Gm ToE readers. A lovely memeish week with AVAX taking the limelight

Macro: Sticky inflation and shifting central bank policies are creating uncertainty. Key data releases will continue to drive market volatility in the near-term. Headwinds of slowing growth, tightening monetary policy, and fiscal uncertainties driving market churn across assets. Oil, autos, stocks and bonds all facing challenges of lower demand and higher costs of capital.

Trend: Cautious optimism on BTC but alts are mixed, with some outperforming on catalysts like conferences and token migrations. More choppiness expected near term but macro trend seems to be steadily upwards. SOL, AVAX, CANTO, RLB seen good moves.

Defi: Socialfi projects stealing the limelight now. $BANANA holders are printing. Angle procotol update with new RWA. ARB grants

Tools: Prevent sim swapping, Tracking tools, Life hack tools, Farms for the month, Token 2049 database,

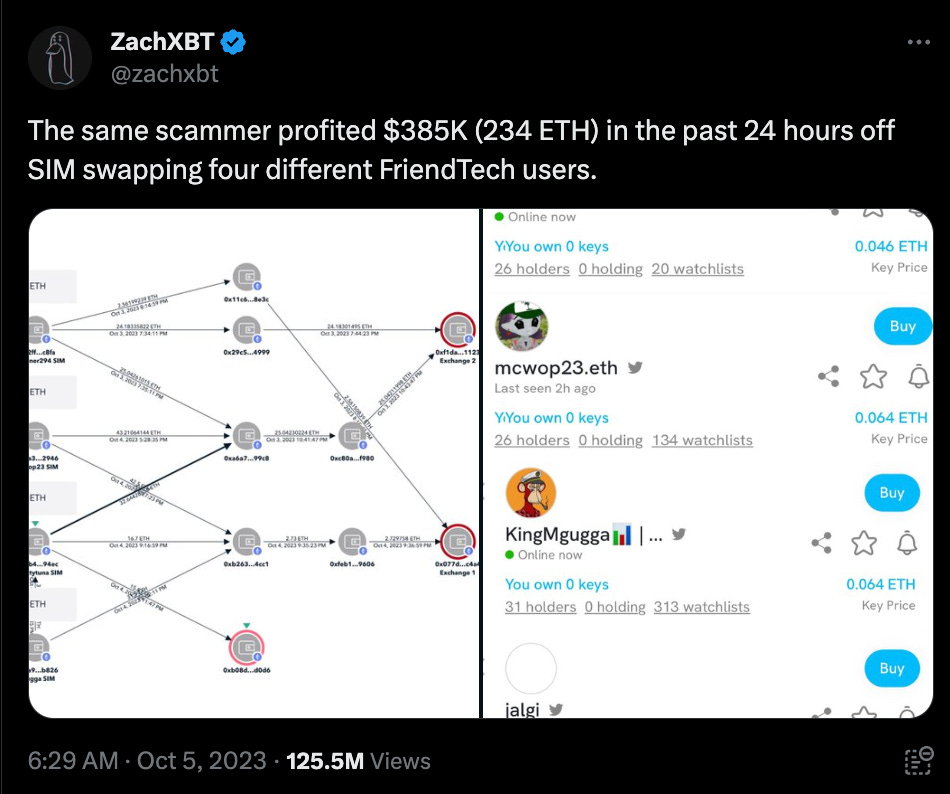

Spicy drama: Zhu behind bars while eating mooncake, Ponzi times newsletter, Zach uncover sim swap fraud

If you have not read the previous week’s highlight, here it is:

Hope you enjoy the content, and feel free to:

Connect with me on Twitter

Join my Telegram Channel

Segmenting the megathread of content into 5 parts:

Macro news

Trending narratives

Defi happenings

Educational resources and tools

Spicy crypto drama

1. Macro News

Sticky inflation and shifting central bank policies are creating uncertainty. Key data releases will continue to drive market volatility in the near-term.

U.S. labor market is showing signs of moderation as private payrolls undershot expectations in September. This could influence the Fed's future rate hike trajectory.

Biden administration expanded student loan forgiveness, with over $9 billion of debt cancelled so far. This provides relief to borrowers but adds to federal liabilities.

Equities rallied on weaker jobs data as it reduces likelihood of more aggressive Fed tightening. Treasury yields also declined. However, eurozone retail sales dropped sharply in August, pointing to impact of higher rates.

Upcoming U.S. jobs data including nonfarm payrolls will be closely watched to gauge strength of labor market. Markets seem positioned for some Fed pivot on policy, but will react to data confirming or disputing this view.

Headwinds of slowing growth, tightening monetary policy, and fiscal uncertainties driving market churn across assets. Oil, autos, stocks and bonds all facing challenges of lower demand and higher costs of capital.

Oil prices dropped sharply on concerns about slowing global growth and higher interest rates. Prices fell below $82/barrel, reversing previous gains. Production cuts by OPEC+ unable to stem declines.

Negative equity on U.S. car loans rising as used car values fall from pandemic highs. Trade-in vehicles now underwater by ~$5,820 on average, creating challenges for dealers and buyers.

Surging Treasury yields up to 2007 highs weighing on equities like S&P 500, Nasdaq and Dow amid Fed hawkishness. Investors shifting to guaranteed returns.

