Gm ToE readers. BTC has been kissing 30k and I love that.

Macro: Fed is poised to hold rates steady but keeps further hikes on the table amidst mixed economic data. Markets remain cautious and volatile given uncertainties around the interest rate outlook. Key indicators like jobs, consumer spending and housing are being closely watched.

Trend: Bitcoin led this week's rally but faced competition from high-beta alts, while memecoins and small caps saw massive pumps. Misleading ETF news pumped the market. SOL is the bigger winner this week

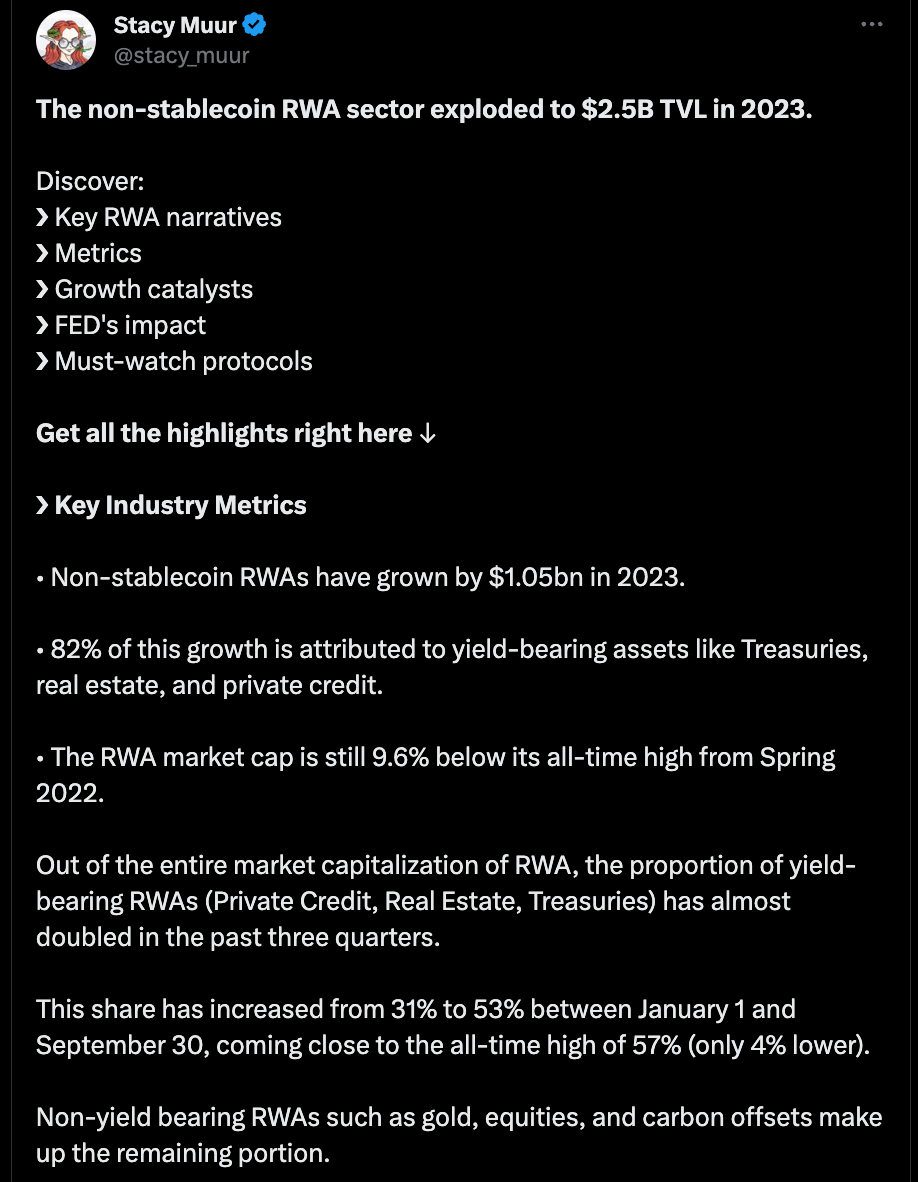

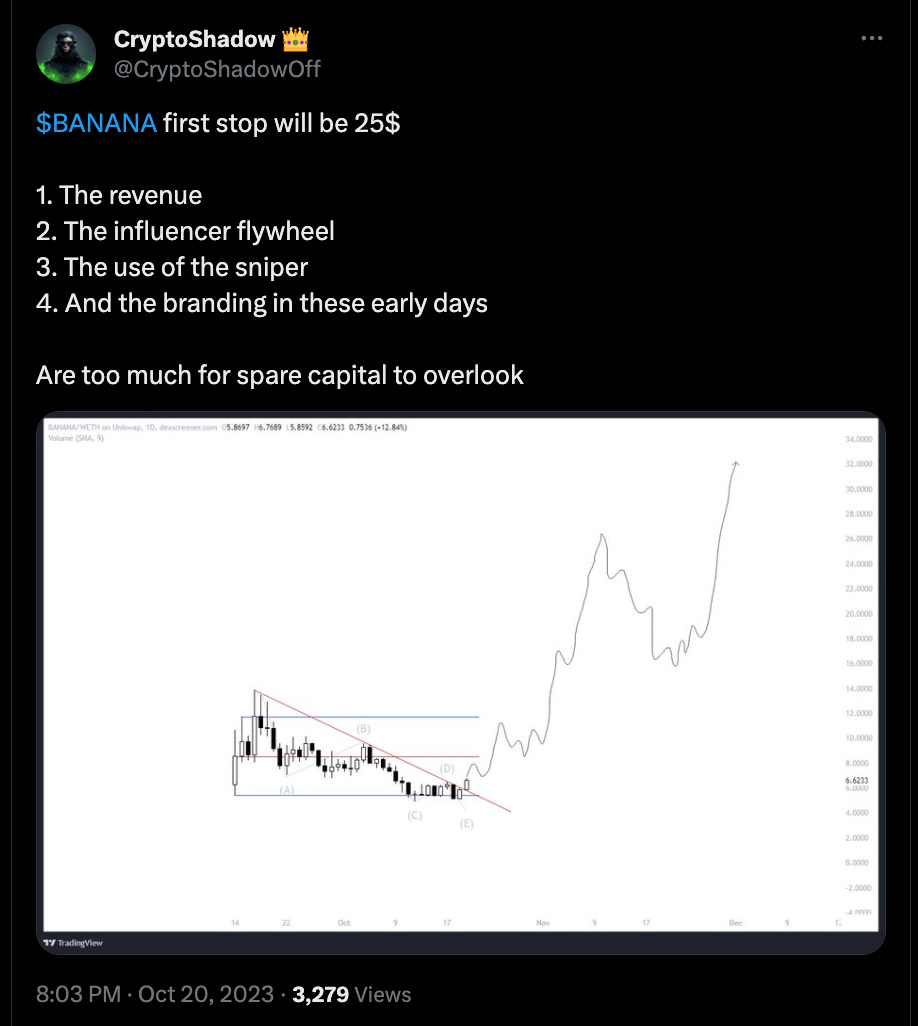

DeFi: RWA and AVAX narrative heating strong. $BANANA beaten out every other sniper bots with $REKT early buys. Onchain shows $BANANA getting lots of fees.

Tools: Getting a web3 job, new accounts to follow, 87 defi research tools, to websites you need to follow

