Gm ToE readers! Market’s boiling with gems in the depths of bear.

Macro: Inflation remains a key concern globally, impacting monetary policy and asset prices. U.S. inflation remains elevated. This aligns with the Fed's stance on maintaining higher interest rates to combat inflation. Markets are split on whether the Fed will hike rates again at their November meeting.

Trends: Bitcoin had a slow bleed. Potential for final capitulation in Q4 down to $22-25k. Ethereum continues to underperform, Alt L1s like Polkadot face challenging conditions. AVAX pumped on Stars Arena launch. RUNE pumped from FTX exploiter using Thorchain. $UNIBOT and $BANANA looking interesting again at lower prices.

Defi: $VKA TGE in 24hrs, Arbitrum concluded STIP, Gaming looking primed, RWA getting heated, AVAX made attention with Starsarena

Tools: OTC trading tools, Dev resources, Avoiding classic scam, Wallet security tools, Newsletters and account alpha,

Spicy news: USDR depegged, Starsarena secured funds, FT potential hack, SBF got the spotlight with Caroline

If you have not read the previous week’s highlight, here it is:

Hope you enjoy the content, and feel free to:

Connect with me on Twitter

Join my Telegram Channel

Segmenting the megathread of content into 5 parts:

Macro news

Trending narratives

Defi happenings

Educational resources and tools

Spicy crypto drama

1. Macro News

Inflation remains a key concern globally, impacting monetary policy and asset prices.

U.S. inflation remains elevated, with the September CPI report showing a 0.3% rise in core inflation. This aligns with the Fed's stance on maintaining higher interest rates to combat inflation. Markets are split on whether the Fed will hike rates again at their November meeting.

Singapore's Q3 GDP grew 0.7% year-over-year, outpacing Q2 growth. The construction sector drove this expansion, while manufacturing declined. Services saw mixed results.

U.S. stocks declined on inflation concerns and rising yields, with the DJIA, NASDAQ, and S&P 500 all dropping. Asian indices also retreated, including Japan's Topix, South Korea's Kospi, Hong Kong's Hang Seng, and China's CSI 300.

@arndxt_xo on Hayes macro prediction part 1

@_FabianHD on macro events

@_FabianHD some market thoughts 👇

starting with the war in the middle east, I'm no expert on the geopolitical implications but prior conflicts show the effect on oil prices are usually not as strong or sustainable as feared.

for reference the Russia-Ukraine war fully retraced the oil pump within 2 weeks and the 2006 war in Lebanon marked a top in energy prices. Both events were seen as more directly impactful to oil.

but of course it all depends on how the situation unfolds with neighbouring countries and impacts OPEC decisions. expect volatility either way.

the first order effects of higher oil prices is actually not for the FED to hike more (yet). The FED looks past blips in energy and higher oil prices constrain the economy even more which makes them less likely to hike right away. this is why FFR expectations are down over the weekend and is actually positive for #BTC at the margins, like Gold.

the second order effects are for higher operating costs on businesses who then pass those costs to consumers in goods inflation. but this process can take a while and only becomes an issue if energy prices remain consistently higher, at which point if the economy is still strong can translate to higher for longer.

in addition to geopolitical developments, the two most impactful events for $BTC this week will be CPI on Thursday (which will either support or push back on the recent higher for longer pricing) and the SEC's decision to appeal the Grayscale ruling (which has implications for the odds of a spot ETF).

from a technical perspective $BTC is in a strange spot. it's still respecting the breakout above 27.2k but was rejected from the 200 day+week MA at 28k for a third time now.

even if it gets above that it quickly faces resistance from 28.6k-29k in order to reclaim the level it initially broke down from. any higher would be back to local highs which seems difficult now that we don't have the same momentum going as the last time we were there.

@heresyfinancial on "blowout" jobs report

@KobeissiLetter on US deficit at 1.7T

@BackTheBunny US is Proof of Violence

@_FabianHD prediction

@EthSnippets on global economy and crypto tole

@CryptoTony__ US inflation report

@leilanibabiez on what is next for interest rates and markets

2. Trending Narratives

Bitcoin had a slow bleed down from $28k to $26.8k this past week, with no major catalysts driving the move. Still lacking strong bids from value buyers or short squeezes. Potential for final capitulation in Q4 down to $22-25k range before going up towards a spot BTC ETF approval.