Treasury yield volatility spiking as measured by MOVE index, signaling continued turbulence ahead in bond markets.

@arndxt_xo on macro pulse

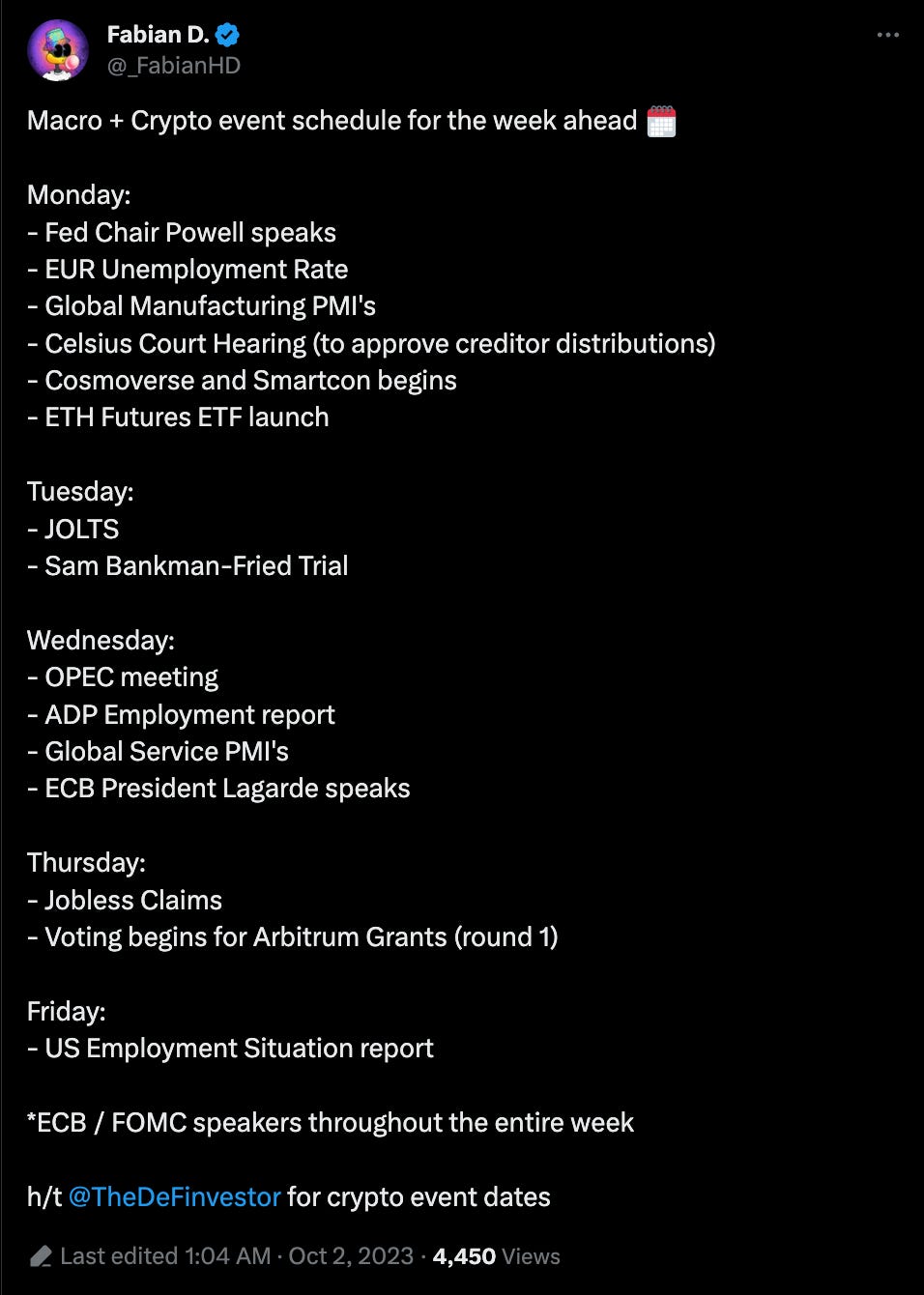

@_FabianHD on macro schedule

@JSeyff list all the ETH ETF

Depression worse than 2008

@fejau_inc launches his macro newsletter

2. Trending Narratives

Cautious optimism on BTC but alts are mixed, with some outperforming on catalysts like conferences and token migrations. More choppiness expected near term but macro trend seems to be steadily upwards.

Bitcoin (BTC) has been slowly trending upwards over the past 30 days, currently around $27,800. There are some bullish signs like the large spot buy this week, but moves get retraced quickly. The overall trend looks bullish but we may see one more dip below $24k before heading to $35k+.

Ethereum (ETH) is slightly down this week to $1,640, with ETHBTC continuing to trend down. The VanEck ETH futures ETF launch had low volume. ETH may continue to underperform BTC in the short term but should outperform longer term.

Solana (SOL) outperformed with a +16% gain this week likely due to a short squeeze as traders were trapped in their short positions. SOL has consistently outperformed on pumps this year.

Avalanche (AVAX) also saw strong double digit gains this week thanks to the new Stars Arena platform built on it. This could mark a reversal after months of bleeding vs BTC.

