Every stablecoin is doing the same thing—T-bills, predictable, boring.

An (un)usual) stablecoin paradiagm that channels 100% of protocol revenue straight to token holders.

This is a first-ever to seriously align token value with real cash flow. 👇🧵

This design goes beyond inflated APYs, focusing on sustainable, user-aligned growth. It’s a stablecoin model built for long-term viability, rewarding early participation while managing inflation through a dynamic emission structure.

Inspired by @2lambro podcast here by

https://x.com/2lambro/status/1849113503615082702

https://x.com/ManoppoMarco/status/1848750369243074722

Dive in how @usualmoney approach this new landscape👇

My Key Takeaways

Based on what I've seen, Usual Money is addressing critical gaps in the stablecoin market. Here are my key takeaways:

Transparency is Non-Negotiable: Projects should prioritize on-chain transparency to build trust.

Align Incentives with Users: Turning users into stakeholders can drive long-term engagement and success.

Embrace Collective Ownership: Sharing revenue and governance fosters a stronger community and aligns with DeFi principles.

Usual Money Identifies the Core Issue: Misalignment in Existing Stablecoins

One thing that they've noticed is that while stablecoins like USDT and USDC have become essential for liquidity and trading, they often lack transparency and decentralization.

This misalignment with the core principles of blockchain technology has been a persistent concern. Users are essentially placing trust in centralized entities, which runs counter to the decentralized ethos that attracted many of us to crypto in the first place.

Stablecoins like USDT (Tether) and USDC (USD Coin) have become crucial components of the crypto ecosystem. They facilitate billions of dollars in daily transactions, providing a stable value peg to the US dollar and acting as a bridge between volatile crypto assets and traditional finance. However, this central role comes with significant trade-offs, particularly in transparency and decentralization—issues that go against the original values of blockchain technology.

1. Transparency Issues:

Traditional stablecoins like USDT and USDC are issued by centralized entities—Tether Ltd. for USDT and Circle for USDC. These entities maintain reserves to back the value of the stablecoin, typically in the form of cash, commercial paper, or other financial assets.

The challenge arises because the details of these reserves are often not fully transparent. Users must trust that the issuing entities maintain sufficient reserves and that those reserves are liquid enough to redeem their holdings at any given time.

Historically, questions around Tether’s reserves have fueled skepticism, with periodic reports attempting to clarify their asset composition. Even Circle’s regular attestations of USDC’s reserves require users to take the reports at face value, relying on third-party audits and assurances.

In a space built on principles of transparency and verifiability, the opacity around how reserves are managed contradicts what many users expect from blockchain-based assets.

2. Centralized Control and Single Points of Failure:

USDT and USDC are centralized by design. While this allows for efficiency in issuance and management, it also concentrates control in the hands of a few entities. These issuers have the power to freeze or blacklist specific accounts and transactions, which can be seen as a breach of the decentralized ethos.

For instance, during regulatory crackdowns or legal disputes, both USDT and USDC issuers have complied with government orders to freeze assets. While this is understandable from a regulatory compliance perspective, it clashes with the expectation of censorship resistance that many crypto enthusiasts value.

The fact that a centralized entity can decide to freeze funds at will introduces a single point of failure—if the issuing entity were to face insolvency, regulatory action, or technical issues, it could directly impact the value and liquidity of the stablecoin.

3. Trust in Centralized Entities vs. Trustless Systems:

One of the foundational principles of blockchain is the ability to operate trustlessly, meaning users do not need to rely on a central authority. Bitcoin, for example, allows users to verify transactions and balances without needing to trust a third party.

However, with centralized stablecoins, users must trust the issuer to maintain sufficient reserves and act in good faith. This introduces an element of counterparty risk, as the stablecoin’s value is directly tied to the issuer’s management of reserves.

This model stands in contrast to decentralized finance (DeFi) projects, which aim to remove intermediaries and allow for greater user autonomy. Many in the crypto community view centralized stablecoins as a necessary but imperfect bridge to traditional finance rather than a long-term solution.