Ethereum continues to underperform, now at $1540 levels last seen in March 2023. ETHBTC at just 0.058, partly due to FTX exploiter selling ETH for BTC.

Alt L1s like Polkadot face challenging conditions with unlocked crowdloan tokens adding sell pressure. Layoffs and decentralized transitions at Parity are illustrative.

AVAX pumped on Stars Arena launch but then dumped hard after the $3M hack. Damaged reputation and lost momentum.

RUNE pumped from FTX exploiter using Thorchain but was later dumped and put in maintenance. Trying to block illicit activity now.

INJ continues to hold up well compared to other Cosmos coins, comfortable long-term hold. KUJI also a strong gainer.

FXS gained on launch of staked FRAX, sFRAX. Part of "RWA narrative" now.

New gaming token BIGTIME launched and pumped 400% but likely overvalued. Volatile with opaque tokenomics.

Arbitrum coins like Dopex and Lodestar gained on grant votes and support.

Privacy coin ATOR and predictions market HILO both hitting ATHs from Cevo shilling. Good to follow his likes.

Onchain summer coins dumped hard besides RLB which is holding value. $UNIBOT and $BANANA looking interesting again at lower prices.

@Defi_Maestro feeling bullish

@_FabianHD on crypto total funds

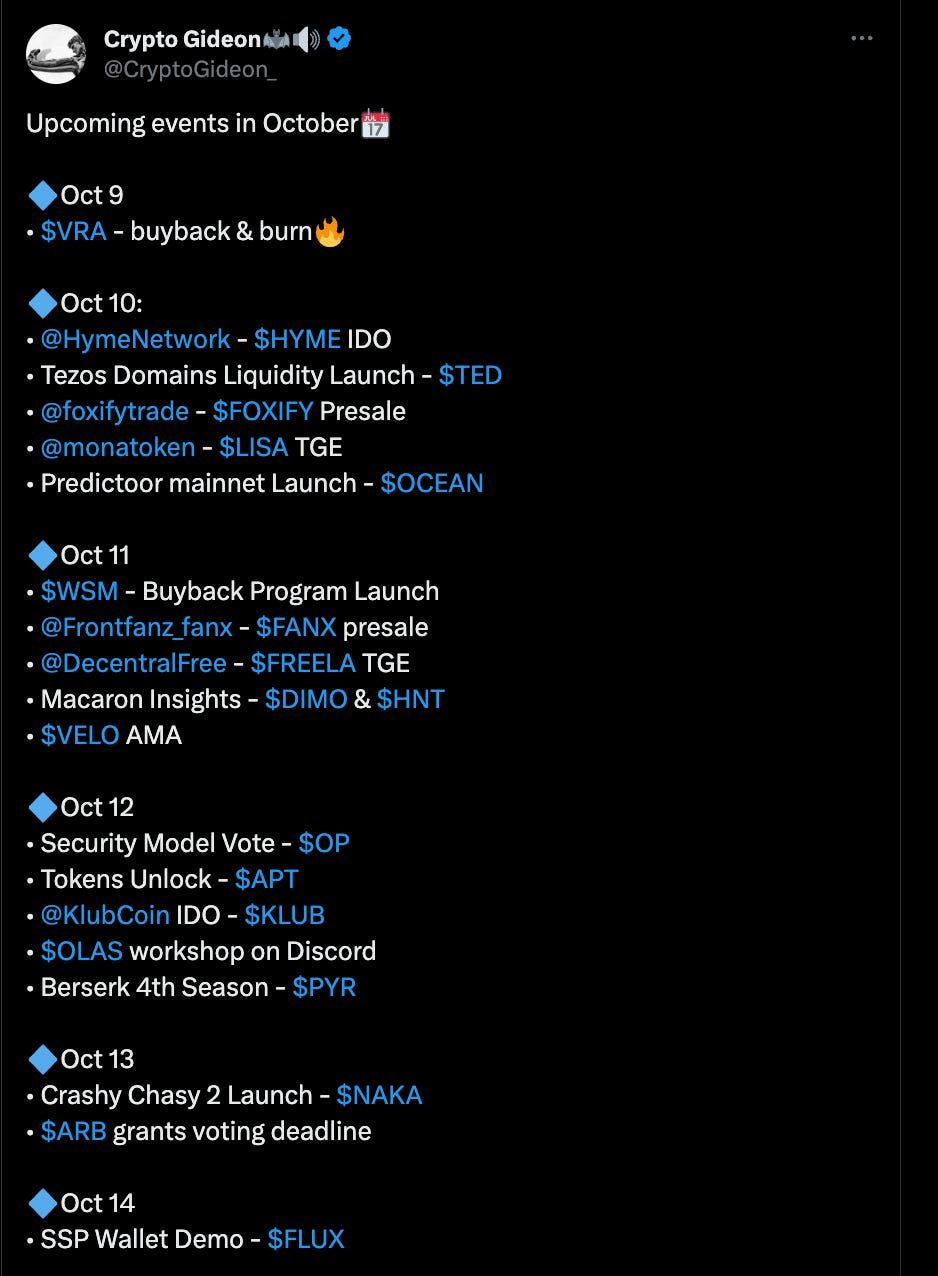

@CryptoGideon_ upcomign events in oct

@jake_pahor bullish on sports betting

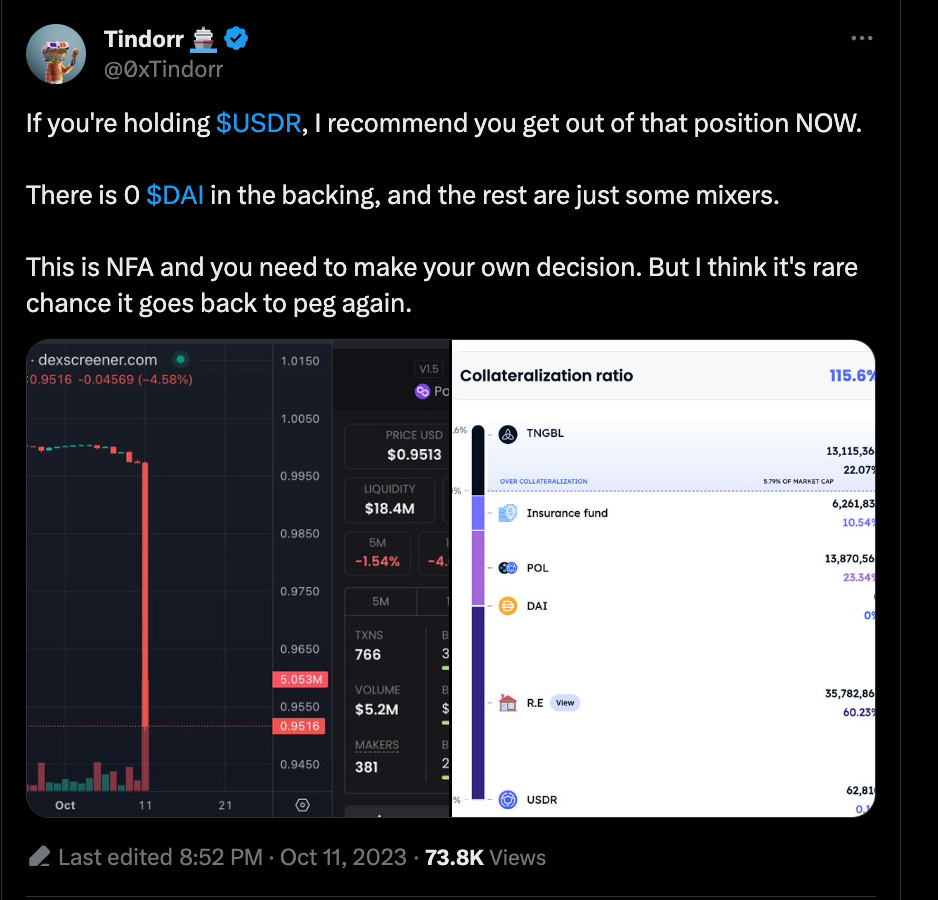

@0xTindorr advising to remove USDR position

@TheDeFinvestor watchlist

⚠️ 5 Year Predictions : Crypto in 2028 🔮

• $RNDR : A significant player in the Metaverse and Rendering Tech.

• $KAS : A champion of Layer 1 Solutions for the people.

• $VRA : Largest Streaming Hub

• $ATOR : Empowering Privacy in Web3.

• $TAO : A Hub For Artificial Intelligence

• $DMTR : Democratizing Agricultural Tech.

• $KOIN : A Layer 1 blockchain made for builders.

• $RIO : Leading in the booming RWA industry.

• $EWT : Ensuring the security of renewable energy grids.

• $CSPR : Gaining mass adoption for public permissions.

