That's just 1% = 80,000+ BTC ($2.2B) flooded into DeFi in just 3 months.

Yet 99% still sits idle.

Bitcoin's DeFi potential is colossal

With more than $1T+ from institutions, banks, whales and from DeFi, @SolvProtocol bridges BTC across chains, unlocking institutional liquidity, and delivering transparent yields.

A deep dive into the first on-chain “MicroStrategy” 🧵👇

2025 has been a historic year for Bitcoin accumulation, with institutional players, sovereign nations, and high-net-worth investors aggressively acquiring BTC at record levels.

The trend is unmistakable:

Trump’s Bitcoin Reserve: Recent policy shifts indicate that the U.S. is exploring a BTC-backed reserve strategy, positioning Bitcoin alongside gold as a strategic financial asset.

MicroStrategy’s Relentless BTC Accumulation: Michael Saylor’s firm now holds over 200,000 BTC, doubling down on Bitcoin as its primary corporate treasury reserve.

El Salvador’s Bitcoin Strategy: The nation continues to integrate Bitcoin into its economy, reinforcing BTC as a state-backed financial asset.

Whale & Institutional Inflows: Q1 2025 saw record Bitcoin accumulation, with on-chain data showing that large entities are absorbing BTC supply at unprecedented rates.

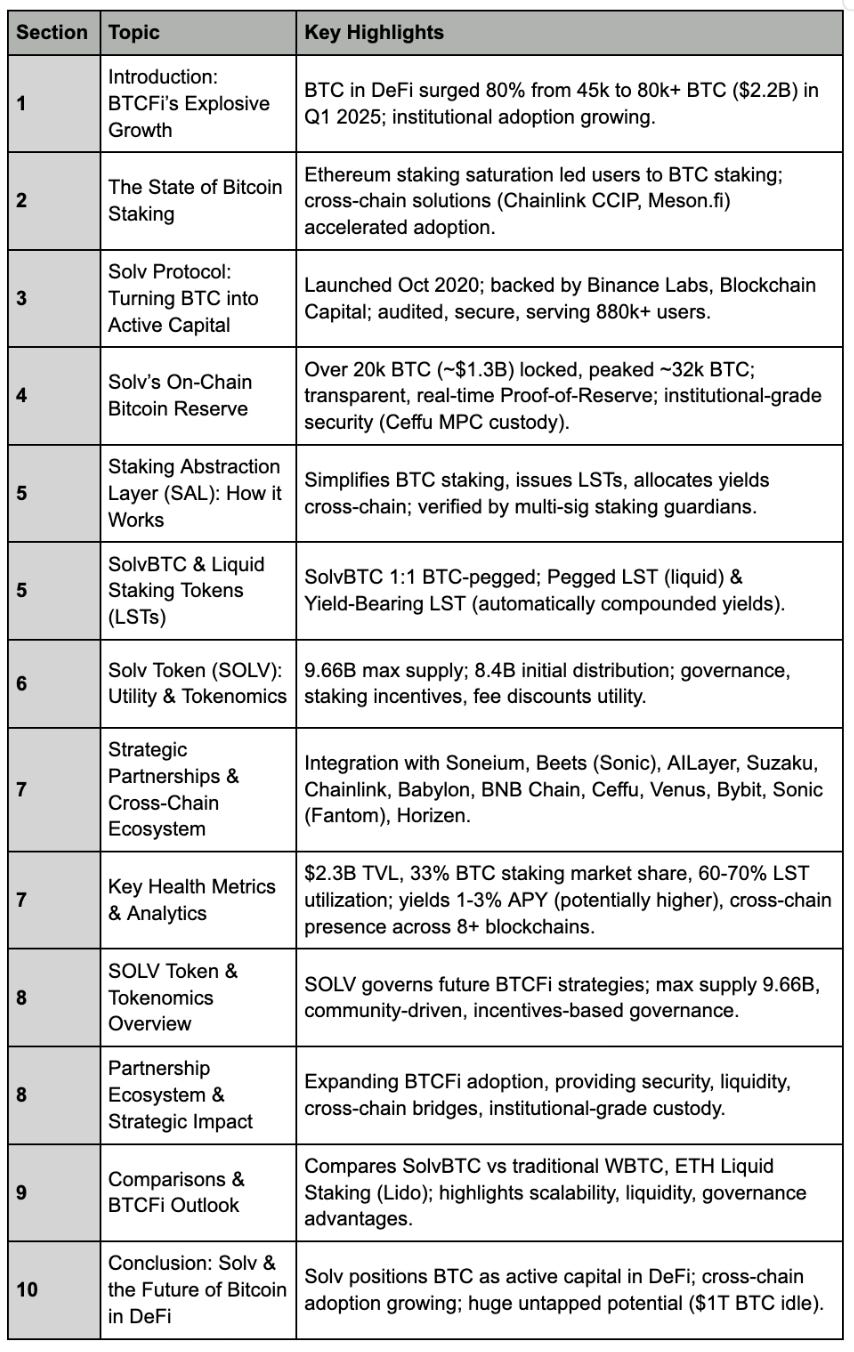

Table of Contents

Introduction

The State of Bitcoin Staking

Solv Protocol and Key Health Metrics

Solv’s On-Chain Bitcoin Reserve

Staking Abstraction Layer (SAL): Architecture & Flow

SolvBTC & Liquid Staking Tokens (LSTs)