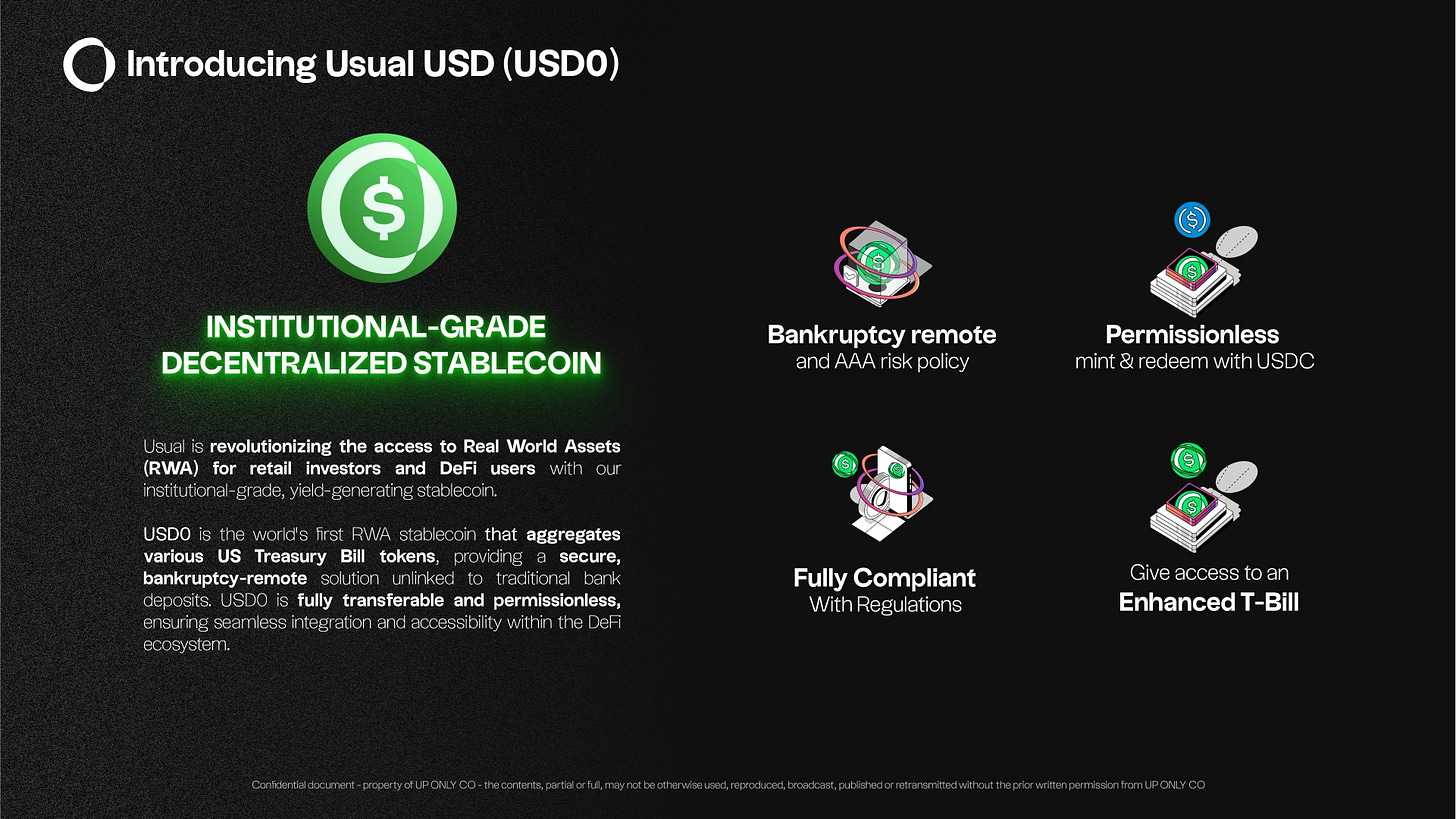

Usual Introduces USD₀, A Transparent and Decentralized Stablecoin

Usual Money is tackling this issue head-on with their stablecoin, USD₀. What stands out is that USD₀ is fully backed by on-chain collateral in the form of cash equivalents. By keeping the collateral transparent and accessible on the blockchain, they're removing the opacity that plagues other stablecoins.

Usual Money seeks to address these misalignments by introducing a model that is both transparent and decentralized:

On-Chain Transparency with USD₀

Usual Money’s stablecoin, USD₀, is backed by on-chain collateral. This means that users can verify the backing of their stablecoin directly on the blockchain, providing a level of transparency that is not possible with USDT or USDC.

This approach aligns with the ideals of trustless verification. Users can see for themselves the assets backing USD₀, reducing the need to place blind trust in an issuer’s claims.

Decentralized Governance

Usual Money emphasizes community ownership and decentralized governance through its USD₀⁺⁺ model. When users stake their USD₀, they earn governance tokens that grant them a say in how the protocol is managed.

This shifts power away from a single centralized entity and distributes it among users, aligning with the decentralized ethos that many in the crypto space value. It also ensures that decisions about the protocol’s evolution and risk management are made collectively, rather than by a few stakeholders.

Aligning Incentives with the Community

By redistributing revenue back to the DAO’s treasury and providing governance rights to users, Usual Money creates a system where the benefits of growth are shared collectively.

This stands in contrast to centralized stablecoins, where profits from reserves typically go to the issuing company rather than the user base. Usual Money’s model aims to create a more equitable distribution of value and aligns incentives between the protocol and its users.

The USD₀⁺⁺ Mechanism Adds Value Beyond Stability

But Usual Money doesn't stop at just providing a stablecoin. They've introduced USD₀⁺⁺, a yield-bearing version of USD₀. When users stake their USD₀, they receive USD₀⁺⁺ along with governance tokens linked to the protocol's future revenue.

