I don’t think this is what you want to hear but I will still say this.

Solana is becoming the Bloomberg for crypto, built for speed, composability, and raw revenue throughput.

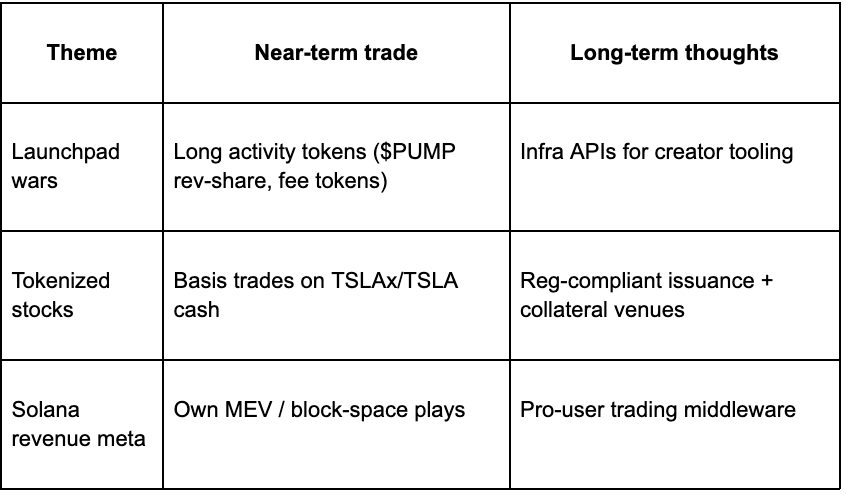

Three data-backed theses anchor my view:

