The RWA hype is back in full swing. 782% growth compared to last year.

While the $170B stablecoin market struggles with centralization—Tether and Circle dominate.

A project founded in 2017 and backed by @ChainLink and @Lineabuild 🧵👇

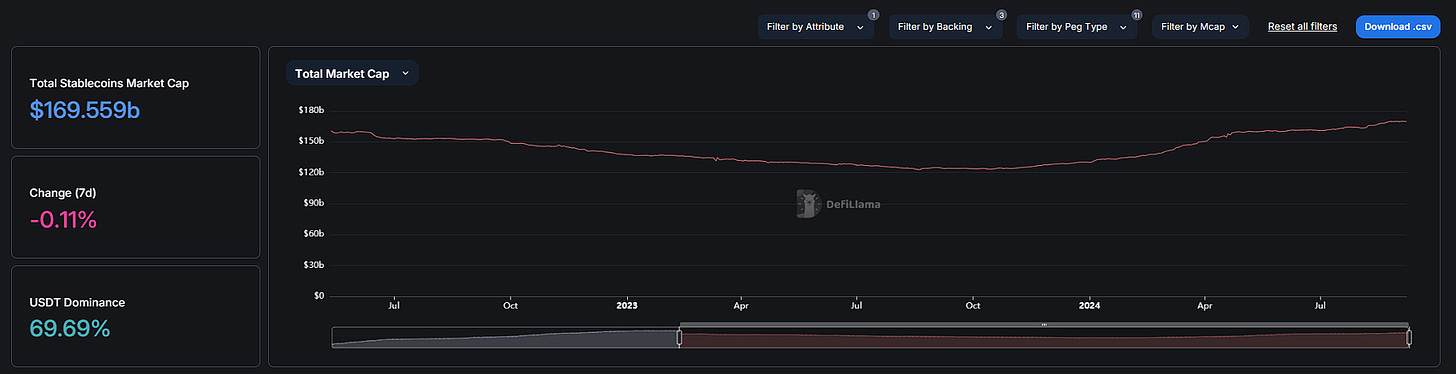

The Stablecoin Oligopoly

The stablecoin market just hit an all-time high of $170B, and while it’s become a key player in DeFi, the irony is that it’s far from decentralized.

With Tether ($USDT) and Circle ($USDC) controlling over 90% of the market, it’s more like an oligopoly than true decentralization.

Why is this a problem?

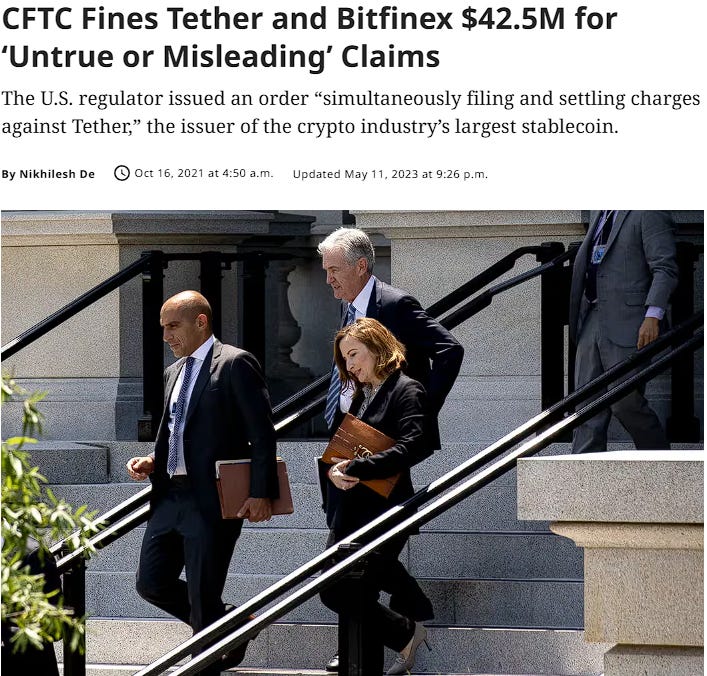

Centralization: Both Tether and Circle operate under strict regulations, which means they can freeze or blacklist accounts. Circle already did this by freezing $75,000 linked to Tornado Cash after U.S. sanctions.

Transparency: Tether has faced years of skepticism about its reserves, even paying a $41M fine for misleading claims.

Regulatory Threats: If regulators crack down, it could trigger a liquidity crisis across DeFi.

That’s why @AryzeOfficial is stepping up, aiming to disrupt this dominance with a more secure, RWA-backed stablecoin alternative.