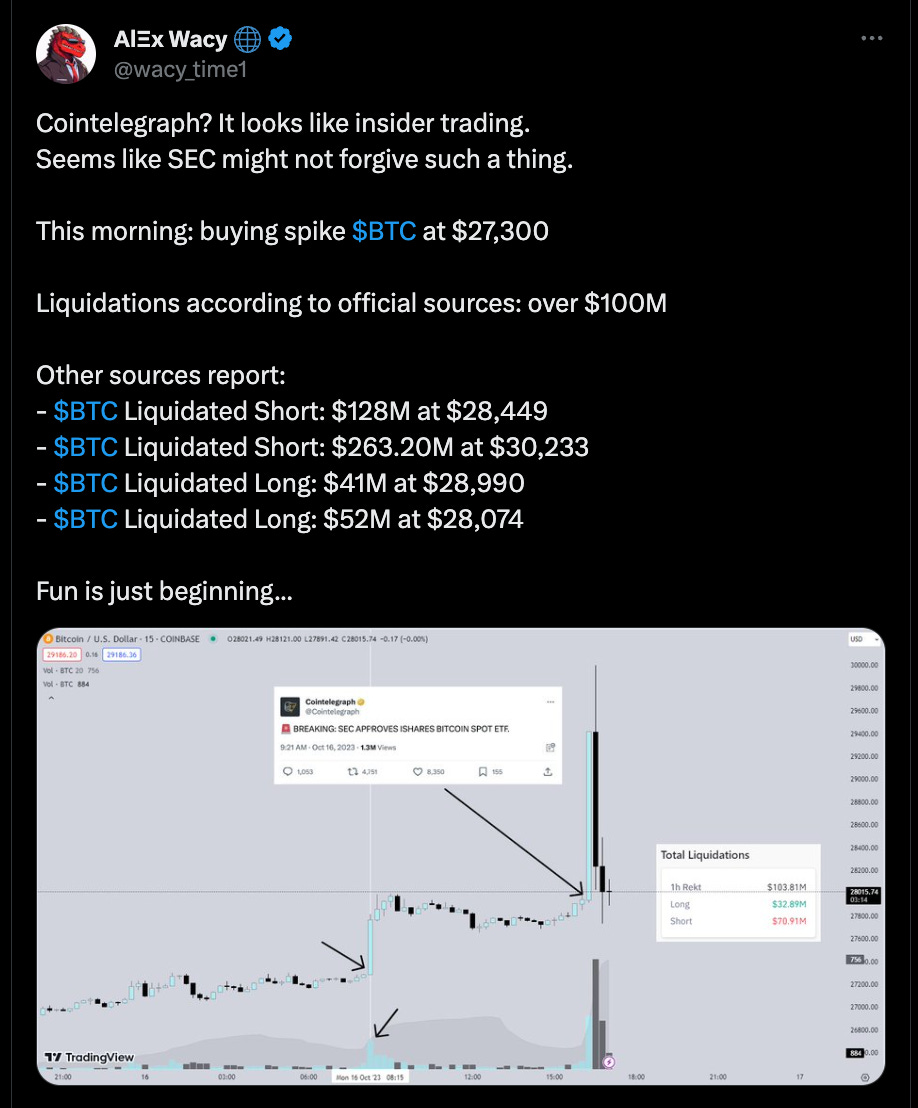

Spicy news: New users on Twitter to pay to tweet and retweet, Ferrari accepting crpyto payments, Cointelegraph insider trading

If you have not read the previous week’s highlight, here it is:

Hope you enjoy the content, and feel free to:

Connect with me on Twitter

Join my Telegram Channel

Segmenting the megathread of content into 5 parts:

Macro news

Trending narratives

Defi happenings

Educational resources and tools

Spicy crypto drama

1. Macro News

Fed is poised to hold rates steady but keeps further hikes on the table amidst mixed economic data. Markets remain cautious and volatile given uncertainties around the interest rate outlook. Key indicators like jobs, consumer spending and housing are being closely watched.

The Federal Reserve is likely to keep interest rates unchanged at its upcoming meeting, but remains open to further hikes if economic data remains strong. This aligns with market expectations.

Long-term Treasury yields rising reduces the need for more rate hikes, highlighting the importance of financial conditions in shaping Fed policy. The Fed is proceeding cautiously given uncertainties.

Jobless claims falling to a 9-month low signals ongoing labor market strength and economic momentum despite rate hikes. However, the housing market remains weak due to higher mortgage rates.

Stocks fell on Thursday, driven by Tesla's disappointing results, surging yields, and rate-sensitivity concerns. However, some companies like Netflix and American Airlines saw shares rise on positive news.

While the labor market remains strong, concerns about extended Fed rate hikes continue to impact markets. The Fed is data-dependent and watching developments closely.

