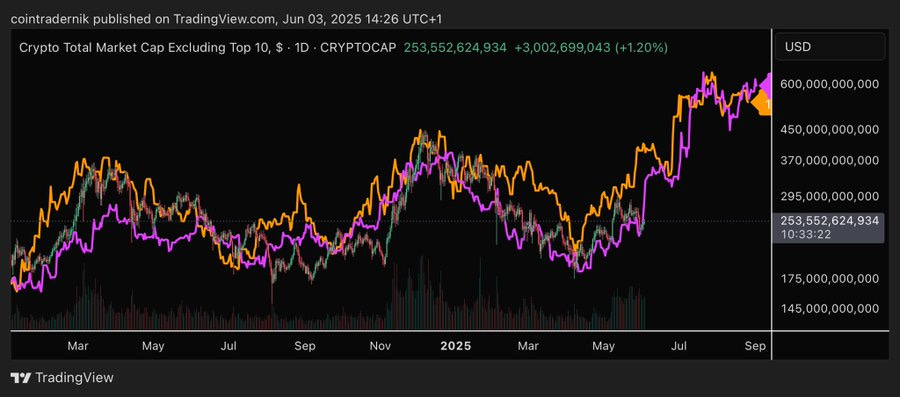

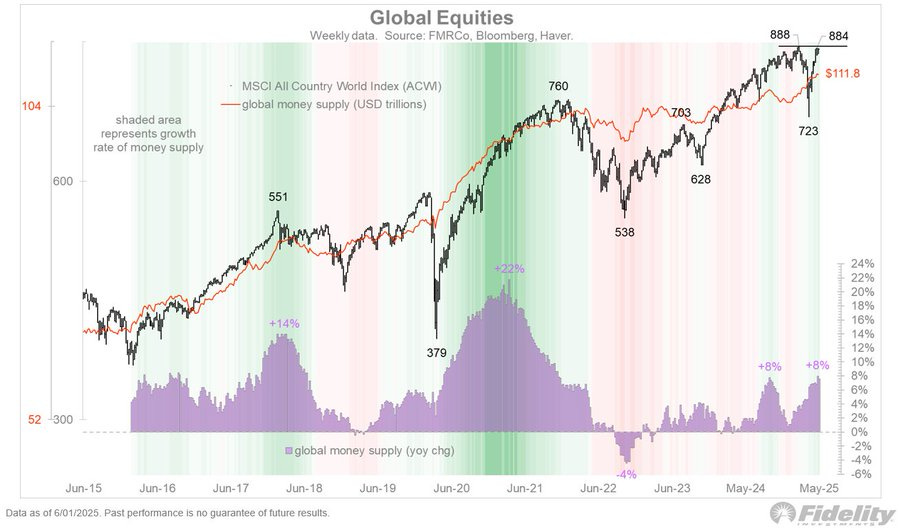

Just M2. Not fundamentals. Not flows.

The signal is clear: liquidity is quietly back and the smartest assets are already responding.

Global money supply is now growing at +8% YoY, reversing the 2022 contraction. Every past cycle tells us what that means:

• In 2016–17 → M2 surged, equities ripped.

• In 2020–21 → M2 exploded, everything rallied.

• In 2022 → M2 collapsed, markets cratered.

Now, M2 is rising again, and we’re entering a new rotation phase.

ECB has cut 8x. BOJ is re-expanding. China is re-leveraging.

Even the Fed, hawkish in speech, is quietly injecting via RRP runoff, SOMA reinvestments, and long-end yield suppression.

Until then, the game is liquidity 👇🧵

Macro Pulse Update 08.06.2025, covering the following topics:

1️⃣ Macro events for the week

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ Tariffs Spotlight

1️⃣ Macro events for the week

Previous Week

Next Week

2️⃣ Bitcoin Buzz Indicator

Launches

Ethena now supports USDe savings on TON wallets with up to 18% APY via Tonkeeper, TON Space, and TONHub.

Plume Genesis Mainnet is live with 50+ dApps, staking, lending, and Season 2 airdrops.

Stable launches a new USDT-native L1 with gas-free transfers and Bitfinex backing.

GMX Express launched on Arbitrum & Avalanche with one-click trading and gas abstraction via Gelato.

Bubblegum v2 by Metaplex adds onchain royalties and enterprise features for compressed NFTs.

Bluefin7K goes live on Sui as a hybrid DEX aggregator with RFQ engine.

Derive unveils a pro trading terminal for customizable onchain trading.

infiniFi debuts with flexible tenors and zero-spread interest using Aave, Compound, Lido collateral.

Berachain launches Bectra upgrade with Pectra features and $HONEY gas.

Euler Frontier introduces lending + swapping infrastructure with $110K incentives.

