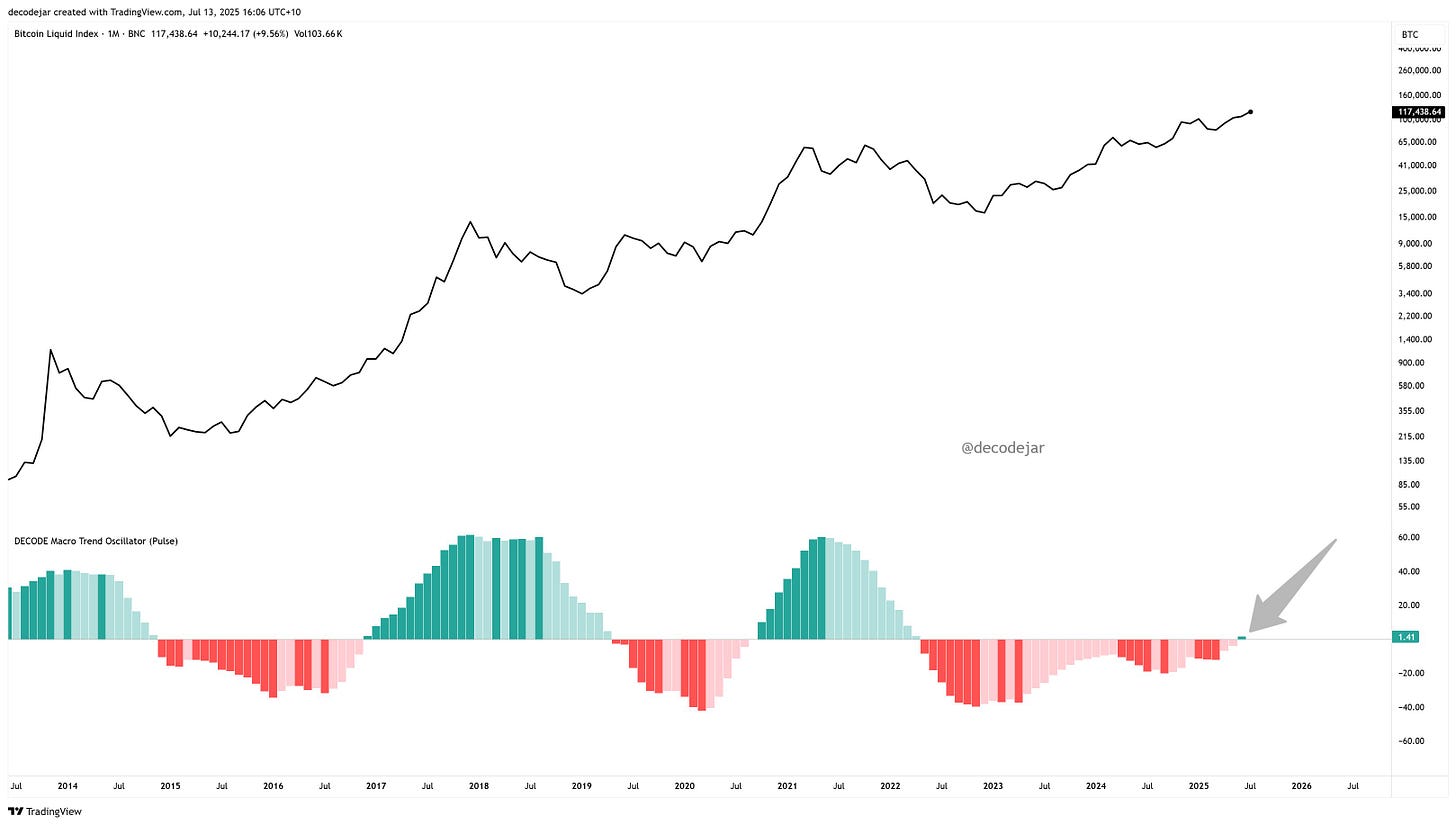

For the first time in nearly two years, the macro trend oscillator is about to post a green monthly print.