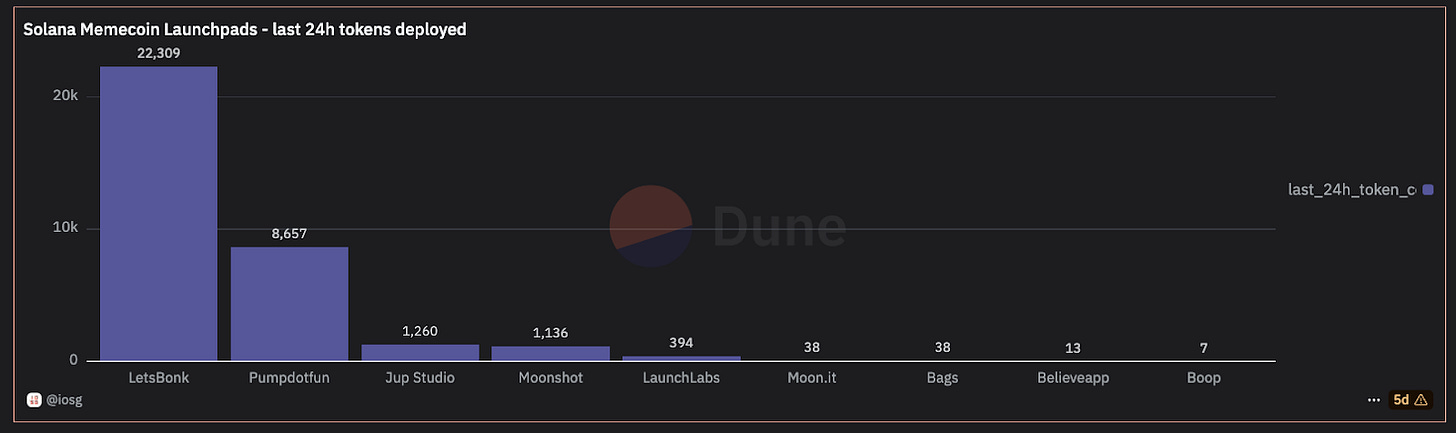

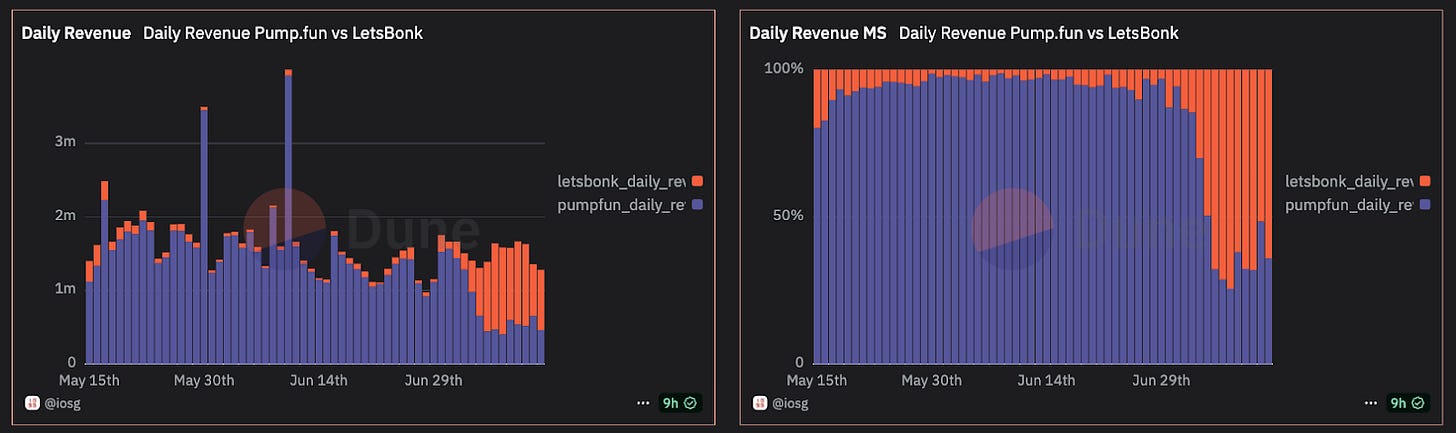

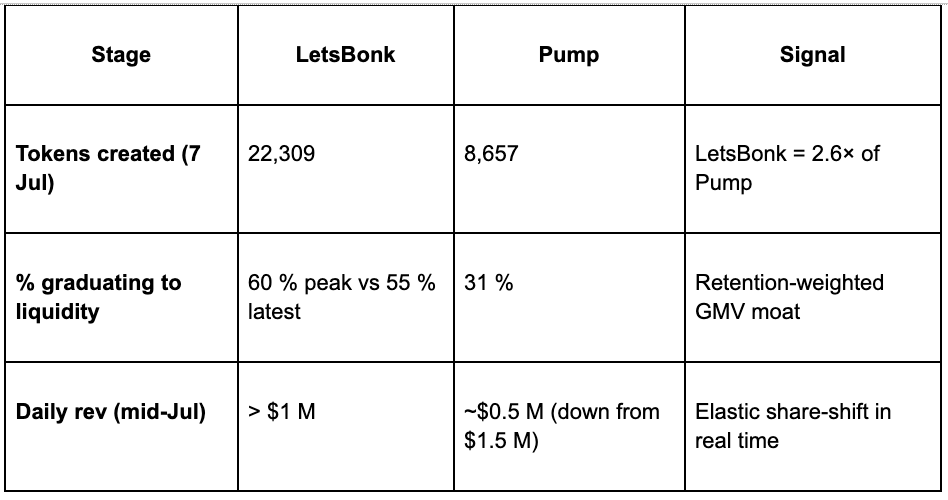

Launchpads are now SaaS: LetsBonk flipped Pump with 60% graduation into liquidity and $1M+ daily revs. Creator loyalty is leaking, retention-weighted Gross Merchandise Value (GMV) is the new moat.

Tokenized stocks = collateral rails: It’s unlocking 24/7 liquidity, composable margin, and capital for private markets. The real TAM is pre-IPO equity.

Solana owns the revenue stack: $570M Q2 revenue = 46% of all chains; income, powered by dApps, bots, launchpads, and prosumer tools.