Dinero’s pETH launches as Plume’s native ETH LST for seamless cross-chain utility.

Origin’s Super OETH enables yield-generating liquid staking on Plume.

Gamma’s SDK allows gas-only limit order trading for pro users on Uniswap v4.

Superform’s Piggy agent analyzes wallets for onchain scoring and early access to v2.

Protocol & Platform Updates

OpenSea OS2 now supports trading across 19 chains with XP rewards via Voyages.

Uniswap’s ChainHopper enables cross-chain LP migration with one click.

Spark allows direct USDT deposits to earn on Spark Savings.

Nexus zkVM 3.0 improves zk stack with modularity and efficient memory checking.

Aave’s Umbrella module enables non-governance staking with new sGHO token.

Ostium adds 24/7 withdrawals, performance charts, and NotiFi alerts.

Ethereum Foundation revises treasury to sustain 2.5-year runway, backs DefiPunk-aligned protocols.

USD1 gains institutional access on DWF Liquid Markets’ RFQ platform.

Chainlink Labs joins Canton Network’s Global Sync Foundation to support cross-chain standards.

Sky Protocol activates USDS staking rewards for SKY holders.

Pendle updates token naming for clarity across PT and YT markets.

Farcaster adds support for HyperEVM wallet + swaps.

Kinetiq’s StakeHub dynamically delegates HYPE based on validator KPIs.

Symbiotic Relay SDK enables trustless staking + verification across chains.

Morpho on Unichain introduces vaults from top allocators for earning/borrowing.

Aave integrates CoW Swap into its UI for better prices and MEV protection.

Jumper now bridges to HyperEVM for assets like ETH and USDT.

Kamino adds dfdvSOL to expand SOL-based leveraged strategies.

Gearbox launches on BNB Chain with leverage, no lockups, and credit markets.

Upcoming

Arbitrum to launch an AI-focused chain built on Orbit Stack.

Theoriq details phased mainnet plans for Alpha Protocol + Swarm.

Aave’s Umbrella proposal to protect suppliers is set for activation.

Solv Protocol launching BTC-native yields via HyperEVM and UBTC.

BOB upgrading USDC to Chainlink CCIP for seamless cross-chain transfers.

Fuel Network extends token migration deadline to August 18.

Origin Protocol proposes $3M OGN buyback for stakers.

HUSD rebranding to USDhl with dual DeFi + treasury-backed yields.

Airdrops

Optimism distributed 60M OP across Superchain builders and tools.

YieldNest airdrop claims open for $YND seed and partner users.

WLFI auto-airdropped $4M in USD1 to token sale participants.

Stargate opens APT rewards claims for Aptos bridging.

Drift completed FUEL snapshot for future airdrop rewards.

Skate Chain snapshot ended for Season 1 airdrop.

Galxe x Kryll Earndrop offers 50K $KRL across 2 phases.

Galxe x Algorand Quest launches with 2.5K USDC prize pool.

Yapper airdrop via Kinto rewards Ascension Month participants.

Ostium rewards early users via Cookie DAO.

WalletConnect x Layer3 quest offers rewards on Solana expansion.

Elys Network opens S1 claims, kicks off S2 ahead of PerpDEX.

Jumper launches Lisk Surge Epoch 2 with 252K LSK + 80K OP.

Farms & Yield Strategies

Kamino’s SyrupUSDC integrates fixed-rate institutional strategies with up to $500K in rewards.

OpenEden x Equilibria launches 12x Bills points campaign for cUSDO LPs.

Velodrome lists Spark’s sUSDC on OP Mainnet + Unichain with LP incentives.

LiquidLaunch offers real yield from 100% revenue with LIQD staking.

yBOLD by Liquity + Yearn enables yield-optimized Stability Pool exposure.

Silo Finance enables leveraged Pendle PT strategies with new correlated markets.

KelpDAO activates $KERNEL rewards for rsETH, agETH, hgETH on Equilibria.

f(x) Protocol introduces fxSAVE/scrvUSD pool with active gauge vote.

Drift offers 8.2% APY on SOL staking with lending utility.

Spectra activates 30x Coinshift multiplier on csUSDL pool until June 30.

Silo Sonic adds yUSD–USDC market with dual utility and point rewards.

Pendle x Euler launches PT pools for USDC and ETH maturing Dec 2025.

RateX’s fragBTC debuts as the first BTC-yield asset on Solana.

KelpDAO adds wrsETH–WETH Superchain pool with OP and EIGEN incentives.

3️⃣ Market overview

Circle IPO: Stablecoin issuer Circle raised $1.1B in its NYSE debut, with shares soaring over 200% and closing near $85, signaling strong demand for crypto equities.

