For months, many dismissed Hyperliquid as “just another perps DEX with a fast chain.”

But after tracing its volume trajectory, real-time fee payouts, and the verticalization of its entire stack, I’ve come to a different conclusion: Hyperliquid is the only VERTICALIZED infra and its value chain.

While most DeFi protocols still bolt onto generalized L1s and pray for user retention, Hyperliquid built its own execution layer, integrated liquidity engine, and value accrual flywheel. This resulted in CEX-grade execution with DeFi-native incentives.

This isn’t a narrative play. It’s an infra shift.

Image credits to : @OAK_Res_EN and @GLC_Research

TLDR

Hyperliquid has quietly become the largest on‑chain order‑book exchange by volume, revenue and trader retention.

Hard numbers: ~$7–9 billion / day in perpetuals volume, >$800 million in annualised protocol revenue, ~$550 million TVL and >$1.7 trillion cumulative volume.

Why it matters: A fully on‑chain order‑book that settles in <1 second finally delivers CEX‑grade execution without custody risk.

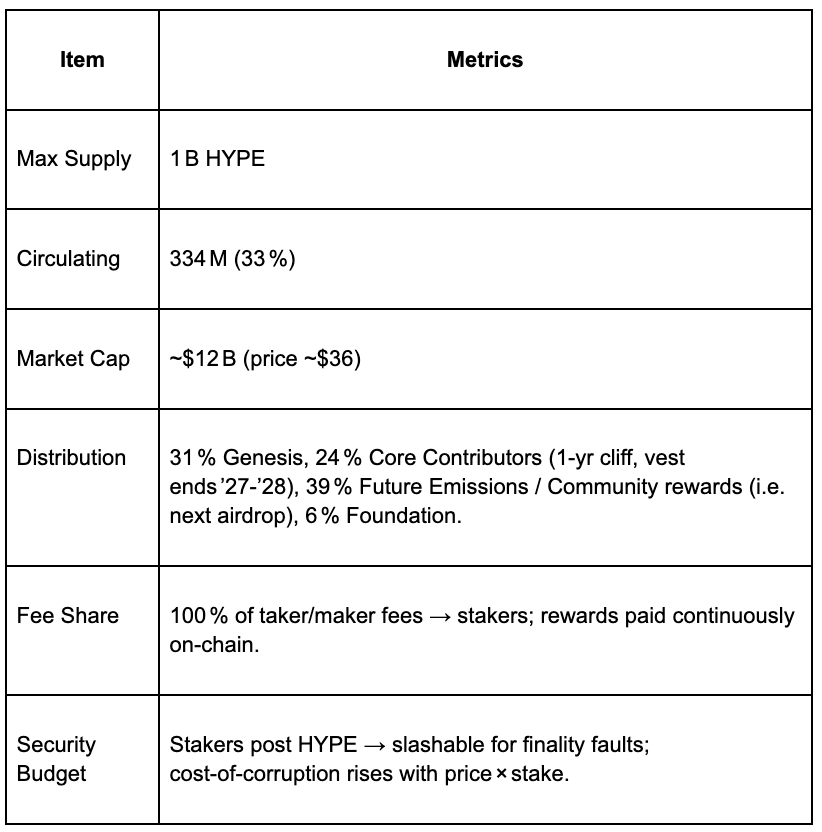

How value accrues: 100 % of trading fees flow to stakers, and ~39 % of the 1 B‑supply HYPE tokens are still earmarked for future community emissions / airdrops.

Catalysts: HyperEVM (EVM roll‑up on the same L1), new fee‑sharing vaults, a likely second airdrop, and an expanding builder ecosystem.

Key risks: Token unlock overhang, execution rivals (dYdX v4, Aevo, GMX v3), and regulatory pressure on high‑leverage venues.

