The State of Yield-Bearing Stablecoins in 2025 (Part 3)

Here’s a breakdown of 5 yield-bearing stablecoins and how they generate returns

🧵👇

Part 1: https://x.com/arndxt_xo/status/1907471355945308596

Part 2: https://x.com/arndxt_xo/status/1909579297578467393

16. USDtb (Ethena Labs)

Summary of Yield Strategy

USDtb, launched by Ethena Labs, yields ~3-5% by allocating 90% of its reserves to BlackRock’s BUIDL fund (Treasuries and cash equivalents), passing stable returns to holders.

Detail of Yield Strategy

USDtb diversifies Ethena’s stablecoin offerings by backing its value with BlackRock’s BUIDL, a tokenized money market fund focused on U.S. Treasuries and cash equivalents. This shift from Ethena’s USDe (which uses crypto hedging) provides a more traditional, fiat-based yield source. The remaining 10% of reserves may be used for operational flexibility, but the core yield comes from BUIDL’s consistent returns, enhanced by cross-chain functionality via LayerZero.

USDtb Yield Strategy – Ethena’s Low-Risk, RWA-Backed Stablecoin

Overview

Launched by Ethena Labs in December 2024, USDtb is a yield-bearing stablecoin pegged to the U.S. dollar. It differs from Ethena’s synthetic USDe by focusing on real-world assets (RWAs)—offering 3–5% APY through interest from U.S. Treasuries and daily auto-accrual, appealing to risk-averse users.

Core Yield Engine: BlackRock’s BUIDL Fund (90%)

USDtb allocates 90% of reserves to BlackRock’s tokenized USD Institutional Digital Liquidity Fund (BUIDL), which invests in:

Short-term U.S. Treasuries

Cash equivalents

Repurchase agreements (repos)

BUIDL’s assets yield a stable 3–5% annually, with the fund distributing returns daily to holders. For example, $1B in BUIDL earning 4.5% APY generates ~$123K in daily interest. This interest flows through to USDtb holders after fees, forming the primary source of passive income.

Liquidity Layer: Stablecoins (10%)

The remaining 10% of reserves are held in USDC and USDT to facilitate redemptions and cross-chain liquidity, especially during off-market hours. These assets are not yield-generating but support operational stability, ensuring USDtb is liquid and always redeemable.

Daily Yield Distribution

Yield is distributed daily, likely via an auto-accrual mechanism (comparable to USDM or USDY). At 4% APY, a holder of 1,000 USDtb would receive ~0.011% daily (1,000 → 1,000.11), compounding to ~1,040 after a year. No manual staking is needed, making it ideal for passive income.

Secondary Yield Source: Cross-Chain Fees (LayerZero)

USDtb functions as an Omnichain Fungible Token (OFT) via LayerZero, enabling seamless transfers across Ethereum, Base, Solana, and Arbitrum. Minor fees (typically 0.1–0.5%) from bridging or swaps contribute additional, variable revenue—estimated at ~0–0.5% APY.

Strategic Role in Ethena Ecosystem

USDtb serves as a stabilizing reserve asset for Ethena’s USDe. In times of negative funding (e.g., bear markets), USDe’s collateral can shift into USDtb to preserve capital and stabilize yields, effectively linking the two stablecoins and improving ecosystem resilience.

Yield Sources and Contributions for USDtb (Ethena Labs)

To quantify the yield for USDtb, we estimate contributions from two primary sources, based on available data and market comparisons:

