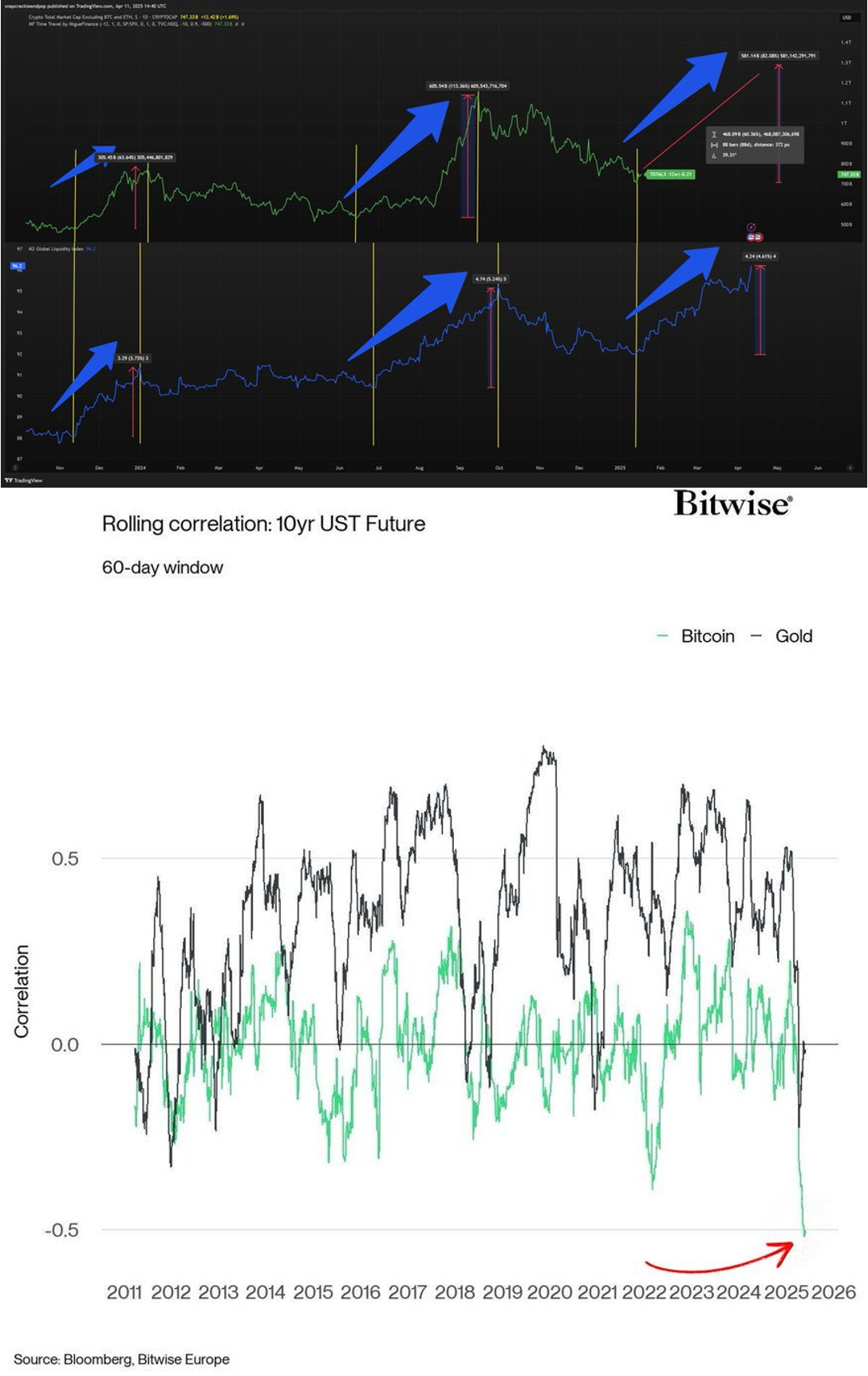

Lately, I’ve been watching one chart on repeat: M2 vs. TOTAL3 (minus 12 weeks).

If history rhymes (and it often does) then this setup could validate my cautious bullishness on alts.

