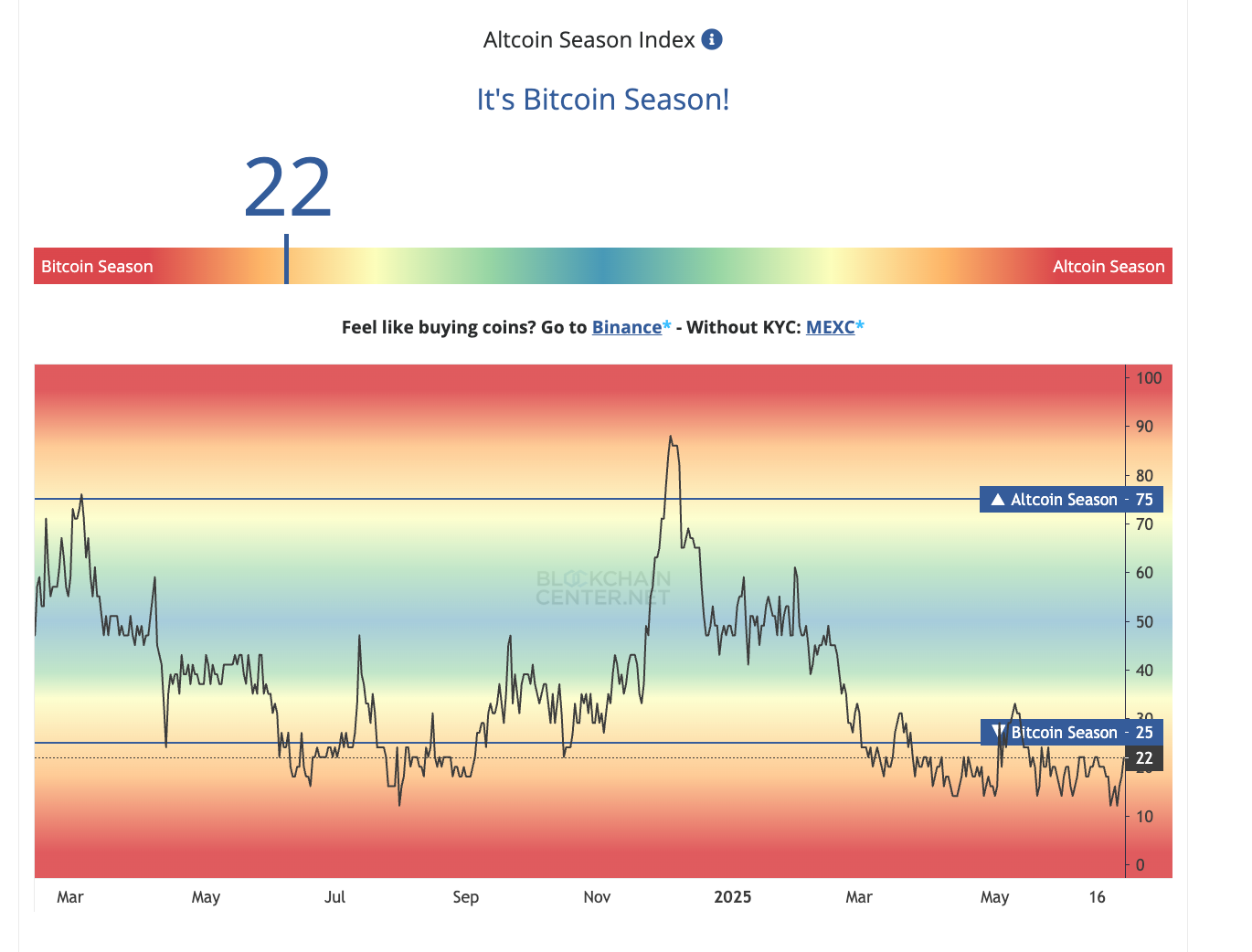

Bitcoin dominance is breaking above 2021 highs. Altcoins are in capitulation.

A structural rise in Bitcoin dominance, liquidity-driven but rate-dependent upside for ETH, early-cycle consumer fatigue, and prescient miner signals together paint a nuanced picture that crypto’s next leg will be selective.