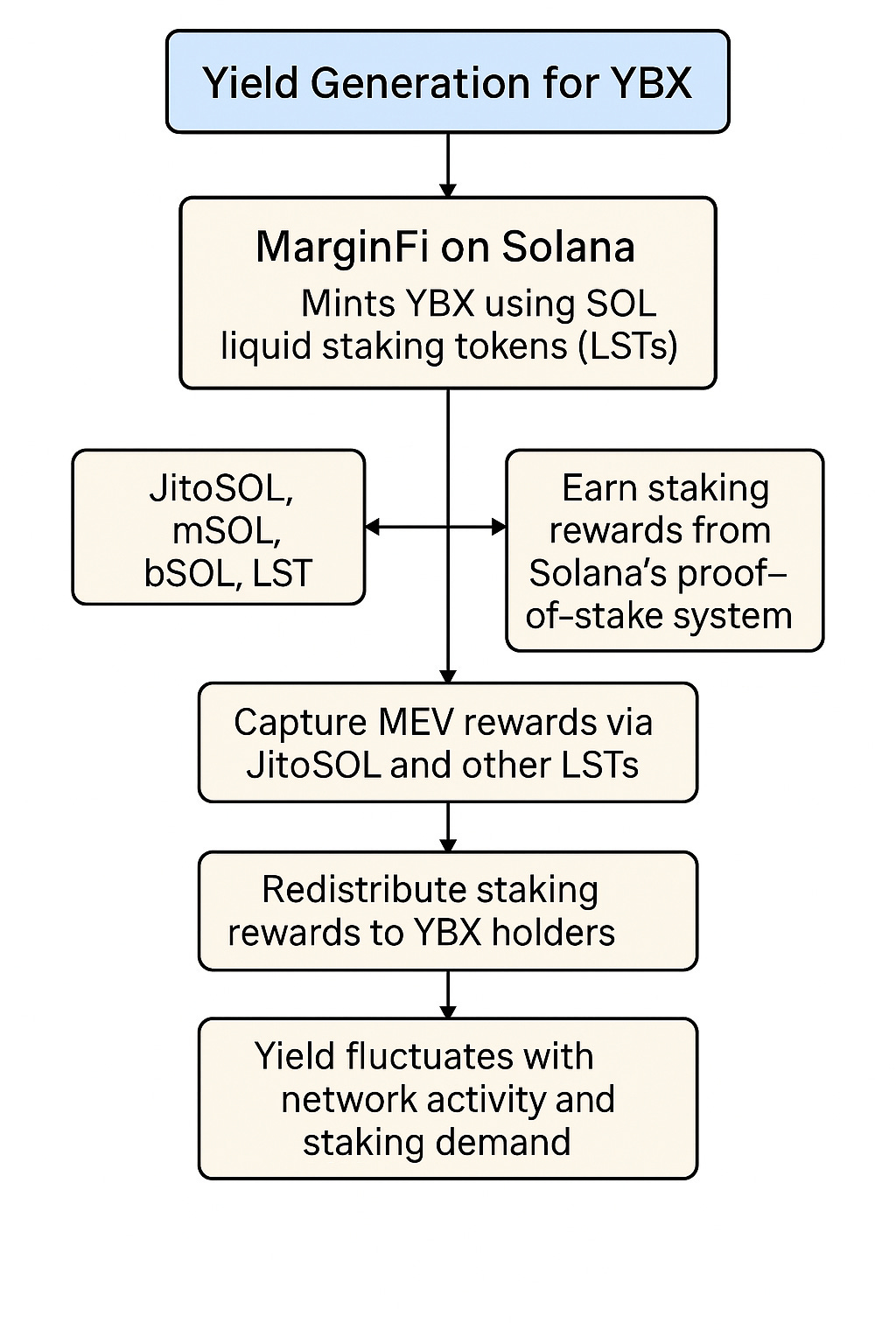

17. YBX (MarginFi)

Summary of Yield Strategy

YBX, from MarginFi on Solana, yields ~4-7% by redirecting staking rewards from SOL derivatives (e.g., JitoSOL, mSOL) to holders, varying with network activity.

Detail of Yield Strategy

MarginFi mints YBX using SOL liquid staking tokens (LSTs) like JitoSOL and mSOL as collateral. These LSTs earn staking rewards (~5-8%) from Solana’s proof-of-stake system, which are then redistributed to YBX holders. The yield fluctuates based on Solana’s network performance and staking demand, offering a high-potential return tied to a fast-growing blockchain ecosystem.

YBX is a soft-pegged USD stablecoin launched by MarginFi, a Solana-based DeFi protocol offering lending, borrowing, and staking. Unlike traditional stablecoins that hoard staking yield, YBX redistributes it to users by tapping into Solana’s proof-of-stake and MEV (Maximal Extractable Value) rewards—creating a composable and passive income stream.