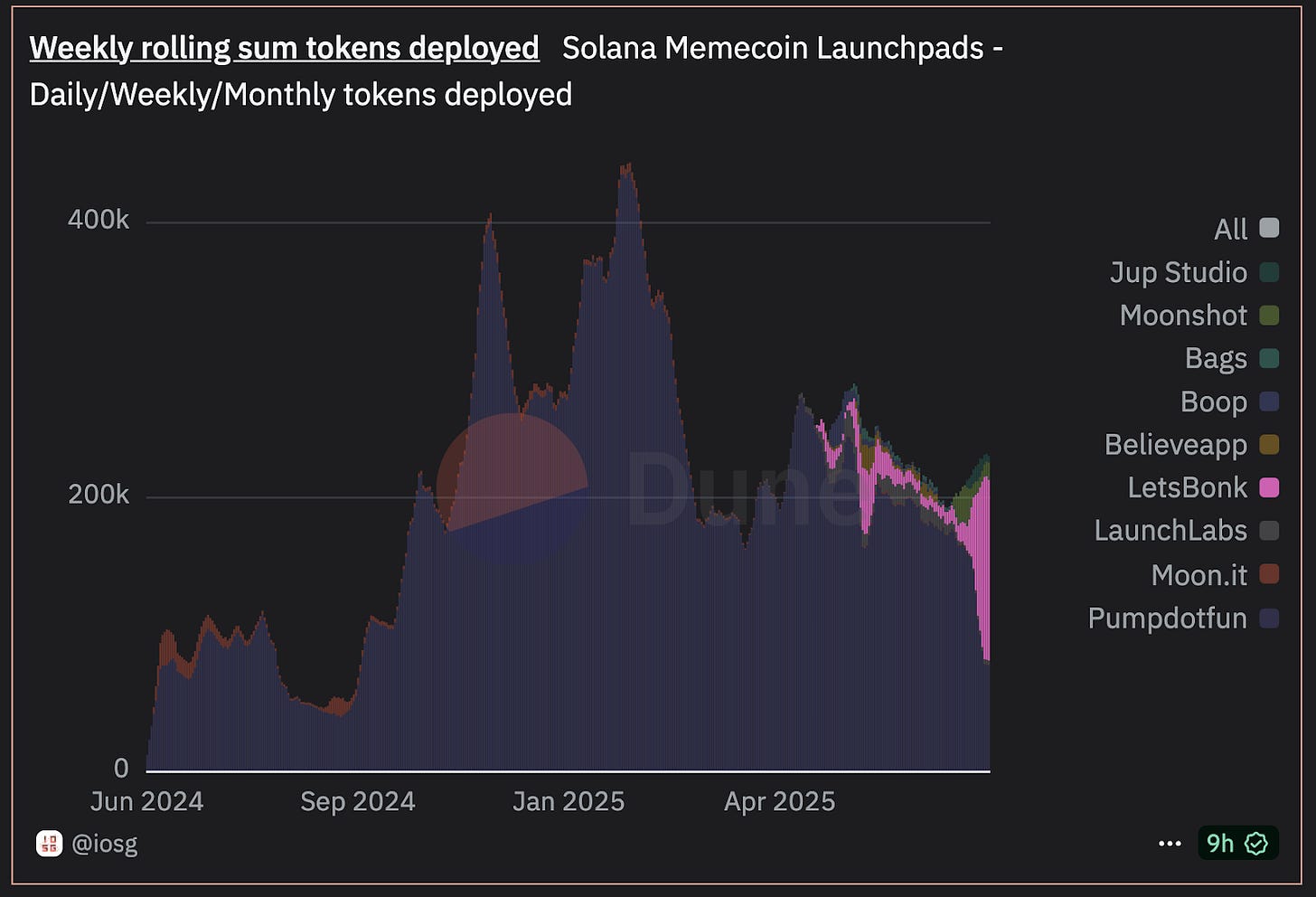

1. Launchpad Wars → Battle-tested PMF

LetsBonk’s moment on Solana is more than a metric race.

Market share flip: On 5 July it produced 66 % of all new tokens vs. Pump’s 26 % .

Quality of flow: Better than raw volume, LetsBonk graduated ≈60 % of launches into liquid pools vs. Pump’s 31 % .

Monetisation: Daily revenue jumped from ~$0 to >$1 M while Pump slid to $0.5 M.

My thoughts:

Retention-weighted GMV is the real moat. Graduation ratio is effectively an NRR metric for launchpads; the first to institutionalise it wins enterprise API integrations (Telegram bots, “spin-up-a-meme” SDKs).

Pump still owns the creator mind-share loop (~$700 M lifetime revenue) but LetsBonk just proved switching costs are ≈0. The next defection wave could be orchestrated, not organic—think tier-one influencers bundling “listed in 24 h” guarantees.

For venture sizing: even a steady-state $1 M/day rev line equals ~$100 M ARR. With Solana infra margins (~80 %), these are SaaS-like economics on a one-year-old protocol. Discount heavy volatility and you still justify $1–2 B valuations on 10–15× forward sales.

Switching costs are near-zero, so mind-share is rented, not owned

Pump’s cumulative ~$700 M revenue only took 18 months to build , but LetsBonk grabbed share in < 3 weeks, spurred by a trading competition.

Incentive-driven flips imply:

Creators are mercenaries. Airdrops and “list-in-24h” influencer bundles can migrate entire cohorts overnight.

