This is the LayerZero moment for multi-chain UX.

And it starts today with a leader for chain abstraction.

@ParticleNtwrk proved it through UniversalX, with $4.3M+ in revenue and 1.5M trades.

Here is how $PARTI is delivering a $382M revenue potential in 2025 🧵👇

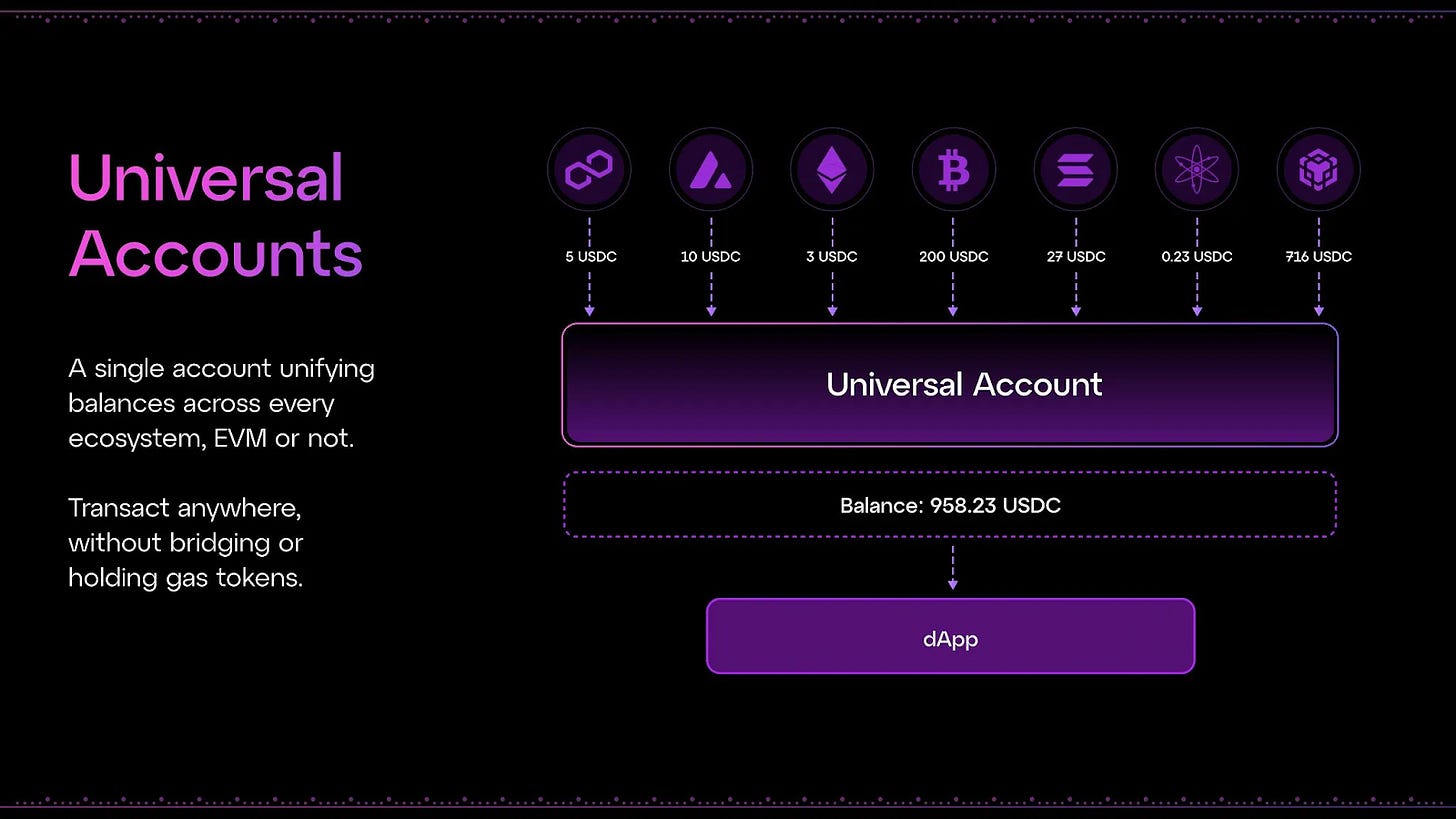

At the core of Particle Network's vision is its Universal Accounts system, which abstracts away the complexity of managing assets across multiple blockchains, making it easier for users to interact with decentralized networks.