How Yield Is Generated

Collateralization with Yield-Bearing LSTs

Users mint YBX by depositing LSTs like JitoSOL, mSOL, and bSOL. These represent staked SOL, already earning ~5–8% APY via validator rewards.Staking + MEV Rewards

Base rewards come from Solana’s PoS system.

MEV rewards (1–2%) come from validators using Jito’s client—now adopted by 89% of Solana validators.

For example, JitoSOL combines staking + MEV to reach yields ~7.3% APY.

Pooled Rewards & Redistribution

MarginFi collects rewards from all collateralized LSTs, deducts protocol fees (~4%), and redistributes the net yield to YBX holders via an auto-accruing mechanism—no manual claiming needed.Protocol Optimizations

Yield is enhanced through validator rebalancing, fee tuning, and selecting MEV-optimized delegations (e.g., 0% commission validators), contributing an additional ~0–1% APY under ideal network conditions.

Yield Sources and Contributions

To quantify the yield for YBX, we estimate contributions from two primary sources, based on available data and market comparisons:

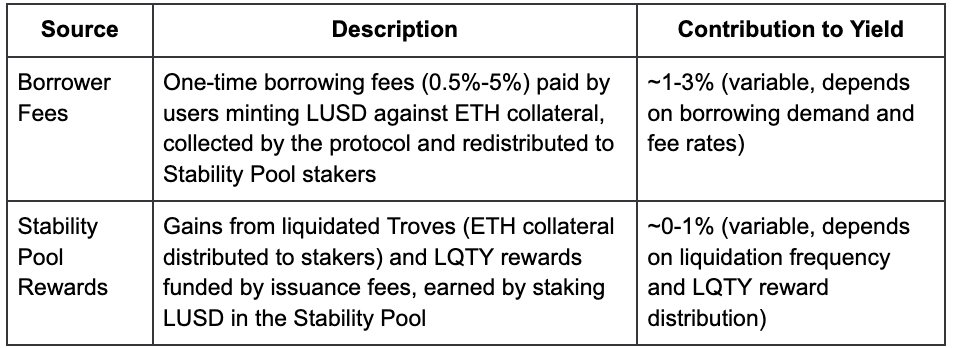

8. LUSD (Liquity)

Summary of Yield Strategy

LUSD yields ~1-3% through lending overcollateralized ETH in Liquity’s decentralized system, with returns driven by borrower demand.

Detail of Yield Strategy

Liquity operates a decentralized lending platform where users mint LUSD by depositing ETH at a high collateral ratio (e.g., 150%). Borrowers pay interest, which is collected by the protocol and distributed to LUSD holders who stake in the Stability Pool. The yield is low due to conservative collateral requirements and depends on lending demand, making it a stable but modest return option.

How LUSD Generates Yield (Step-by-Step)

Yield Range: ~1–3% APY, occasionally higher during liquidation spikes.

1. Minting LUSD with ETH Collateral

Users open “Troves” by depositing ETH (minimum collateral ratio: 110%; typically: 150%+ for safety).

Example: Deposit $1,500 worth of ETH to mint 1,000 LUSD (150% CR).

A one-time borrowing fee (0.5–5%) is applied—no ongoing interest.

These fees are collected in LUSD and partially redistributed to yield-generating mechanisms.

2. Borrower Fees Fund Yield

Borrowing fees vary algorithmically (higher during redemption spikes).

Example: Minting 1,000 LUSD with a 1% fee = 10 LUSD paid.

Fees flow into Liquity’s revenue pool and support the Stability Pool, forming the base yield layer.

3. Staking LUSD in the Stability Pool

LUSD holders can stake in the Stability Pool, which absorbs debt from undercollateralized Troves (CR < 110%).

When a Trove is liquidated:

The Stability Pool burns LUSD equal to the Trove’s debt.

It receives the Trove’s ETH collateral, typically at a discount (e.g., $109 ETH for 100 LUSD).

This provides liquidation rewards—yield for stakers.

4. LQTY Rewards: Bonus Yield Layer

Stakers also earn LQTY, Liquity’s native token, as an incentive.

LQTY is issued with a declining emission curve and can be sold or staked separately.

Adds a variable APY component depending on protocol activity and staking participation.

5. Auto-Accruing, Flexible Rewards

ETH from liquidations is distributed pro rata to LUSD stakers.

Rewards auto-accrue in staked balances—no lock-up, withdraw anytime.

Yield is in ETH (not more LUSD), offering real asset growth.

Yield Sources

To quantify the yield for LUSD, we estimate contributions from two primary sources, based on available data and market comparisons:

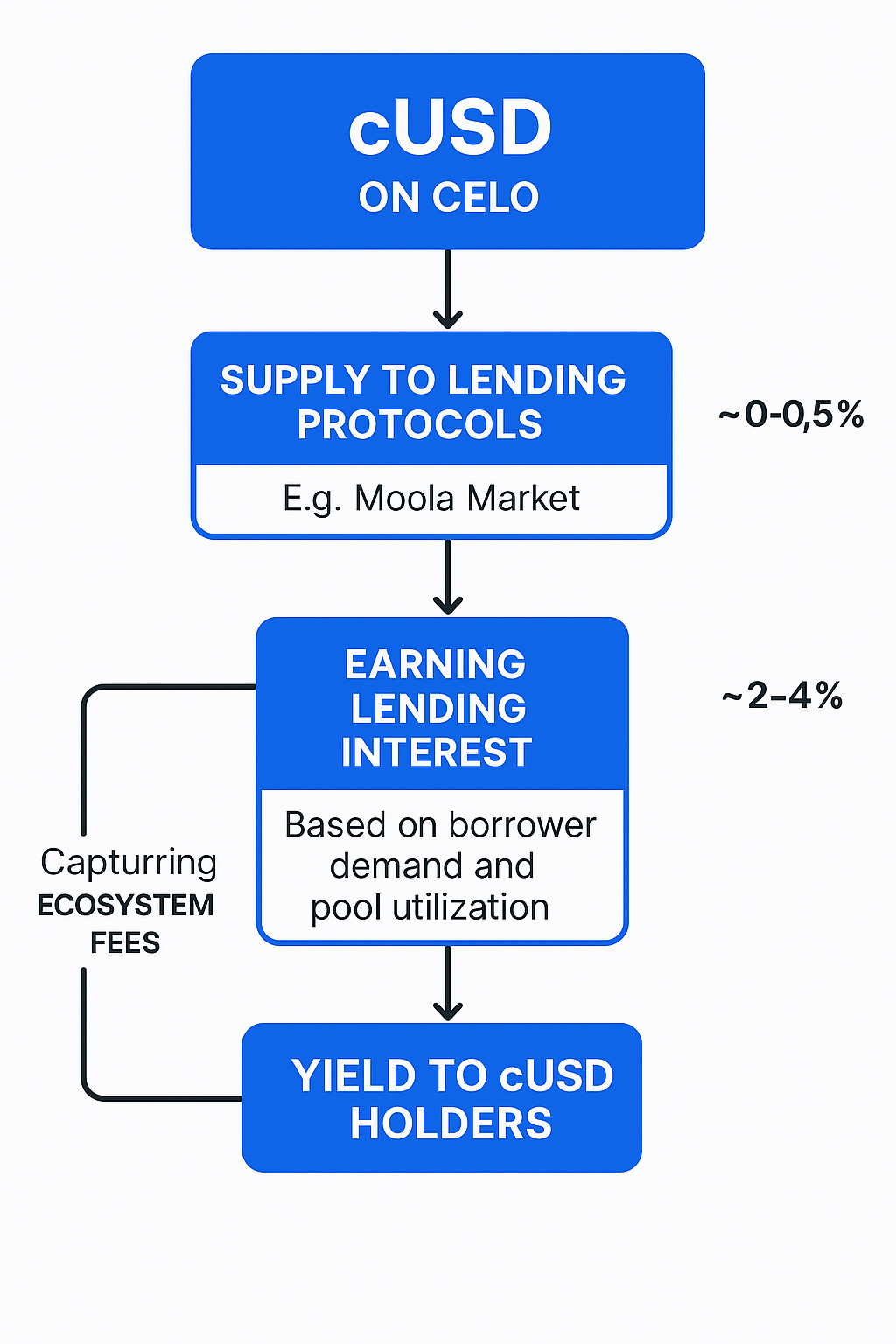

9. cUSD (Celo)

Summary of Yield Strategy

cUSD yields ~2-4% through lending within Celo’s DeFi ecosystem (e.g., Moola Market), with returns tied to mobile-driven adoption and pool utilization.