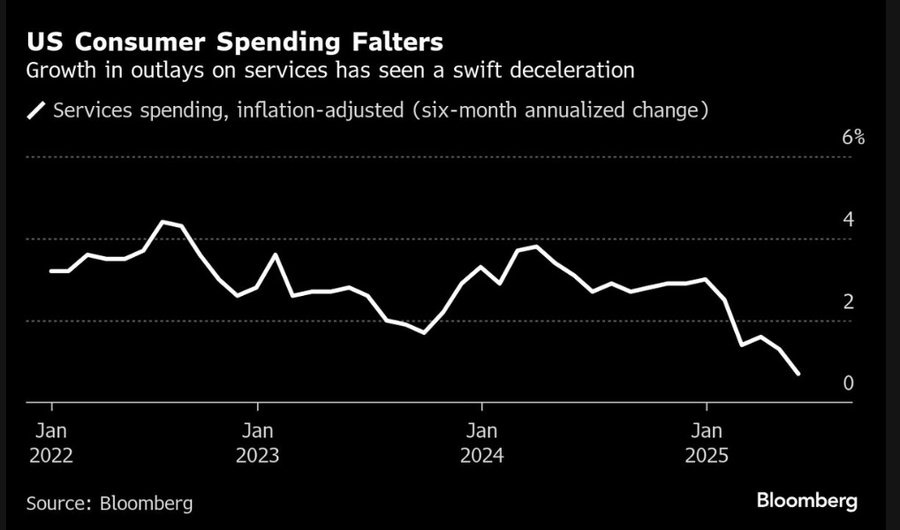

U.S. consumer spending just posted its steepest decline since the pandemic.

It’s the early phase of a macro inflection point most are blind to.

Not just “chop before pop.” Something bigger is shifting structurally, and the signs are everywhere if you’re looking beyond memes and echo chambers.

Here’s what the data says:

BTC.D breakout = a regime change. Bitcoin is asserting itself as the reserve asset of crypto. The failed altcoin rebound confirms it.

Alts are bleeding quietly. Liquidity has rotated out, communities gone silent, and most low-float tokens are trending to zero.

Smart money is selling into strength. Mining stocks are rejecting key levels, this happens before Bitcoin tops.

Global liquidity is climbing. The Fed hasn’t cut, stablecoin regs are unlocking, and cash is still on the sidelines.

And yet, CT is asleep. This cycle will be something much bigger, and much more selective.

Here’s my breakdown of where we really are:

1. Bitcoin Dominance

BTC.D is on the verge of breaking its 2021 highs. What’s crucial is that it never even touched the 2017 lows in the last cycle washout, meaning dominance never truly broke down. Now it’s surging despite ETFs already being priced in.

This is likely the start of a secular uptrend in BTC dominance. The old playbook, where altcoins outperform in late-cycle phases, is looking obsolete. Expect prolonged pain for altcoins, even if BTC grinds higher.

We might’ve already seen the bottom in alts… but that doesn’t mean they recover any time soon.

2. The June Rally And What Comes Next

Everyone was hyped for a June melt-up in risk assets. Then:

Iran/Israel escalations hit

U.S. macro data disappointed

And the “everything rally” turned into sideways chop

Now eyes are on late July/August, but desks are already warning about a liquidity vacuum in that period. Summer volume + macro uncertainty = fakeouts galore.

Fed rate cuts. That’s likely coming September. That’s when global liquidity will break above key trend thresholds, and that’s when risk truly gets legs.

3. Ethereum

ETH is hugging its monthly 55EMA inside a textbook bull flag. Why?

Because macro’s still messy.

But when you zoom out:

Global liquidity is ticking up

The GENIUS Act will kick open the doors for regulated stablecoin flow

And ETH is still the best structural bet on tokenized USD rails

4. Consumer Breakdown

May’s retail sales in the U.S. fell the most since the pandemic. Layoffs are ticking up. Home sales hit lows we haven’t seen since 2009.