Solv Token (SOLV) & Tokenomics

Partnerships

Comparisons & Outlook

Conclusion

1. Introduction

BTCFi: The Emergence of Bitcoin-Driven DeFi

Over the past year, the concept of “BTCFi”—using Bitcoin for yield-bearing activities in DeFi—has evolved into one of the most prominent narratives in the crypto landscape. Rather than being relegated solely to long-term “HODLing,” Bitcoin is increasingly finding new utility in staking, lending, liquidity provision, and other decentralized finance use cases across multiple chains.

Rapid Growth from Q4 2024 to Q1 2025

Rising BTC in DeFi: During Q4 2024, approximately 45,000 BTC were actively deployed in DeFi protocols (across all blockchains). By the close of Q1 2025, that figure climbed above 80,000 BTC, representing an increase of nearly 80% in just one quarter.

TVL Expansion: The total BTC-denominated value locked in DeFi jumped from around $1.3 billion to over $2.2 billion in the same period, reflecting heightened user appetite for yield opportunities tied to the world’s largest cryptocurrency.

Institutional Attention: A growing number of hedge funds and digital asset managers began allocating a portion of their BTC holdings to protocols promising attractive, low-volatility yields—further accelerating the shift toward BTCFi.

The Potential Ahead

Room to Grow: Even with the jump to 80,000 BTC in DeFi, this sum represents only a small fraction of Bitcoin’s trillion dollar market cap. Capturing just 5–10% of total BTC supply could unlock billions more in liquidity and spark new DeFi primitives.

Ecosystem Synergies: Ongoing innovation—liquid staking tokens (LSTs), derivatives marketplaces for BTC yield, and cross-chain aggregator platforms—points to continued momentum for BTCFi well beyond Q1 2025.

Institutional-Grade Products: As protocols introduce enterprise-friendly security, compliance, and insurance, larger financial entities may devote increasing percentages of their Bitcoin treasuries to yield-generating DeFi strategies.

In short, BTCFi has gone from an experimental idea to a vibrant growth sector. Thanks to protocols like Solv—and their focus on cross-chain interoperability, transparent backing (Proof-of-Reserve), and simplified user flows—Bitcoin holders can now tap into the same DeFi opportunities previously available only to ETH, stablecoin, or alt-L1 communities. This shift between Q4 2024 and Q1 2025 is just the beginning of a longer-term trend as BTC’s vast liquidity and brand strength fuel the next wave of decentralized finance.

Launched in October 2020, Solv quickly attracted notable investors like Binance Labs and Blockchain Capital, secured multiple security audits, and today serves over half a million users worldwide. By bridging Bitcoin to various blockchains and integrating with DeFi protocols, Solv transforms “passive” BTC into a yield-generating powerhouse.

While these large-scale Bitcoin reserves demonstrate growing demand, Solv Protocol is set to launch a comprehensive suite of Bitcoin financial services, unlocking new possibilities for BTC holders across DeFi.

The Bitcoin Lending Program will enable users to borrow against their SolvBTC, providing instant liquidity while maintaining BTC exposure.

The Bitcoin Yield Program will introduce xSolvBTC, allowing users to earn yield without sacrificing liquidity.

For institutional participants, Solv is launching the Bitcoin Reserve Offering, an innovative BTC-native convertible bond designed to drive large-scale adoption.

The Bitcoin Fund Market will introduce 40+ diversified Bitcoin-based financial products, enhancing yield opportunities and risk management across multiple asset classes.

These upcoming offerings position Solv as a powerhouse in BTCFi, bridging Bitcoin into a fully integrated DeFi ecosystem.

Key features of Solv Protocol:

SolvBTC: A 1:1 pegged token representing Bitcoin, redeemable for the underlying BTC.

Staking Abstraction Layer (SAL): A cross-chain, modular framework for staking BTC and managing the complexities of multi-network strategies.

Liquid Staking Tokens (LSTs): BTC-derived staking tokens that preserve liquidity while accruing yields.

Proof-of-Reserve Transparency: Real-time on-chain verification that each SolvBTC is fully backed by BTC or recognized wrapped BTC assets.