Defensive moat = networked liquidity, not interface lock-in. Expect Pump to go vertical (native DEX, LP bribes) to raise exit costs.

Playbook for new entrants: Overpay for incentives, drive public leaderboard optics (tokens/day), monetise before CAC resets.

The funnel economics shows that volume is cheap, graduation is king

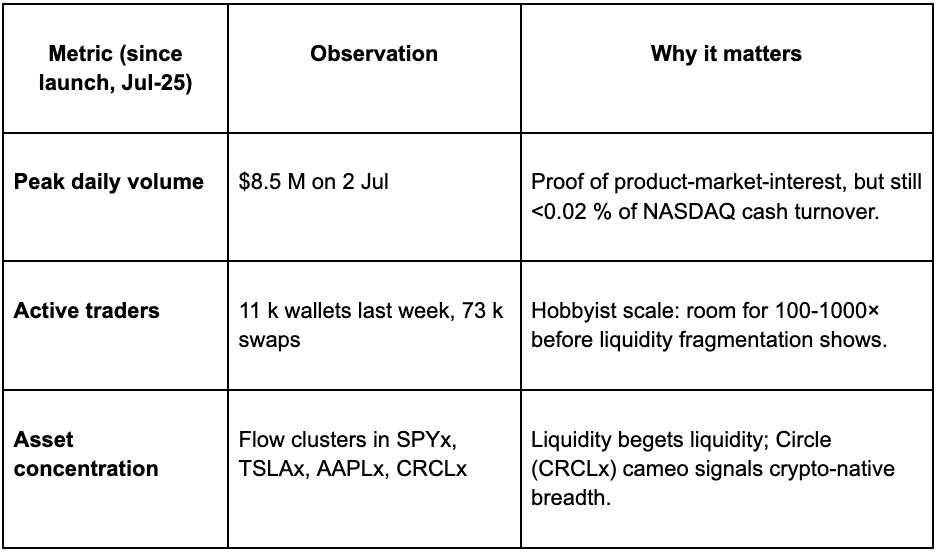

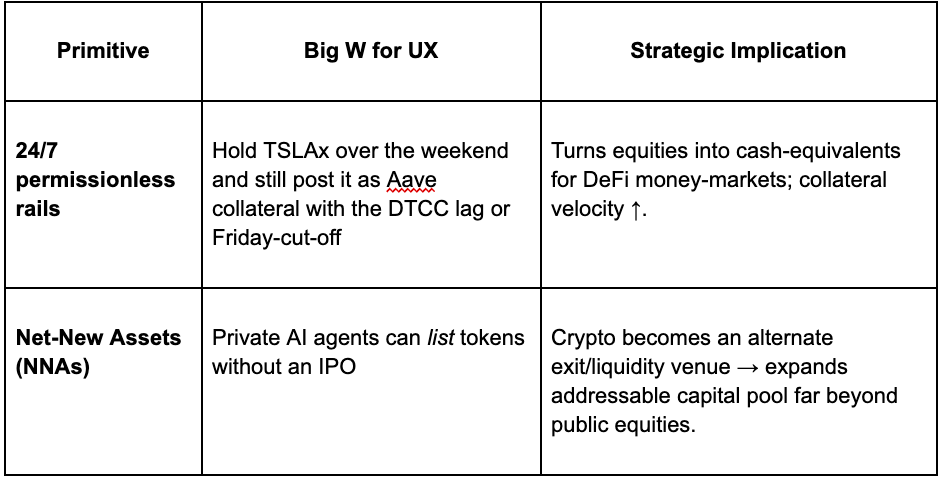

2. Tokenised stocks is the Trojan horse for TradFi liquidity

Tokenised stocks are more than just “AAPL on a blockchain.”, they:

Collapse TradFi settlement latency to minutes,

Surface entirely new collateral classes, and

Unlock a financing rail for private-market giants.

The winning stack needs regulated issuance, oracle integrity and liquid perps, and the winner will be the “Stripe Connect” for tokenised equities that captures the upside.

