Every cycle has its own story, and right now, the market is wrestling with conflicting chapters: Bitcoin seasonality vs. post-halving dynamics, dovish Fed rhetoric vs. sticky inflation, and bond market “steepening” that could signal either relief or recession.

We are in a market whiplash narrative

Short-term: September may deliver the volatility Bitcoin hasn’t yet shown this year. Weakness could be a buy for those willing to fade seasonality in a post-halving year.

Medium-term: Fed policy is at risk of credibility erosion. Rate cuts into rising core inflation shift the investment regime.

Long-term: Crypto cycles may hinge not just on retail or institutional flows, but on the structural health of treasury wrappers — a fragile pillar that, if it breaks, flips demand into supply.

The investor thesis is simple: we are entering an environment defined by narrative whiplash, where seasonality, policy, and structural mechanics point in different directions.

From an investor’s lens, the signal isn’t in any single datapoint — it’s in how these narratives collide.

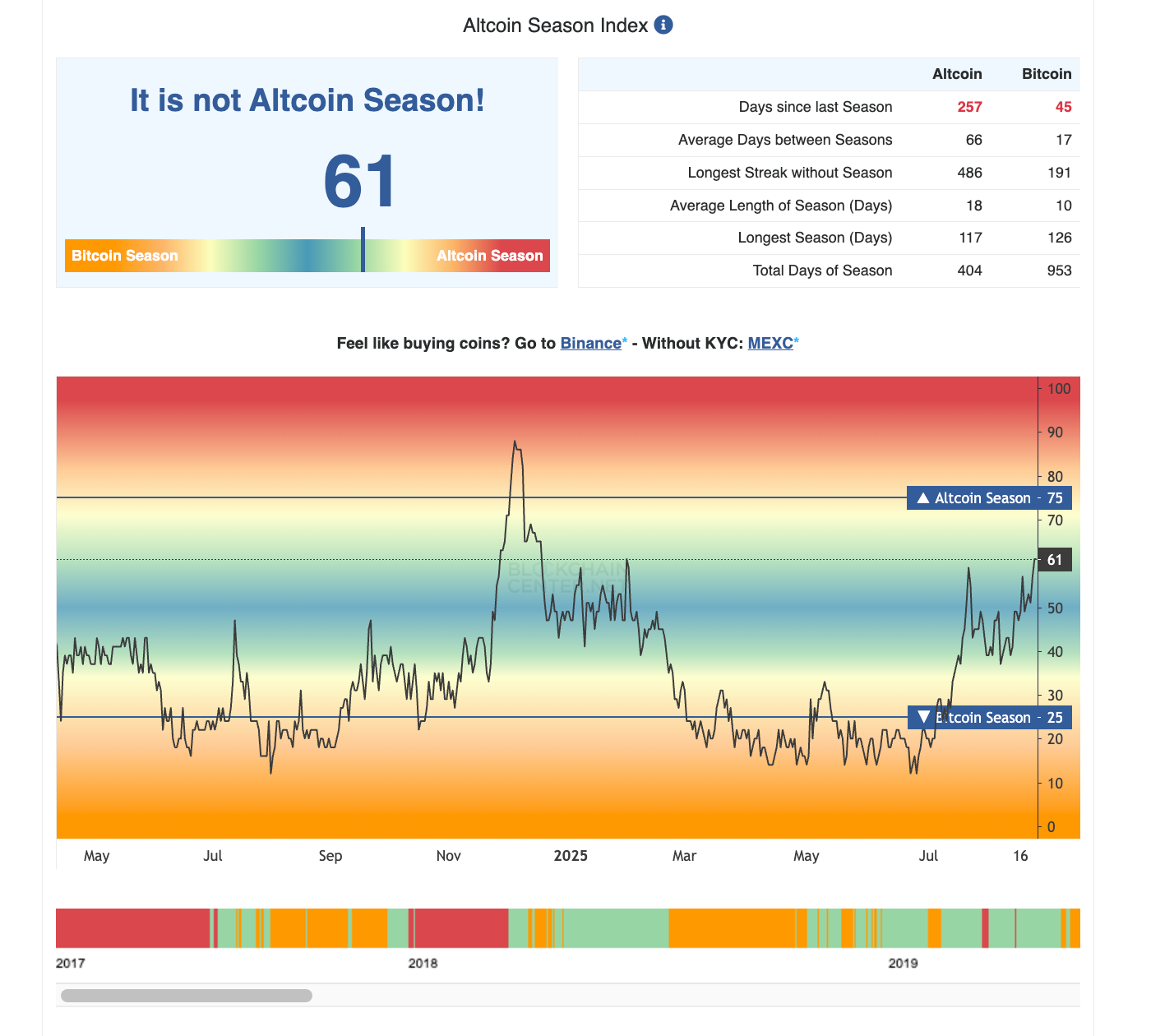

1. Bitcoin’s September Ghost vs. Post-Halving Reality

Historically, September has been Bitcoin’s weakest month. The charts show repeated drawdowns as fresh longs get flushed out. But this cycle is not like prior ones: we’re in a post-halving year, and historically Q3 has always skewed bullish in that context.

The fact that 2025 has yet to deliver a single +30% or even +15% month suggests compressed volatility. In every bull cycle, explosive moves come in clusters. With four months left, the question isn’t if volatility returns, but when. The investor takeaway: September weakness, if it appears, could set up the last big entry window before the inevitable Q4 squeeze.

