User's funds are often exploited by deceptive APYs and expensive borrowing fees.

What if I told you could create your own:

🔥Profitable active strategies with 700% APY

🔥Backed by @TheSpartanGroup @BinanceLabs @multicoincap

Here's how you can earn 120% APY on stables 🧵👇

In this thread, I will walk you through on how you can earn those juicy yields with @stellaxyz_

1️⃣About @stellaxyz_

2️⃣Incentive Program

3️⃣Stella Lend

4️⃣Stella Strategy

5️⃣Roadmap and Conclusion

1️⃣About @stellaxyz_

At Stella, users can create their own leveraged strategies at 0% borrowing cost.

It uses a a pay-as-your-earn (PAYE) model where users only have to pay fees when they make profits.

Stella strategies have these features:

👉Capital efficient with Uniswap V3,

👉Leveragoors able to take high APY positions

👉 Feature to long/short an asset price as part of strategy

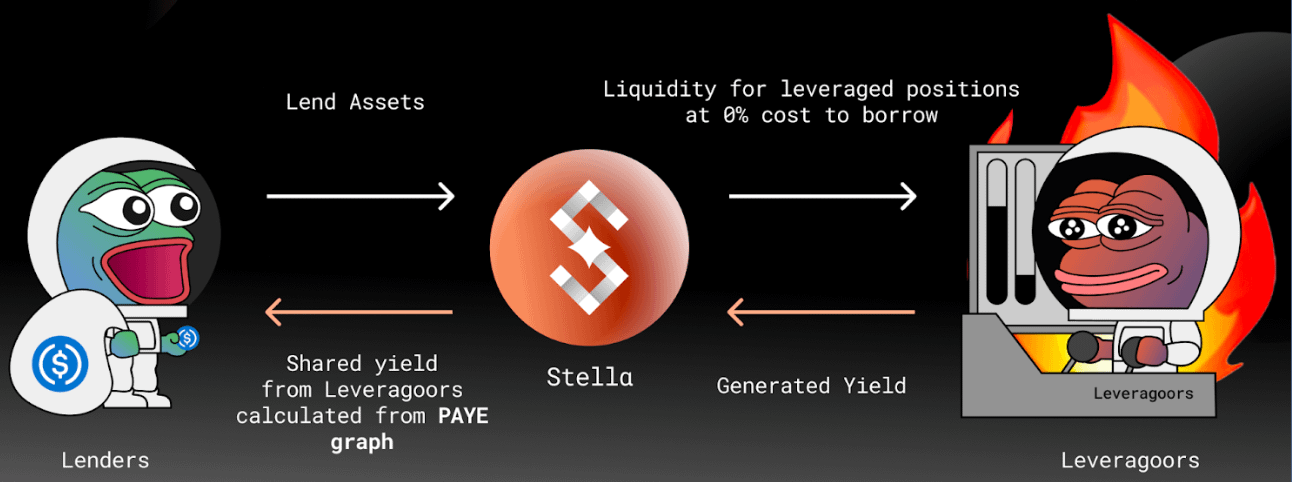

There are 2 user types for any leveraged strategy:

• Lender : Users who lend into the Stella money market to earn passive yields.

• Leveragoor/Borrower: Users who take leveraged LP/staking positions.

Based on your user type, you can use Stella to your advantage👇

2️⃣Incentive Program

It is already running and will go in 2 phases. The best part is you will receive an NFT👀

🔹 Phase 1: Lender Incentive Program

You can supply in selected asset pools to be eligible for boosted yields.

Asset groups will be weighted differently

🔹Phase 2: Leveragoor Incentive Program

Leveragoors who close their position during this timeframe and with a positive PnL will earn a 20% yield on top of the generated yield.

There will be a different set of incentives for this phase.

Read more:

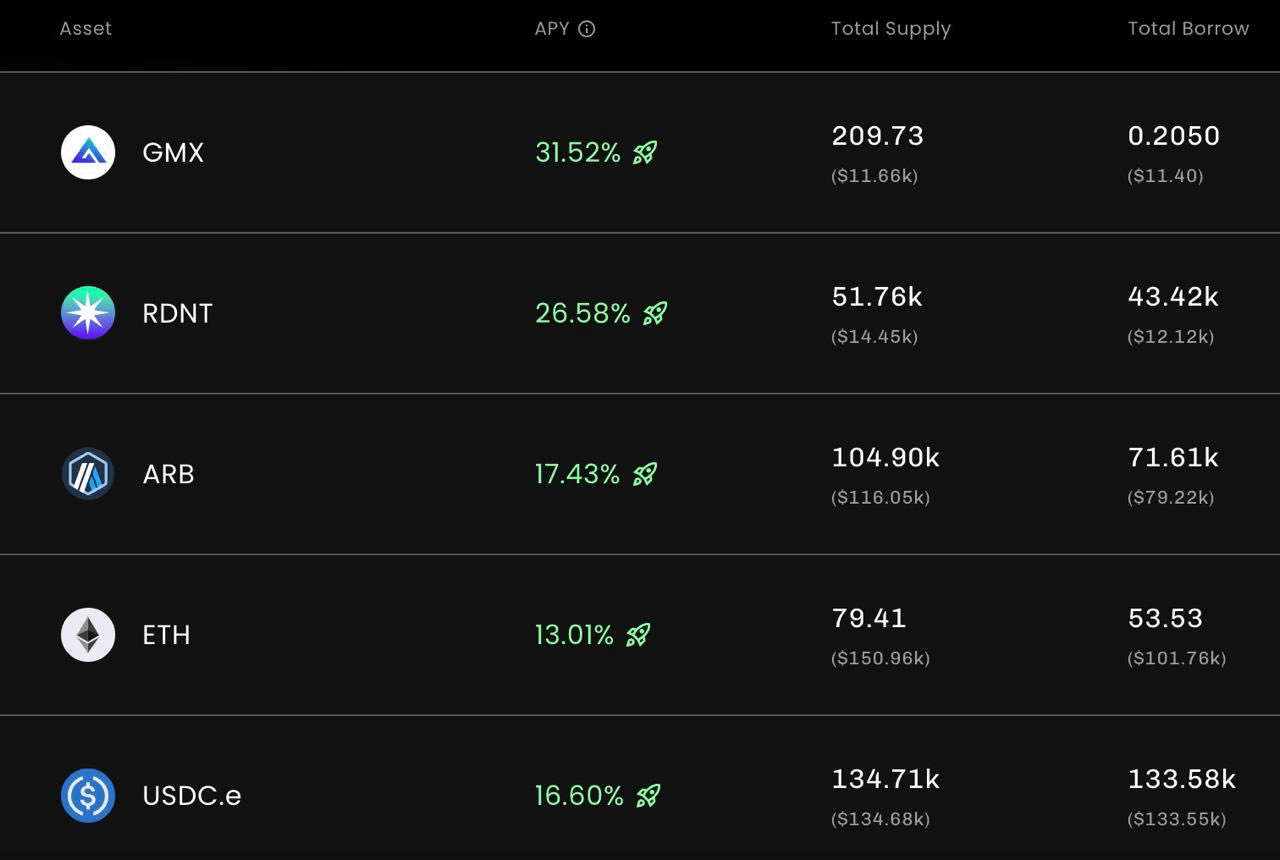

3️⃣Stella Lend

It allows ‘lenders’ to earn passive yield with uncapped upside.

Instead of a traditional Interest Rate Model, Stella lend relies on the PAYE Model invented by the Stella team

Here's 2 features about Stella Lend👇

👉Uncapped upside for lenders

We often see low lending APY. Its low because they are derives from the utilization rate in the interest rate model.

Stella uses PAYE which relies on the yield share from the leveragoor’s profitable positions.

Yields that the Lender gets depend on the yields available in the market and if the leveragoors closed out with profitable positions.

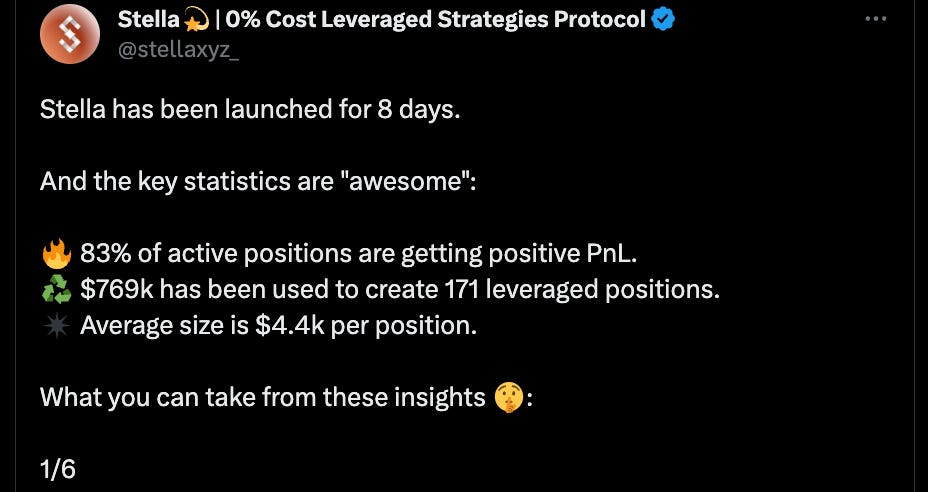

As a lender, I would not be too concerned, as many active positions are profitable.

👉 Incentive program for lenders

The current lending APYs on Stella is low because a lot of leveragoors still have their positions open.

As leveragoors begin closing positions and realize profits, lenders will start getting higher real APYs too.

With the incentive program the boosted yields can be adjusted to ensure lenders are still getting juicy yields.

4️⃣Stella Strategy

It allows ‘leveragoors’ to take leveraged yield positions at 0% cost of borrowing.

Here's some benefits for Leveragoors👇

👉Incentive program for leveragoors

They will get an additional 20% bonus yield in $ALPHA tokens on closing their positions.

This will incentivize them to open profitable positions.

👉Stella Leveragoors are more profitable than traditional leverage strategies.

Because more than 85% of the active leveragoor positions on Stella are profitable because of the PAYE Model.

👉Earn up to 700% APY

Stella has various strategy modes so here I'll just be walking you through how a CHAD would do it with Chad Mode (Advanced) strategy

For instance, I am bullish on ARB in the long so I want to take a leverage long for ARB. So, what I will do is...

a. Choose a strategy and decide leverage amount

b. Because Stella builds ontop to Uniswap V3, users can choose a price range among 'Wide’, ‘Medium’, ‘Narrow’

The narrower the range the higher IL, the higher the APY

c. Supply and borrow assets, I will be able to control my long exposure

d. Always take note on the debt ratio, once all good with the metrics, go to open position

5️⃣Roadmap and Conclusion

Currently, we are seeing strategies on Arbitrum and Stella will further expand into protocols like TraderJoe.

Given that it would be a cross-chain future with a heavy focus on LSDs, Stella is not missing out on that.

They have plans to expand across major L2s and Ethereum along with leveraged LSD strategies too.

Also, Stella has been rebranded from Alpha Finance, hence the token $ALPHA.

With its innovative PAYE model, I am interested to dig further into this.

Thread: https://twitter.com/arndxt_xo/status/1677637425542369280