2. The State of Bitcoin Staking

The surge in BTCFi adoption is driven by a convergence of key factors reshaping Bitcoin’s role in DeFi. As Ethereum staking and stablecoin yield farms reached saturation, Bitcoin-based DeFi platforms emerged as a compelling alternative, offering fresh opportunities with comparatively higher APYs. This shift was further accelerated by advancements in cross-chain solutions—bridging technologies like @chainlink CCIP and @mesonfi made it easier and more secure for BTC holders to migrate liquidity across multiple blockchains. By lowering friction and mitigating risks associated with wrapped BTC models, these innovations unlocked Bitcoin’s potential across diverse DeFi ecosystems.

At the same time, the maturation of DeFi infrastructure played a pivotal role in fueling BTCFi’s expansion. Protocols like Solv introduced institutional-grade features such as Proof-of-Reserve frameworks, multi-signature custody, and staking abstraction layers, ensuring transparency and reducing complexity for users. These safeguards encouraged broader participation from both retail and institutional investors.

Additionally, Bitcoin’s “digital gold” narrative found a new dimension amid rising global inflation—rather than remaining a passive store of value, BTC could now serve as an inflation hedge while simultaneously generating tangible yield. This shift in perception solidified Bitcoin’s integration into DeFi, turning BTCFi from a niche experiment into one of the fastest-growing sectors in Web3.

Despite being the largest cryptocurrency, more than $1 trillion worth of BTC sits idle (un-staked), partially because Bitcoin’s base layer doesn’t offer native staking functionality. In contrast, about 28% of the total ETH supply is staked natively or through liquid staking protocols. Bridging BTC to other chains or using wrapped-BTC solutions has historically been fragmented, siloing liquidity on different networks and creating friction for end users.

Main Challenges

Cross-Chain Complexity: BTC must be wrapped or bridged before being used in modern DeFi protocols on chains like Ethereum.

Liquidity Fragmentation: Multiple wrapped Bitcoin variants spread liquidity thin across separate ecosystems.

No Native Yield: BTC’s Proof-of-Work design doesn’t inherently reward holders.

Solv addresses these hurdles with its On-Chain Bitcoin Reserve, Liquid Staking Tokens, and Staking Abstraction Layer, providing a universal solution to stake BTC seamlessly across multiple blockchains.

3. Solv Protocol and Key Health Metrics

What is Solv Protocol?

Solv Protocol is a Bitcoin staking protocol designed to unlock Bitcoin's potential. Launched in October 2020, Solv bridges the gap between Bitcoin's vast liquidity—traditionally idle due to its lack of native staking capabilities—and yield-rich world of DeFi.

At its core, Solv Protocol operates an on-chain Bitcoin Reserve, enabling BTC holders to stake their Bitcoin assets and participate in diverse DeFi yield strategies. Users can deposit Bitcoin into Solv to mint SolvBTC, a tokenized representation of Bitcoin, freely transferable and fully redeemable at a 1:1 ratio. SolvBTC serves as a universal liquidity token across multiple blockchain ecosystems, such as Ethereum, BNB Chain, Avalanche, and Arbitrum.

To enhance user experience and security, Solv features a robust architecture called the Staking Abstraction Layer (SAL). SAL simplifies the complexity of cross-chain transactions, yield strategy allocations, and reward distributions through its sophisticated infrastructure. The protocol's transparent governance, robust security audits, and real-time Proof-of-Reserves system further bolster its trustworthiness and appeal to both retail and institutional investors.

Backed by notable investors including Binance Labs and Blockchain Capital, Solv has rapidly become one of the leading platforms enabling Bitcoin holders to earn yield and actively participate in DeFi's growth, turning Bitcoin into a yield-generating asset.

Total Value Locked (TVL)

The Total Value Locked (TVL) in Solv Protocol has grown rapidly since launch, reflecting strong adoption.

From mid-2024 through late 2024, Solv’s TVL climbed to over $2.3 billion (currently about $2.3B), even briefly peaking above $3.1 billion in December 2024 as Bitcoin’s price surged.

This expansion has positioned Solv as the second-largest player in the Bitcoin restaking sector, with roughly 33% market share among BTC liquid staking platforms.

Notably, Solv’s TVL (measured in USD) moves in tandem with its BTC-denominated TVL, indicating that fluctuations have been largely driven by Bitcoin’s price rather than large inflows or outflows.

Overall, the high and growing TVL underscores substantial liquidity and confidence in the protocol, though maintaining momentum against competitors (like market-leader Lombard) remains an ongoing challenge.

BTC Reserves Locked

Solv Protocol’s BTC reserves underpinning SolvBTC are considerable and transparent.

The platform has over 20,000 BTC locked as reserves (approximately $1.3 billion in value as of late 2024), comprising a diversified mix of native BTC and wrapped BTC variants.

In fact, SolvBTC is backed 1:1 by a reserve pool that includes actual Bitcoin as well as assets like BTCB (Binance-pegged BTC) and cbBTC (Coinbase Base chain BTC). This diversified reserve design ensures robust backing and trust in SolvBTC’s peg.

As Bitcoin prices climbed, the BTC reserves in the protocol reached as high as ~32k BTC in late 2024 (tracking the TVL peak) and currently sit around the 15k range, reflecting both price changes and some net growth in BTC deposits.

Solv further enhances transparency by leveraging real-time proof-of-reserves and audits – for example, integration with Chainlink oracles helps monitor cross-chain reserve balances – giving users confidence that every SolvBTC is fully backed.

Multiple independent security audits (5 audits by mid-2024) have affirmed the safety of the reserve contracts, with no critical vulnerabilities found.

This strong security posture, evidenced by a top-tier CertiK “AA” rating (ranked in the top 5% of projects), bolsters the trustworthiness of Solv’s reserves.

SolvBTC Supply

The circulating supply of SolvBTC has expanded steadily as more BTC has been staked into the protocol. As of early 2025, about 15,000 SolvBTC are in circulation – meaning roughly 15k BTC-equivalent tokens minted – up from zero at launch in 2024.

This supply growth mirrors the rising BTC reserves: by February 2025 Solv had minted ~15,171 SolvBTC tokens (worth ~$1.39B at the time).

While this is a substantial amount, SolvBTC’s scale is still moderate relative to older wrapped Bitcoin products – for context, Wrapped BTC (WBTC) has a market cap nearly 10x large.

The increasing SolvBTC supply over time indicates growing user uptake of Solv’s Bitcoin staking service.

Periodic jumps in supply have coincided with campaign events and integrations that attracted BTC deposits (for example, a Binance Megadrop event in Jan 2025 spurred many users to mint SolvBTC).

Overall, the circulating SolvBTC has trended upward, supporting greater liquidity and usage across DeFi. Importantly, Solv’s design strictly maintains a 1:1 peg between SolvBTC and BTC; the expanding supply is fully collateralized by the protocol’s Bitcoin reserves, preserving SolvBTC’s value integrity.

LST Utilization Rate

A key health indicator is the utilization rate of issued Liquid Staking Tokens (LSTs) – i.e. what portion of SolvBTC is actively staked to earn yield in DeFi.

Solv has seen a high uptake of its SolvBTC staking opportunities: a significant majority of minted SolvBTC is deposited into yield-generating vaults, converting into SolvBTC.LST tokens.

In fact, Solv’s LST vault TVL has remained in the $850 million to $1 billion range, which (given SolvBTC’s ~$1.3–2.3B total value) implies roughly 60–70% of all SolvBTC in circulation is staked to earn yield at any time.

This indicates that most users are not just holding SolvBTC passively but actively deploying it to generate returns.

A high LST utilization rate suggests strong demand for Solv’s yield products – users are taking the extra step to mint LSTs and integrate them into DeFi strategies. It also reflects Solv’s effectiveness in creating utility for SolvBTC beyond simple holding.

By contrast, any large amount of idle SolvBTC would signal under-utilization, but so far utilization remains robust.

This metric will be important to watch as more SolvBTC is issued: sustaining a high utilization rate means new supply is finding productive use (e.g. in lending, liquidity provision, or other protocols), rather than sitting idle or speculative.

Solv’s healthy LST uptake thus far points to a positive feedback loop where more BTC staked leads to more yield opportunities being utilized, attracting yet more participation.

Yield & APY Trends

Earning yield on Bitcoin is Solv’s core value proposition, and SolvBTC holders’ returns have been evolving as new strategies come online. Notably, minting SolvBTC alone does not directly generate yield – instead, users stake their SolvBTC into various DeFi vaults to receive SolvBTC.LSTs which accumulate rewards.

These yields come from third-party protocols in which Solv participates (for example, partnering with @babylonlabs_io, @ethena_labs, @berachain, etc., to put the BTC to work in lending markets, delta-neutral trading, synthetic assets, and more.

Currently, the yield earned by SolvBTC.LST holders is paid in the form of protocol reward points (and partner tokens) rather than an immediate BTC dividend.

This makes calculating a simple APY tricky, but in practice the effective yield has been in the low single-digit percentages range annually, according to available data and comparable BTC DeFi yields. For instance, depositing BTC into Solv’s Babylon strategy or other vaults might target a few percent APY in BTC terms – modest, but meaningful given that idle BTC yields 0%. These returns are on par with or slightly below industry benchmarks (ETH liquid staking yields ~4-5% APY, while most Bitcoin yield opportunities hover around 1-3%).

Over time, Solv’s expanding set of yield sources could boost APYs for SolvBTC holders. They have hinted at ambitious targets (e.g. combined strategies potentially offering up to double-digit % yields in optimistic scenarios). However, realized yields will depend on market conditions and third-party protocol performance.

So far, yield trends for SolvBTC have been relatively stable and conservative, prioritizing reliability over sky-high rates. As the SolvBTC.LST portfolio grows, watchers should compare its average yield to benchmarks like other BTC lending rates or staking derivatives to assess competitiveness.

In summary, SolvBTC provides a steady, if not high, yield on Bitcoin – a return that, while moderate, marks a significant improvement over simply holding BTC, and one that is expected to trend upwards as new yield strategies come online.