2. The Fed’s Narrative Schism

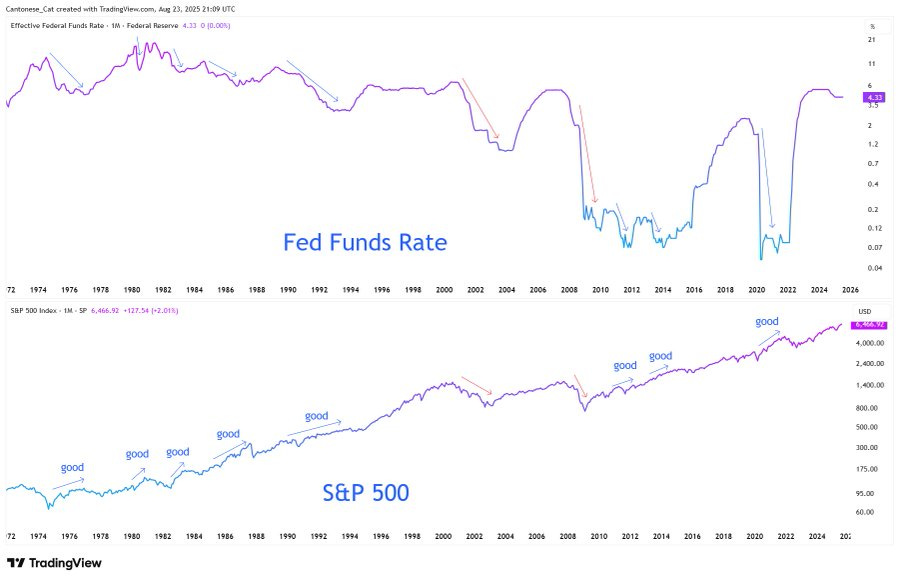

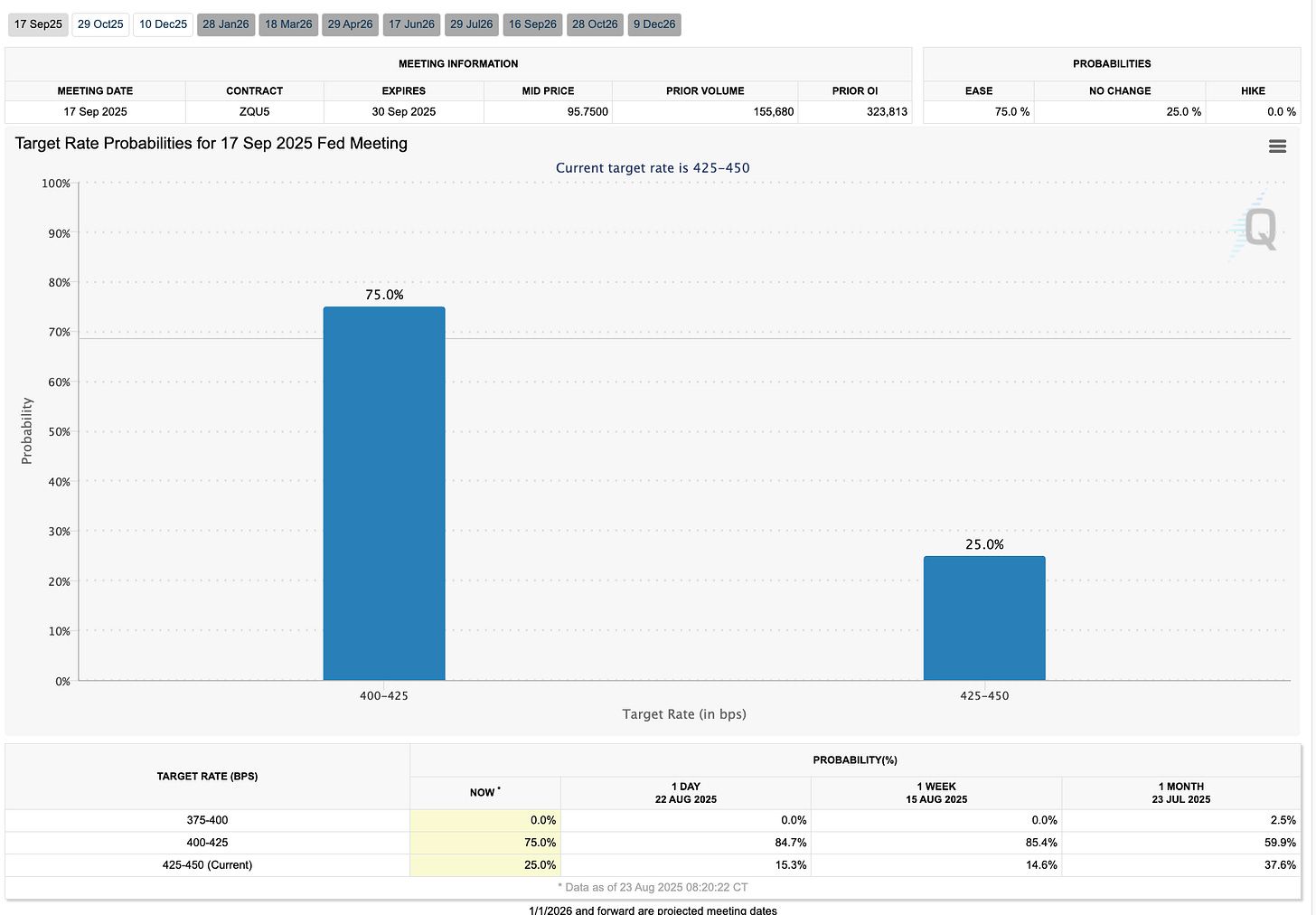

Powell’s Jackson Hole speech was widely misinterpreted as a green light for aggressive easing. In reality, his message was more nuanced: he left the door open for a September rate cut but emphasized it would not mark the start of an easing cycle.

On labor, Powell acknowledged a “curious balance”, both supply and demand for workers have slowed, leaving the market fragile. The risk is asymmetric: if it breaks, it could break fast, in the form of layoffs.

On inflation, he was explicit: tariffs are now clearly feeding into prices, and their effects will keep accumulating. While Powell called this a “one-time shift in the price level,” he stressed that the Fed cannot allow expectations to unanchor.

The framework shift is even more telling. The Fed formally abandoned the 2020 “average inflation targeting” regime and reverted to the 2012 balanced-approach model: no more tolerance for running above 2%, no more focus solely on unemployment “shortfalls.” In other words, the Fed is signaling a stricter interpretation of its 2% mandate, even while markets price near-certain cuts.

Here lies the paradox: the Fed is preparing to cut into stagflation, easing just as core inflation accelerates and labor weakens. Why? Because structurally, the U.S. debt load makes higher-for-longer politically and fiscally untenable. Powell can speak to credibility, but the system’s trap is vicious: spend, borrow, print, repeat.

From an investor’s standpoint, the key takeaway is that credibility risk is now the asset-pricing risk. If the 2% target erodes from “anchor” to “aspiration,” it resets valuations across bonds, equities, and hard assets. In such an environment, scarce assets, Bitcoin, Ethereum, gold, productive equity stakes, become the rational hedge against dilution.

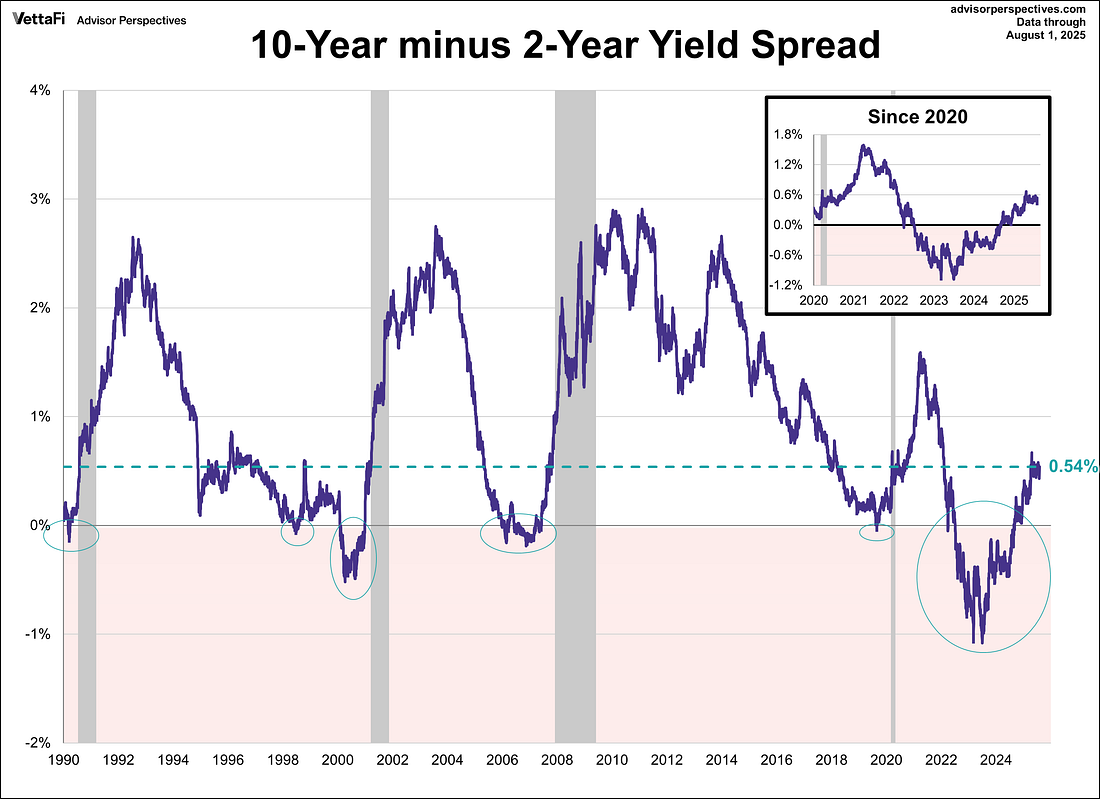

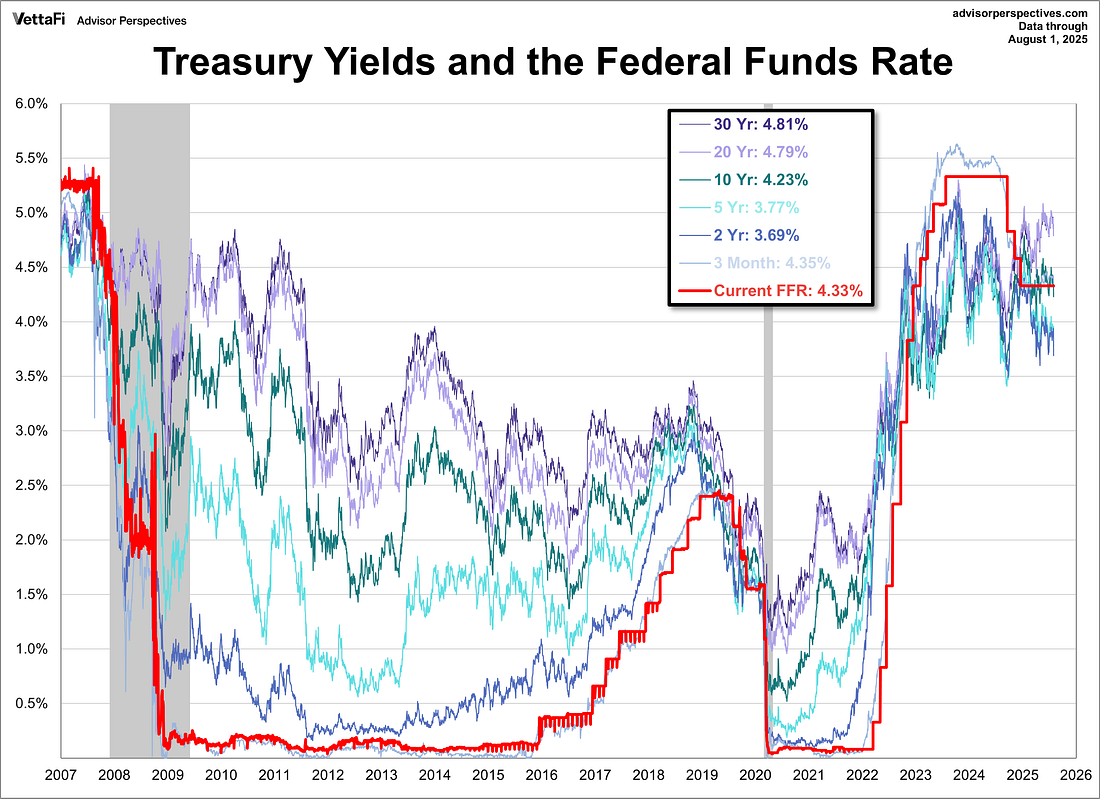

3. The Bond Market’s Steepening Signal

The yield curve has quietly un-inverted: the 10y-2y spread rebounded to +54bps from one of the deepest inversions in history. On the surface, this looks like normalization — a healthier curve.

But history warns otherwise. In 2007, the curve’s steepening after inversion wasn’t the “all-clear”, it was the precursor to collapse. What matters is why the curve steepens: if it’s growth expectations improving, bullish. If it’s short rates falling faster than long-term inflation expectations, it’s a warning that recession risk is looming.

Right now, the curve is steepening for the wrong reasons: markets pricing cuts into sticky inflation. That’s a fragile setup.

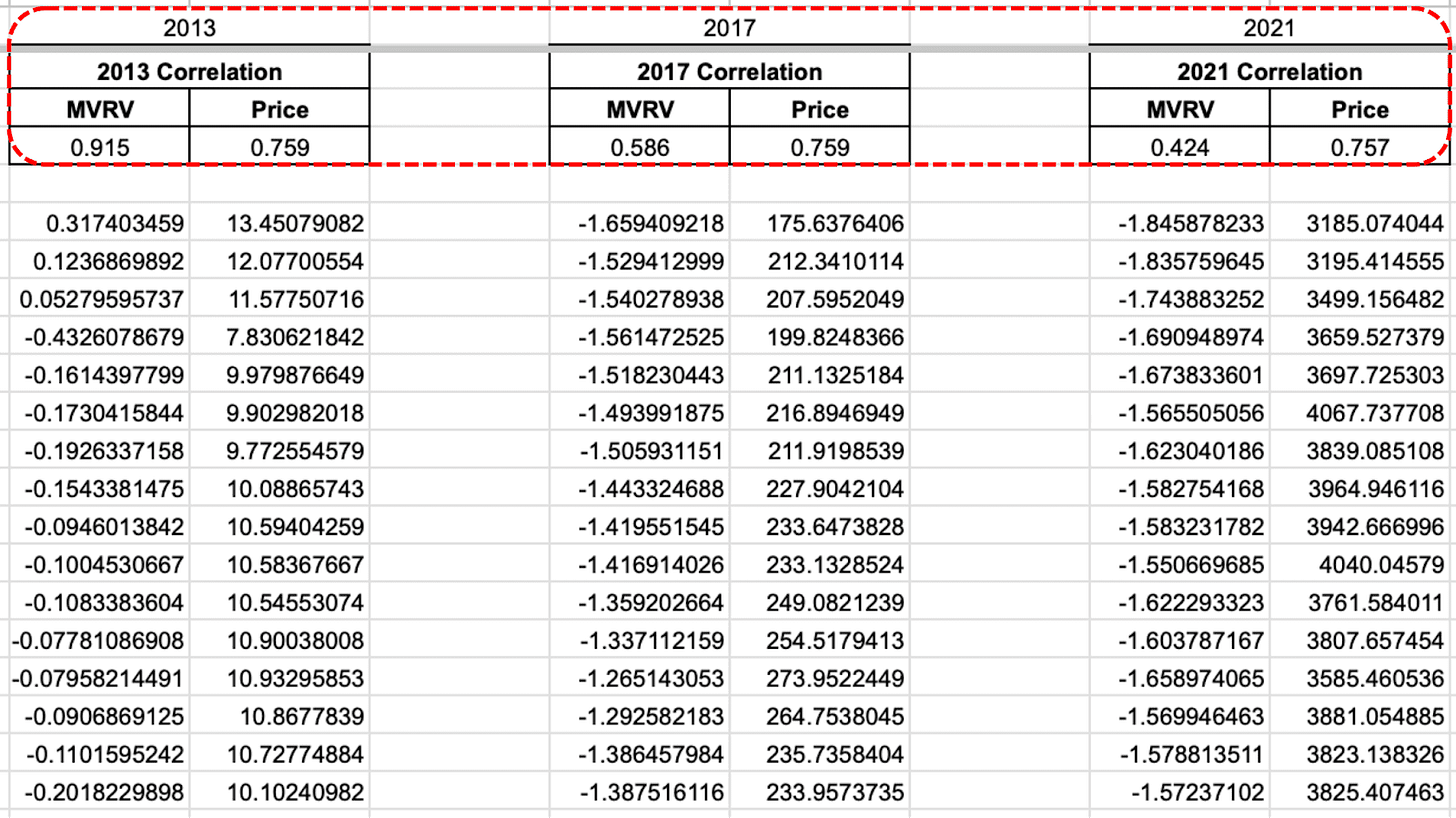

4. Crypto’s Structural Question

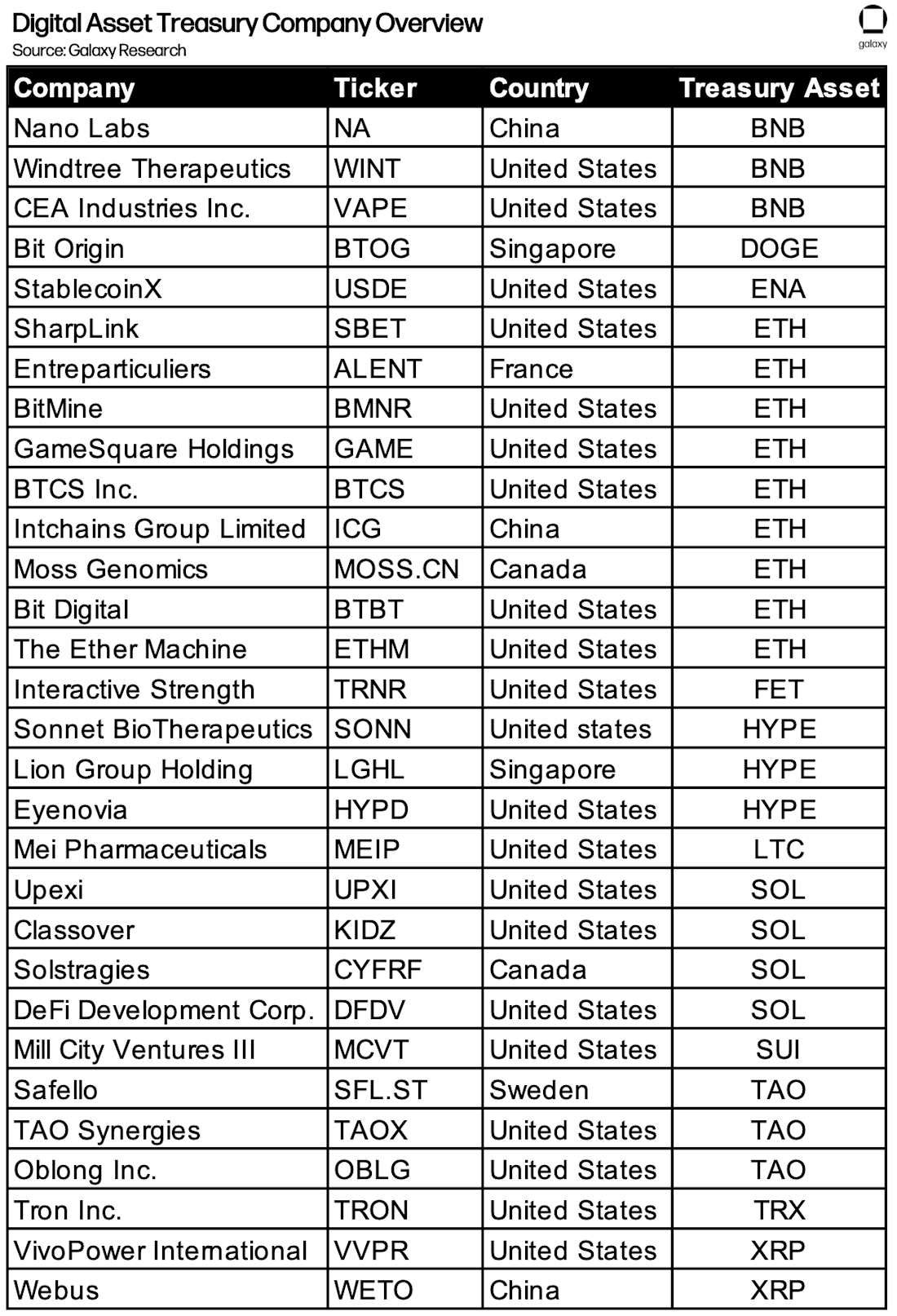

Amid this macro backdrop, crypto faces its own existential test. Treasury accumulation (MSTR, Metaplanet, ETH corporates) has been a core demand pillar. But as NAV premiums compress, the danger is these entities flip to discounts — turning from buyers into forced sellers.

Cycles don’t end because narratives die, they end because the mechanics that fueled demand reverse. In 2017 it was ICOs, in 2021 DeFi/NFT leverage, and in 2025 it may be crypto treasuries hitting the limits of balance sheet arbitrage.

At the highest level, the story of this cycle is one of narrative dissonance: markets are being pulled in opposing directions by seasonality, policy, and structural mechanics.

Bitcoin’s September weakness collides with the inevitability of post-halving upside;

Fed speaks in the language of caution while being cornered into cutting in a stagflationary backdrop;

the bond market steepens in ways that look like relief but smell like fragility;

crypto’s own fuel source — treasury accumulation — risks inverting into liquidation.

For investors, the thesis is simple: we are in an age of narrative collision, and the premium lies with those who can anticipate the breaks, hedge against dilution, and lean into volatility as the only true constant.

The opportunity lies not in choosing one story, but in recognizing that volatility itself is the asset.

👇🧵

Macro Pulse Update 24.08.2025, covering the following topics:

