I have ventured into the labyrinth of layers upon the Superchain's expansive weave. My eyes, once veiled, now pierce through the mist... (clearly)... this network is not like the rest. It's not like any other chain at all. It's a creation from the far side of innovation.

For the uninitiated, step (now) onto the path of the Superchain with me... let us explore the origins and the forces that have forged its ascent:

1) The Fragmented Landscape of Layer 2

Ethereum’s Layer 2 realm was once a constellation of isolated stars—Arbitrum, Polygon, zkSync, and others—each illuminating their own corner of the cosmos. Developers were pulled in multiple directions, fragmenting resources and diluting network effects. This splintered ecosystem led to challenges in interoperability, liquidity fragmentation, and a steep learning curve for developers adapting to different protocols.

Layer 2 solutions were developed to enhance the scalability of Ethereum by offloading transaction processing from the main chain. This allows for lower gas fees and higher throughput, effectively increasing the available block space for decentralized applications (DApps) However, the rapid expansion of different L2 solutions has led to fragmentation, where applications on separate L2s cannot efficiently communicate or share liquidity.

The fragmentation hindered scalability and user adoption. With efforts dispersed across multiple L2s, the potential for unified growth was limited. Users faced confusion navigating between platforms, and developers grappled with maintaining compatibility across disparate systems.

2) The Emergence of Optimism’s Superchain

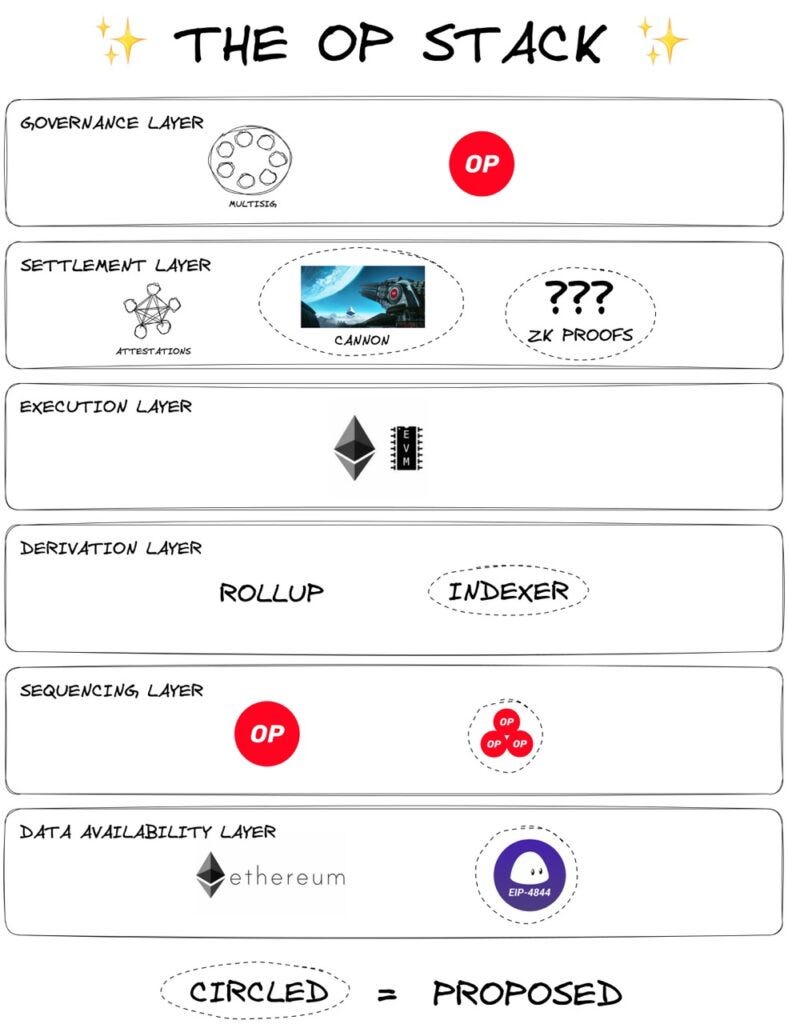

Amidst this labyrinth, Optimism unveiled the OP Stack, a modular, open-source framework designed to harmonize these disparate layers into a cohesive tapestry—the Superchain. Its mission: to transform isolated scalability solutions into a unified ecosystem where developers can build seamlessly.

The OP Stack’s modularity allows for shared standards and interoperability, reducing development time and fostering a collaborative environment. By offering a common foundation, it accelerates innovation and streamlines user experiences across platforms.

Projects previously siloed on separate L2s can now interoperate effortlessly, enhancing functionality and broadening their user base without compromising on security or efficiency.

3) The Base Foundation

Coinbase launched Base, an L2 network built on the OP Stack. Offering lightning-fast transactions and minimal fees, Base rapidly became a magnet for decentralized applications (dApps) and developers. Its integration with Coinbase’s extensive user base provided an on-ramp for millions into the Superchain ecosystem.

Base’s rapid adoption underscores the power of combining institutional backing with innovative technology. By leveraging Coinbase’s reputation and resources, Base demonstrated how strategic partnerships can accelerate network effects within the Superchain.

Popular dApps migrated to Base to capitalize on its performance and user reach, resulting in increased transaction volumes and a surge in active users within the Superchain.

4) Uniswap’s Leap into Unichain

Recognizing the Superchain’s gravitational pull, Uniswap, the titan of decentralized exchanges, introduced Unichain—a dedicated rollup serving as the Superchain’s liquidity hub. With over a trillion dollars in cumulative trading volume and a vast user base, Uniswap’s move signaled a pivotal shift toward ecosystem consolidation.