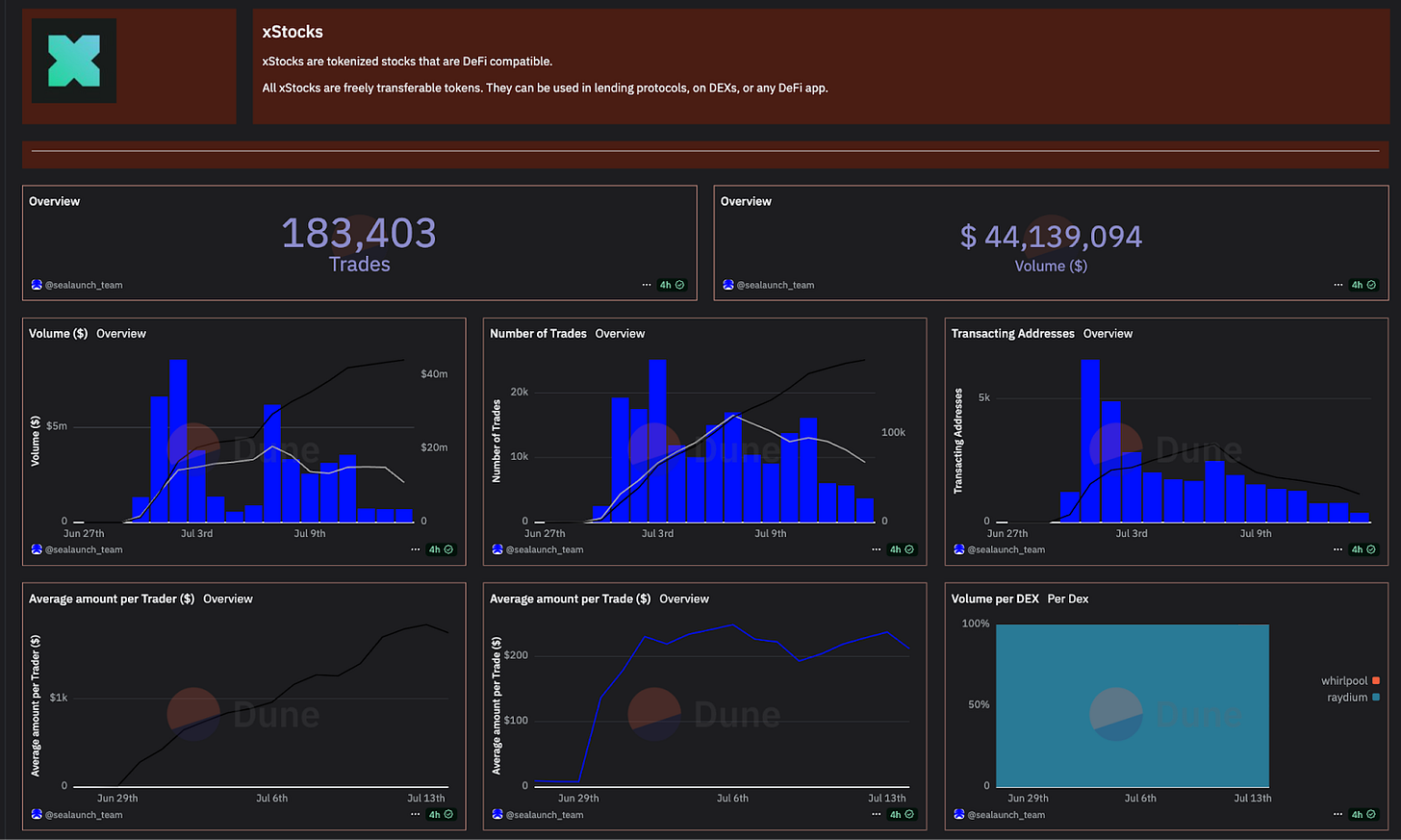

Where we really are on the “S-curve”

@BackedFi @xStocksFi and @RobinhoodApp whitelisted synthetics put $AAPL on-chain while turning illiquid or private equity into composable collateral .