We’re seeing clear demand fatigue:

Stimulus is long gone

Credit is tighter

And households are out of ammo

Policymakers mistake this for “soft landing disinflation,” when it’s really early-stage stagnation. If the Fed stays too tight for too long, it could cement the recession they’re trying to avoid.

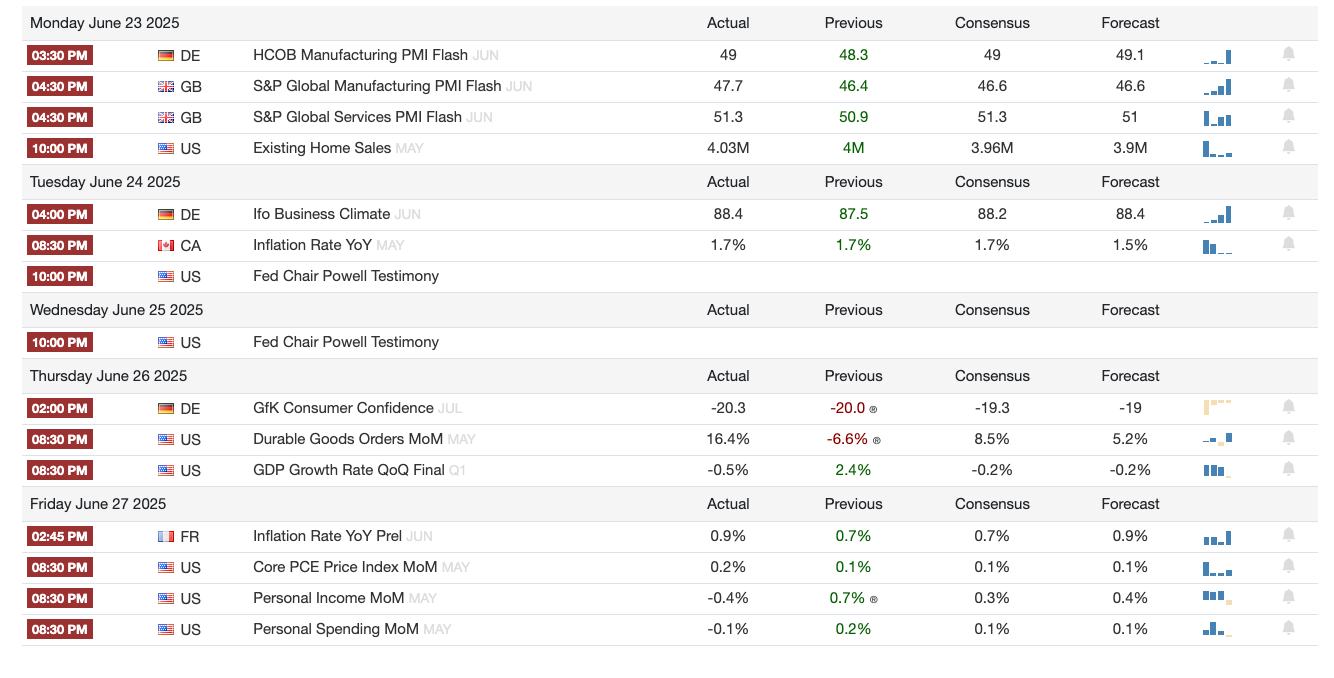

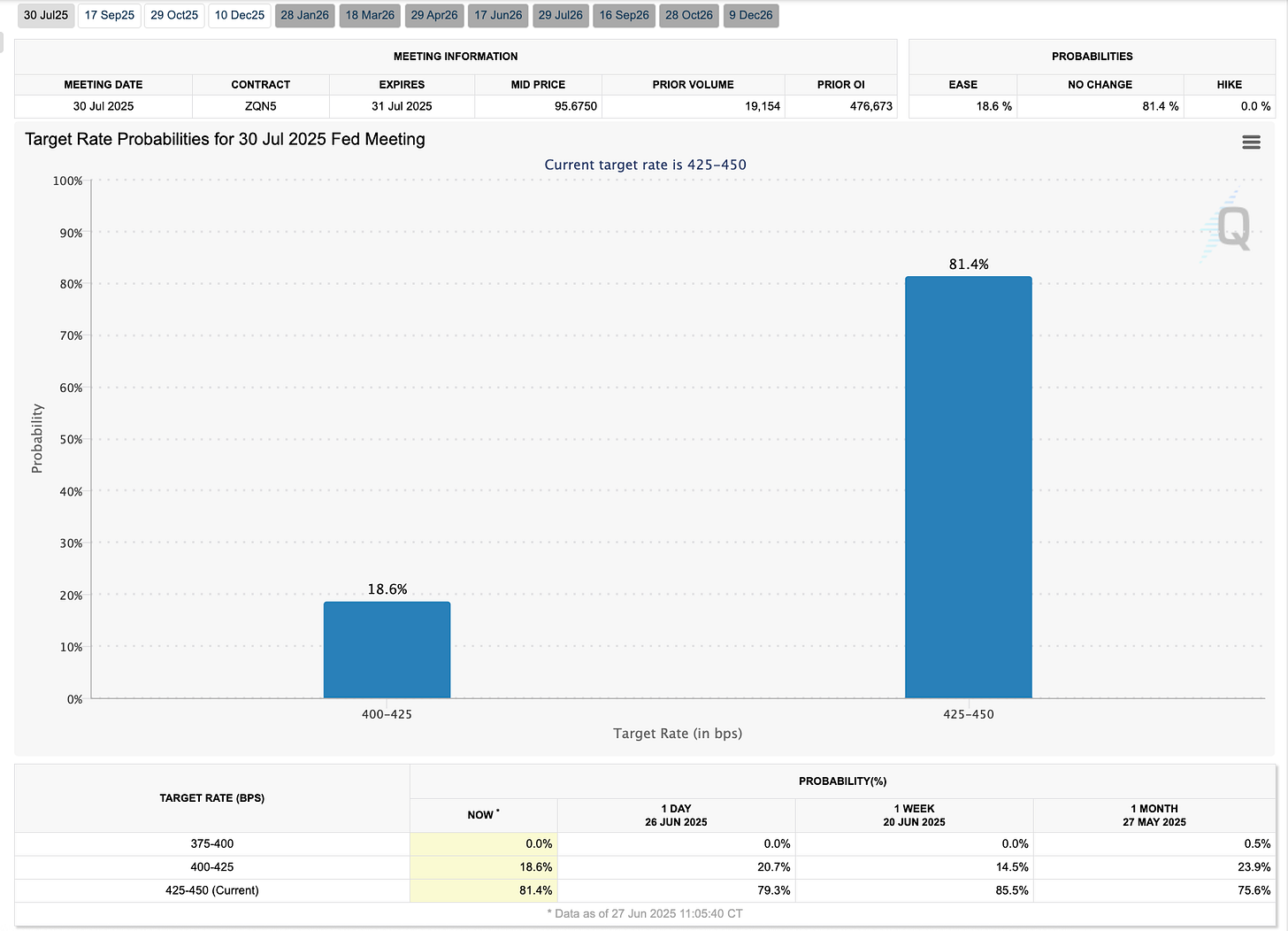

Macro Pulse Update 28.06.2025, covering the following topics:

1️⃣ Macro events for the week

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ Japan Spotlight

1️⃣ Macro events for the week

Last Week

Next Week

2️⃣ Bitcoin Buzz Indicator

Launches

Euler (Arbitrum): Launched Super Lending App with rEUL rewards & $100K incentive pool.

t1: Released Proof of Read testnet for real-time cross-chain proving (Arbitrum ↔ Base).

Aptos: Unveiled Shelby, a decentralized infra enabling real-time data access.

Doma Protocol: Public testnet live + $1M USDC dev fund for domain RWA innovation.

Enso: Deployed Cross-chain DeFi Deposit widget using LayerZero/Stargate.

MagicBlock: Magicnet now open for Solana devs with Ephemeral Rollups.

ZKsync: Launched Airbender zkVM (Ethereum blocks <35s proof, $0.0001 cost).

Supra: Undergoing mainnet upgrade with native automation support.

Tenor x Morpho: Partnership for institutional fixed-rate lending on Morpho V2.