Detail of Yield Strategy

Celo’s cUSD is designed for mobile-first financial inclusion, and its yield comes from lending protocols like Moola Market. Users supply cUSD to lending pools, earning interest based on borrower demand and pool utilization rates. The yield varies with Celo’s ecosystem growth, particularly in emerging markets where mobile payments drive adoption.

How cUSD Generates Yield

Estimated Yield: ~2–4% APY, depending on borrower demand and mobile ecosystem activity.

1. Lending via Moola Market (Primary Yield Source)

Mechanism: cUSD holders supply tokens to Moola Market, a lending protocol on Celo.

Borrower Demand Drives Rates: Interest is earned when borrowers take out cUSD loans by overcollateralizing with assets like CELO or cEUR.

Utilization-Based Yield:

High utilization (e.g., 80%) → higher yield (~4%)

Low utilization (e.g., 20%) → lower yield (~1%)

Contribution to APY: ~2–4%, dynamically adjusted by pool demand.

2. Network & Ecosystem Fee Capture (Minor Component)

Mechanism: As cUSD is widely used for mobile payments on Celo (e.g., via phone numbers in Valora wallet), transaction fees (paid in CELO or cUSD) accumulate across the network.

Redistribution: These micro-fees contribute to Celo’s reserve or are indirectly recycled into DeFi protocols like Moola, supporting ecosystem liquidity.

Contribution to APY: ~0–0.5%, depending on transaction volume and network growth.

3. Auto-Compounding Interest to cUSD Suppliers

Interest from lending is continuously accrued to suppliers' balances.

Example: At 3% APY, 1,000 cUSD earns ~0.0082 cUSD/day → 1,030 cUSD after 1 year, assuming constant rates.

No lock-up or staking required—users can withdraw at any time, ideal for mobile-first users.

Yield Sources

To quantify the yield for cUSD, we estimate contributions from two primary sources, based on available data and market comparisons:

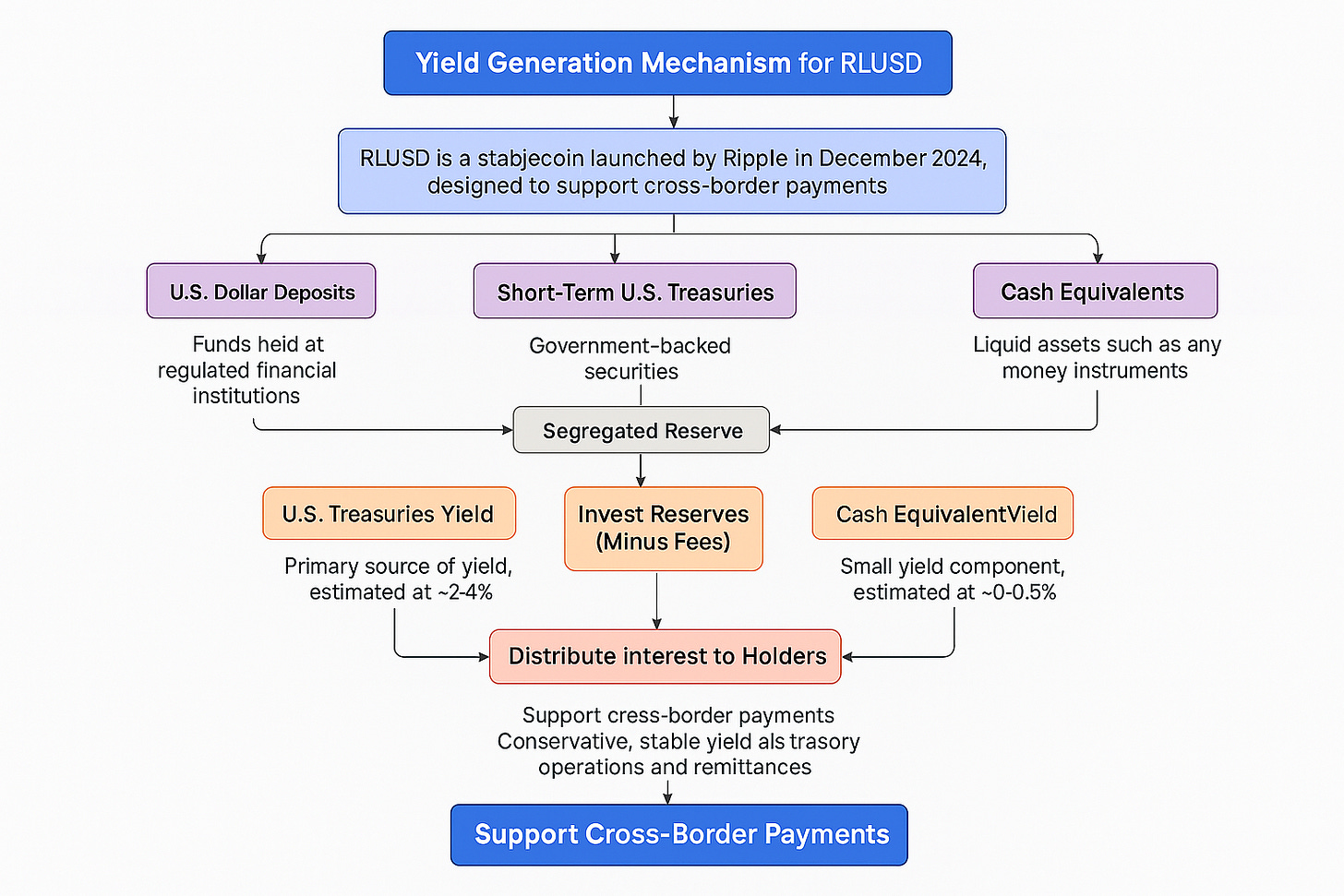

10. RLUSD (Ripple)

Summary of Yield Strategy

RLUSD’s yield (TBD as of April 2025) is expected to come from investing fiat reserves in low-risk assets like U.S. Treasuries, supporting its use in cross-border payments.

Detail of Yield Strategy

Ripple’s RLUSD, launched in December 2024, is backed 1:1 by USD deposits, government bonds, and cash equivalents. While yield specifics are not yet public, it’s likely to follow a model similar to USDP or USDC, where reserves are invested in Treasuries, and interest is distributed to holders. The focus on cross-border payments suggests a conservative, stable yield strategy, with monthly attestations ensuring transparency.

How RLUSD Will Likely Generate Yield

While official yield distribution is TBD, RLUSD’s structure suggests a conservative model, similar to USDP (Paxos) or USDC (Circle). Here's how:

1. Reserve Allocation: U.S. Treasuries (Major Yield Driver)

Assets: Short-term U.S. Treasury bills (e.g., 3–6 months), backed by the U.S. government.

Expected Return: ~4–5% annually, depending on market rates.

Net Yield to Holders: Likely ~2–4% after Ripple’s operational fees.

Example: $100M in T-bills @ 4.5% = $4.5M/year or ~$12.3K/day.

2. Cash Equivalents for Liquidity

Assets: FDIC-insured deposits, money market instruments, short-term commercial paper.

Purpose: Ensure instant redemptions and smooth cross-border transactions.

Returns: ~0–0.5% annually—modest, but essential for liquidity.

3. Yield Distribution to Holders (TBD but Likely Auto-Accruing)

While not yet public, Ripple is expected to pass yield to holders, either:

Daily compounding (like USDM, USDTb)

Or monthly distributions (like Paxos’s USDP)

Projected Example: At 3% APY, 1,000 RLUSD = ~30 RLUSD/year (0.0082/day)

RLUSD’s Role in Cross-Border Finance

Integrated with Ripple Payments, live since April 2025.

Used by iSend, BKK Forex, and other clients for institutional treasury operations.

Dual-chain support on Ethereum and XRP Ledger with plans to expand.Yield complements global remittance use cases by offering low-volatility returns.

Yield Sources

To quantify the yield for RLUSD, we estimate contributions from two primary sources, based on available data and market comparisons:

Twitter: https://x.com/arndxt_xo/status/1915788551243133155