Every time a new chain launches, I hear the same promise: “We’re going to onboard the next billion users.”

We’ve been in this space long enough to know how that story ends.

No one’s cracked the code on real distribution or stickiness until now.

It made me realize that the biggest moat in crypto isn’t faster transactions or cheaper gas fees, it’s distribution.

For the first time, we’re not talking about the hope of onboarding a billion users.

We’re talking about a billion people already sitting behind a door that @TacBuild just unlocked.

And that’s a narrative I’m finally excited to bet on.

Here are the 8 reasons why TAC stands above the rest 👇

1. Where distribution triumphs incentives

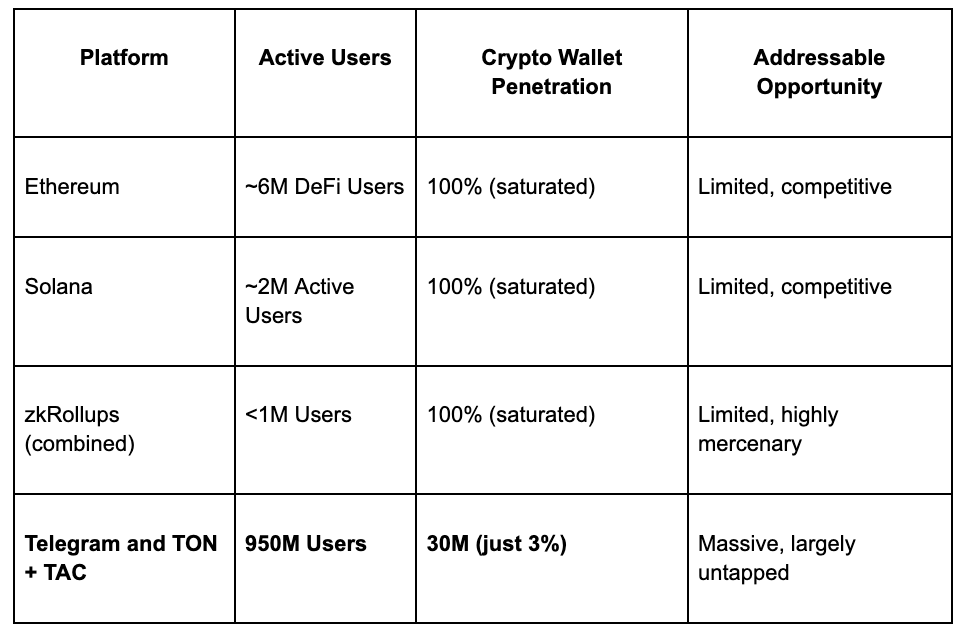

Most liquidity wars are fought over the same ten-million-odd DeFi wallets that hop from one farm to the next. We’ve seen this playbook countless times:

A new chain or roll-up launches.

They offer aggressive yield incentives and airdrops.

The same capital and users rotate in, farm rewards, and exit once emissions slow.

This is the mercenary capital cycle, and it’s a zero-sum game. Chains aren’t onboarding new money and they’re recycling the same 10-15 million DeFi wallets that have existed since 2020.

TAC plugs straight into Telegram’s 1 BILLION users, all of whom already have a TON wallet by default. Even if say, 2-3 % try a Mini App, TAC’s addressable base dwarfs every roll-up combined.

Even a modest 5% conversion of Telegram’s user base to TAC-powered DeFi apps would onboard nearly 50 million new users, more than the entire current global DeFi user base combined.

In a war for attention, distribution is the ultimate force-multiplier.

950 Million Telegram Users: This is the largest captive Web2 user base adjacent to crypto. No other chain or roll-up comes close to this kind of distribution.

30 Million TON Wallet Activations (as of mid-2024): These aren’t just passive users, this represents a rapidly growing crypto-ready user base that already has wallets set up, without the typical onboarding friction.

500 Million Monthly Mini App Users: Telegram’s Mini Apps have already trained hundreds of millions of users to interact with app-like experiences inside Telegram. Crypto protocols integrating through TAC simply become the next layer of these native experiences, without asking users to leave the app or download new wallets

2. Up only TVL as solution for incentive curse

Conventional bridges mint a wrapper token that can leave the moment yields fall.

This is the inevitable flaw of conventional bridges. They mint wrapped assets (IOUs) that can be redeemed and bridged back at any time. While this creates the illusion of high TVL, it’s hollow capital is always just one transaction away from leaving the ecosystem. We’ve seen this play out with countless Layer 2s and alt-L1s: rapid inflows, followed by equally dramatic outflows when incentives dry up.

The TON Adapter V2 works differently: it locks assets natively on TON and executes them on TAC EVM, no synthetic IOUs, no exit ramp. Once liquidity crosses, it belongs to TON’s ecosystem. That single design choice converts mercenary capital into captive economic muscle.

The TON Adapter V2 reverses the curse of mercenary capital:

Native Asset Locking: When ETH, USDC, or BTC derivatives flow into TAC, they’re locked natively on TON. No wrapped tokens are minted on another chain.

No Redemption Path: There’s no easy “exit ramp” back to the originating chain through standard liquidity bridges. This isn’t liquidity passing through—this is liquidity migrating permanently.

Economic Commitment, Not Just Allocation: The moment capital crosses via TAC, it becomes part of the TON economy, accessible to TON-native apps, DEXes, and lending protocols.

3. “Triple-Stack” Reward Yield

Yield farming is no longer just about the highest APR—it’s about the quality and sustainability of that yield. TAC offers layered rewards backed by the strongest assets in crypto.

Here’s how TAC creates a Triple-Stack Security Reward System that makes its yield uniquely attractive and defensible:

First Layer: dPoS from CosmosSDK Validators (TAC EVM L1 Security)

TAC’s execution layer is built on CosmosSDK + EVMOS, using Delegated Proof-of-Stake (dPoS).

LPs can delegate their assets to professional validators securing TAC’s EVM L1, earning base staking rewards from protocol emissions.

This layer provides the foundational security typical of any robust L1—but it’s only the first of three yield sources.

Second Layer: @babylonlabs_io’s BTC Restaking (Bitcoin-Secured Yield)

This is where TAC outclasses most chains. Through Babylon’s BTC restaking module, LPs can restake Bitcoin-native assets like tgBTC, stTON, and tsTON directly into TAC’s security model.

Why is this powerful?

BTC restaking is non-correlated yield—it pays out in BTC-denominated rewards, offering a hedge against ETH and altcoin volatility.

BTC is the most secure and valuable asset in crypto. Restaking it to secure TAC is a signal of high trust and long-term conviction.

LPs earn BTC-based rewards alongside TAC emissions, something no other major chain currently offers at scale.

Third Layer: TON’s Base-Layer Finality (Network-Level Assurance)

Unlike typical rollups or sidechains that rely on optimistic or zk proofs, TAC inherits finality directly from TON’s mainnet.

Every transaction and asset lock has TON’s native finality guarantees, eliminating common exit fraud or bridge vulnerability risks.

This third layer gives institutional-grade LPs the confidence to deploy sizeable capital without worrying about weak consensus models.

Why This Is a Nightmare for Competing Chains

Competing chains typically offer inflationary yield only, they must constantly inflate their token supply to maintain yields, leading to long-term sell pressure.

TAC, however, supplements its token emissions with Bitcoin-backed yield, making its rewards harder to outbid without blowing up a rival’s token economy.

LPs aren’t just chasing numbers—they’re chasing risk-adjusted, sustainable returns, and TAC’s triple-stack model delivers exactly that.

4. Instant Product-Market Fit for Builders

That means proven EVM dApps, DEXes, money markets, games, can migrate in days, bringing their liquidity communities with them. The faster good apps land, the faster sticky TVL follows.

In most ecosystems, entering a new chain requires costly rewrites, new architecture decisions, and a lengthy go-to-market cycle.

With TAC, that entire friction layer disappears.

As a developer I don’t rewrite Solidity for a new VM. I:

Deploy existing contracts on TAC EVM L1.

Wrap a TVM front-end with the JavaScript tac-sdk.

Connect a Proxy App and I’m live in Telegram.

How the Fast-Track Deployment Works

Deploy Your Existing EVM Contracts to TAC EVM L1

TAC’s EVM L1 is fully compatible with existing Solidity code.