Canto (CANTO) pumped 63% as its migration to a Polygon zk-Rollup was announced. The RWA narrative may be benefiting it.

Chainlink's (LINK) SmartCon conference boosted its price in the preceding weeks, though it did see some sell the news dumping.

Wilder World (WLD) couldn't break $2 and you are looking to short it again on a bounce from $1.5.

SwissBorg's (CHSB) token migration starting on Oct 17 has pumped its price 30%+.

Su Zhu's arrest impacted Open Exchange (OX) negatively but it may be a risky buy opportunity at current lows.

Rollbit (RLB) held up well after the onchain summer dump. Their new on-chain buyback transparency is positive.

@schizoxbt interviews @rektdiomedes

@Curious__J on RWA

@layerggofficial Weekly Token & Narrative Watchlist

@ThorHartvigsen on Uptover watchlist

@insomniac_ac on cross chain monday

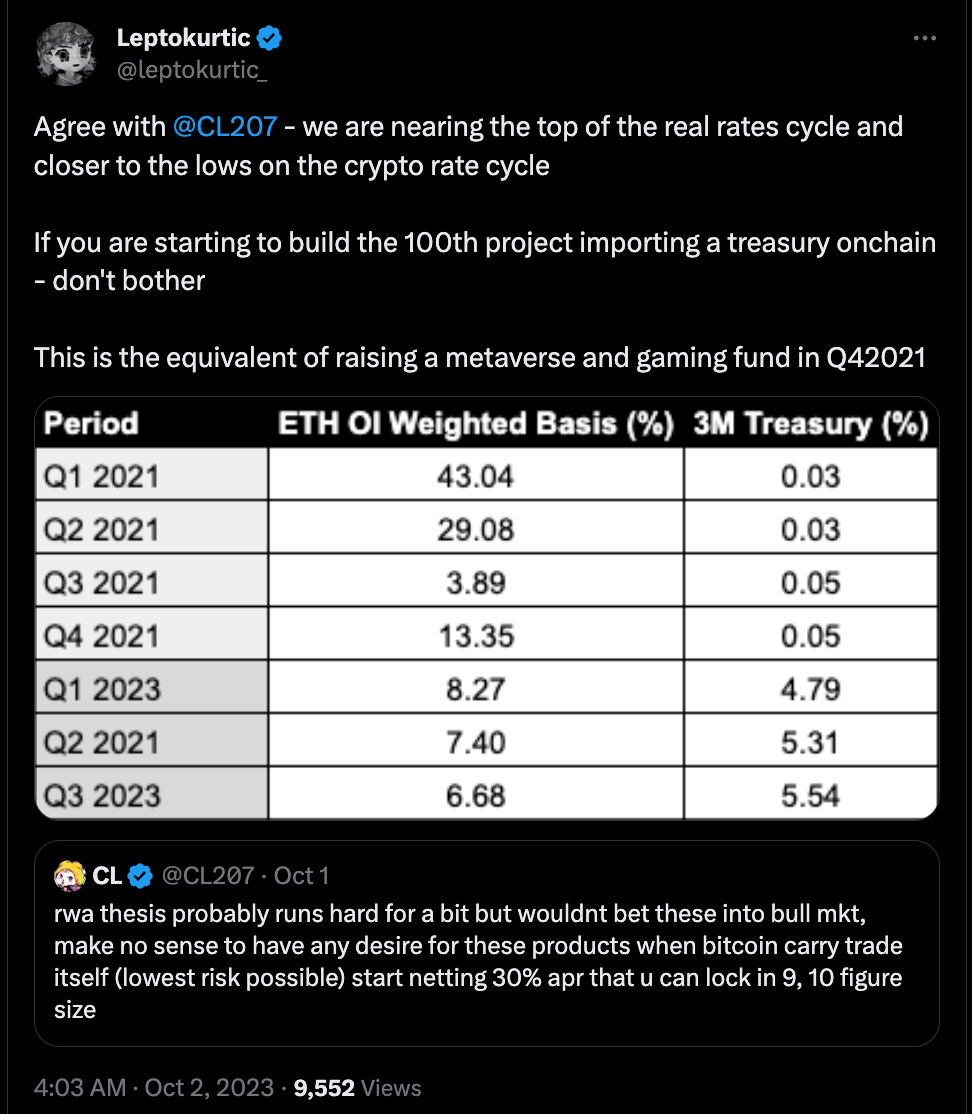

@leptokurtic_ nearing to low crypto rate cycle

@InspectorDefi Decentralied derivatives monthly overview

@blockscriber on Depin

@myBlockBrain on October playbook

@thedefivillain speedrun 2023 narratives

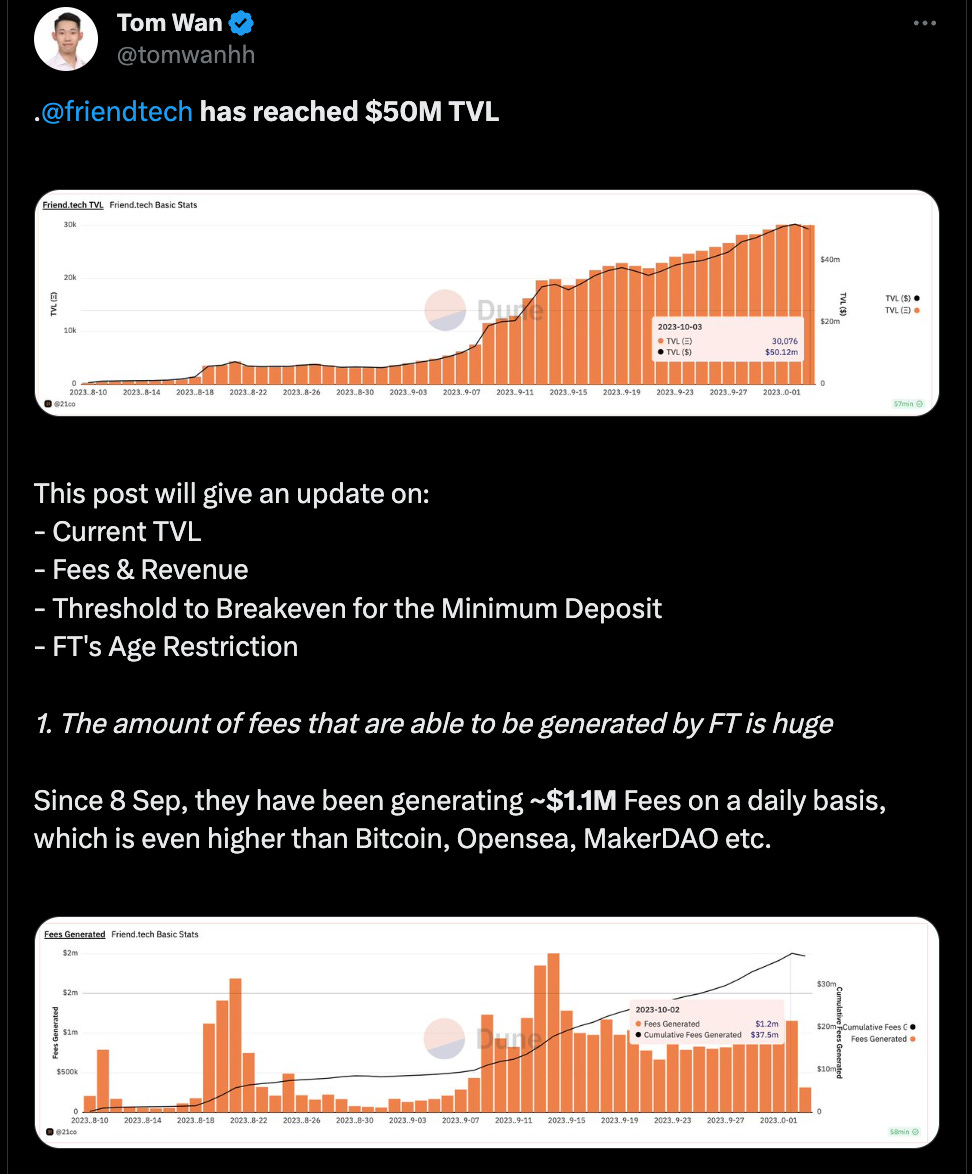

@tomwanhh on friendtech

@BinanceResearch midweek udpate

@Prithvir12 on Oct narratives

@apes_prologue Weekly Alpha

3. Defi Happenings

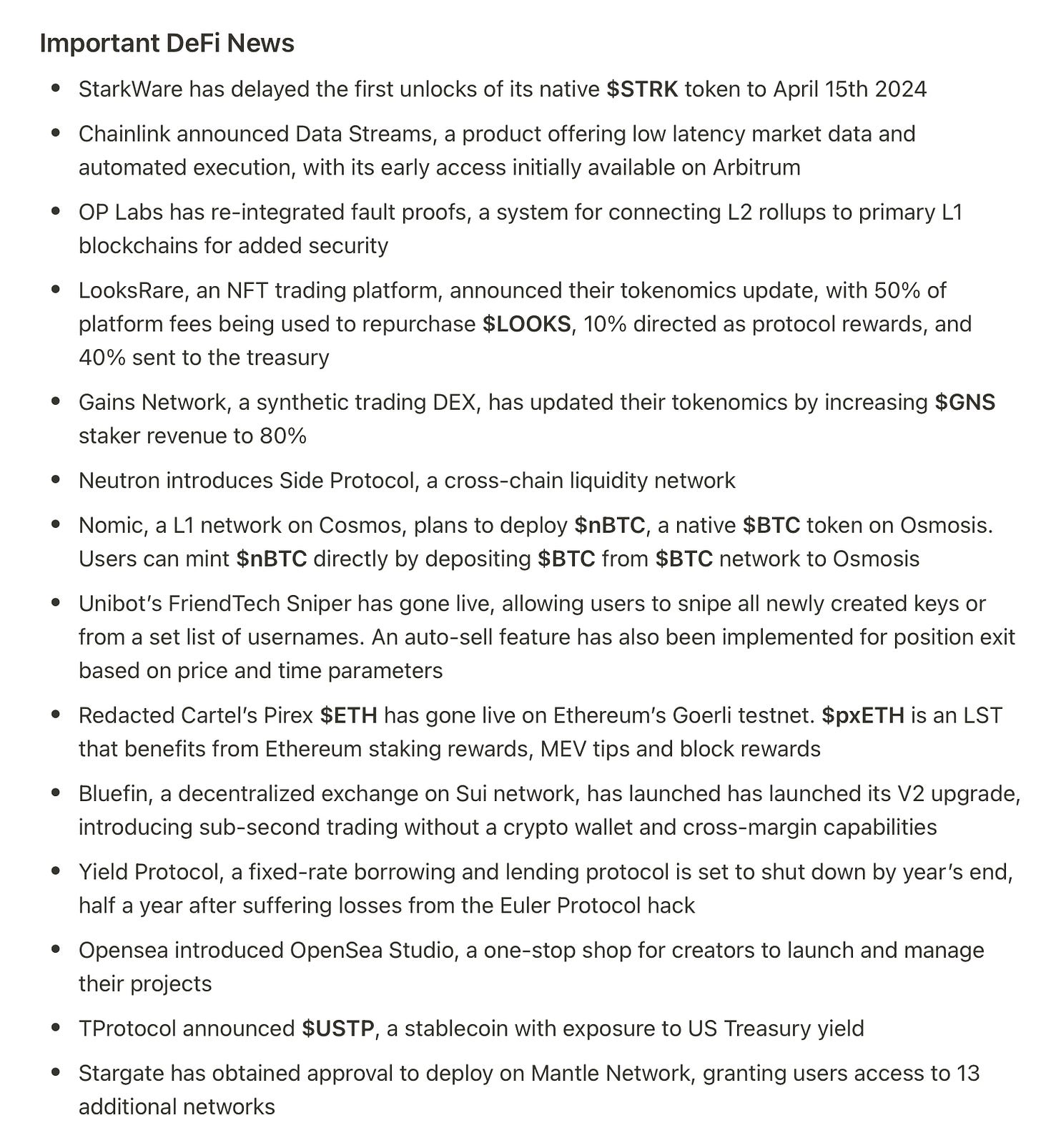

@twindoges gems

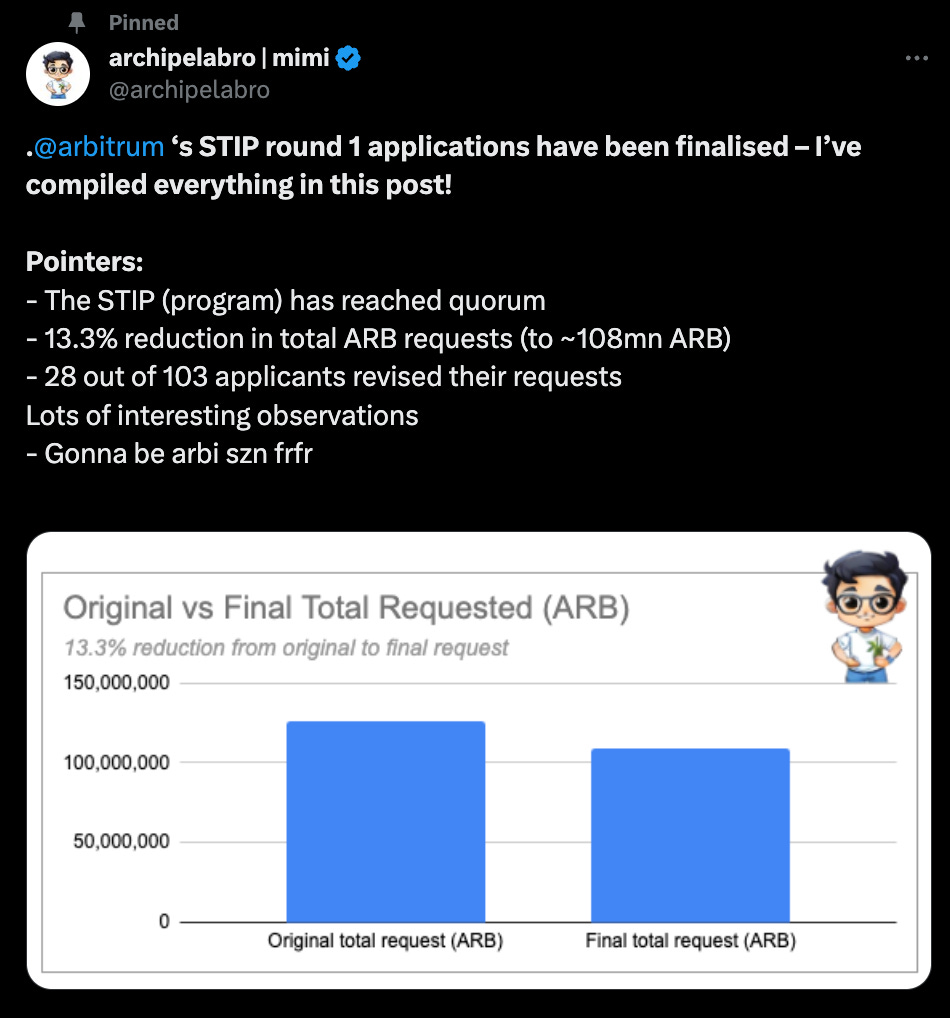

@archipelabro on summary of Arb grants

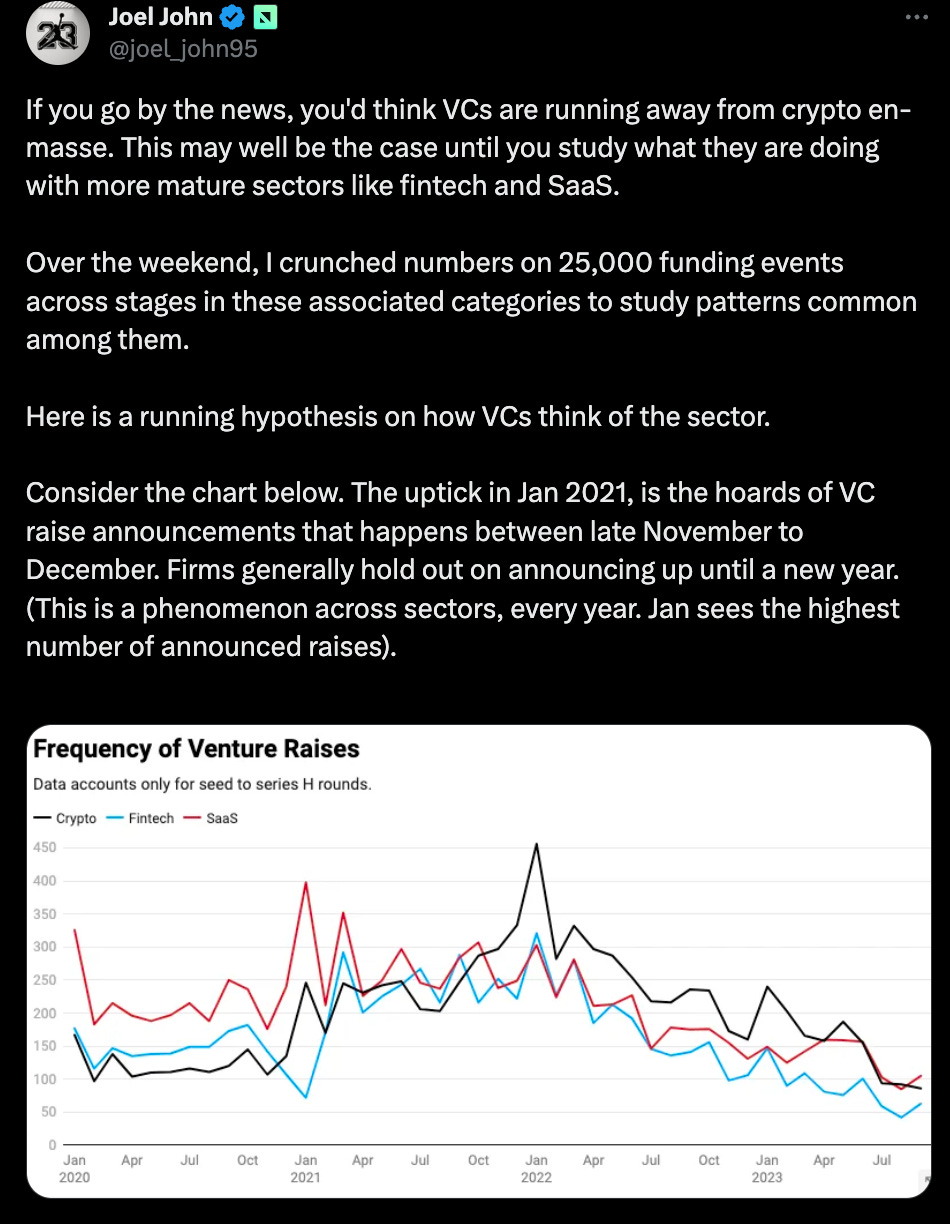

@joel_john95 on VC investments

@matrixthesun bullish on BB

@CryptoNikyous on 10 new launches

@TweetByGerald 10 VC projects

@dontbuytops on SOLANA

Status as a service

https://www.eugenewei.com/blog/2019/2/19/status-as-a-service

@gambleguru_eth presale

A List of Open Problems in Crypto - II

https://crypto.mirror.xyz/hl284jc3A2MI_QeTE39nRsTPihOigNuLKIWjiU2pFzw

@jinglingcookies on Monad

@DistilledCrypto on HILO

@RealDegenGMX on $BANANA

@InspectorDefi reviews the TOP 3 Social Finance Apps:

@FarmerTuHao on omni chain protocol

@blockscriber on RWA projects

@GetReachxyz OG role

@CryptoGideon_ projects to watch for bull

@TheDefiDog on Arb projects listing

@OnlyHumansTech partnered with EspressoTG

@FantaLeagueETH sports game

@asxn_r on Lido staking

https://twitter.com/asxn_r/status/1710023792204841330

@thecoreloop Is gaming dead?

