The State of Yield-Bearing Stablecoins in 2025 (Part 1)

👇🧵

@sparkdotfi (Spark Protocol under MakerDAO)

@Ethena_Labs (USDe and USDtb)

@SkyEcosystem (formerly MakerDAO, for USDS)

@OndoFinance (USDY)

@MountainPrtcl (USDM)

@BlackRock (BUIDL, though less crypto-specific; Ethena Labs covers USDtb)

@UsualMoney (USD0)

@FigureMarkets (YLDS)

@Pi_Protocol_ (USP)

@OriginProtocol (OUSD)

1. sDAI (MakerDAO, Spark Protocol)

Yield Generation Mechanism: sDAI operates within MakerDAO’s Spark Protocol, where users deposit DAI into the Dai Savings Rate (DSR) module. This module lends funds to other DeFi protocols and invests in RWAs, such as U.S. Treasuries, generating yields of ~5-8%, variable and set by MakerDAO governance based on market conditions and protocol strategy.

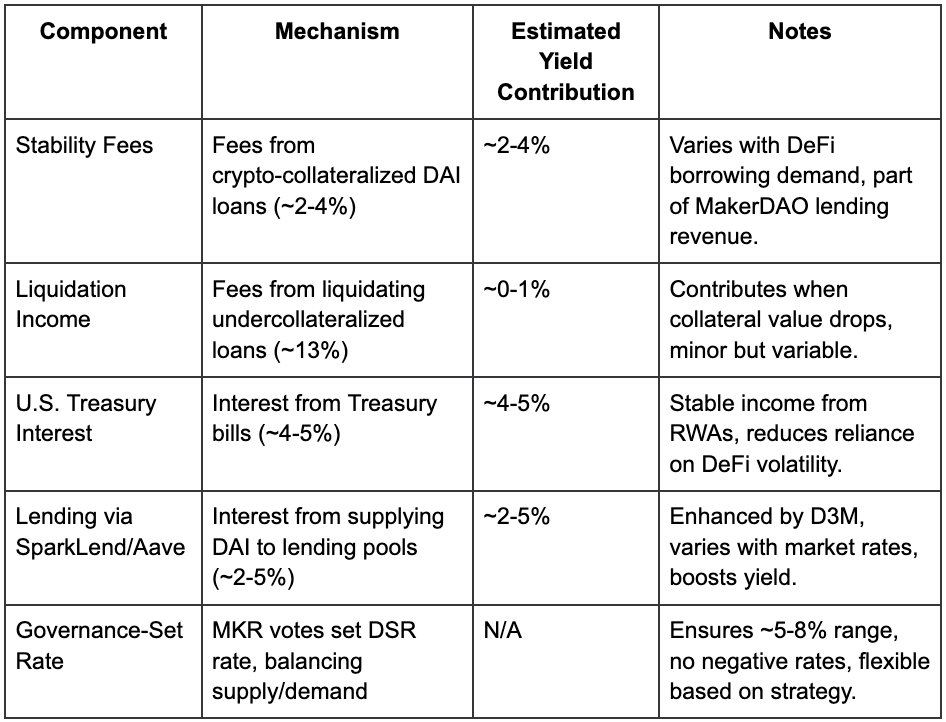

sDAI Yield Strategy – MakerDAO’s RWA-Backed Passive Income Engine

sDAI is a yield-bearing token minted when users deposit DAI into MakerDAO’s Dai Savings Rate (DSR) module via Spark Protocol, a DeFi lending platform launched in May 2023. It offers passive, flexible yield with no lock-up, powered by Maker’s diversified revenue streams from both DeFi and real-world assets (RWAs).

How Yield is Generated

DAI deposited into the DSR is utilized across four key income channels:

Stability Fees & Liquidation Revenue: MakerDAO earns fees from crypto-backed loans. Borrowers pay interest (2–4%) and liquidation penalties (e.g. 13%), contributing directly to DSR yield.

RWA Investments: Maker invests DSR reserves into tokenized U.S. Treasuries, typically yielding 4–5%, providing a stable TradFi-backed income layer.

DeFi Lending via SparkLend & D3M: Funds are lent on SparkLend and external protocols like Aave, earning 2–5% APY, expanding Maker’s revenue base.

Governance-Tuned Yield (5–8%): The DSR rate is dynamically adjusted by MKR governance to reflect market demand and protocol strategy, keeping yield responsive and sustainable.

How sDAI Works

When users deposit DAI, they receive sDAI, an ERC-4626 vault token that accrues value over time—not by rebasing, but by increasing its redeemable DAI value. For example, 1,000 sDAI at 5% APY becomes worth 1,050 DAI after a year, with full liquidity and DeFi composability throughout.

Summary of sDAI yield components

Potential Catalysts

MakerDAO governance votes could adjust DSR rates, impacting yields.

Changes in U.S. Treasury yields, given their role in RWAs, may affect returns.

Growing DeFi adoption, especially in lending, could boost demand, while regulatory clarity on DeFi lending might enhance trust.

2. USDe (sUSDe, Ethena)

Yield Generation Mechanism: USDe employs a delta-neutral strategy, staking ETH (e.g., stETH) to earn staking rewards (~3-5%) and shorting ETH futures to capture funding rates, yielding ~10-15% variable. sUSDe holders receive compounded returns, making it attractive for high-yield seekers, though it carries higher risks due to synthetic strategies.

USDe Yield Strategy – Delta-Neutral, High-Yield Stablecoin

USDe, launched by Ethena Labs, is a crypto-native synthetic dollar built on Ethereum, maintaining a 1:1 USD peg via a delta-neutral strategy. It leverages staked ETH (stETH) and short ETH perpetuals to preserve stability while generating yield. Its staked variant, sUSDe, compounds returns, offering high APYs that adjust with market conditions—up to 29% during bull cycles and ~8.4% in early 2025.

How the Yield Works

Users deposit ETH, which Ethena stakes via Lido or similar protocols, earning 3–5% base staking yield. This creates a long exposure to ETH, which is neutralized by shorting ETH perpetual futures on centralized exchanges. These shorts lock in a delta-neutral position, ensuring price stability of USDe regardless of ETH's market movement.

The primary yield driver is the funding rate from these short positions. In bullish markets, funding rates rise, and shorts earn payments from longs—often yielding 7–12%, and at times much higher. Combined with staking rewards, this allows USDe (and especially sUSDe) to offer double-digit APYs, particularly during high-demand periods.

sUSDe holders benefit from compounded returns, as both staking and funding rate profits are reinvested. The result is a scalable, high-yield stablecoin alternative that remains non-reliant on TradFi, offering transparent, market-driven yield while preserving dollar stability.

Summary of USDe Yield Components

Potential Catalysts

A $100M funding round in February 2025, as reported by Bloomberg (Ethena Funding), could expand operations and drive growth.

Ethereum staking trends may boost yields, while regulatory scrutiny on synthetic strategies, given past Terra concerns, could affect adoption.

3. USDS (sUSDS, Sky)

Yield Generation Mechanism: USDS, formerly part of MakerDAO and now under Sky, blends RWAs (e.g., tokenized Treasuries) and DeFi lending, with interest auto-accruing at ~4.5%. This hybrid approach balances stability from RWAs and variable returns from lending, appealing to conservative investors seeking moderate yields.

USDS Yield Strategy – Hybrid RWA + DeFi Income Model

USDS, launched in August 2024 through Sky Protocol’s rebranding of MakerDAO, is a next-generation stablecoin blending real-world assets (RWAs) with DeFi lending to deliver sustainable, auto-accruing yield. Since launch, USDS has seen explosive growth—135% supply increase in five months—solidifying Sky as a top-6 DeFi protocol with $5.5B TVL.

Yield Generation Breakdown

USDS yield is powered by two core components:

RWA Base Yield

Sky Protocol allocates a large share of USDS reserves into tokenized U.S. Treasuries, earning a stable 4–5% annual return. This low-risk, government-backed income forms the foundation of the USDS yield pool and supports peg stability.DeFi Lending via Spark

A portion of USDS is deployed in Spark, Sky’s native lending platform, where borrowers post overcollateralized crypto to borrow USDS at 2–5% interest. These returns fluctuate with market demand, adding a variable income layer.

Sky Savings Rate (SSR) and Auto-Accrual

The total yield (~4.5% APY) is distributed via the Sky Savings Rate (SSR). Users deposit USDS and receive sUSDS, a yield-bearing token that auto-accrues interest daily—no staking or lockups required. Yield compounds passively and is redeemable anytime, offering both liquidity and predictability.

Governance and Yield Flexibility

The SSR is set and adjusted by on-chain governance, ensuring that the yield adapts to real-time protocol performance and market conditions. This hybrid model balances the stability of RWAs with the dynamism of DeFi, creating a user-friendly, sustainable yield solution for both retail and institutional investors.

Summary of USDS Yield Components

Potential Catalysts

Sky’s ecosystem expansion, including new DeFi integrations, and RWA tokenization trends could drive adoption.

Regulatory clarity, especially post-rebranding, might enhance trust.

4. USDY (Ondo Finance)

Yield Generation Mechanism: USDY earns ~4-5% from tokenized U.S. Treasuries and bank demand deposits, with yields reflecting short-term Treasury rates, paid to non-U.S. holders due to regulatory restrictions. This RWA-focused approach ensures stability tied to traditional finance.

USDY Yield Strategy – Tokenized U.S. Treasuries for Non-U.S. Investors

USDY, issued by Ondo Finance, is a tokenized yield-bearing asset backed by short-term U.S. Treasuries and bank demand deposits, designed for non-U.S. holders under Regulation S to remain compliant with U.S. securities laws.

How Yield is Generated

Ondo holds real-world assets—3–6 month U.S. Treasury bills and interest-bearing bank deposits—and tokenizes them on-chain. These assets generate a stable 4–5% yield, aligned with traditional money market instruments. Treasury bills pay fixed interest at maturity, while bank deposits earn daily interest, creating a blended, low-risk return profile.

Stable, RWA-Backed Income

Yields are sourced exclusively from traditional finance, offering predictable returns with minimal volatility. Treasuries are backed by the U.S. government, and bank deposits are typically FDIC-insured, making USDY attractive to conservative investors seeking secure, on-chain exposure to dollar-based yield.

Auto-Accrual

Though not explicitly detailed, USDY likely features auto-accruing interest, increasing token value or balance over time without requiring user action—standard practice among DeFi-native yield tokens. This ensures ease of use while maintaining continuous yield for eligible holders.

Summary of USDY Yield Components

Potential Catalysts

U.S. interest rate changes, given their impact on Treasury yields, could affect returns.

RWA adoption in DeFi, especially for global investors, may increase demand, and non-U.S. investor interest could grow.

5. USDM (Mountain Protocol)

Yield Generation Mechanism: USDM invests 100% of reserves in short-term U.S. Treasury bills, auto-rebasing daily to distribute ~4-5% yield to non-U.S. holders. This ensures stability and constant yield distribution, aligning with traditional finance returns.

USDM Yield Strategy – 100% T-Bill-Backed, Auto-Rebasing Stablecoin

USDM, launched in September 2023 by Mountain Protocol, is the first permissionless, yield-bearing stablecoin fully backed by short-term U.S. Treasury bills. Pegged to 1 USD and restricted to non-U.S. holders under Regulation S, it delivers stable, predictable returns through a daily auto-rebasing mechanism.

How Yield is Generated

Mountain Protocol allocates 100% of USDM reserves to short-term U.S. Treasuries (e.g., 3–6 month bills), yielding ~4–5% annually. These government-backed assets ensure low risk and steady income. The interest earned—e.g., $50M annually per $1B in assets—is distributed daily via rebasing.

Daily Auto-Rebasing for Passive Yield

USDM uses a daily rebase mechanism to distribute yield directly to holders. At 5% APY, balances increase by ~0.0137% daily, compounding automatically without user action. For example, 100 USDM becomes ~105 USDM over a year, maintaining the $1 peg while growing balances.

Summary of USDM Yield Components

6. BUIDL (BlackRock via Ethena)

Yield Generation Mechanism: BUIDL yields ~3-5% from BlackRock’s tokenized fund, investing in cash equivalents and Treasuries, integrated into Ethena’s USDtb. This offers institutional-grade returns, bridging traditional finance and DeFi.

An interesting aspect is how BUIDL’s tokenization allows traditional assets like Treasuries to be used in DeFi, enabling 24/7 trading, fractional ownership, and integration with protocols like Curve Finance, enhancing DeFi’s accessibility to institutional-grade investments.

BUIDL is the BlackRock USD Institutional Digital Liquidity Fund, a tokenized fund on the Ethereum blockchain managed by BlackRock, with Securitize as the tokenization platform and BNY Mellon as custodian. It invests in short-term U.S. Treasury bills, cash, and repurchase agreements, which are low-risk assets. The yield, around 3-5%, comes from the interest these assets earn: U.S. Treasuries pay fixed interest based on their maturity, typically 3-5% for short-term ones, and cash equivalents like repurchase agreements earn interest through short-term loans backed by Treasuries. This interest is distributed daily to BUIDL token holders via smart contracts, making it efficient and transparent.

BUIDL’s Integration with Ethena’s USDtb

USDtb is Ethena’s stablecoin, designed to maintain a 1:1 peg with the U.S. dollar, and it holds 90% of its reserves in BUIDL. This means USDtb’s stability and yield are tied to BUIDL’s performance. By using BUIDL, USDtb inherits the 3-5% yield from the interest on Treasuries and cash equivalents, passed to holders. This integration bridges traditional finance—BlackRock’s institutional fund—and DeFi, as USDtb can be used for payments, lending, or as collateral in DeFi protocols, while offering stable, yield-generating returns from traditional assets.

Summary of BUIDL and USDtb Integration

Potential Catalysts

Institutional adoption of tokenized funds, BlackRock’s RWA strategy expansion, and cross-chain growth via LayerZero could boost performance.

7. USD0 (Usual Money)

Yield Generation Mechanism: USD0 blends DeFi strategies (lending, liquidity provision) and RWAs for ~5-7% variable yield, optimized via platform integrations. This hybrid approach aims for balanced returns, reflecting its focus on DeFi innovation.

USD0 Yield Strategy Overview

USD0, developed by Usual Money, is the first stablecoin backed by tokenized U.S. Treasury Bills (T-Bills), offering users a secure, permissionless, and yield-generating asset designed for the DeFi ecosystem. Its hybrid yield strategy combines Real-World Assets (RWAs) with DeFi integrations and staking incentives, aiming to deliver ~5–7% variable yield with potential upside for long-term holders.

Base Yield – Real-World Assets (3–5%)

USD0 is fully backed by short-term, AA-rated U.S. Treasury Bills, delivering a stable base yield.

Interest from these T-Bills (typically 3–5%) is rebased daily to USD0 holders.

Assets are held in a bankruptcy-remote structure, separate from traditional bank deposits.

An insurance fund, backed by protocol revenue, protects users during systemic events.

DeFi Yield – Lending & Liquidity (1–3%)

USD0 is deeply integrated into 30+ DeFi protocols across 27+ chains, unlocking additional yield:

Lending Platforms: Users earn interest by supplying USD0 on protocols like Aave.

Liquidity Pools: Providing USD0 liquidity on DEXs (e.g., Camelot) generates trading fees and token rewards.