Two structural primitives that make tokenised equities less of a gimmick

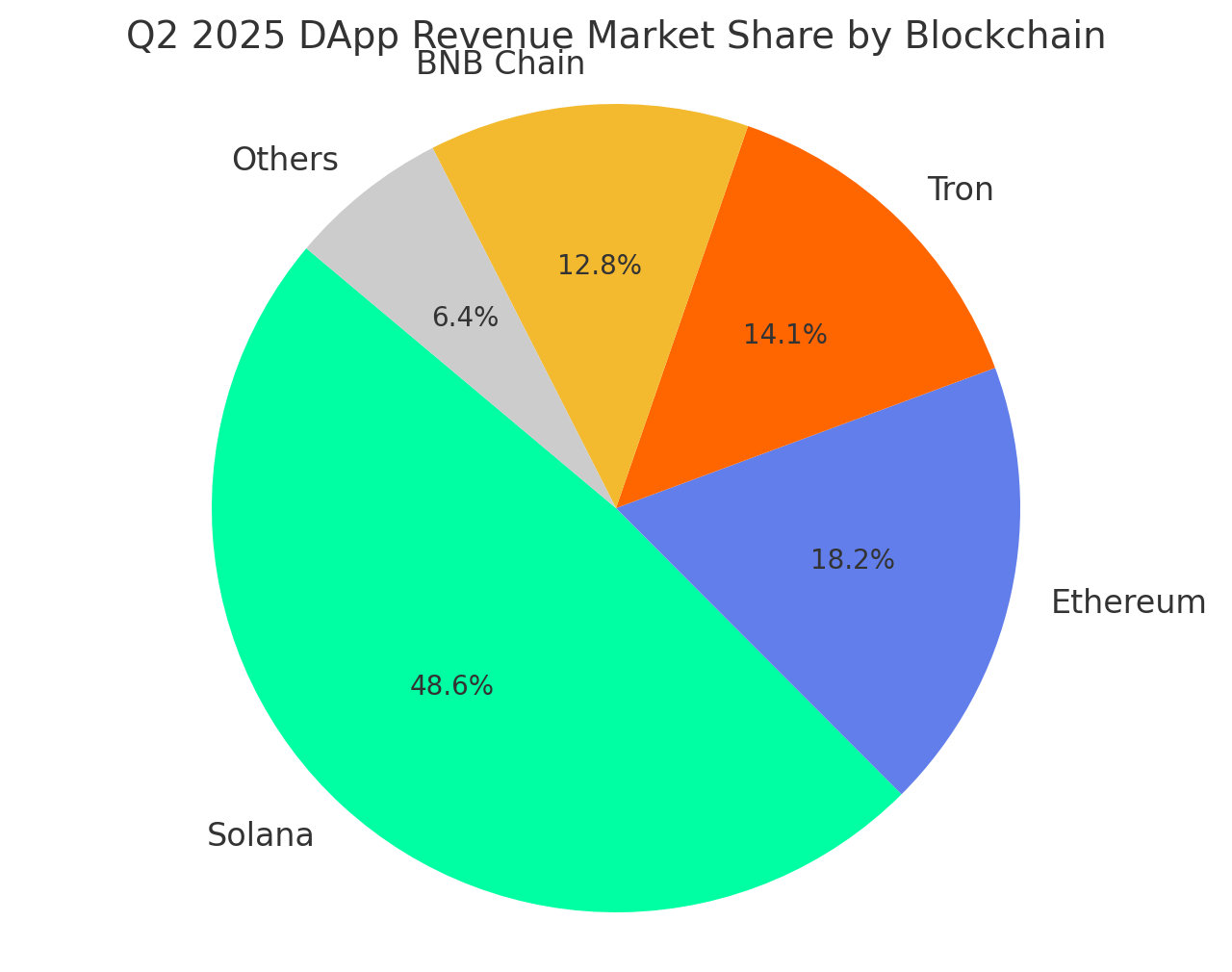

3. The “Revenue Meta” with Solana as the prosumer chain

Solana printed $570 M revenue in Q2, taking 46% market share.

Ethereum: $213M

Tron: $165M

BNB Chain: $150M

Others: $75M or less

Two truths follow:

Crypto’s dominant use-case is still trading-as-a-service .

Build for prosumers: Power users drive the P&L; CEXs will onboard the masses later

Why “prosumer” beats “mass-market” in crypto (for now)

Solana optimises for power-user lifetime value while CEXs shoulder KYC, fiat rails, and newbie support costs.

Latency-arbitrage loop – 400 ms slot times and negligible fees let bots refresh orders dozens of times per second; each micro-edge converts directly into protocol fees.

Composable leverage – Launchpad tokens → instant AMM pools → perp collateral within minutes. Capital velocity is an order-of-magnitude higher than on Ethereum L2s.

Network incentives line up with whales – Pros pay more, churn less, and seed liquidity that attracts the next cohort of pros.

Closing Thoughts

Solana optimises for power-user lifetime value while CEXs shoulder KYC, fiat rails, and newbie support costs.

Crypto’s fastest-compounding businesses treat blockchains as high-frequency rails for capital markets.