1 | Where Things Stand

Performance – The protocol clears $6.0 B notional perps daily (30-day avg. $7.8 B); cumulative volume just crossed $1.8 T

Revenue – Annualised protocol revenue sits at $772 M, all paid to stakers in real time

Market share – @HyperliquidX now processes >60 % of on-chain perps volume, dwarfing dYdX-v4 ($93 M) and GMX-v2 ($152 M)

Why it matters: Sub-second, fully-on-chain CLOB execution finally lets pros run latency-sensitive strategies (hedging, basis trades, HFT) without custody risk.

*P/S relative to current m-cap. For context, dYdX trades at ~18× and GMX at ~22× P/S on forward revenue . Hyperliquid is cheaper today, but dilution narrows the gap quickly.

2 | Market Context

The Execution Gap Is Closed

The 2024–25 cycle proved that speed and self‑custody are not mutually exclusive. First‑generation perps DEXs (@dYdX v3, @GMX_IO) solved custody, but could not match CEX latency. Hyperliquid’s custom L1 settles ~200 k tx/s with sub‑second finality, allowing a live on‑chain central‑limit order book (CLOB).

Tighter spreads: Market makers can quote aggressively without risk of stale execution.

Lower slippage: Limit orders fill more predictably, especially in volatile conditions.

Real leverage: Traders can execute high-frequency strategies, long/short, arb, and hedging — the building blocks of pro trading.

Hyperliquid is the only DEX viable for latency-sensitive strategies. This means market participants can do things on Hyperliquid that are literally impossible elsewhere, such as:

Scalp basis trades on volatile meme pairs

Hedge risk in milliseconds after breaking news

Arbitrage listings across chains within a second

Traders responded en masse:

The result is institutional-caliber experience without giving up custody, which until now was a holy grail.

Hyperliquid now clears ~35 % of all on‑chain perps volume, surpassing some mid‑tier CEXs. A single whale (“James Wynn”) drove press coverage when his positions pushed daily fees to $4.65 M on May 21 2025.

3 | Technology Stack

Hyperliquid is the very full VERTICALIZED infra stack I have seen. Then followed by Katana, probably.

Hyperliquid is a vertically integrated on-chain trading stack, custom-built for high-performance, self-custodial finance. Unlike most DeFi protocols that rely on general-purpose blockchains, Hyperliquid developed a purpose-specific L1, sequencer design, execution layer, and capital deployment systems.

Each layer plays a vital role in enabling speed, trust, and composability at scale:

Hyperliquid L1

Traders get full custody + latency competitive with Binance, the best of both worlds.

What It Is:

A custom delegated proof-of-stake (dPoS) blockchain capable of ~200,000 transactions per second (TPS).

Offers sub-second finality with ~700–800ms block times.

Written from scratch (not built on Cosmos SDK or EVM) to optimize for central-limit order book (CLOB) trading.

Why It Matters:

Most L1s like Ethereum or Cosmos chains cannot support millisecond-level updates for CLOBs due to consensus latency. Hyperliquid’s bespoke architecture bakes order matching and execution into the base layer.

This lets every action, order submission, cancellation, trade settlement, happen directly on-chain in real time.

This removes trust assumptions on matching engines or sequencer honesty while retaining pro-grade speed.

Sequencer Design – Round-Robin Slot Bidding

What It Is:

A novel sequencing mechanism where validators bid for block slots in a round-robin fashion, rather than having one dominant sequencer or MEV auction system.

Block proposers cannot reorder or front-run transactions; they can only include or exclude them.

Why It Matters:

MEV (Miner Extractable Value) has become a central pain point in DeFi. Sandwich attacks, back-running, and unfair ordering degrade user trust.

Round-robin slot bidding creates censorship resistance and fairness:

No single party can consistently profit from ordering manipulation.

Traders enjoy predictable execution and true price discovery.

Institutional traders and market makers are more comfortable deploying capital into the protocol, knowing they won’t get MEV’d.

HyperEVM – The Onboarding Engine for Builders

What It Is:

An EVM-compatible execution shard built on top of Hyperliquid’s L1 (currently testnet live).

Shares security with the core L1 but offers EVM flexibility, allowing developers to write in Solidity and deploy existing DeFi primitives (e.g., Uniswap-style AMMs, lending pools, synthetics).

