$PENDLE latest yield curves tell us how the market values flexibility vs. predictability and where capital is making its macro bets.

The divergence between stablecoin and ETH curves says alot about is more about opportunity cost, structural scarcity, and forward expectations.

3 things I would look at in this market👇

1. Stablecoins: Liquidity as a Call Option on the Future

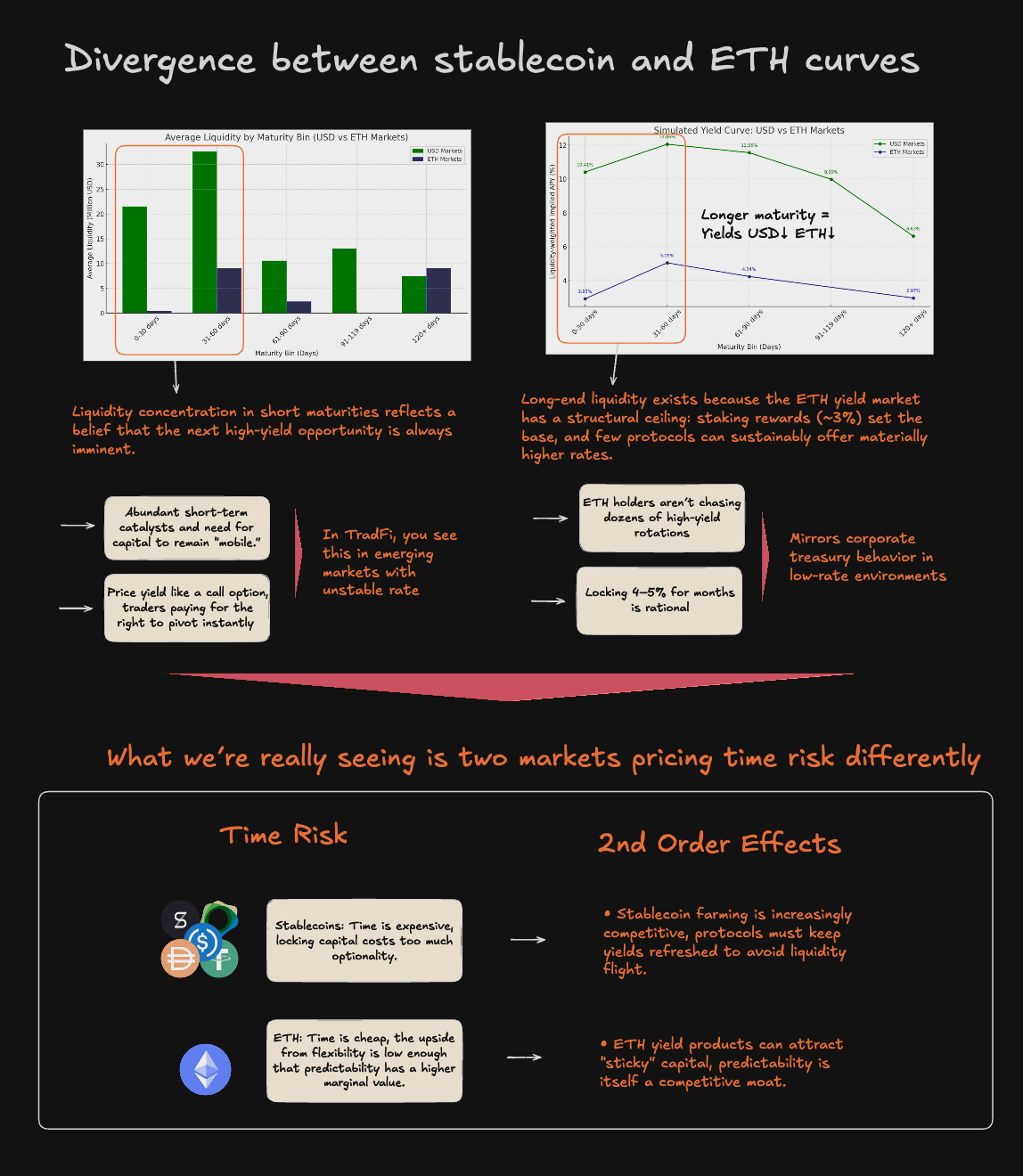

Stablecoin yields spike in the 31–60 day range (~12% APY) but decay rapidly after. Liquidity concentration in short maturities reflects a belief that the next high-yield opportunity is always imminent.

The underlying signal:

• Abundant short-term catalysts: from incentive programs to new protocol launches, create a dynamic where yield is transient and capital must remain “mobile.”

• The market is effectively pricing yield like a call option: traders are paying (in foregone long-term stability) for the right to pivot instantly when the next airdrop, farm, or liquidity appears.

In TradFi, you see this in emerging markets with unstable rate, investors won’t lock duration when the opportunity curve is steep but volatile.

2. ETH: Locking Against Yield Scarcity

ETH yields are flatter, peaking at ~5% APY in 31–60 days and holding steady out to 120+ days. Long-end liquidity exists because the ETH yield market has a structural ceiling: staking rewards (~3%) set the base, and few protocols can sustainably offer materially higher rates.

The underlying signal:

• ETH holders aren’t chasing dozens of high-yield rotations: there aren’t enough of them.

• Locking 4–5% for months is rational when upside surprise is low and principal asset appreciation is the larger bet.

This mirrors corporate treasury behavior in low-rate environments. when the opportunity set is thin, even marginally higher long-term rates are worth locking.

3. Diverging Risk & Liquidity Premiums

What we’re really seeing is two markets pricing time risk differently:

• Stablecoins: Time is expensive, locking capital costs too much optionality.

• ETH: Time is cheap, the upside from flexibility is low enough that predictability has a higher marginal value.

This split has second-order effects:

• Stablecoin farming is increasingly competitive, protocols must keep yields refreshed to avoid liquidity flight.

• ETH yield products can attract “sticky” capital, predictability is itself a competitive moat.

Bottom Line:

@pendle_fi curves are a live dashboard of DeFi’s liquidity psychology. Stablecoin markets are playing a short-dated options game, while ETH markets are making longer-term fixed-income bets in an ecosystem where the rate ceiling is known.

That divergence is both a reflection of current market structure and a predictor of where capital will and won’t stick in the next cycle.