Ethereum Foundation Restructure: The Ethereum Foundation consolidated its R&D into a single Protocol division, aiming to improve scalability, data storage, and user experience, while some researchers exit.

Strategy’s Stride Offering: Strategy (formerly MicroStrategy) is issuing 2.5M STRD preferred shares with a 10% dividend to fund more bitcoin purchases, growing its treasury past 580K BTC.

Trump Media BTC Push: Trump Media closed a $2.44B raise, allocating $2.32B to buy bitcoin, and plans to launch a crypto-focused financial services arm with ETF ambitions.

World Liberty Financial Airdrop: WLFI airdropped its fully backed USD1 stablecoin to 85K+ wallets, following a 99.96% community vote, in a move to grow stablecoin adoption.

Market Movers: Livepeer (LPT) surged over 53% for the week, while BTC ($103K) and ETH ($2.57K) slipped slightly, reflecting mixed sentiment after recent highs.

4️⃣ Key Economic Metrics

The US-EU trade relationship is in flux, with legal battles, policy posturing, and economic consequences unfolding simultaneously. Despite recent court rulings questioning executive tariff powers, the administration retains other tools, ensuring trade tensions remain unresolved. The result is a highly uncertain environment for global businesses and investors alike.

Trade Policy Shifts & Uncertainty

Trump’s Tariff Threats Escalate: The U.S. president proposed a 50% tariff on all EU imports, calling negotiations ineffective and dismissing the need for a deal.

Temporary Postponement: Despite strong rhetoric, the U.S. postponed the 50% tariff until July 9, following market backlash and a positive call with EU leadership.

Existing Tariffs Still Apply: A 10% blanket tariff and higher rates on specific EU goods remain in place, with the EU prepared to retaliate if talks fail.

Investor Sentiment Cautious: The market reacted positively to the postponement but remains wary due to erratic policy shifts and continued uncertainty.

Court Ruling on Tariff Legality

Federal Court Decision: A U.S. Federal Court ruled that tariffs imposed under the IEEPA are illegal, stating the law doesn’t permit tariff authority.

Appeals Process Underway: An appellate court has allowed existing tariffs to remain in place while the U.S. administration appeals the decision.

IEEPA Use Rejected: Judges noted that persistent trade deficits don’t qualify as a “national emergency,” undermining the legal foundation for the tariffs.

Alternative Legal Tools for Tariffs

The administration retains multiple fallback mechanisms to impose tariffs even if IEEPA is invalidated:

Section 232 (national security): Used for steel, aluminum, and possibly future sectors like pharmaceuticals and aerospace—requires a slow, investigative process.

Section 301: Targets discriminatory or unjust trade practices—used previously against China in 2018; several new investigations are ongoing.

Section 122: Allows short-term tariffs (max 15%, 150 days) in case of balance-of-payments deficits—but not currently applicable.

Section 338: An obscure 1930 law permitting up to 50% tariffs on nations imposing “unreasonable” trade practices—potential basis for action against the EU.

Trade Volume & Strategic Stakes

Massive Trade Exposure: The U.S. imported $606B from the EU in 2024 (led by pharma and autos) vs. $370B in exports.

Imbalance Not Economically Critical: Economists note that bilateral trade deficits are not inherently harmful, challenging the rationale for aggressive U.S. policy.

EU’s Limited Leverage: The EU has few tools to directly adjust imports or currency policy due to ECB independence and sovereign VAT rules.

Market Impact & Investor Behavior

Markets Swayed by News Cycles: Bond and equity markets responded sharply to announcements, delays, and legal developments—highlighting short-term volatility.

Strategic Planning on Hold: Multinationals may delay cross-border investments and long-term decisions due to unclear future tariff regimes.

5️⃣ Tariffs Spotlight🔴

The April data reveals the short-term distortionary effects of tariffs—from front-loaded imports and spending to a subsequent collapse in demand and inflation moderation. While inflation progress suggests the Fed could ease policy, tariff uncertainty and potential price shocks may force caution, with Q3 poised to reveal the longer-term impact on growth.

Record Drop in Imports

U.S. goods imports fell 19.8% in April, the sharpest monthly decline on record.

Driven by steep drops in industrial supplies (-31.1%), consumer goods (-32.3%), and vehicles (-19.1%).

Reflects post-tariff-anticipation pullback following Q1 import surge.

Trade Deficit Shrinks—but at a Cost

Exports rose just 3.4%, narrowing the trade deficit.

A smaller trade deficit may look positive, but without higher savings or reduced investment, it’s likely not sustainable.

Consumer Spending Slows

Real consumer expenditures rose only 0.1%, while real income rose 0.7%.

Spending on goods declined (-0.2%), especially durables (-0.8%).

Consumers likely pulled forward spending in March, now becoming more cautious.