Every time it flips, the market re-prices.

We’re potentially closing July green. But even if not, August is almost guaranteed. If you’re waiting for a confirmation beyond this, you’re effectively waiting for 20–30% higher prices to make a decision.

Global M2 just hit an all-time high of $94.6 trillion, growing at its fastest pace since the pandemic stimulus era. And Bitcoin, which has lagged this metric by ~100 days consistently since 2015, is finally catching up.

Historical trend is clear:

2016–2017: Moderate M2 growth → BTC 50x

2020–2021: Stimulus-fueled M2 explosion → BTC 8x

2022: M2 contraction → BTC crashes to $17K

2025: M2 expanding faster than equities or gold → BTC consolidating above $100K, with room for parabolic expansion

Yes, pockets of the market are euphoric. But zoom out, and most of the capital is still underweight, waiting for breakdowns or confirmation. If they are expecting clean retracements and orderly entries.

There is a bear thesis:

Inflation reaccelerates, central banks panic, rate hikes return, and global liquidity reverses. M2 growth turns negative. BTC retraces to $50K.

But you have to believe that central banks will voluntarily tank asset markets, crush credit, and ignore their own debt obligations while growth in China, Europe, and emerging markets is already fragile.

If the last two years taught us anything, it’s that policy flexibility is now the default. Every market wobble gets met with easing. Bitcoin isn’t immune to macro stress, but it is disproportionately favored by any re-expansion in money supply or dovish pivot in rates.

👇🧵

Image credits to @decodejar

Macro Pulse Update 13.07.2025, covering the following topics:

1️⃣ Macro events for the week

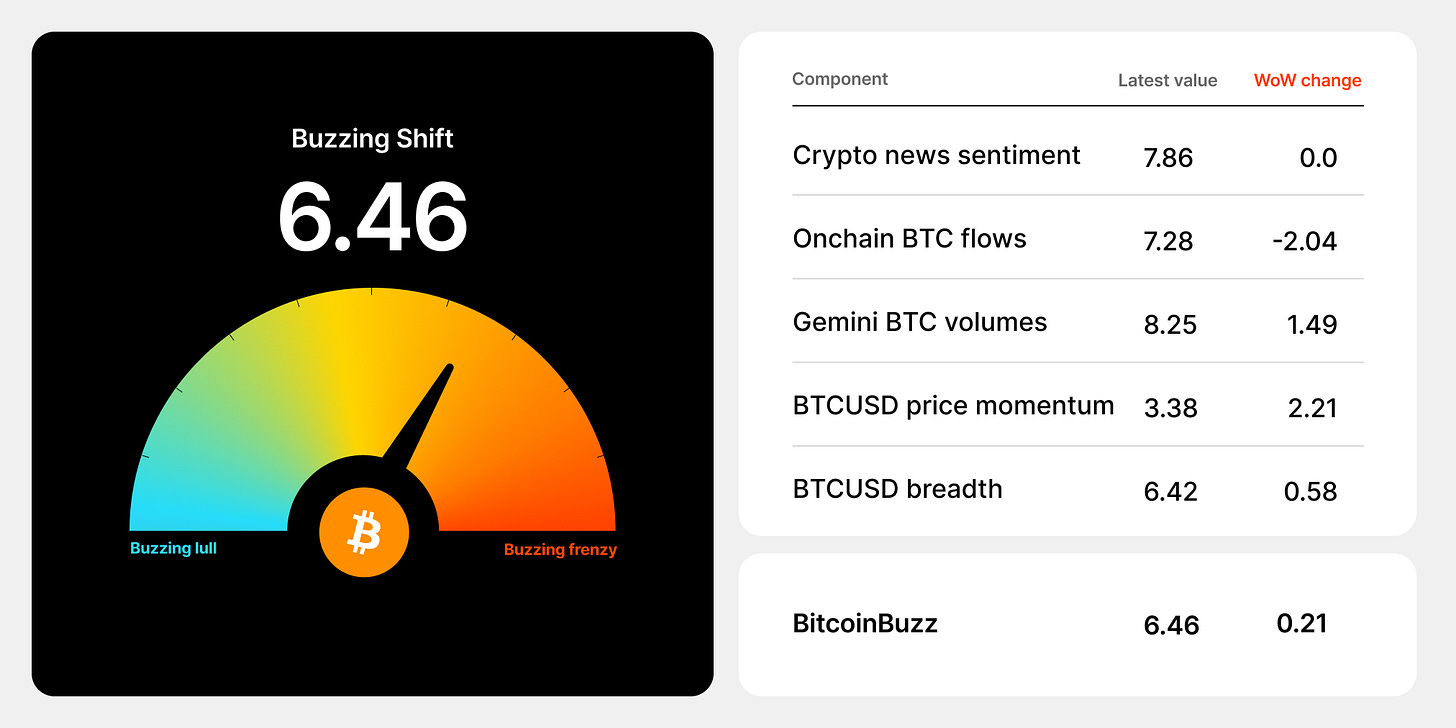

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ Topic of the Week

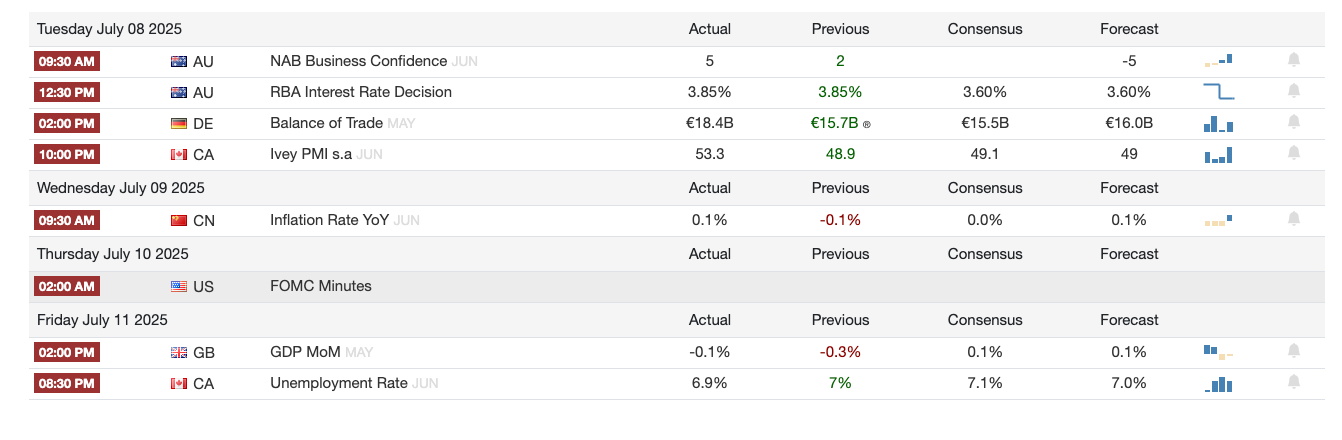

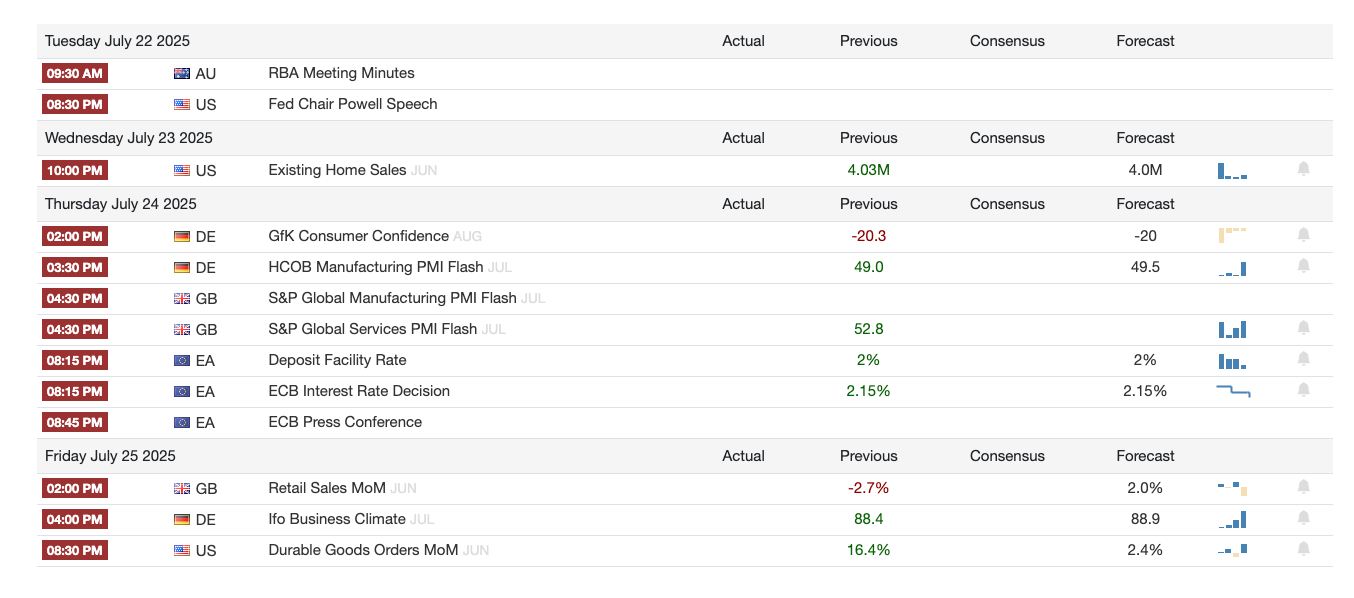

1️⃣ Macro events for the week

Previous Week

Next Week

2️⃣ Bitcoin Buzz Indicator

Market Movers & Institutional Inflows

Bitcoin Hits $118,909 as ETF Inflows Top $15B; BlackRock's IBIT Achieves $80B in Record Time

Political, Regulatory & Legal News

Elon Musk Launches "America Party" Emphasizing Bitcoin and Deregulation

Trump's Truth Social Files for Crypto ETF to Track Top 5 Coins

Pump.fun's PUMP Token Sale Aims for $1.32B with 150B Tokens, Faces Criticism Over Centralized Tokenomics and Regulatory Hurdles

Security & Exploits

GMX V1 Exploit Results in $42M Loss, Partial Fund Recovery, and DeFi Security Concerns

Phishing Attack Targets Mt. Gox Wallet Holding 79,957 BTC via Fake Salomon Brothers Site

Crypto Exchange & Platform Developments

Kraken Expands xStocks to BNB Chain, Unlocking Global Access to Tokenized US Equities

OpenSea Acquires Rally to Launch Unified "Onchain Everything App" and Enhance Mobile Token Management

Industry Trends & Reports

Grayscale Reveals Q3 2025 Altcoin List: 31 Tokens, Including New Addition BONK, Trims Previous Selections

NFT Sales Reach $2.82B in H1 2025 Despite Trading Volume Decline

3️⃣ Market overview

Bitcoin hit a new all-time high of $117K, up 24% YTD and more than 2x YoY, driven by institutional demand and tech sector momentum.

BlackRock’s IBIT ETF now holds 700,000+ BTC ($76B+ AUM), capturing 56% of all U.S. spot BTC ETF assets and dominating daily ETF volume (~80%).

Strategy announced a $4.2B preferred stock offering to fund more BTC purchases. It currently holds 597,325 BTC, valued at ~$65B.