But here’s what really caught my attention lately:

1) Bitcoin’s 60-day correlation to U.S. 10Y Treasury Futures just hit an all-time low.

Smart money may be quietly rotating out of bonds and into Bitcoin. For those watching macro flows, this could be the chart to keep on your radar.

2) For almost two years, VIX futures lived in a compression channel, a dream for risk-on traders.

Here’s what I see:

VIX broke trend and is riding a steep ascending channel

Systemic volatility being repriced

MOVE (bond market VIX) never cooled, rates are now amplifying equity stress

We’ve officially entered a new volatility regime

We’re seeing:

Structural vol shift—traders still expect 2020-style spikes/reversions, but we’re stair-stepping like 2007–08.

Liquidity is behavioral now—hedge fund beta at decade highs. One vol pop = cascade of exits = no liquidity.

Geopolitical stress—Tariffs, sanctions, capital controls, and intentional uncertainty are now policy tools.

Bottom line:

If VIX holds this steep channel, risk premia across all assets need to be repriced. That means: Lower equity valuations, Higher tail risk, Tighter liquidity, A systemic re-rating of what “risk-free” means.

3) Sovereign duration risk is being repriced

This is about structural trust in sovereign balance sheets.

Rising real yields = markets demanding more for long-term risk

Policy paralysis = central banks stuck between inflation and asset collapse

Capital repatriation risk = if Japan loses control, global outflows reverse

We’re entering a regime where long-duration debt behaves like a risk asset.

And that should terrify anyone clinging to outdated models.👇🧵

Macro Pulse Update 31.05.2025, covering the following topics:

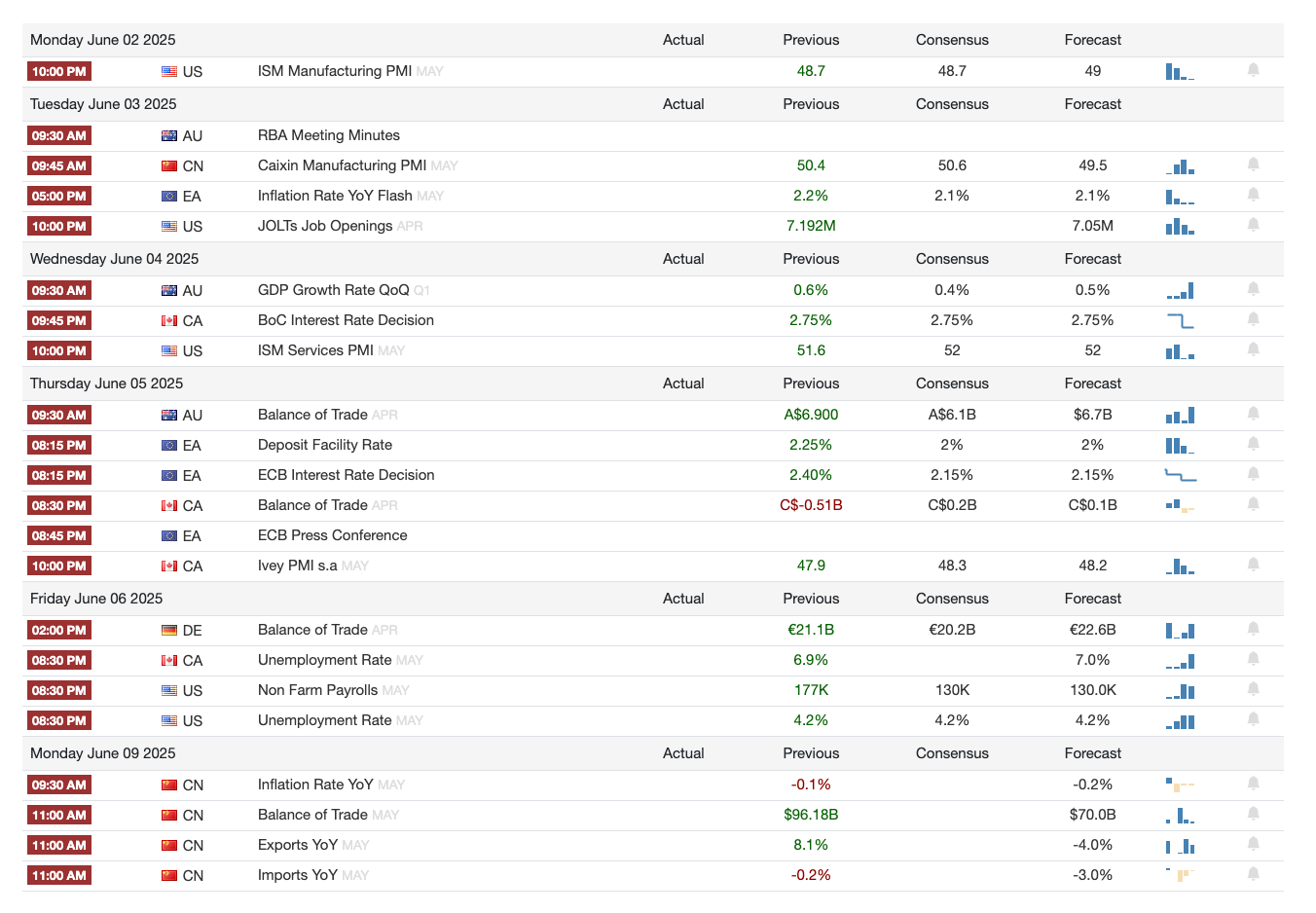

1️⃣ Macro events for the week

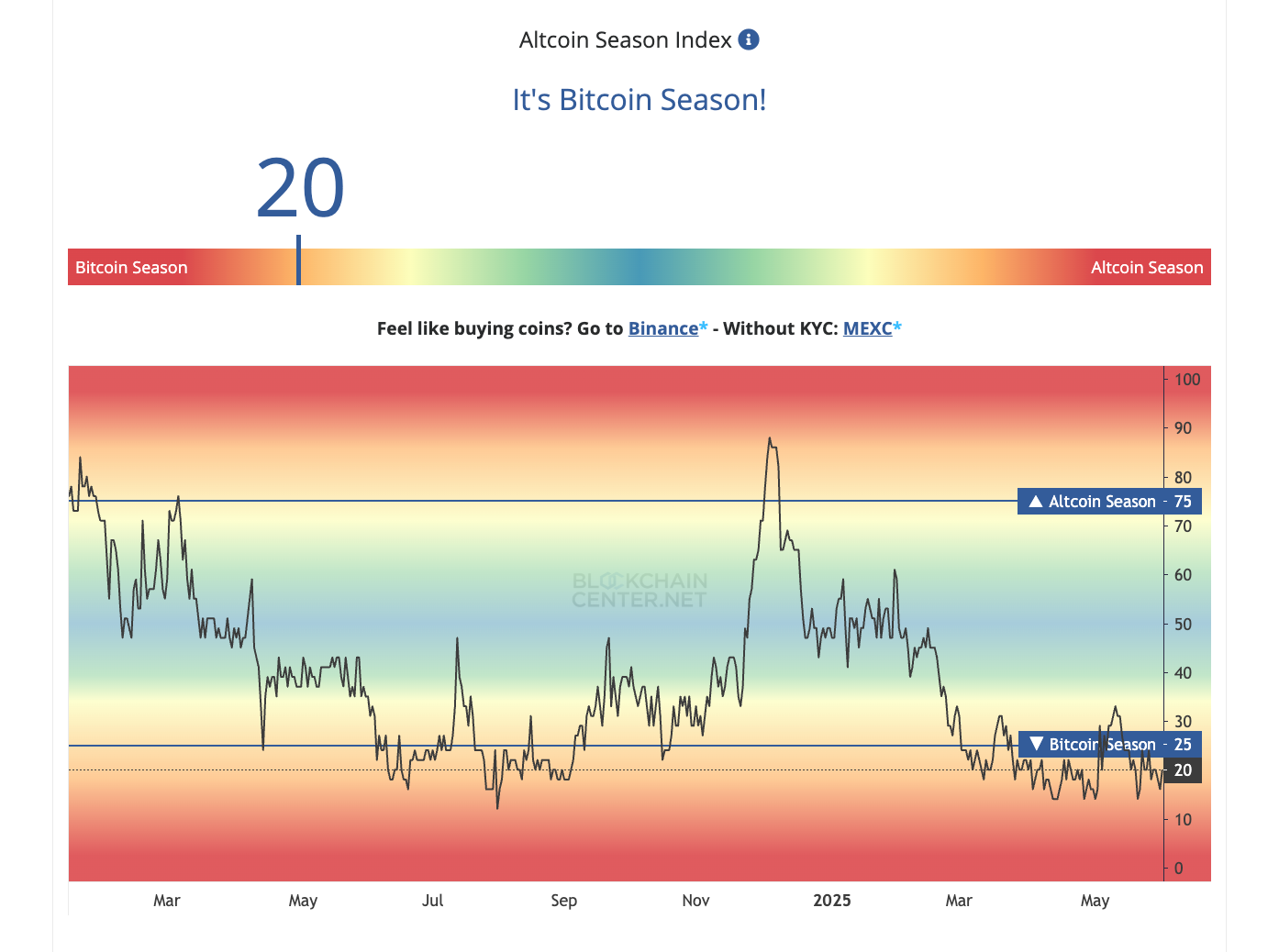

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ US EU Spotlight

1️⃣ Macro events for the week

Previous Week

Next Week

2️⃣ Bitcoin Buzz Indicator

Launches & Mainnets

EulerSwap – Uniswap-v4-compatible AMM linked to Euler lending vaults.

Mezo Mainnet + MUSD – first BTC-backed stablecoin.

Gamma LimitOrderHook – on-chain limit order book (Unichain & Base).

Hyperdrive – USDe/USDT0 money market on Hyperliquid.

Malda “Unified Lending” – cross-chain lend/borrow via one liquidity pool.

Integrations & Upgrades

Curve → Plume, Rabby Wallet → Plume, DIA Lumina → Optimism.

DeFi Saver adds Fluid DEX Vault automation.

Maestro trading toolkit live on HyperEVM.

Starknet bridge brings USDC Runes to Bitcoin.

Gauntlet XLend WETH/USDC vaults on Morpho (Base).

Airdrops & Incentive Campaigns

SOPH, Humanity $H, Lagrange $LA, Resolv $RESOLV claims/registrations open.

Arbitrum × Kaito “Yapper” – 400 k ARB leaderboard (3 months).

Morpho × Katana pre-deposit lootboxes ahead of late-June launch.

Yield & Farming

TermMax fixed-rate lending ~19 % APY + $TMX mining.

Pendle cUSDO pool – 20× YT / 12× LP multipliers.

HyperLend lists sUSDe with 5× Ethena rewards.

Ripple RLUSD, SyrupUSDC now lendable on Euler.

Ethereal eUSDe, Superform Season 0 vault, Liquity BOLD strategies, Kelp rsETH vault MOVE incentives.