1️⃣ Macro events for the week

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ China Spotlight

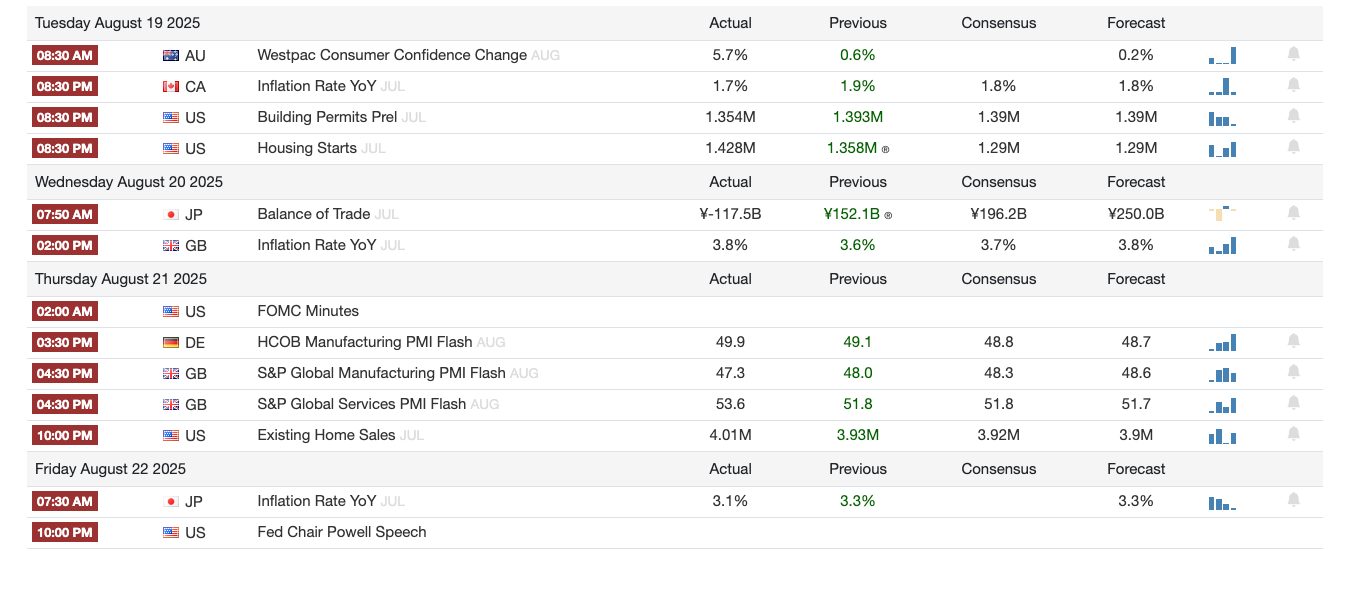

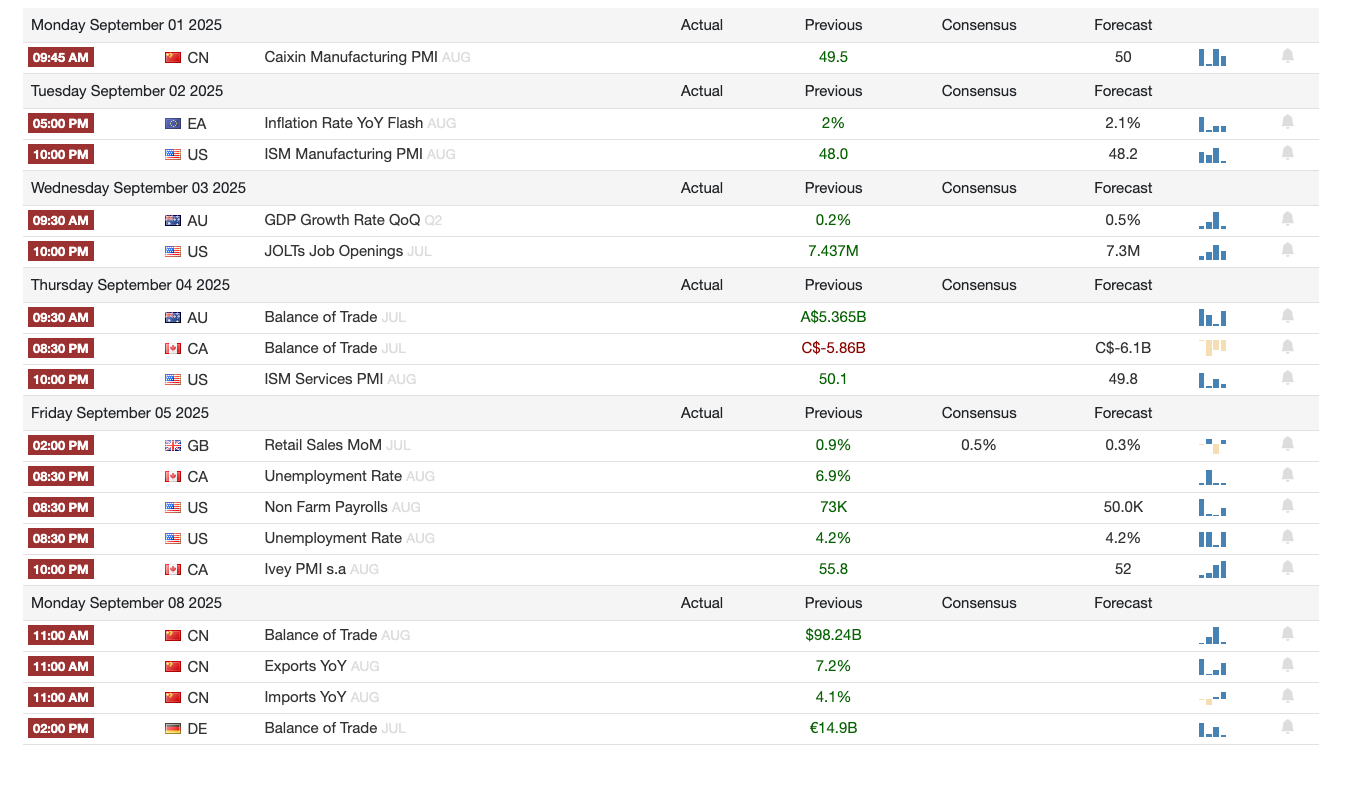

1️⃣ Macro events for the week

Last week

Next Week

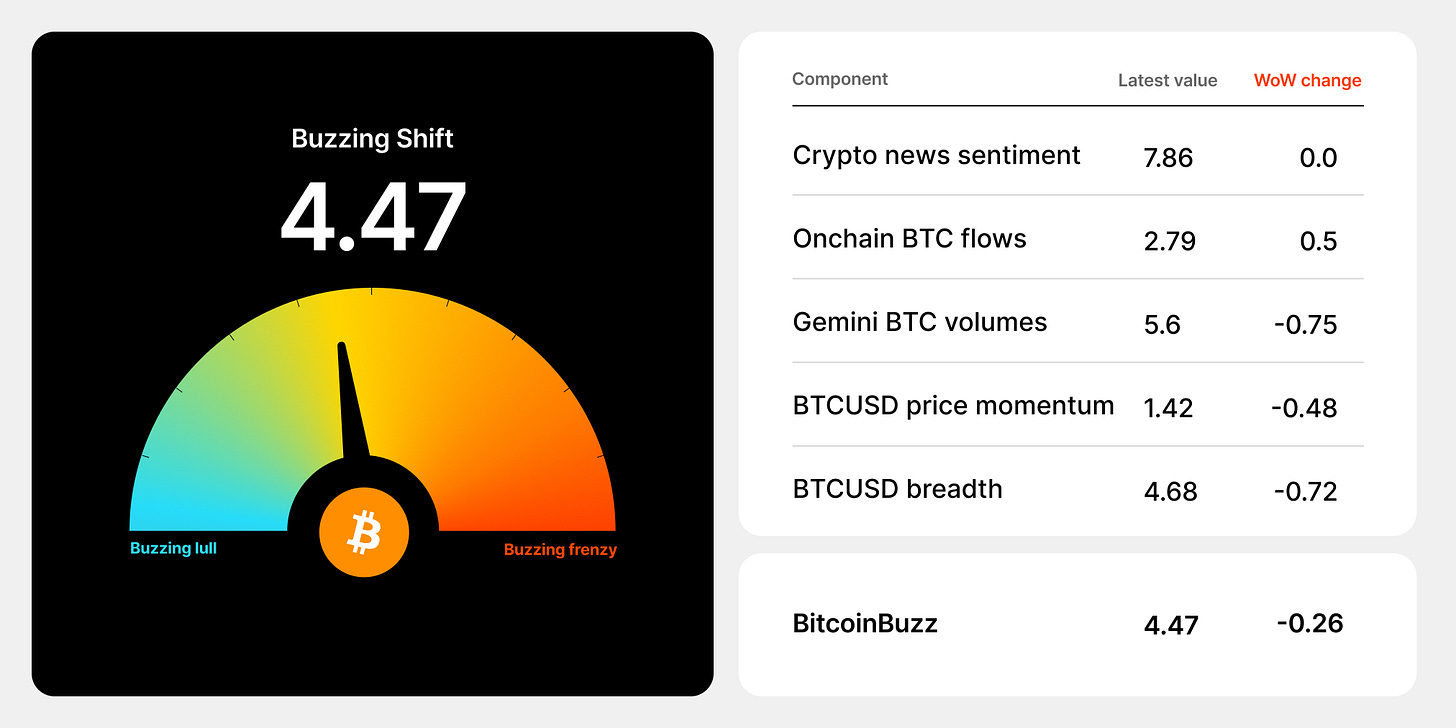

2️⃣ Bitcoin Buzz Indicator

Market Movements and Trends

Ethereum Peaks at $4,885; BNB Soars to $900 and OKB Hits $255 Amid Crypto Surge

Ethereum Treasuries Exceed 4.1 Million ETH, Valued at Nearly $20 Billion

Stablecoins and Wallet Innovations

Wyoming Launches First U.S. State-Backed Stablecoin, Frontier Stable Token (FRNT)