Cross-Chain Activity

Solv Protocol is designed to be cross-chain, and SolvBTC’s reach spans multiple blockchain ecosystems.

In practice, SolvBTC operates across at least 8 major chains. These include @ethereum, @BNBCHAIN, @avax, @arbitrum, @base, as well as Bitcoin-adjacent or newer networks like @Mantle_Official, @MerlinLayer2, and @build_on_bob.

Solv has integrated @chainlink Cross-Chain Interoperability Protocol (CCIP) to enable seamless bridging of SolvBTC between these chains. This means users can transfer liquidity easily – for example, moving SolvBTC from Ethereum to BNB Chain to take advantage of a higher-yield farm, and vice versa, all secured by a decentralized bridge.

Cross-chain activity has been growing, as evidenced by SolvBTC liquidity and users on multiple chains.

BNB Chain in particular saw a huge influx of users (thanks to Binance’s involvement).

Bridging volumes are distributed across these networks; while exact figures vary, large portions of SolvBTC supply have migrated to BNB Chain (for PancakeSwap liquidity and BSC yields) and Ethereum (for DeFi integration).

The protocol’s presence on many chains indicates a focus on interoperability – SolvBTC is becoming a Bitcoin liquidity layer that any ecosystem can tap into.

Each additional chain integration (recently, for example, SolvBTC went live on Layer2s like Base and @LineaBuild) adds to the overall utility of the token.

Monitoring cross-chain metrics: the number of unique SolvBTC transfers via bridges and the liquidity on each chain’s pools – shows healthy multi-chain adoption.

With SolvDAO’s plans to even incorporate Bitcoin ETFs and more sidechains, SolvBTC’s cross-chain footprint is likely to expand further, driving higher bridging volumes and making SolvBTC a ubiquitous Bitcoin representation across DeFi.

In summary, SolvBTC is actively used on numerous blockchains, and its cross-chain mobility (facilitated by secure protocols like CCIP) has been a key factor in its growth.

User Growth & Retention

User adoption of Solv Protocol has shown both steady growth and sudden surges tied to incentive programs.

By early 2025, the platform had attracted over 882,000 unique users (wallet addresses) in total.

For much of 2024, user growth was gradual – the user base was increasing at roughly 2–3% per month in the absence of major events.

However, large-scale campaigns dramatically accelerated adoption.

A notable spike occurred in a 12-day period around a Binance Web3 “Megadrop” airdrop event, which caused total unique users to jump from ~484k to 882k (a ~100% increase).

This growth was especially pronounced on BNB Chain, where users quadrupled (from ~292k to 686k) thanks to the major Megadrop airdrop event on Binance.

In terms of active usage, Solv also saw record activity during these events.

On the day of the SOLV token listing and associated campaigns, on-chain activity spiked – for example, daily active addresses reached about 5,000 (performing $500k in transactions) on January 17, 2025, and Dune Analytics data shows Solv’s daily active users peaked in the hundreds of thousands across all chains during the Binance airdrop period.

The critical question is retention: do users stick around after claiming rewards? Following the airdrop, active user counts normalized to lower levels, suggesting some attrition (many participants were likely primarily airdrop hunters).

Nevertheless, Solv’s retention rate has been reasonable for a new DeFi protocol – a portion of those new users continued to stake BTC or engage with SolvBTC even after the campaign.

The protocol’s growing base of SolvBTC holders (15k+ SolvBTC in circulation) indicates that a meaningful subset of users have remained invested beyond initial incentives. Solv has been working to keep users engaged through ongoing yield opportunities and community programs (e.g. Solv Points loyalty system).

Over time, we see consistent growth in both new and returning users, albeit with some volatility. To solidify retention, Solv will need to convert one-time airdrop participants into long-term users.

Solv’s user growth has been very strong (nearly a million addresses), and while retention is an acknowledged challenge (as with any incentive-driven growth), the protocol’s continuous offering of BTC yield and new features aims to sustain user activity in the long run.

4. Solv’s On-Chain Bitcoin Reserve

Solv Protocol’s “on-chain Bitcoin reserve” provides 1:1 backing for every SolvBTC token, using a fully transparent Proof-of-Reserve system. Reserves include native Bitcoin, plus trusted wrapped Bitcoin assets that are categorized (e.g., core reserve vs. isolated reserve) based on security and liquidity.

4.1 The On-Chain “MicroStrategy”

Solv draws a parallel to MicroStrategy (a company famous for holding ~400k BTC), but instead of just “HODLing,” Solv activates that BTC for yield generation:

4.2 Active BTC Deployment

As of Dec 15, 2024: Over 11,611 BTC are staked in SolvBTC.LSTs, generating yield while retaining liquidity.

Cross-Chain Utilization: 10,688 BTC deployed across Ethereum, BNB Chain, Arbitrum, Avalanche, Bitcoin Mainnet, etc.

