Massive potential for on-chain perps

CEXes like @binance have dominated trading activities

AMMs like @Uniswap propelled DeFi to new heights in 2020

Why I think perps will lead the glory into BULL for crypto 🧵👇

The emergence of DeFi has introduced new ways to trade and speculate on crypto assets.

As we enter a new cycle, the market is looking for the next big driver of speculation and trading activity.

One potential candidate is on-chain perpetual contracts, also known as perps.

Perpetuals allow traders to speculate on the future price of an asset without expiry dates.

They have become immensely popular on CEXs as a way to get leverage on both long and short positions.

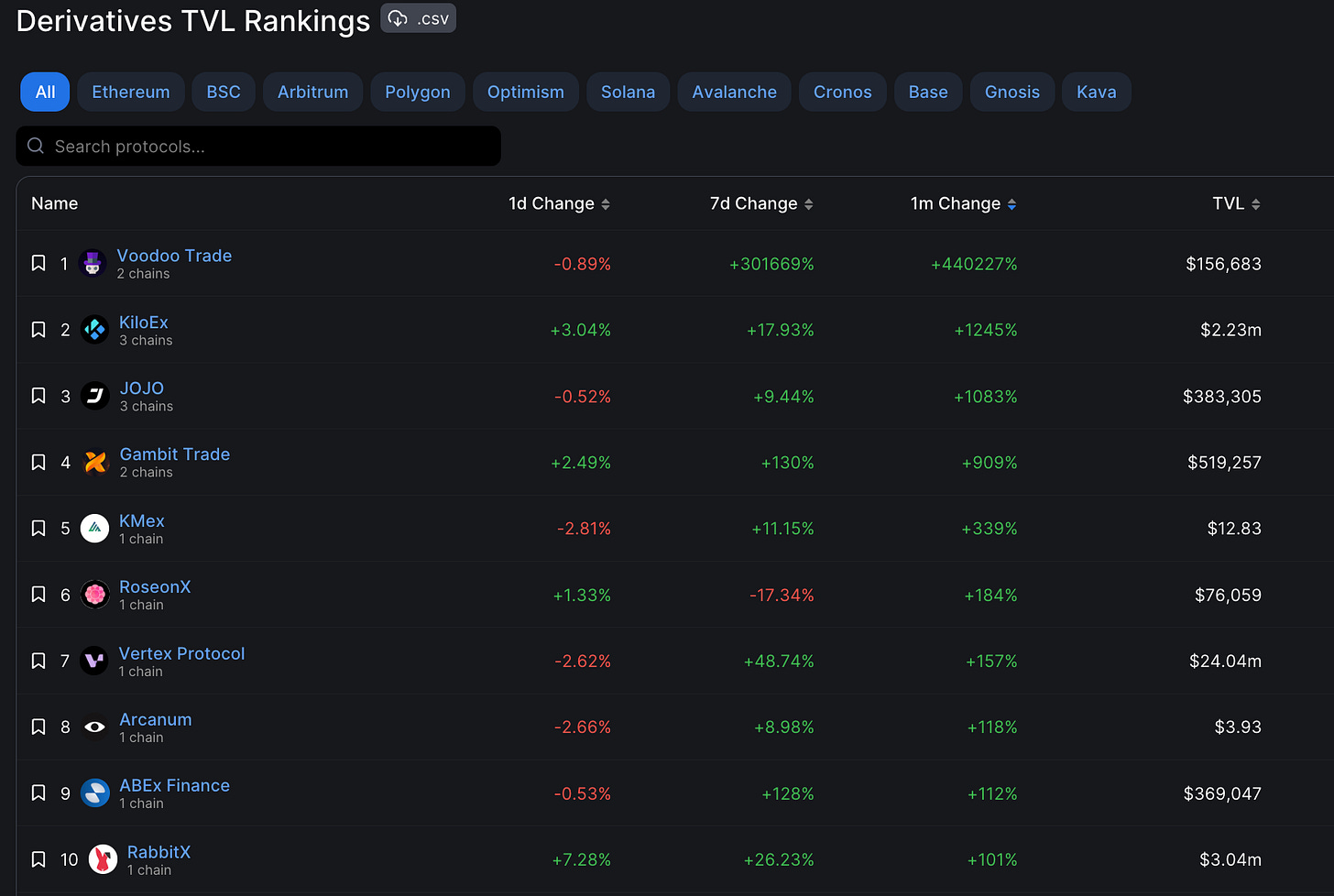

The perps category grew by nearly $1B in the last 30 days reaching a total TVL of $3.1B.

