The Macro Storm Ahead, Extreme Oversold Signals, Trump’s Crypto

Macro Pulse Update 08.03.2025

Markets are slow. CT is quiet. But under the surface, macro uncertainty is brewing. 👀

Trump pressures Powell. No urgent rate cuts. Crypto regs are bullish but slow.

Bad for alts with unlocks. But great for real builders.

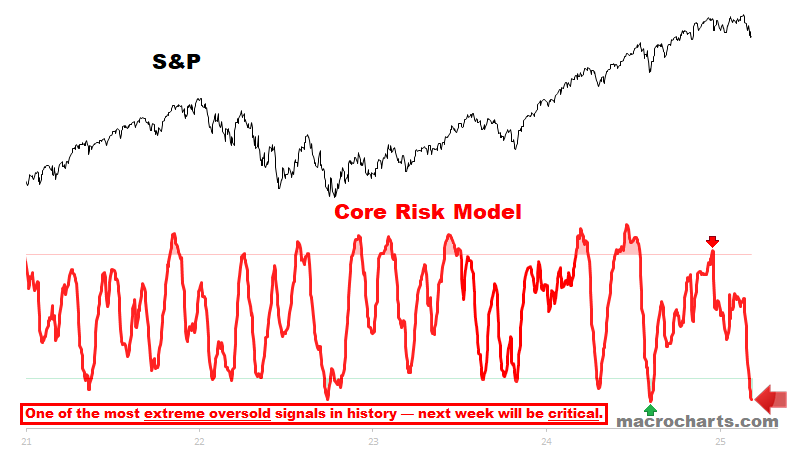

Markets coded with extreme oversold signals 👇🧵

Image Credits to @MacroCharts

Macro Pulse Update 08.03.2025, covering the following topics:

1️⃣ Macro events for the week

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ Inflation & Tariff Impact

1️⃣ Macro events for the week

Last Week

Next Week

2️⃣ Bitcoin Buzz Indicator

Crypto Sector Insights

XLM – Franklin Templeton’s US money fund ($FOBXX) operates on Stellar, aiding Wall Street’s tokenization shift.

HBAR – Backed by Google, IBM, and Boeing, with past collaboration on FedNow payments.

ONDO – Works with BlackRock and Mastercard, holds WLFI governance stake.

LINK – Partnered with DTCC and JPMorgan on fund tokenization pilots.

STX – The first SEC-approved crypto asset, with Princeton-backed research origins.

AAVE DAO Proposes Tokenomics Overhaul – AAVE DAO introduced a new proposal to revise its tokenomics, committing to a $1M AAVE buyback per week for at least six months.

Trump’s Crypto Reserve Sparks Market Volatility – Trump announced a strategic crypto reserve including XRP, SOL, and ADA, driving major price surges followed by sharp corrections. US regulation-linked tokens like XLM, HBAR, ONDO, LINK, and STX are worth monitoring.

Sonic Ecosystem Heating Up – Stability ($STBL) is set for TGE, while Rings YT surged. Pendle launched its first liquidity pools on Sonic, with APYs soaring from 2% to 17%.

Monad Ecosystem Gains Momentum – MEV protocol Fastlane secured funding, and $shMON testnet went live, drawing increased interest.

Orochi Network Secures Key Grants – ZK protocol Orochi Network received sponsorship from Ethereum Foundation, BNB Chain, and others.

Elixir’s $ELX Token Launch – $ELX will debut on Bybit, with pre-market trading already live on Aevo.

Market & Regulation Updates

White House to Host Crypto Summit on March 7 – Expected to outline Trump's crypto reserve strategy.

SEC Ends Yuga Labs Investigation – Concluding a three-year probe with no penalties announced.

SEC Delays Ethereum ETF Decision – Cboe’s Ethereum ETF options ruling postponed to May, while Solana ETF approvals are progressing for a potential 2025 launch.

US Senate Blocks SEC DeFi Tax Rule Expansion – A bipartisan vote overturned an IRS proposal imposing tax reporting on DeFi protocols.

Ray Dalio Warns of US Debt Crisis – The billionaire investor suggests Bitcoin and gold as safe havens.

DeFi & Ecosystem Insights

Ethereum Dominates Capital Inflows Amid Market Sell-off – $249M flowed into Ethereum as investors sought stability.

Solana Gains Momentum Despite Meme Coin Slump – Capital inflows remain strong, fueled by Trump's strategic reserve announcement.

Top Gainers in DeFi TVL:

Maple Finance (+216%) – Attracted $80M in USDC inflows via Pendle’s Syrup integration.

Stability ($STBL, +127%) – Sonic staking aggregator preparing for TGE on March 5.

Rings (+51%) – APYs hit 900% with Sonic-Pendle collaboration.

Exponent (+62%) – Solana yield trading project integrating with Jito.

Funding Highlights

Figure Secures $200M – Crypto-backed lending platform raised from Sixth Street.

Orochi Network Raises $12M – Backed by Ethereum Foundation and BNB Chain to build verifiable data infrastructure.

Fastlane Secures $6M – Monad’s MEV protocol gains funding from Figment Capital and Coinbase Ventures.

DeFi Interest Rate Market Trends

Yield Stripping & Auctions Drive Innovation – Pendle and Term Labs lead with structured yield strategies.