Built on CosmosSDK + EVMOS, it supports all your standard EVM tools (Hardhat, Foundry, Remix).

Wrap a TVM Front-End Using the tac-sdk (JavaScript)

No need to dive into TVM’s complexities.

The tac-sdk lets you build a lightweight frontend that communicates with TON wallets and directly interacts with your EVM backend through the TON Adapter.

Your dApp instantly becomes a Telegram MiniApp, accessible to 1B+ users through a familiar chat interface.

Deploy a Proxy App to Bridge Communication

The Proxy App acts as the middleware connecting your EVM smart contracts with TON’s user-facing layer.

It handles all message passing, smart contract calls, and result propagation without requiring you to touch the underlying infrastructure.

5. The Yield API Supercharges Capital Velocity

Once funds are inside TON, the Yield API lets any Mini App embed “deposit-and-earn” features with a single middleware call. Liquidity is recycled through strategies that keep fees (and users) circulating locally. High velocity equals higher real yield, which, in turn, strengthens the moat.

How the Yield API Works

It’s a plug-and-play middleware layer that allows any Telegram MiniApp to integrate DeFi yield strategies with a single API call.

No need for MiniApp developers to manage complex DeFi logic, yield aggregation, or on-chain strategy building.

Users can interact with financial primitives—staking, lending, liquidity provision—natively inside the Telegram experience.

In simple terms: Users play a game, tip a creator, or use a financial Mini App and behind the scenes, their assets earns yield.

Ongoing via Embedded Finance

High Velocity = Stronger Real Yield

When funds flow continuously through lending markets, DEXs, and staking, they generate real organic yield, not just protocol handouts.High Velocity = Higher Protocol Revenue

Every transaction, swap, or strategy execution means more fees captured, creating sustainable revenue streams for TAC and the apps built on it.High Velocity = Stronger Retention

As users earn passively through apps they already use every day, they’re less likely to exit the ecosystem.

6. Retention-first incentive model

TAC’s pre-mainnet vaults attracted $150 million in two weeks, with rewards that vest only if deposits stay through mainnet. Momentum matters in wars; TAC has already proven it can mobilise capital fast and make it stick.

Key Results from The Summoning Campaign:

$570 Million+ in TVL in Just a month

Retention-First Incentive Design

Unlike traditional liquidity mining, where rewards can be farmed and dumped instantly, TAC structured The Summoning so that rewards only vest if deposits stay through mainnet.No quick in-and-out yield games.

Participants were directly incentivized to become long-term stakeholders, not mercenary farmers.

Most Chains Buy Attention; TAC Rewards Loyalty.

By making liquidity stick before even launching, TAC has already secured a base of committed capital that will fuel the ecosystem’s growth post-mainnet.This Is How Real Economic Moats Are Built.

High-velocity, locked-in capital means dApps have immediate access to deep liquidity pools, driving better execution, higher fee generation, and more attractive opportunities for new users and LPs alike.

7. Roadmap Focused on TVL, Not Hype

Every milestone is tied to deeper liquidity or faster user acquisition—no vanity tech for its own sake.

8. Cost of Attack Is Prohibitively High

For a rival chain to pry capital away, it must:

Match or beat TAC’s yields and

Replicate Telegram’s distribution moat and

Offer equal or better security guarantees.

Doing all three simultaneously is a budget-draining three-front war.

My Closing Conviction

TAC turns TON into a liquidity blackhole by combining:

A billion-user on-ramp,

A one-way bridge that anchors assets, and

A reward stack strong enough for institutions yet attractive to retail.

That’s why I’m convinced TAC will be making TON the place where capital arrives, deploys, and never needs to leave.

At the end of the day, this isn’t just about who has the best tech stack or the biggest incentive program. It’s about who can build a real economic moat, where both capital and users not only arrive but stay.

TAC gets this.

While other chains fight over the same pool of DeFi whales and recycled liquidity, TAC went straight to the source: distribution at scale. With a direct line into Telegram’s one billion users and a system designed to lock in liquidity, it’s playing a game no one else can even enter, let alone win.

That’s why I’m convinced TAC will be the darkhorse that turns TON into crypto’s biggest liquidity sink.

In the liquidity wars, attention wins battles.

For distribution and stickiness, TAC made several moves ahead.