MetaMask Launches mUSD Stablecoin, Integrates with Linea and Plans for Debit Card by 2025

Corporate and Acquisition Moves

Thumzup, Backed by Trump Jr., Acquires Dogecoin Miner Dogehash in All-Stock Deal

Regulatory and Policy Updates

SEC Chair Atkins: "Very Few" Crypto Tokens Are Securities, Advocates for Regulatory Framework and Project Crypto

CFTC Launches Next Phase of "Crypto Sprint," Seeks Public Feedback by Oct. 20

SEC Delays Decisions on Key Crypto ETFs, Including XRP, Litecoin, and Dogecoin

ETF Developments and Proposals

Asset Managers File Amendments for Spot XRP ETFs, Indicating SEC Approval Interest

VanEck Proposes First Spot Solana ETF Backed by Liquid Staking Token JitoSOL

Banking and Institutional Adoption

DBS Bank to Tokenize Structured Notes on Ethereum for Institutional Investors

3️⃣ Market overview

Regulation, monetary policy, and institutional accumulation are converging to reshape crypto’s trajectory. With the SEC softening its stance, Japan and Wyoming pioneering stablecoin models, and firms like SharpLink and Metaplanet amassing treasuries, we are seeing the early outlines of a more mature, state-backed, and institution-led crypto ecosystem.

1. SEC Signals a “New Day” for Crypto

SEC Chair Paul Atkins announced that most tokens should not be classified as securities. His “Project Crypto” initiative aims to modernize securities rules and set clear guardrails for staking and on-chain services. This marks a major step toward regulatory clarity and could accelerate institutional adoption.

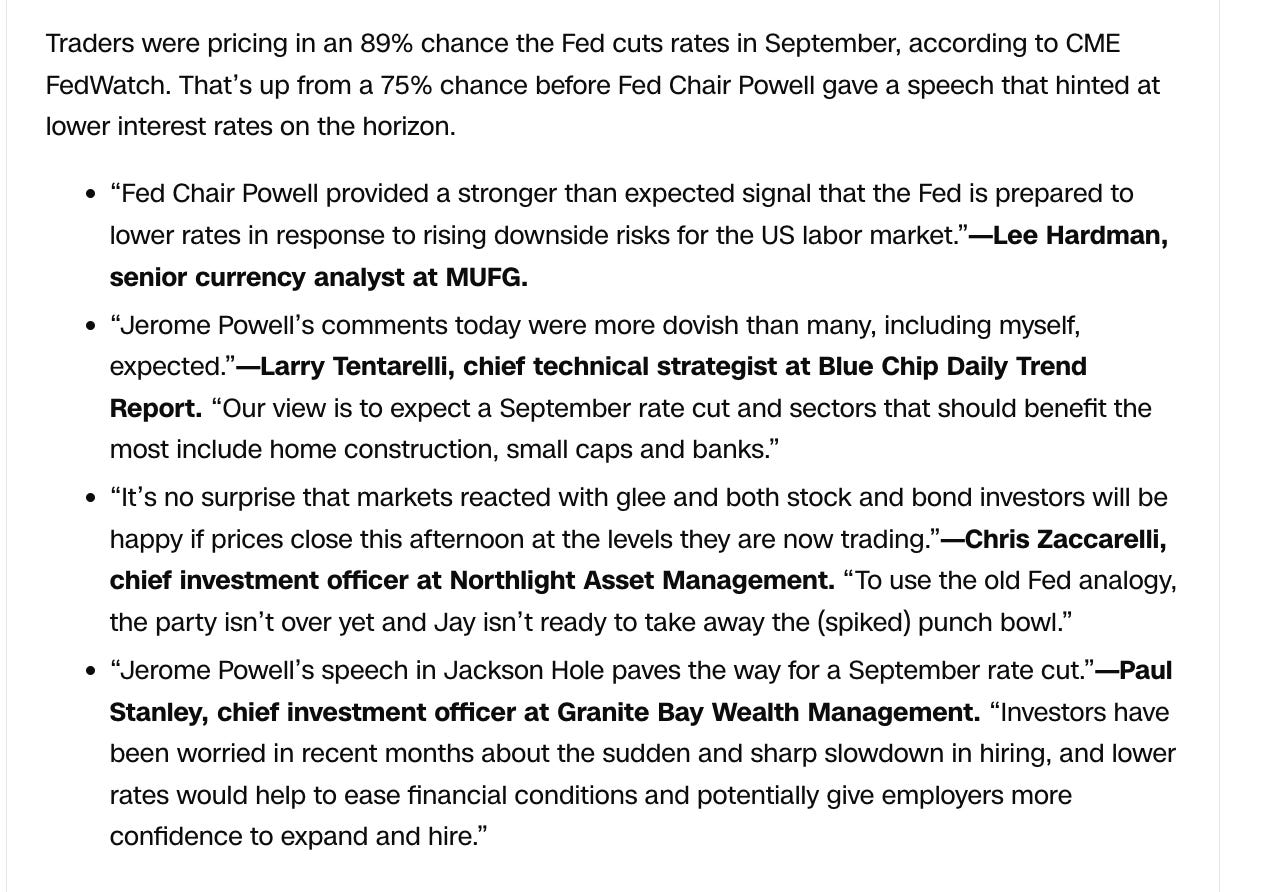

2. Powell Hints at Rate Cuts

At Jackson Hole, Fed Chair Jerome Powell indicated tariffs may have only a short-term inflation impact, while also hinting at a possible September rate cut. Markets responded instantly: Dow +1.5%, S&P 500 +1.3%, Nasdaq +1.35%. Crypto followed, with BTC and ETH surging 3–7.5% post-speech.

3. Japan’s First Yen Stablecoin Incoming

Japan’s FSA is expected to approve JPYC’s yen-pegged stablecoin this fall. Backed by reserves and targeting corporate/cross-border payments, it could fast-track tokenized finance adoption in Asia. Interest is already building from institutional investors and hedge funds.

4. Wyoming Launches Frontier Stable Token (FRNT)

Wyoming became the first U.S. state to issue a fully reserved public stablecoin. FRNT is 2% over-collateralized, backed by USD & Treasuries, and deployed across seven blockchains, including Solana and Ethereum. A landmark move that could inspire other states to follow.