I have also share that stablecoin is probably the best business model out there however, its currently plagued by 2 issues: Tether, Decentralization and I believe novel stablecoin use cases aims to solve these.

https://x.com/arndxt_xo/status/1829445965352468482

What is Aryze?

Aryze is an asset-backed stablecoin platform offering cross-chain liquidity and revenue sharing.

Its asset-agnostic approach allows for the tokenization of various RWAs, including fiat currencies, commodities, CBDCs, bonds, and stocks, with each token fully collateralized.

Aryze is live with eUSD, eEUR, eGBP, and eSGD stablecoins.

What sets Aryze apart -

Interoperability: Aryze’s stablecoins (E-Assets) allow for direct exchange without relying on traditional liquidity pools, using a burn-and-mint process powered by Chainlink for accurate pricing.

Unified Liquidity: All E-Assets share a single liquidity pool, ensuring low slippage and strong market support for new tokens. The $RYZE token underpins this system.

Transparency: Aryze ensures transparency with monthly audits by Grant Thornton, a daily solvency bot, and on-chain proof-of-reserves.

Revenue Sharing: Aryze shares 50% of its revenue by buying back $RYZE, burning half and using the rest to incentivize liquidity providers and ecosystem participants.

reForge is a system within the Aryze ecosystem that facilitates unified liquidity and efficient cross-chain transactions.

It uses a burn-and-mint process to manage stablecoins across various blockchain networks

$RYZE Token

The $RYZE token is at the heart of Aryze’s ecosystem, bringing together liquidity for all E-Assets, powering governance, and keeping everyone’s interests aligned.

With Aryze’s buy-back-and-burn model, $RYZE is set to see strong demand.