Updates

GHO: Now live on Avalanche via Aave V3 with mint/bridge support.

HyperLend: USDhl now borrowable (high risk, not collateral-eligible).

Renzo: Introduced Flow Vaults for restaking bonds with fixed returns.

Succinct: Entered testnet Stage 2.5 with decentralized prover network live.

Wormhole x Ripple: Interoperability for XRPL + EVM sidechain via Wormhole.

DIA: Enabled mainnet staking for $DIA and Oracle Grants via Lumina.

Dynamic: Rolled out universal wallet infra—supports 500+ wallets.

dYdX: Free, instant Cosmos deposits >$100 now live via Skip Protocol.

Deblock: Highlighted Morpho vault yields (up to 6%) with seamless UX.

Zerion: Now supports Hyperliquid’s HyperEVM via wallet/API.

YieldNest: Released $ynUSDx, 82% in SuperUSDC for optimized stablecoin yield.

Morpho V2 (teased): Levered RWA strategy live on Apollo’s ACRED fund.

Airdrops

Spark ($SPK): Claim live on DeFiSaver for eligible campaign users.

SNAPS Airdrop: 5M $SPK distributed to top 500 Spark participants.

KiiChain: Launched ORO Challenge testnet with $ORO task rewards.

Avantis: UGC campaign live—remix “Vanta” mascot to win prizes (till July 25).

Aethir: Cloud Drop Season 2.0 coming early July (7-day claim window).

EigenCloud: VIBEscore X contest launched with $50K+ rewards.

Galxe x Kryll: Earndrop live, distributing first 25K $KRL tokens.

Farms & Incentives

Gauntlet (Unichain): Round 6 launched—$2.4M for hooked/stable pools.

mETH Protocol: Incentives shifted to new cmETH (Sept 18, 2025) pool.

Euler Prime: Added $50K+ rewards for USDT, USDtb, RLUSD deposits.

Spectra: New Resolv RLP pool with x30 LP multiplier now live.

Aegis: sYUSD pool on Pendle with up to 25% APY + max Aegis points.

Elixir: deUSD live on Pendle with 15x potion multiplier on LPs/YTs.

Falcon Finance: 6x daily Miles for $USDf holders + referral rewards.

Size Credit: PT collateral looping now available for 10–15% APYs with USDC borrow.

Issues

Resupply: Confirmed exploit in wstUSR market—contract paused; avoid phishing links.

3️⃣ Market overview

Growth momentum is weakening in the U.S., central banks remain cautious globally, and early optimism about economic resilience is giving way to more sober reassessments.

Rewriting the Q2 Narrative

Early GDP data masked softness in trade and consumption.

Latest data revisions suggest a weaker-than-expected Q2, undermining hopes for a strong rebound.

April’s sharp drop in goods imports no longer guarantees trade-driven growth boost.

United States: Stagflation Watch Begins

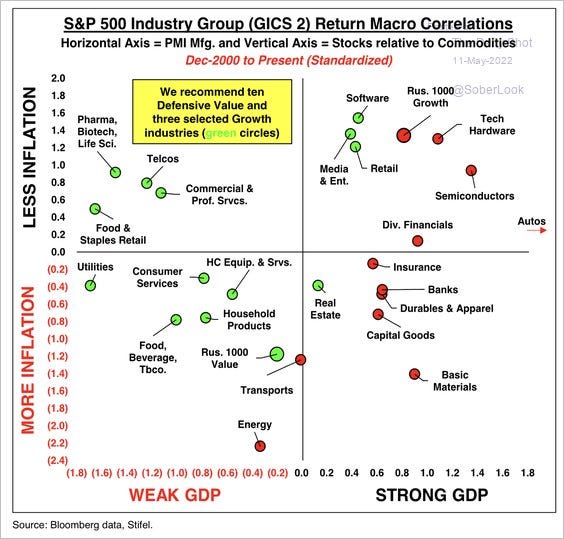

Tariffs taking a toll: Growth indicators weaken as consumer strength wobbles—stagflation risk grows with stagnation arriving before inflation.

Retail sales down: Largest monthly drop in two years.