90% Utilization Rate: Demonstrates how SolvBTC enables BTC to move beyond idle holding.

5. Staking Abstraction Layer (SAL): Architecture & Flow

The Staking Abstraction Layer (SAL) is the foundational infrastructure coordinating all aspects of BTC staking—issuing Liquid Staking Tokens, verifying cross-chain transactions, and distributing yields.

Below is a high-level flowchart illustrating how SAL orchestrates deposits, staking, and yields:

Below is more a indepth flow chart:

Step-by-Step Flow: How SAL Works

Step 1: BTC Deposit

A user initiates staking by depositing BTC (or a wrapped BTC variant) into the Solv Protocol.

Deposited BTC is securely held in Solv’s audited smart contracts and multi-signature wallets.

Step 2: LST Issuance

Upon confirming the BTC deposit, the SAL automatically mints Liquid Staking Tokens (LSTs).

Two types of LSTs can be issued:

Pegged LST: 1:1 pegged token representing staked BTC, liquid for immediate use.

Yield-Bearing LST: Continuously increases in value by accruing rewards from staking activities.

Example:

User deposits 1 BTC → SAL mints 1 SolvBTC (pegged) or SolvBTC.LST (yield-bearing).

Step 3: Staking Guardians

A set of trusted validators (staking guardians) verify and authorize staking operations.

Guardians ensure BTC deposits are correctly and securely transferred across different chains or into various yield strategies.

Transactions must be validated and co-signed by multiple trusted guardians, providing an extra layer of security.

Step 4: Allocation to DeFi Yield Strategies

SAL automatically allocates staked BTC across diverse DeFi strategies, optimizing yields and minimizing risks.

Key yield strategies integrated by SAL include:

Example:

SAL deploys SolvBTC in a GMX-based delta-neutral vault to earn a consistent APY irrespective of BTC volatility.

Step 4: Yield Accrual

Staked assets begin accruing yield from the integrated strategies.

SAL tracks performance across these strategies in real-time, ensuring accurate valuation.

Step 5: Yield Distribution

Accrued yields are periodically distributed back to users.

Yield distribution methods include:

Value appreciation: Increasing the underlying BTC-equivalent value of yield-bearing SolvBTC.LST tokens.

Direct reward distributions: Airdrops of tokens like SOLV to users proportional to their staking participation.

Example:

Users staking SolvBTC receive monthly distributions of SOLV tokens or additional yield via the appreciation of SolvBTC.LST.

Step 5: Redemption (Unstaking)

Users can unstake at any time by redeeming their SolvBTC or LST tokens back into underlying BTC.

SAL automatically facilitates this redemption by burning SolvBTC or SolvBTC.LST and releasing the original BTC collateral back to the user wallet.

6. SolvBTC & Liquid Staking Tokens (LSTs)

Solv Protocol's introduction of SolvBTC and Liquid Staking Tokens (LSTs) uplifts Bitcoin's role in DeFi. Unlike traditional Bitcoin assets that remain idle, SolvBTC’s peg stability and liquidity make it reliable for use in collateralized lending, trading, and yield farming, positioning it uniquely as a trusted, widely-adopted Bitcoin derivative in DeFi.

Meanwhile, yield-bearing LSTs provide automated, compounded returns, creating a powerful solution for both institutional and passive retail investors. By seamlessly integrating with diversified DeFi strategies—including restaking protocols like Babylon and delta-neutral trading platforms such as GMX, Ethena, Jupiter, they deliver consistent, growing yields without active management.

With cross-chain functionality it significantly boosts SolvBTC’s utility, encouraging widespread DeFi adoption by enabling frictionless migration between different yield opportunities.

6.1 SolvBTC: The Universal BTC Reserve Token

Solv Protocol’s core innovation is the introduction of SolvBTC—a fully-collateralized tokenized form of Bitcoin designed specifically for DeFi. Unlike traditional Bitcoin, which sits idle in wallets, SolvBTC unlocks liquidity and yield-generating capabilities for holders.

How SolvBTC Works

SolvBTC is minted 1:1 against real BTC or recognized wrapped BTC assets.

1:1 BTC Backing: Every SolvBTC token minted is always backed fully by either real BTC or reputable wrapped BTC forms (like Binance's BTCB or Coinbase's cbBTC).

Cross-Chain Compatibility: SolvBTC moves freely across multiple ecosystems (Ethereum, BNB Chain, Arbitrum, Avalanche, Base, Mantle), allowing seamless integration with diverse DeFi protocols.

Redeemable at Any Time: Users can burn SolvBTC to redeem the underlying BTC, providing secure liquidity and flexibility.

6.2 LST Varieties

The LST concept is central to Solv’s offering, providing users liquidity and yield benefits simultaneously.

There are two main varieties of LSTs within Solv Protocol:

1) Pegged LSTs

Pegged Liquid Staking Tokens are tokens minted at a 1:1 ratio with deposited BTC and maintain a fixed peg against Bitcoin.