Assets are natively bridgeable to the CLOB for deep liquidity access.

Why It Matters:

Until now, builders had to choose between building on a fast chain (e.g. Solana) or a liquidity-rich ecosystem (Ethereum), often compromising on compatibility or performance.

HyperEVM enables the best of both:

Execution at sub-second speed

Liquidity aggregation via CLOB

Composable apps in the EVM standard

HLP Vaults – Protocol-native Yield Layer

What It Is:

HLP (Hyperliquid LP) vaults are passive liquidity pools where users can deposit USDC (or other stablecoins).

The vault acts as a market maker: it takes the other side of trader positions (perpetual contracts), earning:

Taker fees

Funding rates

Spreads

Current Performance:

Earlier it saw ~8–12% APY, now it's about 6% APY on USDC, fully paid from real trading activity, no token incentifrom pro traders (especially during volatile markets).

No reliance on token emissions or subsidies.

Built-in risk management, with sizing controlled by the protocol to avoid liquidation cascadesves or dilution.

Why It Matters:

Traditional LPing in DeFi (e.g., Uniswap) carries impermanent loss and low returns unless paired with incentives.

HLP vaults provide:

Real yield .

4 | Tokenomics & Value Accrual

Hyperliquid’s token model resembles early BNB + L2 hybrids, except fees go to stakers, not a burn. As volume scales, real yield rises linearly with trader activity, offering fundamental rather than purely reflexive value.

5 | Traction Analytics

Cumulative volume: $1.75 trn since launch; half of that in the last 150 days.

Daily active traders: 118 k wallets (7‑d MA, internal explorer).

Open interest: Peaked at $4.7 B on Jan‑22‑2025.

TVL growth: $308 M → $545 M YTD (+77 %).

Bridge inflow: $4.7 B in bridged assets, indicating sticky capital.

Ecosystem dApps: 46 contracts on HyperEVM testnet (lending, RWA perps, prediction markets).

6 | Competitive Landscape

Hyperliquid’s moat is a vertically integrated chain + matching engine. Swapping that stack is non‑trivial for rivals like @aevoxyz, @dYdX, @GMX_IO, @okx, @binance

7 | Investment Thesis

Hyperliquid is the first on‑chain exchange where real traders pay real fees, and those fees flow directly to the chain’s security layer.

Product–market fit: Sub‑second CLOB solved the execution gap blocking pro flow from moving on‑chain.

Flywheel: More volume ⇒ more rewards ⇒ higher staking APR ⇒ more $HYPE locked ⇒ higher security & lower float ⇒ price appreciation.

Ecosystem expansion: HyperEVM imports DeFi Lego; projects list their tokens on the CLOB and earn fees natively, creating a unique monetary incentive to bootstrap on Hyperliquid.

Supply‑side tailwind: 39 % of supply reserved for future community programmes ensures ongoing retail/user alignment without treasury sells.

8 | Key Risks

9 | 2025‑26 Catalysts

HyperEVM main‑net (targeted Q4 2025): first DEX and money‑market launches.

Second community airdrop from 39 % emissions pool—likely tied to on‑chain activity.

Equity/Commodities perps (approved HIP‑5) broaden addressable market beyond crypto.

Futures curve introduction: attracts delta‑neutral arb funds, boosting fee consistency.

Integrations: Ledger Live, Coinbase Wallet and Fireblocks working on native HL support (announced June ’25 town‑hall).

HLP Vault scaling: Auto-market-making pools yielding 8-12 % on USDC have room to 5× TVL before slippage rises materially.

10 | Conclusion

Hyperliquid represents the CEX killer thesis playing out on‑chain today, not a promise for tomorrow. With unrivalled speed, real revenue share and an on‑ramp for builders (HyperEVM), its trajectory resembles Binance circa 2019—except that value accrues transparently to stakers from day one.

For investors seeking fundamentally‑backed real‑yield exposure to the perpetuals boom, and willing to navigate unlock and regulatory risk $HYPE offers one of the clearest risk‑adjusted bets in crypto today.

Great post buddy