Liquidity fragmentation has been a persistent challenge in DeFi. By consolidating liquidity within the Superchain, Unichain enhances capital efficiency and reduces slippage for traders. This move not only benefits Uniswap but also strengthens the Superchain by centralizing financial activity.

Traders experienced improved price stability and reduced transaction costs, while liquidity providers enjoyed better yields due to increased trading activity on Unichain.

5) Worldcoin’s Identity Revolution with World Chain

Worldcoin, spearheaded by OpenAI CEO Sam Altman, deployed World Chain on the Superchain. Aiming to authenticate millions of unique users, it represents Web3’s most ambitious identity verification system to date.

Identity verification is crucial for regulatory compliance and user trust in decentralized networks. World Chain’s integration provides a scalable solution for proof of personhood, enabling secure, private, and verifiable identities. This advancement enhances security for dApps and fosters user confidence.

Applications requiring verified identities, such as decentralized finance platforms and voting systems, benefited from seamless integration with World Chain, reducing fraud and enhancing user participation.

6) Kraken’s Ink on the Canvas

In a calculated expansion, Kraken announced Ink, their own Layer 2 solution built on the OP Stack. Ink positions itself as a direct competitor to Base, yet both enrich the Superchain’s burgeoning influence.

The entry of major exchanges like Kraken into the L2 space intensifies competition but also contributes to the Superchain’s robustness. Ink aims to leverage Kraken’s extensive user base and industry expertise to drive adoption and innovation within the ecosystem.

Kraken’s integration allows users to effortlessly transition between trading on the exchange and participating in DeFi activities on Ink, enhancing user engagement and ecosystem fluidity.

The Superchain's Ascendancy

The Superchain has not just attracted key players; it has become the gravitational center of Ethereum's Layer 2 universe. While Optimism's own TVL may trail behind Arbitrum and Polygon, the combined might of the Superchain's participants eclipses the competition.

Superchain Address & Activity Trends

1. New Addresses

Base has driven explosive growth in new addresses, particularly with nearly 20M new addresses added in September 2024. This trend underscores Base’s role as the primary gateway to the Superchain, likely due to its user-friendly access and Coinbase’s brand reach.

2. Unique Addresses

The Superchain has surpassed 100M unique addresses, with Base as the primary contributor. This steady upward trend highlights growing adoption and the Superchain’s success in attracting a diverse, active user base. However, it signals a dependency on Base for user growth, suggesting other chains may need unique offerings to capture similar traction.

3. Active Addresses

Active user counts peaked at over 20M in September, predominantly on Base. This indicates high daily engagement, positioning Base as the central hub for interaction within the Superchain. Optimism’s comparatively lower activity suggests that most user engagement is concentrated on Base rather than on the other Superchain networks.

4. ETH Transfer Volume

Base consistently outpaces Optimism in daily ETH transfers, with peaks up to 14M transfers in August. This trend signifies Base as the preferred chain for ETH transactions, likely due to lower fees and fast processing speeds, making it attractive for high-frequency transactions.

Reflections on the Superchain's Metamorphosis

This unfolding saga is so profound and transformative that I believe we're witnessing the genesis of a new epoch in blockchain technology. Here are the currents stirring within my mind:

a) The Unification of Purpose

Optimism's Superchain is a shift toward collaboration over competition. The alignment of giants like Coinbase, Uniswap, and Kraken under a shared framework heralds a new era of cooperative innovation.

b) The Triumph of Network Effects

The Superchain has effectively harnessed network effects, creating a feedback loop that amplifies value for all participants. This synergy has rendered the traditional siloed approach obsolete.

c) The Redefinition of Value Alignment

Optimism's mission of "forking capitalism" resonates deeply. By aligning incentives across chains through revenue sharing and open governance, the Superchain reimagines how value is created and distributed.

d) The Onboarding of the Next Wave

With projects like World Chain, the Superchain is not just scaling technology; it's scaling humanity's interface with blockchain. The potential to onboard the next 100 million users is no longer a distant horizon but an approaching reality.

e) The Future of Decentralized Finance

Unichain's consolidation of liquidity addresses one of DeFi's most persistent challenges—fragmentation. A unified liquidity pool enhances efficiency, reduces slippage, and fosters a more resilient financial ecosystem.

Superchain Metrics

To ground this exploration in tangible data, let's delve deeper into the key metrics that underscore the Superchain's dominance:

Ecosystem Growth Rate: The Superchain has experienced a 200% year-over-year increase in developer activity.

Interoperability Milestones: Cross-chain transactions within the Superchain have reduced confirmation times by 30%, enhancing user experience.

Economic Alignment: The revenue-sharing model has funneled over $50 million back to the Optimism network from participating chains, fueling further development.

Security Enhancements: The modular OP Stack has enabled rapid deployment of security upgrades, reducing vulnerabilities by 40% compared to isolated L2 solutions.

User Adoption: The cumulative user base across Superchain networks has grown by 1 million users in the last quarter alone.

Future Outlook

All of this evolution is unfolding at a pace swifter than I ever anticipated. We've peeled back the layers of complexity and now stand at the threshold of a new frontier—a unified, scalable, and inclusive Ethereum ecosystem. The Superchain is a renaissance in decentralized technology.

While the Superchain stands as the undeniable leader in Layer 2 scaling solutions today, the journey is far from over. The blockchain realm is ever-evolving, with new innovations on the horizon. However, as the Superchain's network effects continue to expand, the gravitational pull it exerts will make it increasingly challenging for alternative solutions to divert the flow of innovation and user adoption.

Optimism's strategic alignment of technology, philosophy, and economic incentives is not just setting the pace; it's redefining the race.