Possibly due to several ongoing narratives: @arbitrum season, @solana run…

Interestingly, the top3 protocols that grew the most in the last 30days are @TradeVoodoo, @KiloEx_perp, @jojo_exchange

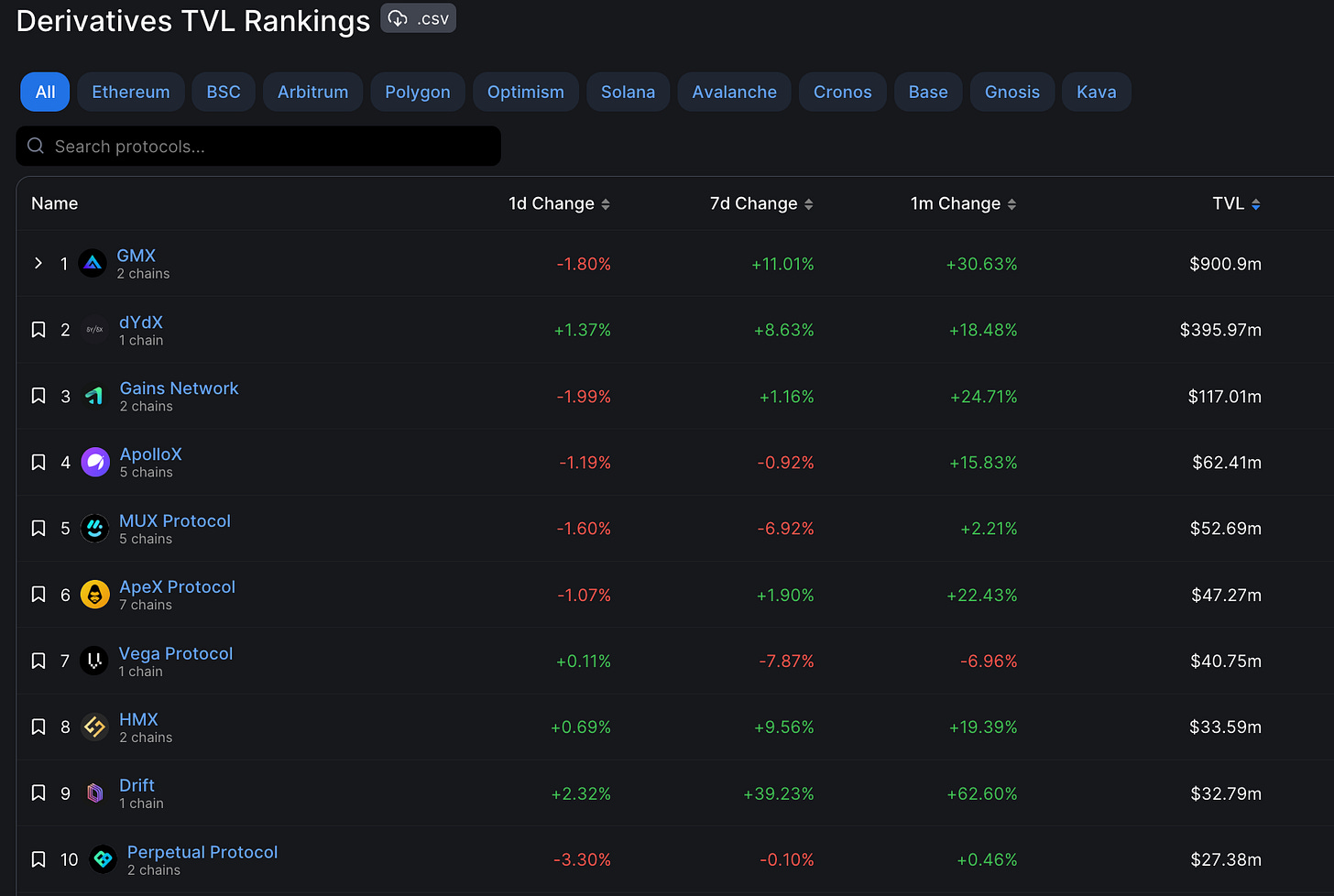

Protocols ranked by TVL have also seen a substantial increase in their TVL.

Naturally, @GMX_IO takes the top spot with $900M in TVL.

Though what is more interesting here is @DriftProtocol that grew 62%, likely attributed to the $SOL run.

However, perps have been limited in DeFi due to technical constraints and liquidity fragmentation across protocols.

This is starting to change with the emergence of many innovative perp exchanges like @dYdX , @perpprotocol , and @HyperliquidX.

These protocols are bringing deep on-chain liquidity and novel product designs like index perps and pre-launch perp markets.

Pre-launch perps are particularly compelling as they allow speculation on tokens before they are even live.

On-chain perp markets can front-run both CEX listings and AMM launches.