• $NXRA : Serving as a hub for startup access.

• $AZERO : Leading institutional treasury management.

• $LINK : Empowering cloud and DLT dApps.

• $MNW : Leader in the Supply Chain Industry

• $NAKA : P2E Gaming Haven

• $INJ : Leader in Web3 finance

• $XDC : Bridging trade finance gaps.

• $XRP : Facilitating global bank payments.

• $QNT : Enabling seamless data exchange for tech.

What are your Predictions?

👇🏻

3. Defi Happenings

⭐️⭐️⭐️@Vaultkaofficial TGE in 24 hours⭐️⭐️⭐️

@Swixyswixxx shares unnoticed alpha

@1CrypTina shares @AsMatchApp web3 matching app using SBT

@RealDegenGMX on $LBR v2

@ESCROWERC doing some interesing OTC products

@wist_defi on Arb eco projects

@DistilledCrypto on gamblefi

@0xRaiden on web3 games

@DeFiMann on Arb grants updates

@CryptoNikyous on early projects

@Swixyswixxx on yield optimizers

@cryptocevo bull run plays

@Fisher8Intern on Yearn’s flywheel

@alpha_pls on Massdotmoney being the super app replacing Nestedfi

@DefiIgnas on Fluid by Instadapp

@eli5_defi interesting project feature

@crypto_popseye shares his watchlist

@Delphi_Digital on gaming ecosystem

@definapkin on intent based solution

@CryptoNikyous again on lowcaps