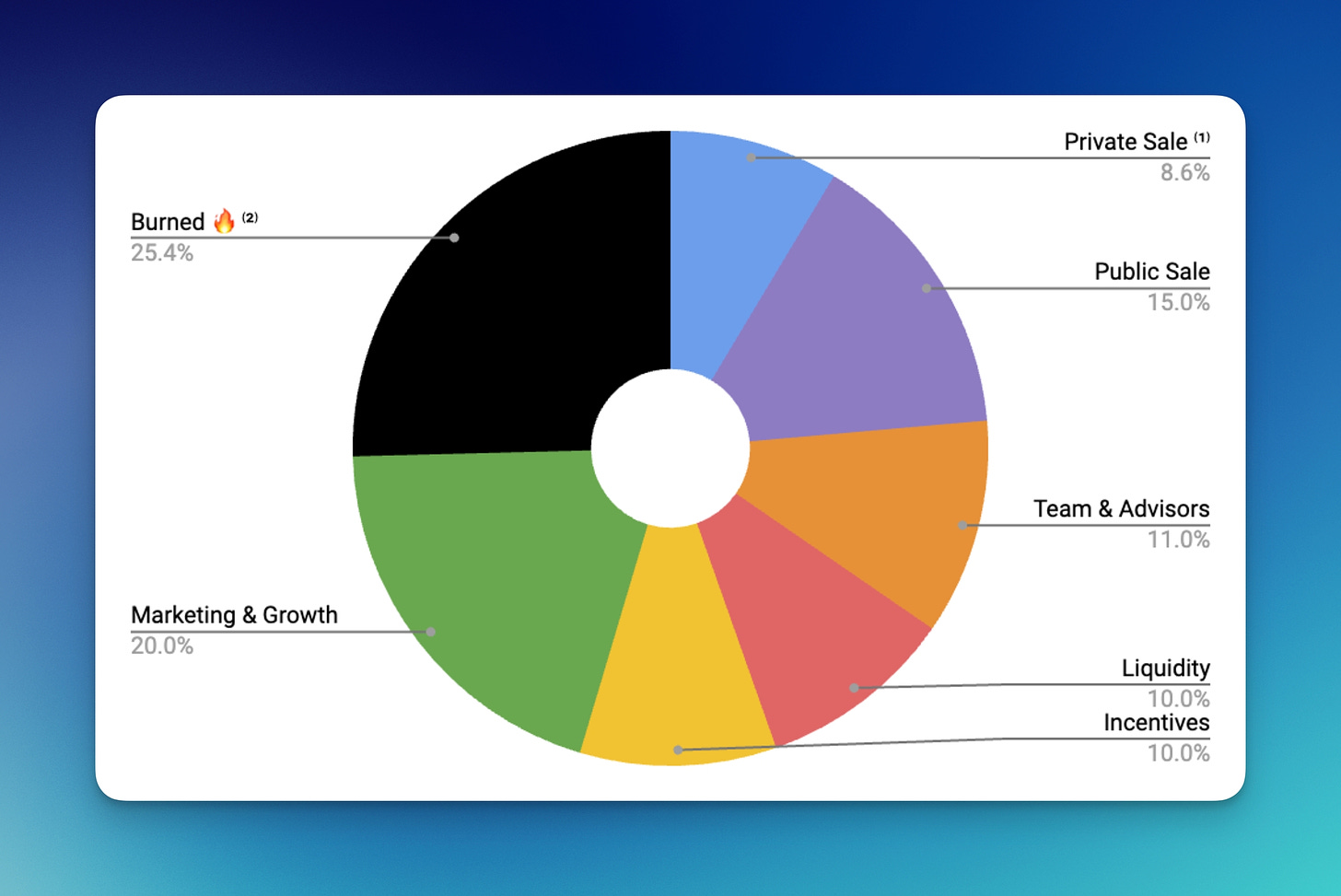

The token has a capped supply of 384M, here’s what the breakdown looks like -

The $RYZE token offer key core utilities:

Unified Liquidity: $RYZE pools liquidity for all E-Assets, minimizing slippage and creating a strong market with fees from $RYZE pairs.

Revenue Sharing: 25% of Aryze’s revenue goes toward buying and burning $RYZE, benefiting holders and liquidity providers.

Liquidity Rewards: Another 25% funds Vaults, rewarding liquidity providers and keeping the ecosystem stable.

Stablecoin Creation: Entities can create their own stablecoins by purchasing and burning $100K of $RYZE.

Governance: In the future, $RYZE holders will vote on key protocol decisions.

There’s no VC involved, private investors voluntarily locked their tokens for 12-24 months.

Their deflationary model has already burnt 25.4% of the supply, with 15% of tokens available in an upcoming sale.

They raised $2.5M privately, with 63% of those tokens locked for up to 48 months, reflecting strong investor confidence.

Partnerships

They’re also introducing a new collaboration with BCIFgold, a leading EU-based gold dealer with vaults in Vienna.

Under this partnership, each eGOLD token will represent 1 gram of physical gold, with BCIFgold pledging 2 kg of gold to support liquidity.

Holders will have the option to redeem their eGOLD tokens for physical gold bars via reForge, adding a tangible dimension to the digital asset.

This gold is not just high quality—it's 99.99% pure, showcasing a level of refinement that enhances its appeal.

That’s not all.

Aryze has a already established a solid backing by key industry players like @ChainLink and @Lineabuild

@ARYZEofficial is offering $75k in $RYZE tokens for engaging in tasks like sharing posts, holding or trading eUSD, inviting friends, and completing weekly challenges.

Plus, you might also qualify for the upcoming Linea airdrop!

https://x.com/ARYZEofficial/status/1816455287563252032

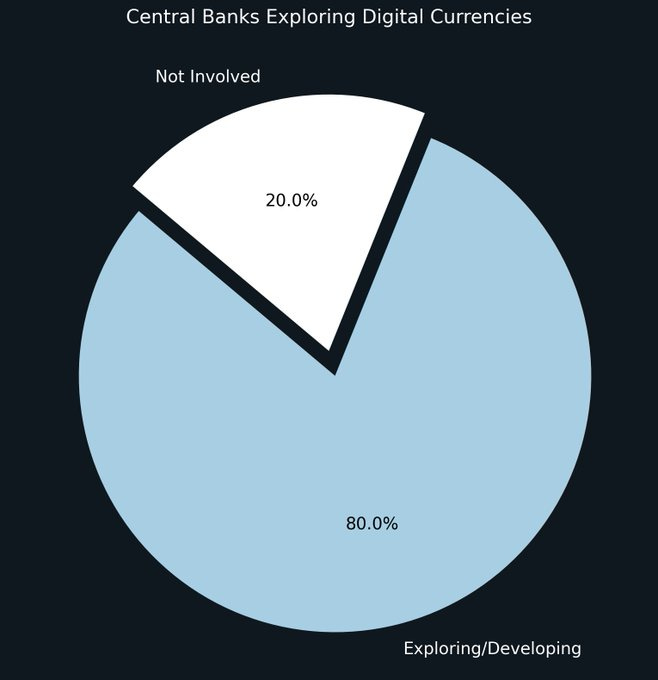

Today, almost 80% of of central banks are diving into digital currencies, and @AryzeOfficial is leading the charge.

Aryze aims to make financial services accessible and efficient, bridging gaps for underserved communities through secure, low-cost digital solutions.

As the stablecoin market grapples with centralization risks, ARYZEofficial offers a fresh, decentralized alternative with its asset-backed, transparent stablecoin system.