More broadly, decentralized perp exchanges unlock new possibilities:

Compete with CEXs by offering fast-moving markets with leverage

Trade exotic assets like metaverse land and NFT indices

Integrate with DeFi through vaults, lending, and derivative products

Advance toward fully decentralized and manipulation-resistant markets

While risks around liquidation and oracle manipulation remain, on-chain perps represent a promising avenue for trading activity.

The exchange that can build up liquidity and credibility in perp markets early has a chance to garner significant traction and volume, just as Uniswap did for AMMs in 2020.

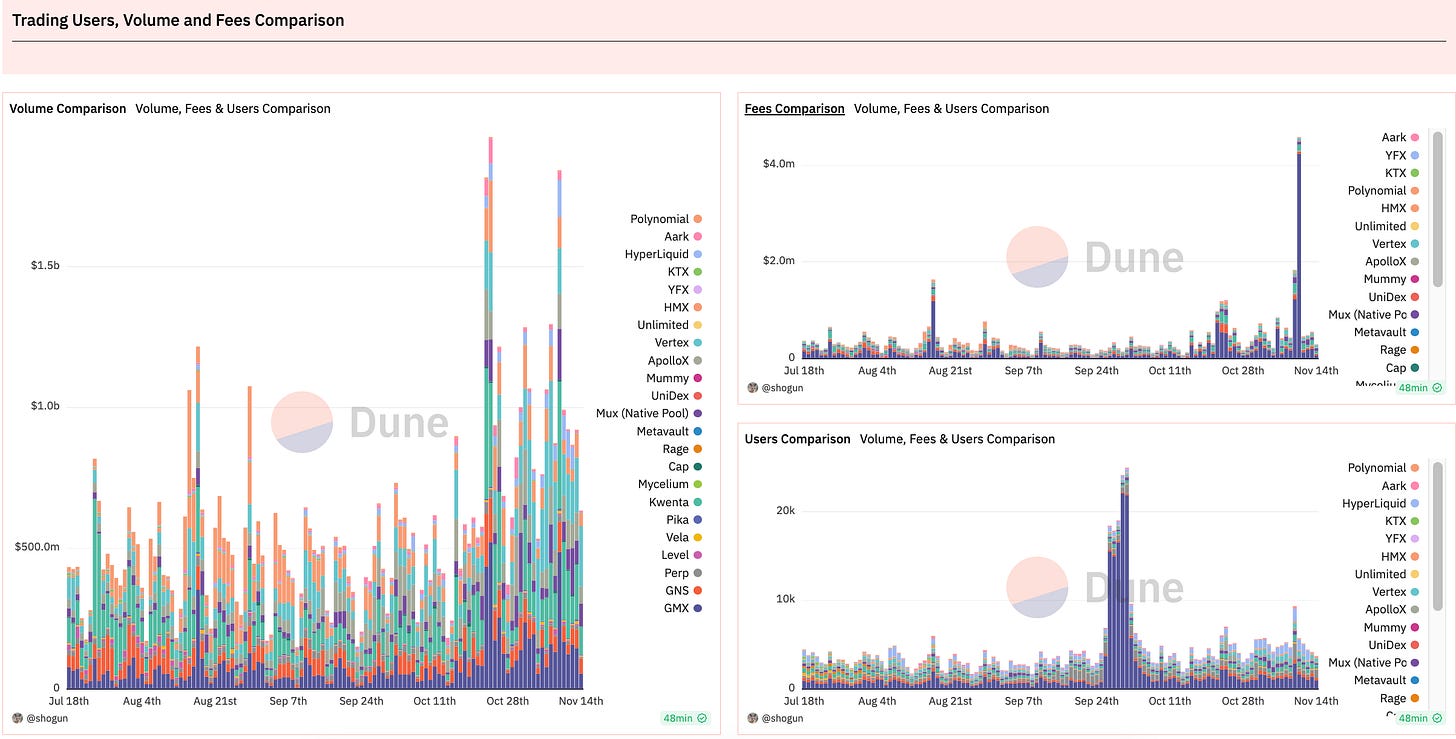

If we look at Dune analytics, fees are volume are seeing an increase in the last 30 days as well and retail is not even in yet.

The full bull is not even here.

As people desire to make those 1000 Xs, perps will be their gateway to do so. Hence, I will be keeping a close tab on its metrics as it could be a good leading indicator signaling our way into bull.

As we enter a potentially intense bull market, keep an eye on decentralized perp exchanges.

Their ability to enable fast speculation and leverage across both new and established crypto assets makes them a compelling sector to watch.

Furthermore, the next Binance or Uniswap-level breakout could very well come from this corner of DeFi. Stay tuned as I cover some cool perp projects under the radar in the next thread!

Drop down in the comments with what you want to hear next.

Twitter: https://twitter.com/arndxt_xo/status/1724741839339819148