@wronguser000 on under noticed projects

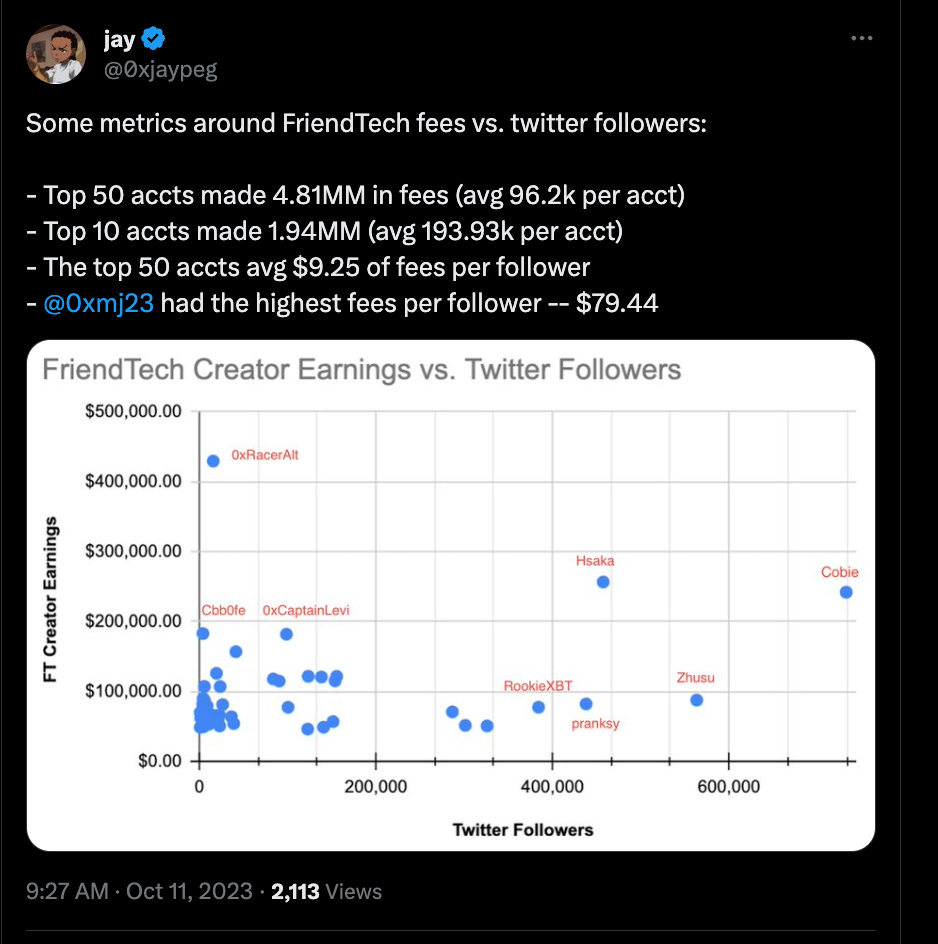

@0xjaypeg FT metrics

@Beacon_Early on scroll early projects

@0x_ultra on Arbitrum STIP

@ThorHartvigsen on DAI 17% APY

4. Educational resources and tools

@officer_cia warns of old scam technique

@MajorM111 on 30 tools to stay up to date

@DeRonin_ on Developer resources

@the_smart_ape smart contract vulnerability

@onchain_edge on charting tools

@DeFiMinty on must follow newsletter alpha

@CoinList on new token

@iambullsworth on crpyto wallet multi sig

@TrangMinhThuan on DeFi mastermind to follow

@archipelabro made a STIP resource

@DeRonin_ on OTC market

5. Spicy Crypto Drama

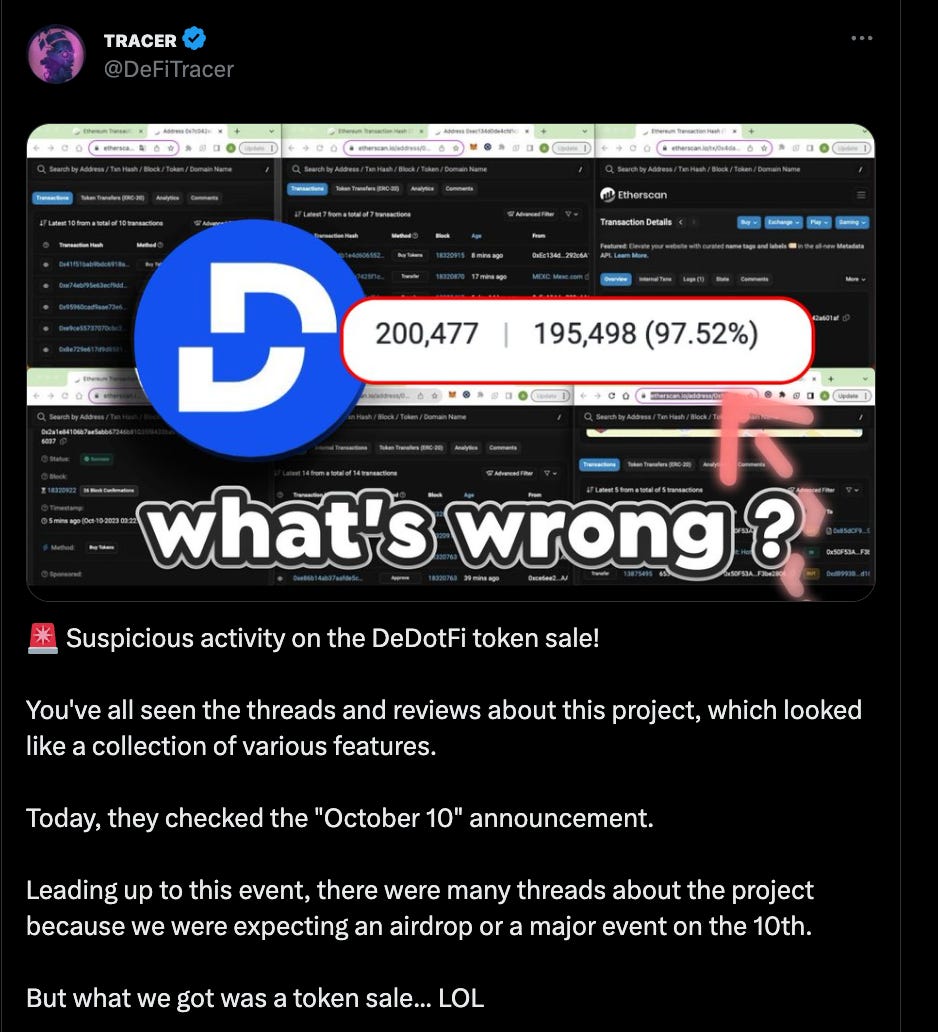

@DeFiTracer on dedotfi token sale

@tomwanhh USDR depegged despite being fully backed

@GarlamWON on FT potential hack

Bankman-Fried’s dad spotted in damning group chat during Ellison’s testimony

https://protos.com/bankman-frieds-dad-spotted-in-damning-group-chat-during-ellisons-testimony/

Twitter: https://twitter.com/arndxt_xo/status/1713551026941571087

Thorchain itself is not in maintenance mode, just Thorswap which is a dex built on top of Thorchain that everything was being routed through.