Fed stays cautious: Powell reinforces a “wait-and-see” stance amid uncertainty.

Global: Fragile Growth, Mixed Inflation

Eurozone & UK: June PMIs indicate a fragile but continuing recovery.

Canada: Core inflation stable.

Australia: Inflation surprised to the downside, easing pressure on RBA.

Mexico: Banxico cut rates to 8.00%, signaling slower pace of easing.

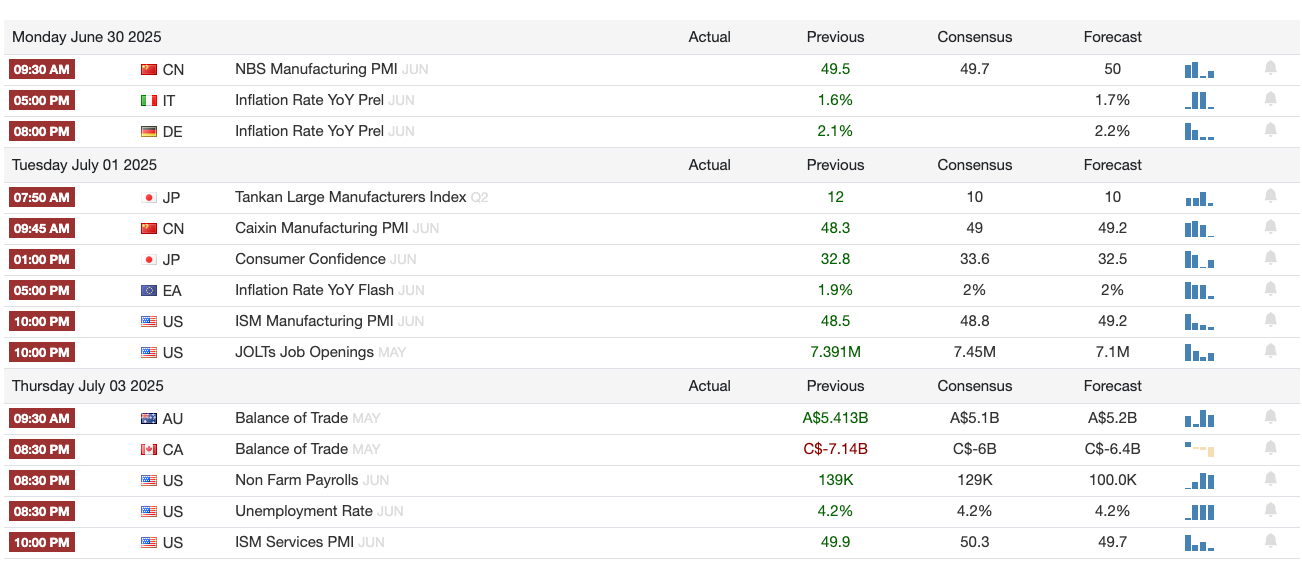

Interest Rate Watch: Fed Holds Ground

Powell’s testimony: Emphasizes the Fed is “well positioned to wait” before adjusting rates.

Internal divergence: Board members express varying views on inflation and timing of cuts.

4️⃣ Key Economic Metrics

China’s consumer spending is rebounding, but industrial output and real estate drag due to global trade tensions.

The U.S. faces declining consumer spending, rising economic uncertainty from tariffs, and a complex policy dilemma for the Fed, caught between inflation and stagnation risks.

Dollar Weakness

Fresh Multi-Year Low: The euro has climbed to its strongest level versus the U.S. dollar since 2021, underscoring persistent broad-based weakness in the greenback.

Oil-FX Correlation Breaks Down: Historically, cheaper oil supports the dollar, yet both crude prices and the dollar fell simultaneously—signalling that other forces are now dominant.

Policy-Rate Expectations Misfire: ECB is clearly on an easing path while the Fed remains cautious; textbook logic points to a stronger dollar, but markets are pricing the opposite, hinting that relative rates are not the main driver.

Trade-Policy Uncertainty: Investors fear a diminished U.S. role in global trade and unpredictable policy shifts, prompting diversification away from dollar-denominated assets and denting dollar demand.

