The Double-Edged Sword of Bitcoin ETFs: Are We Sacrificing Decentralization for Adoption?

It's time we had a frank discussion about the potential long-term implications of Bitcoin ETFs and institutional adoption.

While the price action has been exciting, I'm concerned that we might be overlooking some serious risks to Bitcoin's fundamental value proposition.

👇👇👇

The Good: Adoption and Price Appreciation

Let's start with the positives:

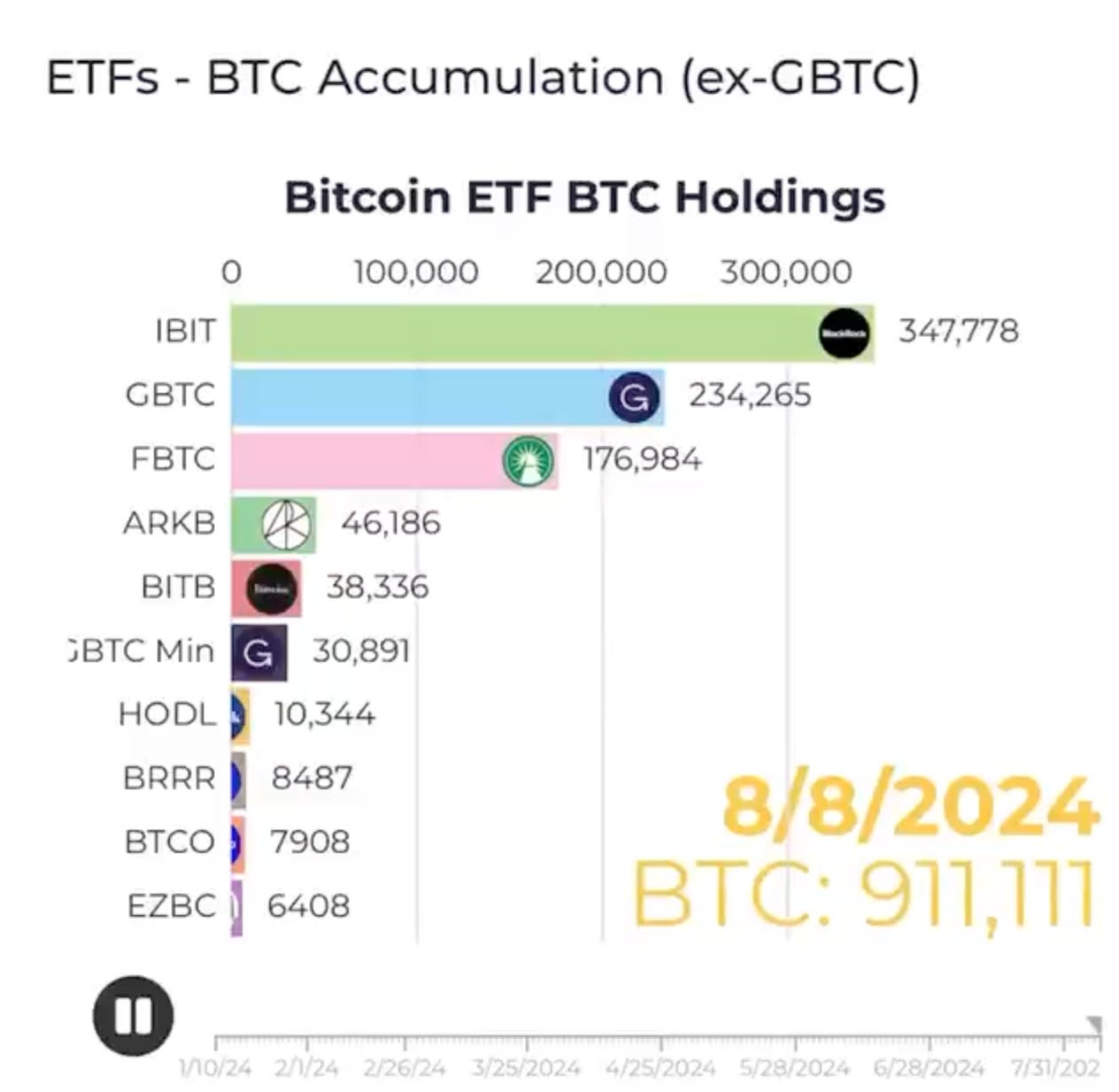

• Bitcoin ETFs were approved about 7 months ago, marking a significant milestone in mainstream adoption.

• Since then, these ETFs have acquired approximately 4.3% of the total Bitcoin supply.

• This influx of institutional money has indeed sparked a new bull run, pushing Bitcoin to new all-time highs.

On the surface, this looks great. More adoption, higher prices, and increased legitimacy in the eyes of traditional finance. But as I dig deeper, I can't shake the feeling that we're trading short-term gains for long-term risks.

The Concerning: Centralization Creep

Here's what's keeping me up at night:

• ETFs have gobbled up 4.3% of Bitcoin supply in just 7 months. And that's likely an underestimate, given lost coins.

• MicroStrategy alone holds over 1% of the supply.

• The US government also controls around 1%.

• Other large entities are undoubtedly accumulating as well.

We're seeing a rapid concentration of Bitcoin in the hands of a few powerful players. This trend directly contradicts the core ethos of Bitcoin: decentralization.

The Dilemma: Adoption vs. Decentralization

This situation presents a classic dilemma:

• We want Bitcoin to be widely adopted and recognized as a legitimate asset class.

• But we also need it to remain decentralized to fulfill its promise as a censorship-resistant, permissionless monetary system.

These goals are increasingly at odds with each other. The very mechanisms driving adoption (ETFs, institutional investment) are also centralizing ownership.

The Risks of Centralization

Why should we care about this centralization? Here are a few reasons:

• Market Manipulation: Large holders could potentially influence price movements.

• Regulatory Capture: Governments and institutions might push for regulations that benefit large holders at the expense of individual users.

• Network Governance: While Bitcoin's protocol is resistant to change, social consensus matters. Large holders could have outsized influence on debates about upgrades or forks.

• Liquidity Concerns: If a significant portion of supply is locked up by long-term holders, it could impact Bitcoin's utility as a medium of exchange.

The Lack of Safeguards

What's particularly worrying is that we have no mechanisms to prevent this centralization. Bitcoin's design prioritizes permissionlessness, which means we can't stop anyone - individual or institution - from accumulating as much as they want.

Personal Thoughts

I'm thrilled to see Bitcoin gaining mainstream acceptance. But at what cost? Are we so focused on number-go-up that we're losing sight of the revolutionary potential of truly decentralized money?

I don't pretend to have all the answers, but I believe this conversation is crucial for the future of Bitcoin and cryptocurrency as a whole.

Twitter: