We started out the week slow and sentiments I get were slightly negative. But still manageable markets I would say. Although analysts and macro data already showed signs of weakness, there is not big event that would trigger a contagion.

Things escalated after Silvergate wind down and then Silicon Valley Bank. This resulted in loss in investor confidences as the VC economy was badly affected. It accelerated and just 24 hours ago USDC was affected which we now see some depegging.

Macro sentiments were only slightly negative and the fallout accelerated investor’s fear

BTC L2 and LSDfi were new narratives and over 60 projects shared here

Over 10 upcoming projects that you keep a lookout for

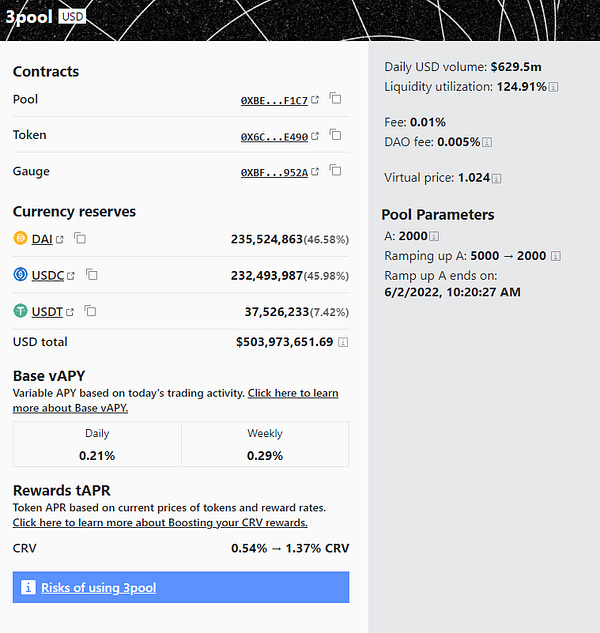

Readings like Defi fixed rates, Curve stablecoin, Airdrop hunt, Strategy simulator tool

Silvergate and SVB collapse, ETH goes to $350, 40 billion of USDC reserves remain at SVB

If you have not read the previous week’s highlight, here it is:

Hope you enjoy the content, and feel free to connect with me on Twitter here.

Segmenting the megathread of content into 5 parts:

Macro news

Trending narratives

Defi happenings

Educational resources and tools

Spicy crypto drama

1. Macro News

The macro sentiments grew intensively negative as we approach the end of the week.

@Travis_Kling recaps the highlights in Feb, where we saw significant US regulatory crackdown on crypto in a single month ever. Likely more to come on that front.

In the beginning of the week, @arndxt_xo shared that its been a pretty quiet week for big macro data releases but already warn that economy is not looking good.

There after, @arndxt_xo review part 1 of @rektdiomedes recommended interview with Mike Green for top 5 macro insights into 2023. Mike expresses about his bearish view for 2023.

Sentiments grew slightly negative towards the mid week as we approach key announcement dates like jobs data.

@tedtalksmacro shares that the probability of a 50bps hike at this month’s FOMC meeting has increased by 40%

@jake_pahor also shares a similar view that the market is now pricing in a 73.5% chance of a 50bp hike at the March FOMC.

While @verumcapital analyses the what worked in the previous bull runs

Silvergate winddown on the 8th of March.

@MacroAlf shares his views on the stock melt down

@CoinNotes_io felt that there is more to go before we hit a macro bottom

2. Trending Narratives

@arndxt_xo summarises 11 projects from earlier ToE’s Weekly Highlights

@TheGemNerd first ALPHA series

@insomniac_ac on his weekly #CrossChain Monday's #29

@CryptoShiro_ finds the best researches

@0xCrypto_doctor on Indices products.

@misaflips looks at Gamblefi projects

@0xMughal shares Farms of the Month - March 2023

@DefiantNews shares a new framework from @RollkitDev

@rektfencer on Kava’s hype

@TheDeFISaint shares these trending DEXes

@ThorHartvigsen on 30 protocols with strong catalysts in the coming months

@jkrdoc shares his plays on these narratives; RWA, BTC defi, LSD, Bridges, AI, ZK EM

@CryptoDamus411 on LSDfi as upcoming narrative

3. Defi Happenings

@arndxt_xo found a undermentioned project called Steadefi

@DAdvisoor on @votexfi A DeFi Voting Aggregator

@blocmatesdotcom on@InfPools; A decentralized exchange that offers unlimited leverage on any asset, with no liquidations, no counterparty risk & no oracles.

@0xkhan_ on @DecentralGames; is a live on-chain metaverse experience.

@0xjaypeg believes that $COIN is the index fund of crypto

@0xTindorr on Pendlefi = simple, yet it enables various strategies for us to trade, hedge, and manage our yields more effectively.

@Dynamo_Patrick Arthur Hayes has proposal of a new stablecoin, NakaDollar, that would be backed by $1 of BTC and a 1x short on BTC.

@0xsurferboy deep dives into @OvertimeMarkets

@Subli_Defi shares that Holding the 7 generations of HC will give access to DAO !

@thelearningpill on @PerpyFinance = Decentralized perps + social trading on Arbitrum with 100% protocol real-yield distributed to stakers!

@Tanaka_L2 bullish on @PepesGame

@Alice_comfy on that USDC de/repegging incident

@ipor_intern deep dives into Balancer Vault

@GearboxProtocol Gearbox V3. Launching Q2, 2023.

@zachxbt ends community requests

@escherxyz is a platform for the fine art edition landscape & the visionaries shaping it.

@PrimitiveFi is a portfolio based product

@itsdevbear introduces Polaris is a general purpose blockchain framework that allows for the integration of the Ethereum Virtual Machine (EVM) into any underlying networking or consensus layer.

@liquid_col is a LSD protocol. That allows user to stake ETH, receive ETH network rewards, access liquidity, and get slashing coverage, all with LsETH.

@Paladin_vote introduces Warlord - the first vote incentives index!

@0xDevinG on @Uniswap being an Options Market disguising itself as a DEX

@Zeneca on ERC-4337 able to recover wallet, bundle transactions

4. Educational resources and tools

@ardizor shares CYBERCONNECT #AIRDROP GUIDE

https://dune.com/hagaetc/dex-metrics

@fluorescent_eth believe that ENS are underdiscovered

@WinterSoldierxz on @synthetix_io

@wacy_time1 shares All Crypto, DeFi & NFT gigabrains here

@rektdiomedes 10 More Chadish Defi Accounts To Follow

@Cryptotrissy on Omnichain vs Crosschain

@rektfencer on his best tools

@0xDoing builds a strategy simulator

@jason_of_cs on AMMs vs LOBs

Introduction to the Principles and Architecture of Curve Stablecoin

5. Spicy Crypto Drama

@innercitypress on Mango Labs v Avi Eisenberg

@CoinDesk on Silvergate Bank will wind down

@CitronResearch estimates price of $ETH around $350.

@arndxt_xo on 2nd largest collapse in American history

@ByzGeneral on USDC depeggging

@unusual_whales shares that before the collapse of Silicon Valley Bank, $SIVB, the CEO sold $3.57 million of stock within the last two weeks.

@circle on ~$40 billion of USDC reserves remain at SVB.

U.S. bankruptcy judge approves Binance.US $1.3 bln deal for Voyager

Appreciate your donation or tipping if you liked this newsletter!