Governance & Proposals

Origin Protocol: route 100 % revenue to $OGN buybacks.

Wormhole kicks off on-chain governance (Code of Conduct & Process votes).

3️⃣ Market overview

Institutionalization of Crypto Accelerates

Circle’s IPO filing—and its size ($624 M target at up to $26/share)—signals that regulated stablecoins are ready for prime-time capital markets. The move, if successful, will place a core piece of crypto market-plumbing on the NYSE and could fast-track U.S. stable-coin legislation.

Corporate Treasury FOMO Continues

Strategy’s latest 4,020 BTC purchase lifts its stack to 580,250 BTC (~3 % of supply), illustrating the playbook of funding bitcoin buys with equity and preferred stock. Trump Media is openly copying the model with a planned $3 B equity + convertible raise aimed at BTC deployment.

Wall Street Lending Arms Reach for Bitcoin Collateral

Cantor Fitzgerald’s $2 B credit facility (Maple, FalconX as first borrowers) validates demand for dollar liquidity against BTC, expanding options beyond the handful of existing crypto-native lenders and deepening the institutional credit stack.

Payments Narrative Gets a Boost

Block’s real-time Lightning checkout pilot puts BTC back into the “medium-of-exchange” spotlight. Merchant opt-in to hold or auto-convert balances could set a template for small-business bitcoin adoption ahead of Block’s planned 2026 full rollout.