Savings Spike

Personal savings rate climbed to 4.9% in April, highest since May 2024.

Indicates rising consumer caution amid growing economic uncertainty.

Inflation Cools Sharply

Headline PCE inflation: +2.1% YoY (lowest since Sept 2024).

Core PCE inflation: +2.5% YoY (lowest since March 2021).

Goods prices fell YoY, while services inflation hit a multi-year low at 3.3%.

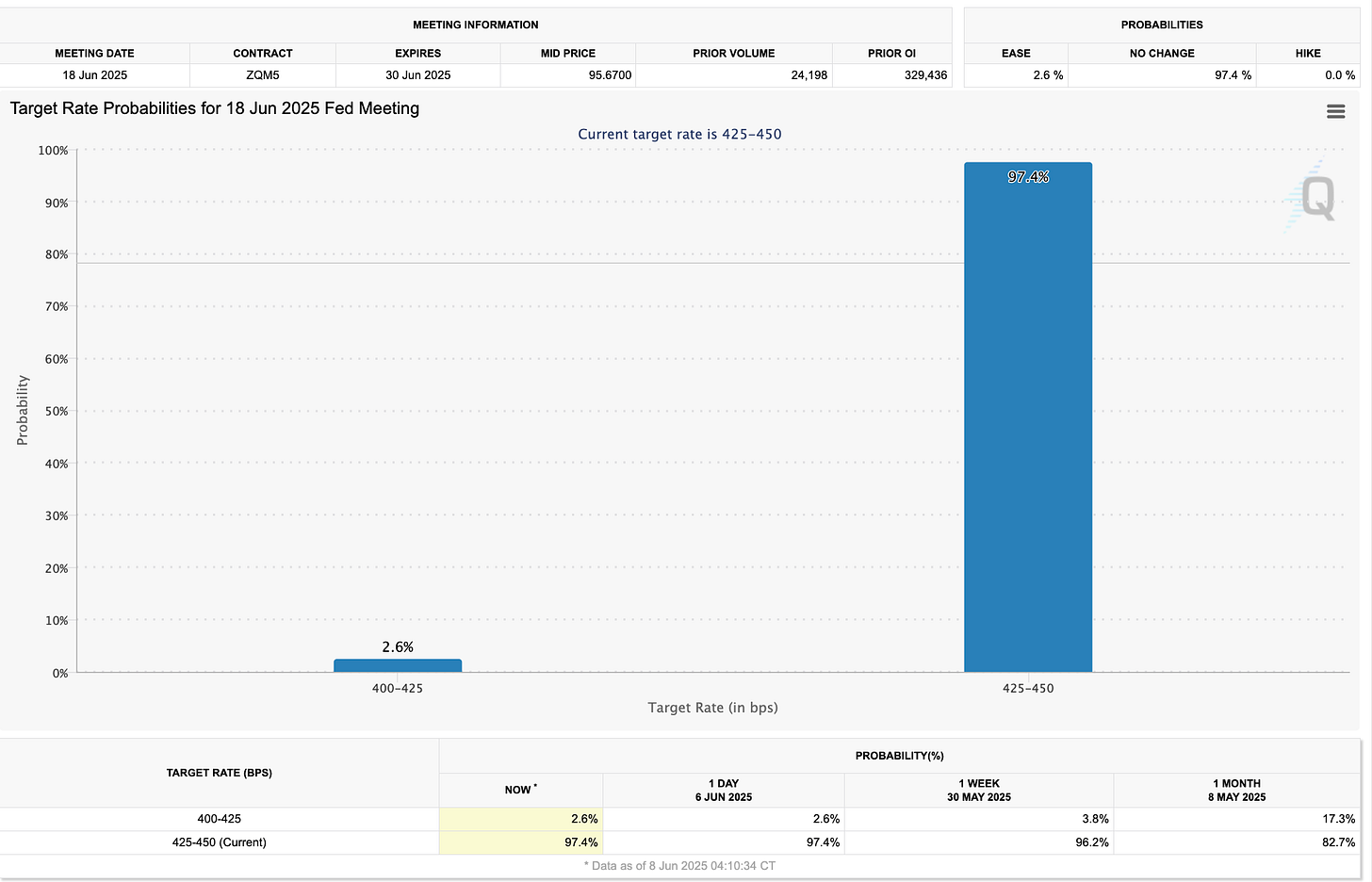

Policy Tension for the Fed

Inflation trends suggest room for easing.

But tariff-related supply shocks may reignite inflation, complicating Fed decisions.

Outlook Uncertain

April data suggests possible Q2 GDP rebound due to falling imports.

But weaker consumer spending may counteract that.

True impact of tariffs likely to surface in Q3 2025.