These integrations are optimized via Usual’s platform, amplifying returns based on demand and activity.

Staking – USD0++ and USUAL Token Rewards (High APY Upside)

Users can stake USD0 to receive USD0++, a liquid staking derivative designed for long-term growth:

USD0++ has a 4-year lock-up, acting like a high-yield savings account for RWA exposure.

Stakers earn USUAL tokens, which appreciate with TVL growth, aligning incentives with platform expansion.

Current staking participation is over 50%, with early exit options available at a discounted floor.

Yield potential for USUALx (associated staking asset) exceeds 60% APY, funded by protocol revenue from DeFi fees and governance incentives.

Breakdown of USD0 Yield Components

Potential Catalysts

Rapid market cap growth since November 2024, DeFi integration trends, and RWA adoption could drive further adoption.

8. YLDS (Figure Markets)

Yield Generation Mechanism: YLDS ties to SOFR minus 0.5%, investing in prime money market funds and short-term securities for ~3.8% yield, SEC-registered for U.S. access. This ensures stability and regulatory compliance, appealing to U.S. investors.

YLDS combines the yield mechanics of traditional money markets with the flexibility of stablecoins—offering U.S. investors a compliant, secure, and income-generating digital dollar alternative. It is a next-gen stablecoin for those who demand both stability and performance, without compromising on regulatory clarity.

YLDS Yield Strategy

YLDS, launched by Figure Markets, is the first SEC-registered, yield-bearing USD stablecoin, native to the Provenance Blockchain. It is designed as a fixed-price, daily-accrual public security, offering regulated yield to U.S. investors—unlike major stablecoins like USDT, which do not share reserve earnings.

YLDS delivers ~3.8% APY, benchmarked against SOFR - 0.5%, with yields backed by a portfolio of prime, short-term securities. Here's the strategy breakdown:

Peg to SOFR Benchmark

Yield is directly tied to the daily SOFR rate, a secure benchmark based on overnight U.S. Treasury repo transactions.

Target yield is calculated as SOFR minus 50bps to cover operations and remain within regulatory limits.

Example: If SOFR = 4.41%, YLDS targets 3.91%.

Allocate Capital to Prime Market Instruments

Reserves are invested in short-term, high-quality securities (e.g., commercial paper, T-bills, CDs)—similar to prime money market funds.

These instruments match the SOFR rate in yield and offer low risk, high liquidity, and stable returns.

Apply Fees for Net Yield

After operational costs (~0.11%), YLDS delivers a net yield of ~3.8% APY to holders.

The fee structure ensures regulatory transparency while maintaining competitiveness in the stablecoin market.

Daily Accrual, Monthly Payout

Interest accrues daily at a rate of ~0.01041% (3.8% / 365), compounding transparently on-chain.

Payouts are made monthly—in USD or YLDS—at a fixed $1 token price, aligning with both DeFi and traditional finance standards.

Potential Catalysts

U.S. regulatory clarity for SEC-registered stablecoins, SOFR rate changes, and traditional finance integration could affect yields.

9. USP (Pi Protocol)

Yield Generation Mechanism: Planned for H2 2025, USP will yield from tokenized RWAs (e.g., U.S. Treasuries), with profits distributed in USI tokens, yield TBD. As a pre-launch project, its mechanism is speculative but aligns with RWA trends.

USP, the forthcoming stablecoin from Pi Protocol—spearheaded by Tether co-founder Reeve Collins—is positioned to reshape how stablecoin holders earn yield. Launching in the second half of 2025 on Ethereum and Solana, USP introduces a decentralized, yield-bearing alternative to traditional stablecoins like USDT, which retain profits centrally. Instead, USP channels profits directly to users through tokenized real-world assets (RWAs), creating a transparent and reward-driven ecosystem.