ReserveOne to go public via $1B SPAC merger backed by Galaxy & Pantera; will manage a diversified, yield-focused crypto portfolio under ticker RONE.

Metaplanet added 2,205 BTC ($239M), growing its total to 15,555 BTC and reaffirming its position as the #5 largest public BTC holder. Q2 revenue rose 42% YoY.

4️⃣ Key Economic Metrics

U.S. Review: Growth Slows as Policy Uncertainty Rises

While economic data was relatively quiet, trade policy took center stage. The Trump administration extended its tariff reprieve to Aug. 1, but over 20 countries received revised rate notices, injecting fresh uncertainty into the business environment.

Consumer momentum is fading:

Q1 real personal consumption rose just 0.5%, a sharp slowdown from 2024’s pace.

May spending declined 0.3%, and credit growth is losing steam.

Forecast downgrade:

Q2 real GDP is now projected at 1.8%, down from 3.4%, as weakening demand and cautious sentiment ripple through the economy.

Business confidence is slipping, but firms are still passing through tariff-related cost pressures in prices. Fortunately, these have not yet triggered broader inflation—inflation expectations continue to cool, giving the Fed more breathing room.

Labor market cracks are emerging:

Layoffs remain low, but hiring is slowing and unemployment is expected to rise in the second half.

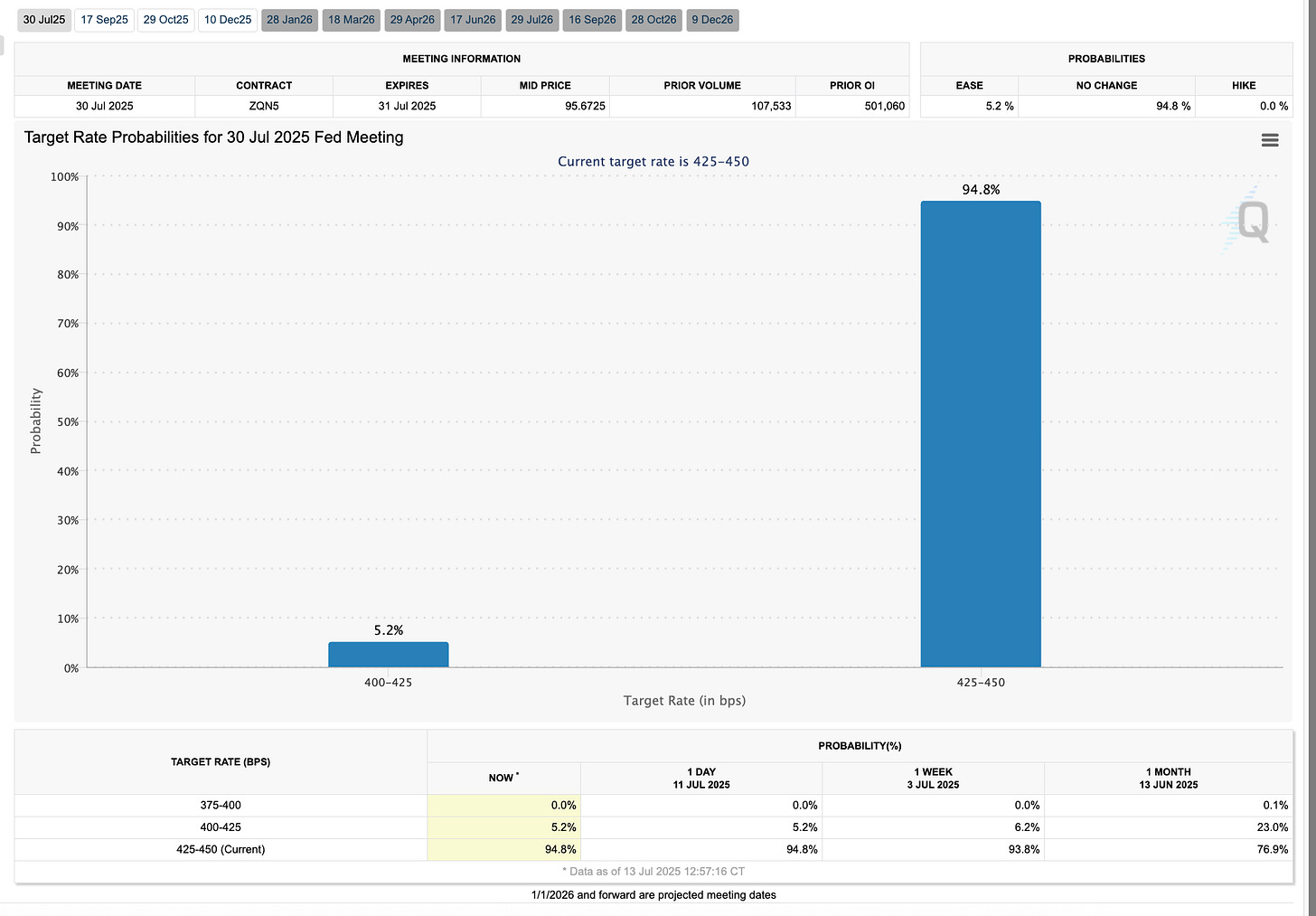

The Fed’s likely path is a 75 bps easing cycle, with the first rate cut expected in September, as inflation moderates and growth slows.

International Review – Central Banks Hit Pause, But Not for Long

Central banks across the globe took a breather this week—but with clear signals of easing on the horizon:

Australia’s RBA held at 3.85%, surprising markets, but hinted at cuts starting in August, citing a mixed backdrop of inflation persistence and improving domestic demand.

New Zealand’s RBNZ also paused, with cuts expected this summer.

UK GDP slipped 0.1% in May, confirming a weak Q2 trajectory as industrial output sagged.

