Most of that "Liquidity" isn’t real

There’s no fresh wave of money hitting the system.

It’s becoming clear that there is no coherent strategy in D.C., all driven by politics and power struggles.

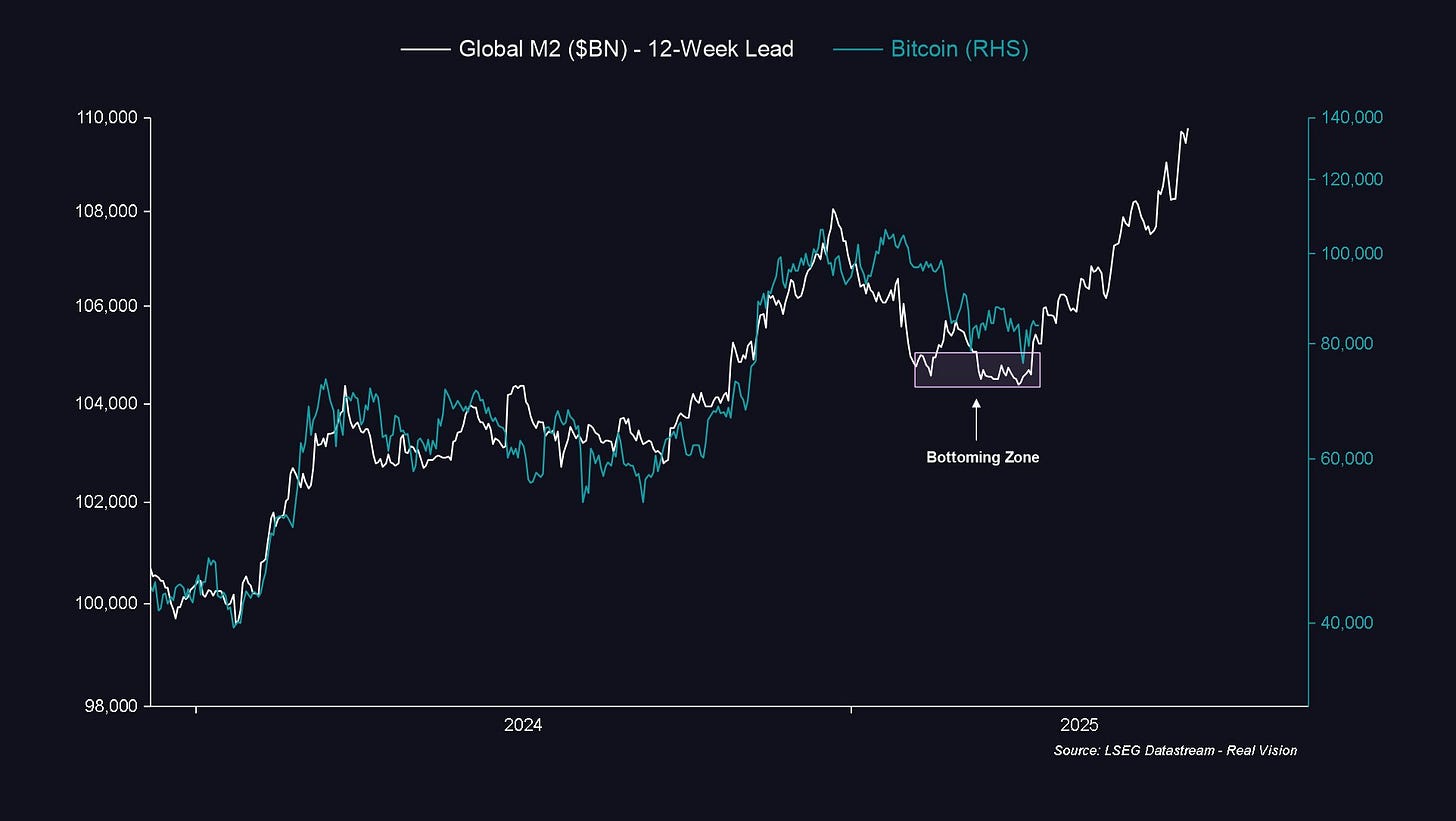

Global M2 is not a daily or even weekly series. Only the U.S. reports M2 weekly. China and Japan — the next biggest players — update with long and irregular lags. Most countries only report monthly. So when you see a “real-time” Global M2 chart, what you’re actually seeing is FX noise dressed up as liquidity.

