This week, I’ll dive into 8 key states of crypto, capturing critical insights and market developments, alongside 6 narrative trends that are shaping crypto next move.

We will cover the rise of AI agents to the resurgence of memecoins, and from Bitcoin’s consolidation to Solana’s explosive performance.

Let’s break it down into 8 major observations and 6 compelling trends that highlight the most important moves in the market. 👇🧵

8 States of Crypto

Below is a concise recap of the seven charts and key takeaways you highlighted.

1. AI Agents Market Cap Remains Relatively Small

While Virtuals (an AI agent launchpad) has soared to a ~$4B market cap, the total market cap of AI agents themselves is only ~$1B.

Despite AI agents being one of the hottest narratives recently, there’s still significant room for growth as adoption and attention continue to rise.

2. DEX-to-CEX Trading Volume Is Surging

Perpetual DEXs have particularly exploded in popularity, while more projects achieve multi-billion-dollar valuations without relying on centralized exchange listings.

This is a promising shift toward the broader DeFi vision of a truly decentralized trading ecosystem.

3. DeSci Mindshare Skyrockets

Decentralized Science (DeSci) has seen a significant uptick in interest, prompting more builders and researchers to pay attention.

Although some narratives (e.g., liquid restaking, BRC-20, modularity, L2, and RWA) lost steam, DeSci’s rapid rise could point to new opportunities for innovation.

4. BTC Supply on Exchanges Keeps Dropping

The percentage of BTC (and ETH) on exchanges continues to decline, suggesting whales and long-term holders are accumulating.

Lower supply on exchanges typically reduces sell pressure, which can fuel bullish momentum—especially for Bitcoin.

5. Programmable Bitcoin via sBTC on Stacks

Stacks introduced sBTC, a 1:1 Bitcoin-backed asset, aiming to unlock ~$2 trillion of BTC liquidity for DeFi.

sBTC’s holders can earn base yields (e.g., ~5% in BTC), lend on platforms like Zest for ~6% APY, and soon more caps will open.

This offers a tangible way to “put BTC to work” and could spur more Bitcoin-focused DeFi innovation.

6. Stablecoin Supply Hits $200B ATH

Up from $125B at the start of 2024, stablecoins now sit at $200B in circulation.

With annual transaction volume surpassing Visa, stablecoins continue to prove they’re a trillion-dollar opportunity in the making.

7. Monthly Crypto Funding on the Rise

Though still below 2021 peaks, there’s a noticeable uptick in private investment capital being deployed.

Historically, funding surges near market tops; the current rise suggests we are still early in the growth cycle, not yet at peak euphoria.

Bonus: Solana’s Rapid Ascent

In December, Solana briefly generated $431M in fees—more than all other L1s combined.

Activity on Solana rivals Ethereum across many key metrics, and the upcoming Firedancer upgrade could further boost scalability and network usage. It’s increasingly clear that Ethereum and Solana can (and likely will) coexist in a multichain future.