Canada’s labor market outperformed, with 83K jobs added, lowering unemployment to 6.9%, suggesting resilience that could delay rate cuts.

In Latin America, inflation painted a mixed picture:

Mexico and Brazil saw upside surprises in June CPI.

Colombia and Chile beat expectations on the downside, supporting easing cycles.

U.S. Outlook – What to Watch Next Week

CPI (Tue): Headline inflation likely rose 0.25% in June, largely on higher gas prices.

Core CPI projected at 0.24% MoM, with 12-month rate rising to 2.9%—still tame by recent standards.

Retail Sales (Thu): June sales expected to be flat, with control group up just 0.3%, signaling cautious consumers amid rising prices and economic uncertainty.

Housing Starts (Fri): Projected to fall to 1.23M units, as single-family construction faces pressure from elevated mortgage rates and growing resale inventory.

Interest Rate Watch – Fed Eyes Fall for Easing

The June FOMC minutes reinforce a wait-and-see approach for now. The Fed sees tariffs adding inflation risk—but also acknowledges significant uncertainty around their ultimate impact.

Markets are pricing in action starting in September, in line with Wells Fargo’s outlook:

Three 25 bps cuts expected in September, October, and December, bringing the federal funds rate to 3.50%–3.75% by year-end.

Bottom line: The Fed remains data-dependent, but a clear softening in labor and stable inflation would open the door to easing.

5️⃣ Topic of the Week 🔴

Everybody Gets a Tariff!

Prolonged uncertainty is stalling investment decisions as businesses await clearer policy signals.

Trade tensions escalated with four major developments:

Tariff pause extended to Aug. 1 for 57 countries.

Updated reciprocal rates announced for 35 countries—some higher, some lower.

Brazil (50%) and Canada (35%) hit with higher tariffs, excluding USMCA energy.

Sector-specific tariffs return:

Copper: 50% by Aug. 1

Pharma: Up to 200%, phased in over a year

Effective U.S. tariff rate could rise from 16% to ~22% on Aug. 1 if changes take effect.