At the core of USP’s strategy is a diversified, over-collateralized pool of tokenized RWAs. These include short-term U.S. Treasuries, money-market funds, and tokenized insurance products—all deployed via smart contracts for transparency and automation. Over-collateralization ensures that the value of deposited collateral exceeds the value of issued USP, creating a safety buffer to maintain the peg to the U.S. dollar and reducing systemic risk.

The base yield for USP comes from the interest generated by U.S. Treasuries, which have historically yielded between 3% and 5%. In today’s high-interest environment, that figure sits closer to 4–5%, offering a stable and predictable revenue stream. Money-market funds contribute similar returns through investments in short-term, high-quality debt instruments like commercial paper. Meanwhile, the inclusion of tokenized insurance products is expected to generate additional yield through premiums or structured payouts, further diversifying the income sources while maintaining a conservative risk profile.

Users mint USP by depositing eligible collateral into Pi Protocol’s smart contracts. In return, they receive not just the stablecoin, but also USI tokens—yield-bearing assets that reflect the interest earned from the protocol’s underlying investments. USI functions as the distribution mechanism for the protocol’s yield, ensuring that profits flow transparently to participants. The smart contract-driven architecture guarantees that all interactions, valuations, and payouts are trustless and verifiable.

Complementing this dual-token model is the introduction of USPi, a yield-bearing NFT that grants both revenue-sharing rights and governance privileges. Holders of USPi NFTs receive a share of protocol revenues—both from minting activities and RWA yields—and can participate in decisions around collateral management, yield allocation, and ecosystem development. This structure replaces centralized control with community-driven governance, reinforcing the decentralized ethos of the project.

Although final yield figures are still to be confirmed, estimates based on USP’s collateral composition suggest a projected return of around 4–5%, in line with other RWA-backed products like BlackRock’s BUIDL. While USP’s return may not match the high APYs of riskier DeFi tokens, it offers something far more sustainable: a yield powered by real, income-generating financial instruments, fully on-chain, and distributed directly to users.

Potential Catalysts

Launch in H2 2025, RWA adoption trends, and investor interest in new stablecoins could drive adoption.

10. OUSD (Origin Protocol)

Yield Generation Mechanism: OUSD lends USDT, USDC, and DAI on protocols like Aave and Compound, auto-accruing ~2-5% variable yield in wallets. Returns depend on lending rates and market demand, simplifying yield earning for users.

Passive Yield Without Staking

OUSD, launched by Origin Protocol in September 2020, is the first passive, auto-yielding stablecoin, requiring no staking or lockups. Fully backed by USDT, USDC, and DAI, it maintains a 1:1 USD peg while earning 4–7% APY, directly reflected in users’ wallets through automated rebasing.

How Yield is Generated

OUSD deploys its collateral into top-tier DeFi protocols to generate stable, multi-source yield:

Lending Platforms: USDT, USDC, and DAI are supplied to Aave, Compound, and Morpho, earning interest from overcollateralized borrowers. Rates fluctuate based on market dynamics, typically 2–5% APY.

Liquidity Provision: OUSD provides liquidity to Curve’s OUSD-3CRV pool, earning trading fees and CRV rewards, enhanced by Convex. Returns vary with swap volume and Curve incentives.

Daily Aggregation & Protocol Cut: All yield is pooled daily. 90% is distributed to holders; 10% goes to veOGV stakers via protocol buybacks.

Rebasing Mechanism: Yield is auto-compounded daily via rebasing—wallet balances increase proportionally, with no action required by users (EOAs auto-rebase; contracts must opt in).

OUSD is built for effortless DeFi participation, optimizing returns across protocols while maintaining liquidity and composability. Its yield auto-compounds, balances remain usable at all times, and no staking is needed—making it ideal for retail users seeking passive, flexible income in a volatile yield landscape.

Potential Catalysts

DeFi lending growth, Aave/Compound protocol upgrades, and mobile DeFi adoption could boost demand.

Twitter: https://x.com/arndxt_xo/status/1907471355945308596