5. Institutions Double Down on Crypto Treasuries

SharpLink Gaming: Bought 143,593 ETH (~$667M), bringing holdings to 740,760 ETH. Nearly all staked, signaling a strong ETH-yield treasury strategy.

Metaplanet: Added 775 BTC (~$93M), raising total to 18,888 BTC. Despite stock volatility, the Tokyo firm remains committed to its accumulation playbook.

4️⃣ Key Economic Metrics

U.S.–China Policy Pivot

Washington’s new approach to China it’s a reconfiguration of the playing field for tech, capital flows, and emerging markets.

For builders and investors, the signal is clear: geopolitics is a core driver of market structure. The opportunity lies in founders who anticipate these fractures and build resilience into their models from day one.

Here’s how I’m reading the shift:

1. Export Controls Become Transactional

The U.S. is now monetizing tech exports: companies can ship downgraded chips and equipment to China by paying a fee.

This marks a departure from the bipartisan “deny at all costs” model.

The risk: once the door is cracked open, Chinese defense and AI ecosystems will adapt faster than policymakers expect. For founders, this accelerates the need for dual-use tech separation, building businesses that can thrive in both restricted and unrestricted domains.

2. Tariff Policy Is Misaligned With Strategy

High U.S. tariffs on China cut FDI sharply (Q2 inflows down to $8.7B, <10% of 2022 peak).

But tariffs on other Asian nations undercut the very “de-risking” strategy Washington has pushed, pushing these countries back toward Beijing.

Net effect: instead of supply chain diversification, we’re seeing regional realignment around China. The investable signal is in alternative trade corridors — India-to-Middle East, ASEAN-to-Europe — where new infrastructure and fintech rails are being built.

3. U.S.–India Relations at Risk

Tariffs on India (over Russian oil) triggered consumer backlash, with boycott movements against U.S. brands.

This undermines the idea of India as a natural counterweight to China.

For investors, the takeaway is nuanced: India’s tech ecosystem remains investible, but alignment with U.S. capital will be less automatic. Expect local champions to gain share at the expense of multinationals.

This is a policy pivot with second-order consequences:

U.S. tech firms may see near-term export revenues, but lose strategic leverage long-term.

Tariffs will accelerate multipolar supply chains, creating whitespace for startups in logistics, cross-border fintech, and trade compliance automation.

Regional politics matter more than ever: we’re in a world where market access is dictated as much by tariffs and licenses as by product-market fit.

The Fed Policy Debate

At stake: whether monetary policy should be rule-bound or politically guided, and what that means for inflation, rates, and markets.

If monetary policy becomes a tool of political discretion rather than data-driven rules, we could see:

Short-term boosts to growth, but higher long-term inflation risk.

A potential loss of credibility in U.S. bond markets, which thrive on trust in Fed autonomy.

Global currency shifts, as U.S. rate cuts paired with foreign hikes reprice the dollar’s role.

For investors, the key is clear: policy risk now competes with inflation risk. Markets must start pricing not only economic fundamentals but also political intervention in monetary policy.

Key Insights

1. The Taylor Rule Debate Resurfaces

The Taylor Rule suggests rates should be much higher today given inflation (3.1%) and output conditions.

Critics on the right have long argued the Fed has kept rates “too low for too long.”

Ironically, today’s right-of-center administration is calling for much lower rates than the Fed’s current 4.3%.

2. A Push for Politicized Monetary Policy

Treasury Secretary Scott Bessent wants rates cut by 150–175 bps (to ~2.6%), which would imply negative real rates — something unseen in the past 70 years at this level of inflation.

Economist Stephen Miran, recently nominated to the Fed Board, has argued Fed governors should be removable at will by the president.

This suggests a shift toward direct executive influence over monetary policy — a break from decades of Fed independence.

3. Market Signals at Risk

If the Fed cuts rates aggressively, short-term yields would fall.

But bond markets could push long-term yields higher if investors fear inflation risk is being ignored.

This paradox means Bessent’s call for rate cuts could ironically tighten financial conditions if markets lose confidence in Fed credibility.

4. Contradictory Global Posture

Bessent urges lower U.S. rates but simultaneously criticizes the Bank of Japan for not hiking enough.

This inconsistency suggests a preference for a weaker U.S. dollar — lower domestic rates + higher foreign rates would push the USD down.

Japan’s central bank, however, rejects this framing, saying inflation risks remain low.

5️⃣ China Spotlight🔴

China’s July data underscores a reality global investors can’t ignore: the country is entering a phase of slower structural growth defined by property fragility, weak household demand, and deflationary risks.

China is unlikely to be the global growth engine it was in the 2000s and 2010s. The playbook is shifting:

Global capital will diversify: Expect supply chains and investment flows to continue rebalancing toward India, Southeast Asia, and LatAm.

Deflationary spillovers: Excess Chinese capacity means cheaper exports, impacting global pricing dynamics in manufacturing and tech hardware.

Tech & capital formation: In times of structural slowdown, innovation clusters (AI, biotech, frontier tech) outside China may capture disproportionate upside.

As investors, the signal is clear: China risk is morphing from cyclical to structural. The opportunity lies in markets and founders building resilience against that shift.

Here are the signals we’re watching closely:

1. Consumers Aren’t Coming Back (Yet)

Retail sales grew just 3.7% YoY, the weakest since Dec 2024.

Without subsidies, big-ticket demand (autos, appliances) falters.

Beijing’s “let the rich spend” strategy might provide short-term lift, but broad-based consumer confidence remains structurally weak.

2. Property: The Structural Anchor

Property investment collapsed -12% YTD, dragging down overall fixed asset growth.

This is more than cyclical, it reflects household balance sheet strain. Until property stabilizes, consumer confidence and credit multipliers will lag.

3. Manufacturing: Strong, But Misaligned

Industrial production rose 5.7%, but growth was skewed to export-heavy sectors like autos, tech equipment, and shipbuilding.

With U.S. demand weakening, this creates excess capacity + deflationary pressure, classic signs of a misaligned growth model.

4. Deflation is the Real Risk

CPI flat YoY, core inflation just 0.8%, producer prices down -3.6%.

It’s systemic overcapacity colliding with weak demand. Deflationary economies erode pricing power and capital efficiency.