Sustainable Yield Models Emerging – Ethena Labs leverages funding rates, while RateX DEX offers leveraged rate trading.

3️⃣ Market overview

Trump Announces US Strategic Crypto Reserve – Trump revealed plans for a government-held crypto reserve, naming XRP, Solana, Cardano, Bitcoin, and Ethereum as key assets. The announcement triggered market volatility, with prices spiking, dipping, and rallying ahead of a White House event expected to outline the reserve strategy.

SEC Forms Crypto Task Force for Regulatory Clarity – The SEC launched a new digital asset task force, led by Commissioner Hester Peirce, to develop practical regulatory solutions. The team includes industry veterans and legal experts, signaling a shift toward a more structured crypto policy framework.

Nasdaq Advances Grayscale’s Spot Hedera ETF Filing – Nasdaq submitted a 19b-4 filing for Grayscale’s Hedera ETF, marking progress in altcoin ETF approvals. This follows a surge in spot ETF proposals, including those for Solana, Cardano, and Dogecoin, amid a more receptive regulatory climate.

Ethereum’s Pectra Upgrade Nears Mainnet Rollout – Ethereum successfully deployed its Pectra upgrade on the Sepolia testnet, overcoming previous testnet issues. The upgrade enhances scalability, security, and staking limits, with a mainnet launch expected in early April.

Senate Overturns SEC’s DeFi Tax Rule Expansion – The US Senate voted 70-27 to block an IRS rule that would impose brokerage tax reporting on DeFi companies. The resolution, backed by bipartisan support, now moves to the House of Representatives and could be signed into law by Trump.

4️⃣ Key Economic Metrics

🟢 U.S. Economy: Tariff Turmoil & Labor Market Softening

February Jobs Report: The U.S. economy added 151K jobs, slightly below expectations, with unemployment rising to 4.1% and labor force participation declining.

Tariff Uncertainty: President Trump imposed 25% tariffs on most Canadian and Mexican goods and raised China tariffs from 10% to 20%, leading to market volatility and retaliation threats.

Trade Deficit Spikes: January’s trade deficit hit a record $131.4B, driven by a 10% surge in imports as firms rushed to get ahead of new levies.

ISM Manufacturing & Services: Manufacturing barely expanded at 50.3, while services grew at 53.5, showing a divide in economic resilience.

Interest Rates & Housing: Residential and commercial construction slowed, with higher interest rates and tariff-driven input cost increases impacting the sector.

🟡 Market & Policy Outlook

Upcoming Key Reports:

JOLTS Report (Tuesday): Labor demand expected to remain sluggish.

CPI Data (Wednesday): Inflation likely moderated to 0.3% MoM, but tariff-driven cost pressures are emerging.

Federal Budget Balance (Wednesday): First full month of spending and revenue under the new administration.

10-Year Treasury Yield Decline: Yields fell to 4.26% from 4.8% in January, driven by escalating trade tensions and a weaker economic outlook.

🔴 Global Economy & Central Banks

Tariff Fallout Simulations: Aggressive tariff hikes with retaliation could trigger a global recession by 2026, with sharp downturns in Canada and Mexico.

ECB Signals Less Dovish Stance: While a 25 bps rate cut is still expected, discussions on EU defense spending and inflation risks reduced certainty on further easing.

Bank of Canada Rate Decision (Wednesday): Tariff risks may push the BoC toward a rate cut, but inflation remains a concern.

Brazil Inflation Report (Wednesday): Elevated inflation could lead to further rate hikes, with policymakers closely monitoring fiscal spending effects.

🔴 Interest Rate & Bond Market Insights

Tariff Impact on Yields: Higher tariffs increase recession risk but also raise tax revenue, contributing to lower long-term interest rates.

Outlook for 10-Year Treasury: Forecasted to stabilize between 4.00%-4.25%, with modest increases expected in 2026 as tariff effects fade and tax cuts come into focus.

5️⃣ Inflation & Tariff Impact 🔴

Outlook for Fed Policy – As long as long-term inflation expectations remain stable, the FOMC is likely to proceed with easing later this year, despite short-term inflationary bumps.

Tariff-Driven Inflation Risks Rising – New trade policies are pushing inflation expectations higher, as firms anticipate cost pass-throughs and workers adjust wage demands.

Consumer Inflation Expectations Are Mixed –

University of Michigan Survey: Shows a notable rise in both short- and long-term inflation expectations.

New York Fed Survey: Indicates little change in medium-term (3-year) inflation expectations.

Businesses Adjusting Price Forecasts –

NY Fed Business Survey: Year-ahead inflation expectations jumped to 4.0% for service firms and 3.5% for manufacturers, particularly those reliant on imports.

ISM Manufacturing Survey: Reports rising commodity prices due to tariffs.

Fed’s Beige Book: Many firms are preemptively raising prices in response to tariff concerns.

Long-Term Inflation Expectations Remain Anchored –

NY Fed Survey: 3-5 year inflation expectations remain steady at 3%, unchanged from a year ago.

Market Indicators: The five-year forward breakeven rate hovers at 2.4%, in line with the Fed’s 2% target when adjusted for CPI-PCE differences.