Safe-Asset Rotation: With quality safe assets scarce, flows are moving into alternatives such as gold, reflecting a search for security outside the dollar.

Euro’s Bid for Reserve Status: President Macron advocates joint EU debt issuance to elevate the euro’s global role; IMF’s Georgieva echoes that the euro has a “great opportunity” to gain share while safe assets are limited.

ECB Cut Odds Trimmed, Yet Euro Rises: Futures now imply slightly fewer ECB cuts (thanks to higher oil), but the euro still gains—reinforcing that political and structural factors outweigh rate differentials for now.

Bottom Line: Trade-policy risk premia, reserve-diversification flows, and Europe’s push for deeper fiscal integration are eclipsing traditional oil-price and rate-spread narratives in driving the dollar lower.

Oil Prices and War – Key Highlights

Unless the Israel-Iran conflict escalates to directly threaten global oil transit routes or production hubs, the macroeconomic risk from oil prices remains limited. The market is pricing in resilience.

Initial Price Surge, Then Stabilization:

Oil prices spiked when the Israel-Iran conflict began but quickly stabilized at a slightly elevated level, suggesting investors do not expect prolonged supply disruptions.

Straits of Hormuz Still Open:

Fears of a significant oil shock hinge on Iran blocking the Straits of Hormuz—a chokepoint for global oil. However, this appears unlikely given recent Israeli military strikes that weakened Iran’s capacity for escalation.

Saudi Mitigation Measures:

Saudi Arabia has increased oil production and possesses pipelines rerouting oil to the Red Sea, reducing dependency on the Straits. These measures help maintain global supply continuity.

Historical Context:

Past Middle East conflicts often failed to cause major long-term global economic shocks. Only the 1974 Arab oil embargo and 1979 Iranian revolution triggered lasting inflation and recessions. Other conflicts (1990 Gulf War, 2003 Iraq War, 2022 Russia-Ukraine war) had short-lived oil market impacts.

Outlook:

Despite geopolitical tensions, oil markets remain relatively insulated due to diversified supply infrastructure, preemptive policy actions by major producers, and subdued market expectations of large-scale supply interruptions.

Tariff Effects & Stagflation Risks:

Tariffs dampened spending, but haven’t yet spurred broad inflation

Risk of stagflation: high inflation + weak demand

If inflation is seen as transitory, Fed may cut rates

If persistent, Fed may maintain tight policy

Fed’s Position:

Interest rates held steady for the fourth straight meeting

Growth forecast downgraded, inflation forecast raised due to tariffs

Fed Chair Powell: “We are well positioned to wait and see”

Concern: Avoiding a wage-price spiral while assessing labor market tightness (including reduced immigration effects)

Historical Parallels:

Powell’s cautious stance echoes his 2021 pandemic-era “transitory inflation” call—which proved accurate

A similar benign outcome may play out again if demand fades and supply adjusts without triggering runaway inflation

5️⃣ Japan Spotlight🔴

The BOJ is balancing elevated inflation with rising global uncertainty. Its decision to pause further tightening and slow bond tapering reflects a strategic pivot—aimed at supporting Japan’s fragile recovery while monitoring geopolitical and trade-related risks.

Policy Rate Unchanged:

The Bank of Japan (BOJ) left its benchmark interest rate steady, maintaining a cautious stance amid global uncertainty.

Bond Purchase Adjustment Slowed:

While the BOJ had begun reducing its bond purchases (a form of monetary tightening), it now plans to slow the pace of reduction, signaling concern over emerging economic risks.

Inflation Above Target, But Growth Risks Loom:

Despite inflation remaining above target, the BOJ downgraded both its inflation and growth forecasts, largely due to uncertainty tied to the U.S.-Japan trade conflict.

High Market Involvement:

The BOJ still owns over 50% of Japanese government bonds, reflecting its long-standing aggressive easing policies from the low-inflation era.

Policy Stance: Cautious and Reactive:

The BOJ is adopting a “wait and see” approach, prioritizing economic stability over inflation control, at least in the near term.

Market Reaction:

The yen initially appreciated following the announcement but later stabilized, indicating a muted reaction from financial markets.