And with the U.S. dollar weakening hard lately, the dollar-denominated value of foreign M2 has ballooned — even though most of those countries haven’t expanded money supply at all. China, for example, makes up 46% of Global M2 and is the only major economy where M2 has pushed higher in USD terms.

The rest is either flat or contracting.

Now overlay this with what’s happening in U.S. policy, its chaos.

Reports have surfaced of White House advisors staging hallway interventions to reverse tariff plans, scheduling meetings just to keep Peter Navarro away while financiers pressured Trump to change course.

Trump allegedly wants Powell out to devalue the dollar.

In parallel, the administration is mulling the creation of a Trade Contingency Group to prepare for a potential breakdown in China negotiations. Their focus would be to secure chips and strategic minerals — effectively war-gaming a new global supply regime.

Macro Pulse Update 20.05.2025, covering the following topics:

1️⃣ Macro events for the week

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ Tariff War

1️⃣ Macro events for the week

Previous Week

Next Week

2️⃣ Bitcoin Buzz Indicator

Launches

Jupiter launched the Juno framework to optimize price execution via adaptive routing with new aggregator support.

Scroll kicked off Phase 1 of its zk-rollup upgrades, eliminating major proving bottlenecks.

DIA Oracles went live on Arbitrum using its decentralized Lumina architecture.

Converge announced a fast EVM chain on Arbitrum with 100ms blocktimes and ENA-backed validation.

TermMax launched mainnet on Ethereum & Arbitrum with fixed-term leveraged lending.

DeepBook v3.1 introduced permissionless third-party liquidations and fee updates on Sui.

Everclear (formerly Connext) launched full mainnet with Solana support and zero-fee rebalancing.

Avantis debuted Zero-Fee Perpetuals offering 250x leverage, fees only on profits.

Jupiter Pro launched for advanced Solana traders with smart analytics and MEV protection.

Updates

a16z invested $55M in LayerZero’s $ZRO, locked for three years.

LI.FI integrated with Sui Network to expand cross-chain access.

Arbitrum launched Timeboost, letting users bid for fast tx inclusion with a private mempool.

Sonic integrated Arkham for real-time wallet/entity analytics.

Monerium’s EURe went live on Arbitrum with SEPA banking support.

Frax launched sfrxUSD on Sonic for seamless yield on frxUSD.

SolvBTC/xSolvBTC are live on Yei Finance’s Solv Market for BTC-backed lending on Sei.

Felix Protocol enabled $UBTC collateral for minting stablecoins on Hyperliquid.

Pendle listed sKAITO, bringing Kaito yield to SocialFi users.

Komainu added custody for Ondo’s OUSG and USDY tokenized treasuries.

Pell Network launched $EGLD restaking testnet for MultiversX.

Euler went live on BNB Chain with $100K rewards and looping strategies.

GMX DAO selected LayerZero for cross-chain messaging.

Level expanded lvlUSD utility via Pendle and Morpho integrations.

Ethena’s USDe to support Plasma mainnet from day one.

Spark deposited $50M into Maple’s SyrupUSDC vault.

KernelDAO launched $KERNEL staking on BNB and Ethereum.

f(x) Protocol passed FIP-12 to yield farm wstETH/USDC on Aave.

OpenSea began beta rollout for Solana token trading on OS2.

Turtle Club launched TAC external vaults for asset porting to TON.

Lombard clarified Bitcoin Bera Vault withdrawals will start May 6.

Balancer V3 launched on Avalanche with 100% Boosted Pools.

Upcoming

Scroll Phase 2 rolls out April 22 with 90% fee cuts and smart account support.

Dolomite’s $DOLO token lists on Kraken April 25 with tri-token utility model.

Superform to launch Rewards v2 with 50x points, NFT multipliers, and unified tracking.

Liquity set to launch $sBOLD as a yield-bearing ETH auto-compounder.

Aave proposed its first non-EVM deployment on Aptos.

Vertex x Foxify will bring prop trading to Vertex via FUNDED v2.

Pendle updates fee structure and boosts vePENDLE APY by 60%.

Avantis Zero-Fee Perps launch tomorrow with XP incentives.

Gauntlet proposes RWA lending revamp via sUSDS Treasury Vault.

Euler expanding to Optimism after 500K OP grant.

Airdrops

deBridge opened DBR claims with bonus rewards for vested users (claim by May 17).

Optimism launched SuperStacks campaign with ecosystem-wide reward incentives.

StakeStone $STO claims opened April 3 with a long-term growth roadmap.

EigenLayer closed Season 2 EIGEN claims on April 14.