https://twitter.com/thecoreloop/status/1710179384848715918

@OnChainWizard on The Chameleon Investor

@HFAresearch on Redacted

@DistilledCrypto on TAO

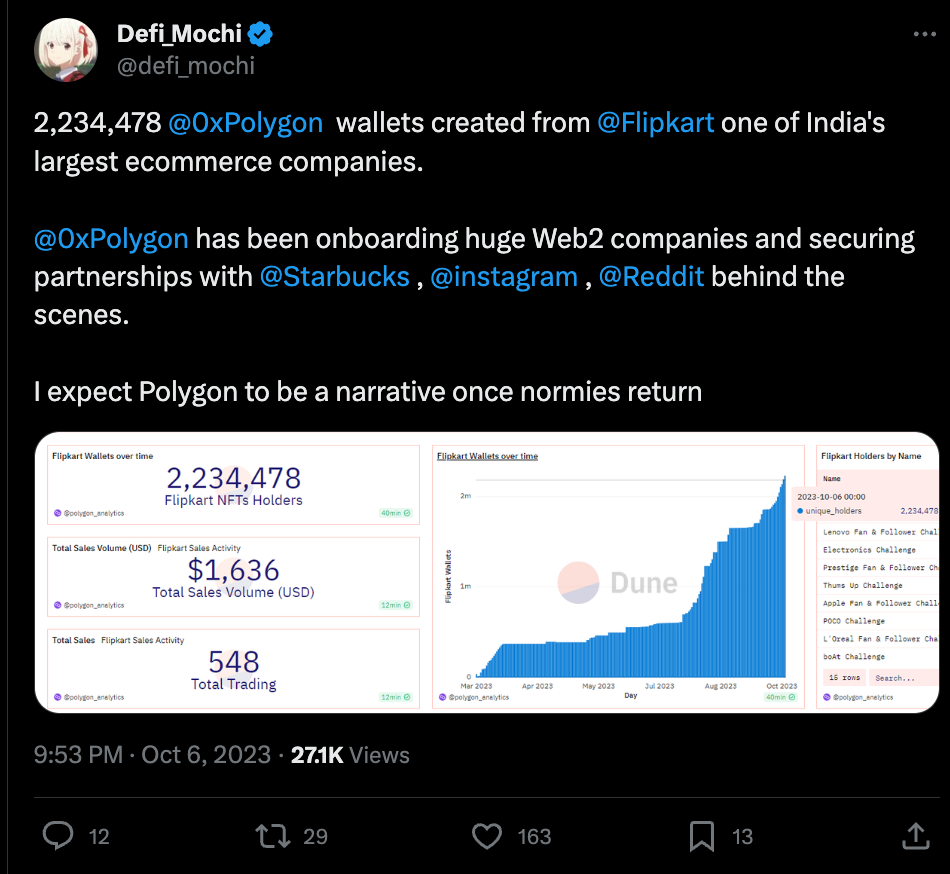

@defi_mochi on Flipkart and Polygon

@Louround_ on Angle protocol

@wacy_time1 on AVAX

4. Educational resources and tools

@MajorM111 on tracking tools

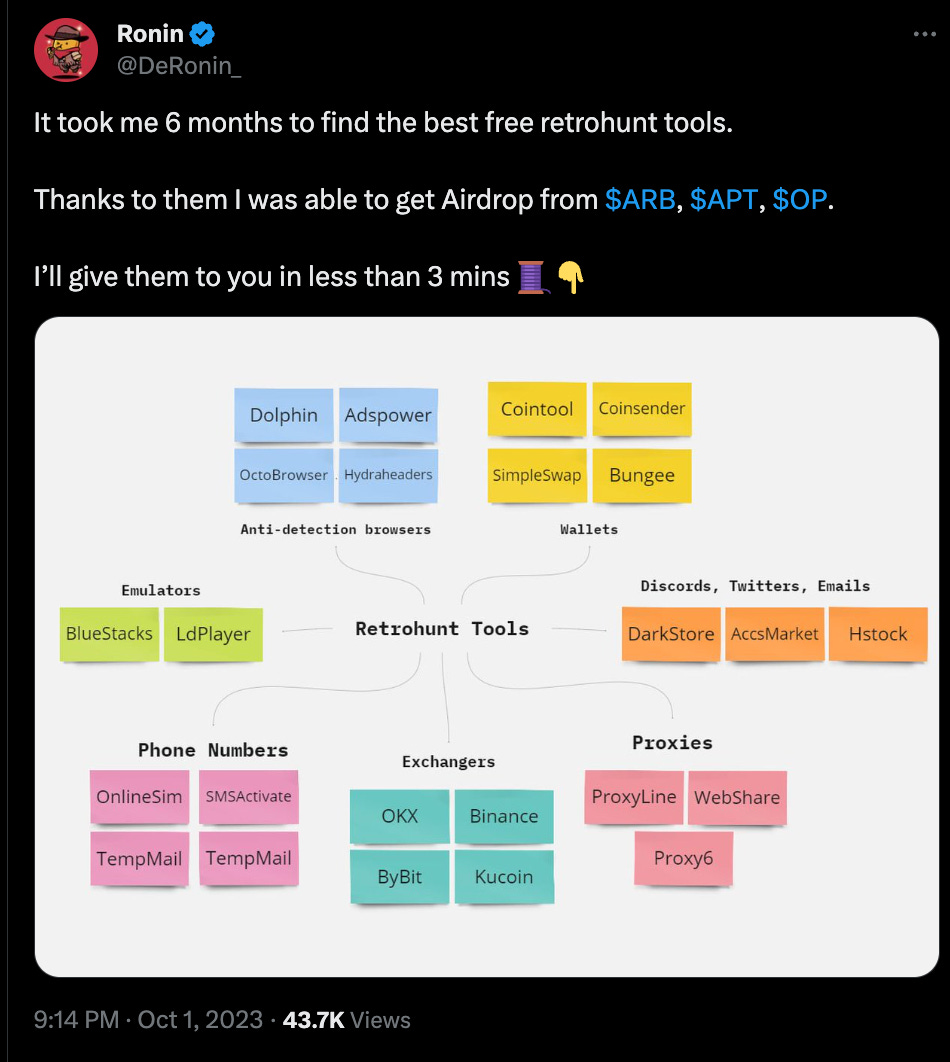

@DeRonin_ on life hack tools

@0xrishavb on Token2049 database

@0xMughal on farms for the month

@thedefiedge 3 year tips

@Hercules_Defi goes gem hunting