2) Yield-Bearing LSTs

Yield-Bearing LSTs are tokens whose value gradually increases as yield accrues from various staking strategies. Unlike pegged tokens, yield-bearing tokens automatically compound yields directly into the token value.

Yield-bearing LSTs introduce a dynamic component to Bitcoin exposure—BTC holders passively benefit from automatic compounding. This setup caters particularly well to passive investors seeking steady returns without active DeFi management.

How Users Interact with SolvBTC & LSTs:

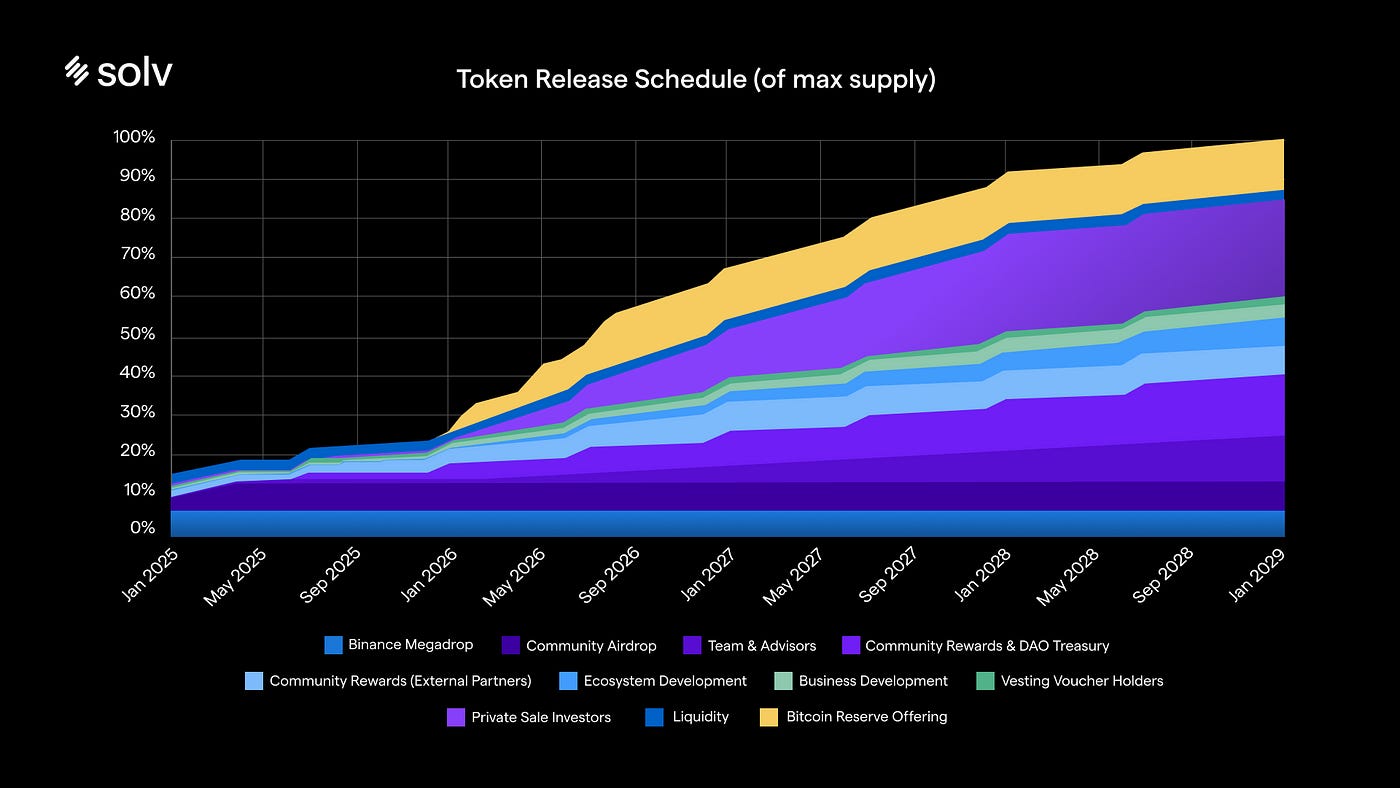

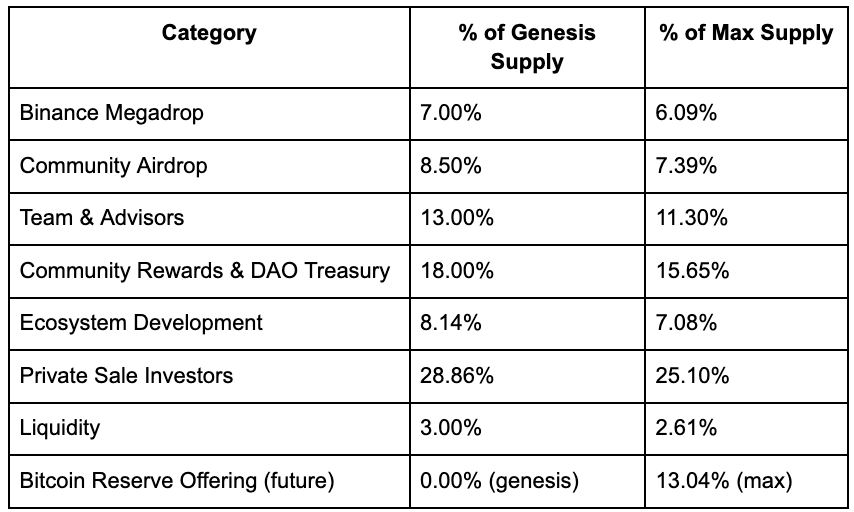

7. Solv Token (SOLV) & Tokenomics

7.1 Token Distribution

Solv has a max token supply of 9,660,000,000 SOLV (with potential for future governance-directed inflation). The initial (“genesis”) supply was 8,400,000,000. Key allocations include:

7.2 Utility & Governance

Governance: SOLV holders can propose changes or vote on protocol-level decisions, including adjustments to SolvBTC strategy parameters or future “Bitcoin Reserve Offerings.”

Staking: Stake SOLV in the Staking Abstraction Layer for potential emissions or yield share.

Fee Discounts: SOLV can reduce protocol fees, e.g., redemption fees for SolvBTC or bridging fees across ecosystems.

8. Partnerships

@soneium

@beets_fi

@AILayerXYZ

@SuzakuNetwork

@chainlink

@babylonlabs_io

@BNBCHAIN

@CeffuGlobal

@VenusProtocol

@Bybit_Official

@SonicLabs

@horizenglobal

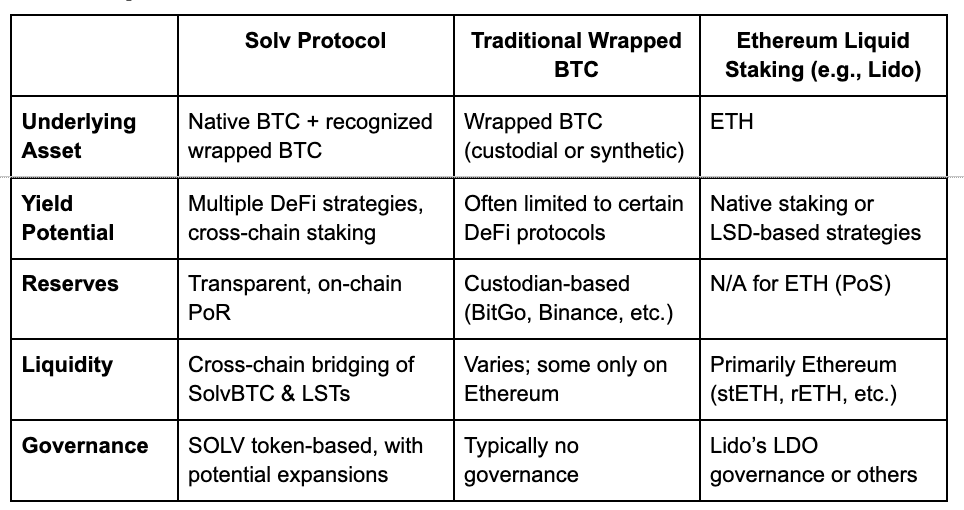

9. Comparisons & Outlook

Growth Factors