How USD₀⁺⁺ Works

USD₀⁺⁺ is a product that allows users to earn yield on their staked USD₀. By staking USD₀, users receive USD₀⁺⁺ tokens, which represent their stake in the system and entitle them to a share of the protocol’s future revenue. Unlike some other yield-generating stablecoins, which often direct yield towards centralized entities or pass it along in the form of interest, USD₀⁺⁺ is part of a broader system designed to create alignment between users and the protocol itself.

This structure encourages users to take an active stake in the ecosystem’s growth, turning them from passive holders into stakeholders with real skin in the game.

TLDR: This is a clever way to align incentives:

Economic Alignment: Users become stakeholders with a vested interest in the protocol's success.

Collective Ownership: By distributing governance tokens, Usual Money fosters a sense of community and shared purpose.

Economic Alignment: Turning Users into Stakeholders

Participation in Protocol Revenue

By staking USD₀ and receiving USD₀⁺⁺, users earn governance tokens that are tied directly to the revenue generated by the protocol. This revenue might come from transaction fees, interest earned on collateral, or other revenue-generating activities undertaken by Usual Money’s ecosystem.

This is key because it means users aren’t just earning a fixed interest rate. Instead, their returns are intrinsically linked to the overall financial health and growth of the protocol. If Usual Money does well—attracting more users, increasing transaction volumes, or expanding its services—the value of these governance tokens and the yields users earn could rise accordingly.

Incentive to Grow and Protect the Ecosystem

When users become stakeholders, their interests become closely aligned with the protocol’s success. If the protocol’s revenue streams grow, their earnings grow. If the protocol faces risks or threats, users have a direct incentive to engage in governance and decision-making to protect and enhance the ecosystem.

This dynamic encourages a level of engagement and alignment that’s often missing in projects where users are only motivated by short-term yield farming opportunities. Instead of simply chasing the highest interest rates, users of USD₀⁺⁺ have a reason to care about the protocol’s long-term sustainability and growth.

Reduces ‘Mercenary Capital’ Risks

One challenge many DeFi protocols face is the problem of ‘mercenary capital’—users who jump from one project to another in search of the highest short-term yields. These users often leave as quickly as they arrive, leading to volatility in the protocol’s total value locked (TVL) and making it harder to build a stable foundation.

By offering governance tokens that represent a share in the protocol’s future revenue, Usual Money encourages users to stay invested for the long haul. The value of holding USD₀⁺⁺ goes beyond just immediate yield; it includes a share in the protocol’s governance and a stake in its future earnings, creating a stronger incentive for loyalty.

Collective Ownership: Building a Community with Skin in the Game

Distribution of Governance Tokens

As users stake USD₀ and earn USD₀⁺⁺, they accumulate governance tokens. These tokens come with real voting power that allows users to have a say in the direction of the protocol.

This means decisions around changes to the protocol, allocation of reserves, or potential expansions into new markets are guided by those who hold governance tokens—essentially, the users who are directly invested in the protocol’s success. It shifts power away from a small team or centralized entity and spreads it across a diverse community of participants.

Strengthening Community Engagement

The distribution of governance power is a powerful way to create a sense of shared ownership and community. When users know their voices can directly impact the protocol’s future, it fosters a deeper connection to the ecosystem.

This sense of ownership can translate into a more active and engaged community—one that’s not just passively using the product, but actively working to improve it. Communities with shared interests in governance decisions can be more resilient and adaptive, responding quickly to market changes and potential risks.

Aligning Value Capture with Value Creation

Traditional stablecoins like USDC or USDT are typically structured in a way where any revenue from collateral management is captured by the centralized issuer. In contrast, Usual Money’s model with USD₀⁺⁺ ensures that revenue flows back to the users themselves.

This distribution of value means that users are rewarded not just for providing liquidity, but for being active participants in the ecosystem’s growth. The more successful the protocol, the more valuable the governance tokens become, creating a virtuous cycle where users’ interests are aligned with expanding the protocol’s reach and capabilities.

Usual Creates a Banking Model in DeFi

What really intrigues me is how Usual Money is essentially creating a decentralized version of a commercial bank or asset manager. All revenue generated from the collateral is funneled back into the DAO's treasury, which is collectively owned by the users.

Usual Money’s approach effectively transforms the traditional banking model into a decentralized framework, resembling a blend between a commercial bank and an asset manager—but with a crucial difference.

Unlike centralized entities, where revenue flows to a select group of shareholders,

Usual Money channels all revenue generated from its collateral directly into the DAO’s treasury.

This treasury is owned and governed collectively by the community of users, ensuring that the financial benefits are distributed among those who actively contribute to the protocol’s ecosystem.

This model aligns user incentives with the protocol’s growth, creating a system where participants are not just customers, but active stakeholders. By eliminating intermediaries and redirecting revenue back to the users, Usual Money aims to build a more equitable financial ecosystem, fostering both user engagement and long-term sustainability.

Final Thoughts

I'm optimistic about Usual Money's potential impact on the DeFi landscape. Their approach could set a new standard for how stablecoins operate and how value is distributed among users.