Wayfinder launched $PROMPT claim across Ethereum & Base.

Layer3 opened Season 3 airdrop claim with lock vs instant options and new league system.

Zircuit x Hyperlane launched HYPER token ExpansionDrop preclaim.

KernelDAO opened $KERNEL claim and announced CEX listing.

Mind Network enabled $FHE airdrop claim with trading on major CEXs.

Jupiter opened Q1 ASR rewards for active stakers.

Muon launched its $MUON airdrop and trading dashboard.

BOB began $BABY airdrop claims for campaign participants.

Galxe launched $NOME earndrop with Genome Protocol.

Farms

Kamino offers $80K+ monthly rewards for borrowing USDG on Solana.

Balancer V3 farming incentives now live on Avalanche.

Penpie launched boosted fxSAVE pool for dual yield and $PENDLE rewards.

M11 Credit introduced lvlUSD vault on Morpho with Pendle-based yield.

Reservoir’s rUSD now on Pendle with high-point strategies and 1:1 redeemability.

Alchemix Boosts live on Optimism with 50% borrow and high OP-funded yields.

ZeroLend launched Prime Vault on Berachain with $50K in rewards and upcoming loops.

Napier’s cUSDO earns ~120% APY via leveraged yield and upcoming Morpho loop support.

Pendle highlights 46% APY boost on scUSD via Sonic Labs and partners.

Uniswap v4 incentives live on Unichain with $UNI across 12 pools.

Falcon’s sUSDf now live on Superform with 14% APY and 10x CRED rewards.

Brahma launched BGT Automation on Berachain for auto-compounded validator rewards.

Shadow Exchange enabled xSHADOW vs SHADOW reward claiming options.

3️⃣ Market overview

U.S. economic growth is holding steady for now, buoyed by strong March retail sales and resilient manufacturing, but looming tariff impacts, rising construction costs, and weak housing starts signal trouble ahead.

Consumer debt is at record highs, with delinquencies climbing, and household spending may soon slow.

Globally, central banks are easing cautiously amid heightened uncertainty—ECB cut rates, BoC paused, and China’s strong Q1 may falter under new U.S. tariffs.

Overall, trade tensions and inflation risks are clouding the outlook, with real GDP expected to decline in the second half of 2025.

4️⃣ Key Economic Metrics

🔴 Market Reactions: Quick Take

Dollar Drops: USD hits lowest levels since 2022 vs. euro, yen, and Swiss franc amid safe haven shift.

Bond Yields Surge: 10-year Treasury yield jumps to 4.48%, up from 3.93%, signaling investor uncertainty.

Global Safe Havens Rise: Switzerland and Japan attract capital due to stable policies and low inflation.

Liquidity Fears: Rising yields spark concerns over U.S. bond market liquidity; Fed signals readiness to intervene.

Fed Dilemma: Tariffs may push U.S. inflation to 4%; Fed faces trade-offs between inflation, growth, and stability.

🔴 Consumer Sentiment & Inflation

Confidence Craters: U.S. consumer confidence hits 2nd lowest level since 1952, down 30% since December.

Expectations Plunge: Consumer expectations index drops 37.9% YoY; fears of inflation and unemployment spike.

Inflation Fears: Consumers expect 6.7% inflation—highest outlook since 1981, driven by tariff anxiety.

Official Data Positive: March CPI rose just 2.4% YoY, core inflation at 2.8%—lowest since 2021.

Price Trends: Durable goods down 1%, non-durables up 0.5%; services inflation eases to 3.7%.

Fed’s Dilemma Grows: Without tariffs, inflation looks controlled—yet trade war may force short-term price pressures and complicate monetary policy.

5️⃣ Tariff War🔴

Tariffs Soar: U.S. tariffs on China hit 145%, China responds with 125%—highest U.S. rates in over 100 years.

Decoupling Deepens: Economic separation between U.S. and China accelerates; small U.S. firms at risk.

Investor Uncertainty: Temporary delays in tariffs offer little relief—uncertainty halts investment decisions.

Global Fallout: Southeast Asia faces postponed U.S. tariffs; China boosts regional diplomacy.

Trade Offers Rejected: U.S. turned down zero-tariff deals from Vietnam & EU, demanding more U.S. imports.

Policy Confusion: Mixed U.S. messaging—negotiation vs. permanent tariffs—adds to business uncertainty.

Recession Risk: High tariffs + uncertainty = growing threat of U.S. economic slowdown.