BTC’s Market Dominance: Even small staking adoption (2-3% of total BTC) could match or surpass the largest ETH liquid staking solutions.

Security & Transparency: Real-time PoR fosters trust among both retail and institutions.

Broad Partnerships: Integrating with popular lending, derivative, or yield aggregator platforms is key to scaling Solv’s user base.

10. Conclusion

Solv Protocol has emerged as a powerful force in bridging BTC’s trillion-dollar market cap into yield-generating opportunities. Its On-Chain Bitcoin Reserve ensures that every SolvBTC is fully backed, while the Staking Abstraction Layer orchestrates cross-chain yield strategies. The SOLV token adds a community-governed component, enabling decentralized decision-making around expansions, fees, and product rollouts.

Key Takeaways

On-Chain Reserve: Combines security (via PoR) with the flexibility of multi-chain deployments.

LST Ecosystem: Liquid Staking Tokens for BTC—both pegged and yield-bearing—unlock new forms of utility.

SAL Infrastructure: Streamlines a complex process of bridging, staking, verifying, and distributing yields.

Future Outlook: Expect further integrations with advanced DeFi protocols, new bridging frameworks, and expansions into institutional-grade custody/trust solutions.

By enabling frictionless cross-chain staking and delivering verifiable 1:1 BTC backing, Solv Protocol is well-positioned to drive the next wave of “BTC Fi” (Bitcoin Finance) adoption, pulling idle BTC into DeFi’s vibrant ecosystem.