Revenue Projection for A $382 Million Potential in 2025

Universal Accounts are Particle Network’s killer feature.

They are the backbone of all cross-chain experience, solving the problem of fragmented assets and inefficient cross-chain bridging. To prove this concept, Particle built UniversalX, a trading platform that’s already seeing remarkable adoption.

In just one month after releasing UniversalX V2, Particle Network hit the following milestones:

$425.75M in Trading Volume

1.52M Total Trades

30,364 Total Users

$45.3M Avg. 7D Daily Volume

$4.25M Fees Generated

These numbers are phenomenal, especially given the current market climate. Generating over $4 million in fees within weeks reflects but UniversalX’s meaningful user engagement. It’s a clear signal that UniversalX is retaining users and that chain abstraction is delivering real, repeatable value.

Now, projecting these numbers forward conservatively over a 12-month period with just a 10% Month-on-Month (MoM) growth gives us some eye-popping figures:

Gross Fees: $91.04M

Net Fees (after referral): $63.73M

These numbers could very well increase significantly, especially as Universal Accounts continue to roll out to new apps and markets. But even conservatively, the revenue generated from just UniversalX is already proving that chain-agnostic trading platforms offer far more upside than their single-chain counterparts.

And when you consider the broader Universal Accounts network and the bridging market (with monthly volumes averaging around $17.6B), things get even more interesting.

Particle Network is already the 6th biggest bridge by number of transactions, and if Universal Accounts captures just 5% of the market by 2026, we could see:

$15.86M in Net Fees from just bridge transactions.

When you factor in bundler revenue and other integrations, Particle Network could conservatively be looking at $80M in total revenue potential by end of 2025.

What is Chain Abstraction and How Does It Work?

Chain abstraction is about eliminating the complexities of interacting with multiple blockchains. In the current Web3 landscape, users must manually bridge assets between different chains, each with its own native gas tokens and protocols. Particle Network’s chain abstraction solution, powered by Universal Accounts, changes that by allowing users to have a single account and balance that spans multiple blockchains.

For example, consider a scenario where a user has assets on different blockchains: 5 USDT on Base, 5 USDT on Arbitrum, and 5 USDT on Solana. With Universal Accounts, the user could seamlessly make a purchase on Ethereum using the combined total of their assets (15 USDT), without needing to manually bridge assets or manage different gas tokens for each chain.

The Particle Chain is the execution layer that makes chain abstraction operational at scale. While Universal Accounts serve as the front-end abstraction for users, the Particle Chain is what turns that abstraction into reality behind the scenes. It functions as a cross-chain coordination engine, aggregating liquidity, executing cross-chain settlement, and optimizing asset movement in real time.

In practice, the Particle Chain acts as a universal settlement layer for fragmented liquidity. When a user initiates a transaction from a Universal Account, the Particle Chain determines the optimal routing strategy—whether it’s aggregating balances across EVM chains or sourcing from Solana—and autonomously handles bridging, asset conversion, and execution through its integrated liquidity and infrastructure stack. Every time this settlement process occurs, $PARTI is used as the underlying gas token, directly tying the token’s utility to cross-chain activity at scale.

This is where Particle’s approach diverges from traditional bridging protocols. Instead of forcing users to manage gas, wallets, or wrapped assets, the Particle Chain abstracts all of that complexity and completes settlement autonomously. The result is a cross-chain functionality with CEX-level simplicity — but fully self-custodial and onchain.

$PARTI in the Particle Ecosystem

All eyes on their TGE on the 25th March 👀

$PARTI serves as the heartbeat of Particle Network’s infrastructure, playing a central role in both user interactions and the protocol’s governance.

Here's a breakdown of its primary utilities:

Universal Gas Token:

As the native gas token for Particle Network, $PARTI facilitates all transactions conducted via Universal Accounts. Regardless of the chain a user is interacting with, all gas fees are settled on $PARTI, making it a unifying force across the ecosystem.Staking & Governance:

Holders of $PARTI can participate in the governance of the Particle Network protocol. This decentralized voting mechanism allows users to help guide the direction of the network, making it more democratic and transparent.Universal Liquidity Token:

$PARTI also serves as an intermediary token for liquidity providers in Particle Network's ecosystem. It plays a key role in cross-chain atomic swaps and ensures liquidity across various networks, providing a seamless experience for users and developers.

Chain abstraction is inevitable. And $PARTI is how you front-run it.