6 Narrative Trends

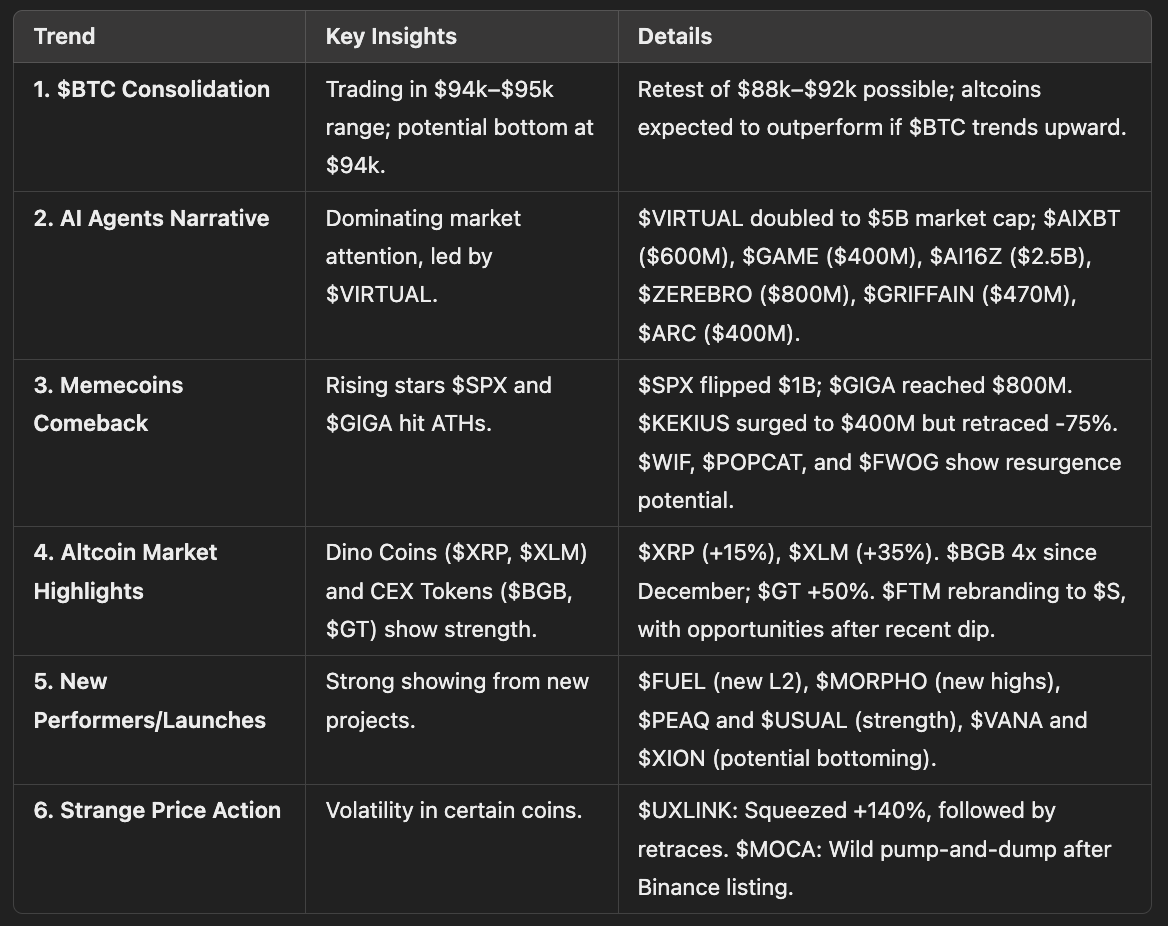

1. $BTC Consolidation and Potential Bottom

Bitcoin has been trading within the $94k–$95k range, frustrating traders with frequent dips below $94k and touches of $93k. Currently, it's hovering just under $97k.

The recent cluster near $94k suggests a potential bottom. However, a retest of $88k–$92k isn't off the table. Altcoins are expected to outperform if $BTC trends upward, reminiscent of 2021's bull market.

2. AI Agents Dominate the Market Narrative

Key Performer: $VIRTUAL, an AI agent launchpad on Base, doubled from a $2.5B to $5B market cap in just 10 days.

Notables in the Ecosystem:

$AIXBT: A Twitter-based agent that grew from $300M to $600M.

$GAME: Nearly reached $400M.

$AI16Z (Solana-based): From $1B to $2.5B.

Other prominent projects include $ZEREBRO ($800M), $GRIFFAIN ($470M), and $ARC ($400M).

AI agents are leading a new wave of innovation, attracting massive attention and investment.

3. Memecoins and Murad Coins Comeback

Rising Stars:

$SPX and $GIGA both hit ATHs, with $SPX flipping $1B and $GIGA reaching $800M.

$KEKIUS: Rose to $400M after Elon Musk's Twitter pfp change but quickly retraced by -75%.

Memecoins like $WIF, $POPCAT, and $FWOG are primed for a potential resurgence.

4. Altcoin Market Highlights

Dino Coins: $XRP (+15%) and $XLM (+35%) continue their strong performance.

Fantom to Sonic Network: $FTM is rebranding to $S, with a sharp dip to $0.66 before bouncing, signaling a possible long opportunity.

CEX Tokens:

$BGB: Up 4x since December; now at $7.5B market cap.

$GT: Up +50% since December.

5. Noteworthy Performers and New Launches

Fuel Network ($FUEL): A new L2 showing strong potential.

$MORPHO: Consistently reaching new highs.

Other New Coins to Watch: $PEAQ, $USUAL (strength), and $VANA, $XION (bottoming out).

6. Strange Price Action

$UXLINK: Extremely volatile, with a massive squeeze (+140%) followed by sharp retraces.

$MOCA: Wild pump-and-dump patterns post-Binance listing.