@the_smart_ape on BNB yield

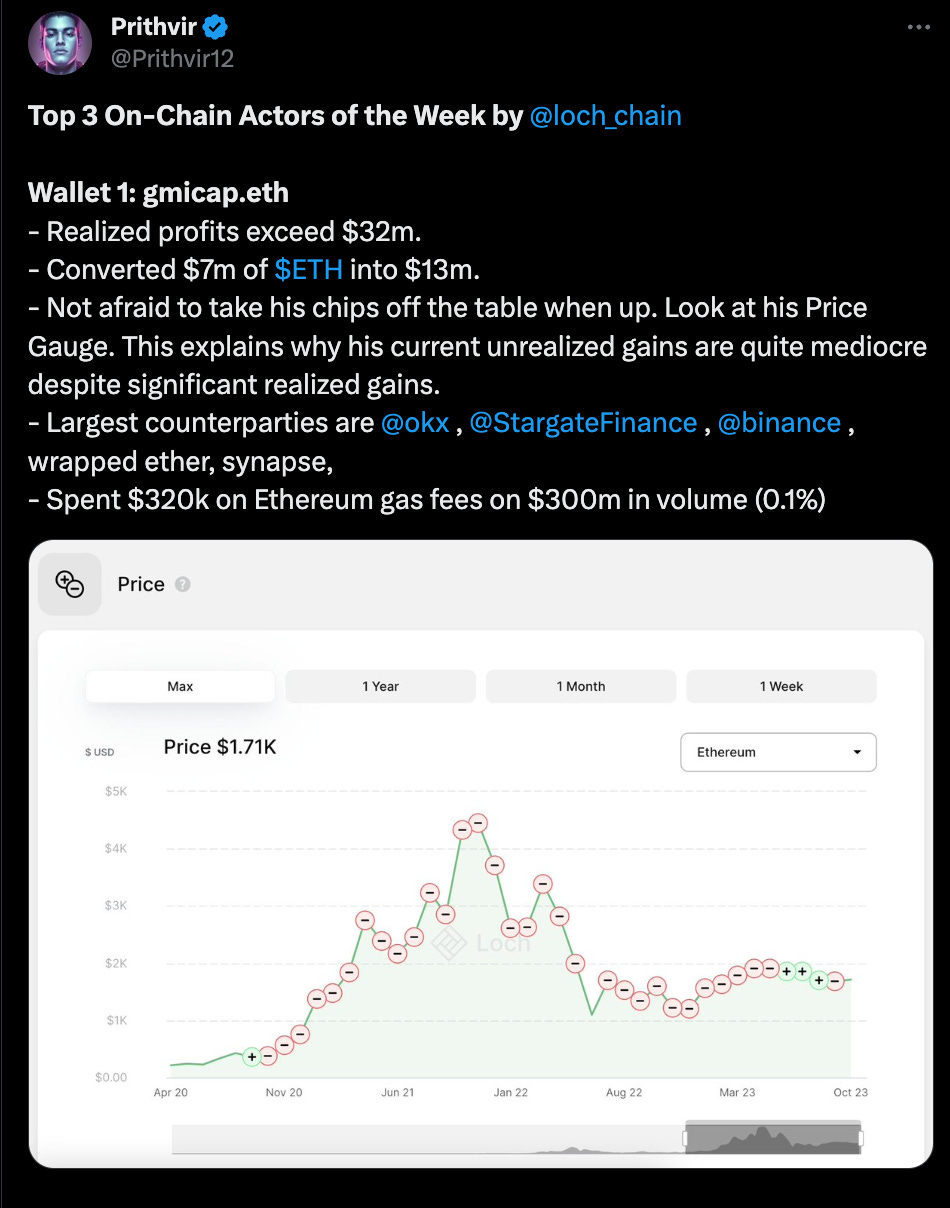

@Prithvir12 on top on chain actors

@naryaplayground on code testing tool

@splinter0n sim swapping

@leilanibabiez 13 on chain tools

@DeRonin_ on making your own list of smart money wallets

5. Spicy Crypto Drama

@narratoor Zhu Su behind bars

@ThePonziTimes Crypto drama newsletter

How Binance Turned Its Failed Token ICO Into A Billion Dollar Windfall

@zachxbt on scammer sim swapped

Twitter: https://twitter.com/arndxt_xo/status/1711004680233566348