Macro Price Action: Healthy Consolidation After New Highs

BTC pulled back -4.6 % to ~$106.6 k after tagging a fresh ATH above $112 k; most majors followed suit (ETH -0.6 %, XRP -6.2 %). The sell-off is mild relative to YTD gains and comes amid profit-taking around month-end and IPO-related capital rotation.

Narrative Underpinning: Tokenization & On-Chain Financing

From Circle’s USDC IPO to Maple’s BTC-backed loan uptake, the common thread is tokenizing real-world assets and credit. This week’s data point reinforces the theme that on-chain representations of dollars (USDC), treasuries (Cantor), and even corporate equity (convertible bonds aimed at BTC buys) are converging.

4️⃣ Key Economic Metric

🔴 Tariffs

Tariffs at 90-year highs: Even after the temporary U-S/China détente, the average effective U-S tariff is still ~18 %—the steepest since 1934—while most other economies remain near post-war lows.

Uncertainty is the new tariff: With another round of duties threatened for July, firms and consumers cannot plan confidently; tariff investigations now span semis, pharma, minerals, lumber and aerospace, almost guaranteeing more barriers.

🔴 Inflation and Policy

Real-world bite: inflation, sentiment, growth: Three-quarters of U-Michigan survey respondents now cite tariffs for their gloom; 12-month inflation expectations jumped to 7.3 % versus a current CPI of 2.3 %, pointing to sharp price pass-through.

Fiscal policy pulling the other way: House-passed tax-cut bill would lift publicly traded debt from 100 % to 125 % of GDP within a decade, pushing annual deficits near 7 % of GDP and eroding the bond market’s faith in U-S solvency.

Markets are punishing, not sheltering: Unlike the 2011 downgrade, Moody’s cut triggered a simultaneous fall in equities, rise in Treasury yields, and dollar weakness—signalling that “safe-haven” status is no longer automatic.

Dollar privilege at risk: Sustained twin deficits (budget + trade) plus tariff-induced fragmentation could curb foreign capital inflows and chip away at the dollar’s dominance, raising long-term funding costs for both government and private borrowers.

Policy paradox: Tariffs act as one of the largest tax hikes in U-S history, dampening demand, yet Washington is adding late-cycle fiscal stimulus instead of consolidation—deepening concerns over inflation, crowd-out, and future growth.

European contrast: The euro-area faces slower growth and softer inflation, but steadier policy; if U-S risk premia keep climbing, European assets may see relative inflows, though a weaker U-S outlook would still sap external demand for European exports.

5️⃣ US and EU Spotlight🔴

Overview

US activity rebounded but was artificially inflated by tariff-induced restocking, not true demand.

US inflationary pressures rising, with tariffs as the key driver.

Eurozone still fragile, though manufacturing shows early signs of recovery and stimulus may aid growth.

Divergence emerging: US faces overheating risks tied to trade and fiscal policies; Europe is flirting with contraction but with potential upside catalysts.

United States: Tariff-Driven Growth & Price Pressure

Composite PMI rose from 50.6 in April to 52.1 in May, indicating modest growth—fueled largely by inventory build-ups amid tariff fears.

Input purchases surged, the highest on record, as firms stockpiled goods in anticipation of new trade restrictions.

Output prices jumped, marking the fastest increase in three years—S&P Global attributes this largely to tariffs driving up import costs.

Export orders dropped sharply, especially in services, as foreign travel to the US declined significantly.

Supply chain delays worsened, reaching their most widespread level since the pandemic.

Eurozone: Weak Growth, But Glimmers of Hope

Composite PMI fell to 49.5 in May (from 50.2), signaling contraction; services PMI hit a 16-month low.

Manufacturing PMI rose to a 33-month high, potentially reflecting pre-tariff stockpiling efforts.

Economic momentum remains weak overall, with S&P noting consistent stagnation since January.

Long-term optimism emerging: Signs of broad-based manufacturing recovery, lower oil prices, and expectations of further ECB rate cuts.

Germany may rebound, driven by planned expansionary fiscal policy focused on defense and infrastructure.

Twitter: https://x.com/arndxt_xo/status/1928764663149506654?s=46&t=hr2fbvcHJGpvp_SbDstdzg