@arndxt_xo on macro pulses

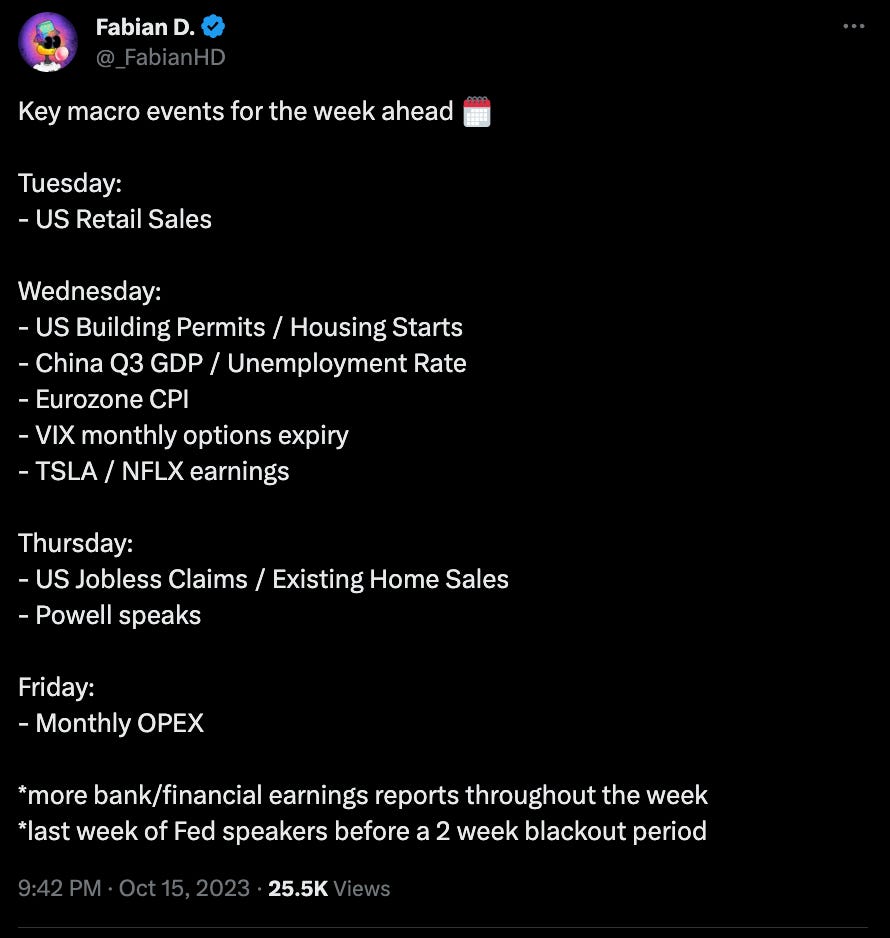

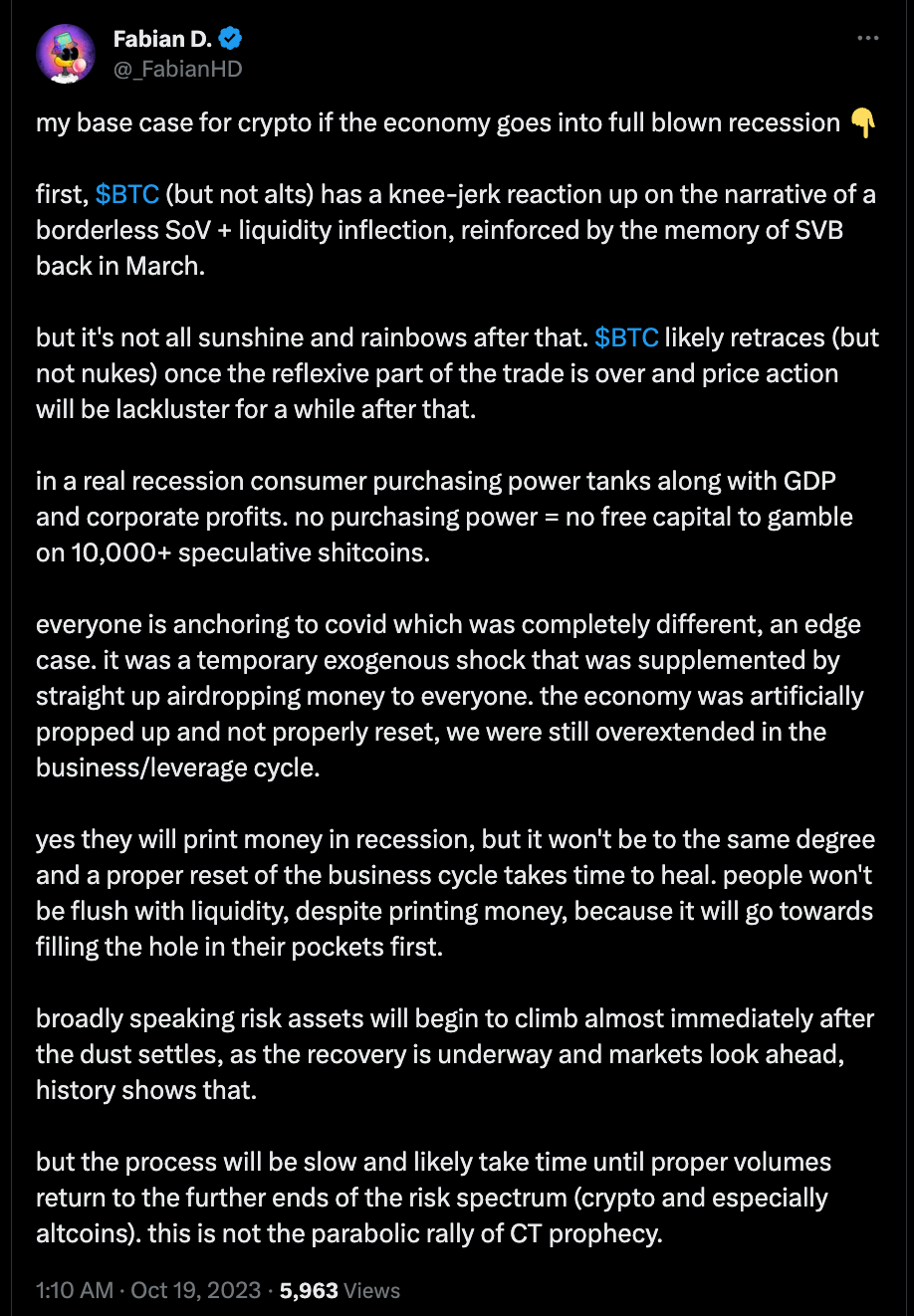

@_FabianHD Key macro events

@KobeissiLetter on key macro events

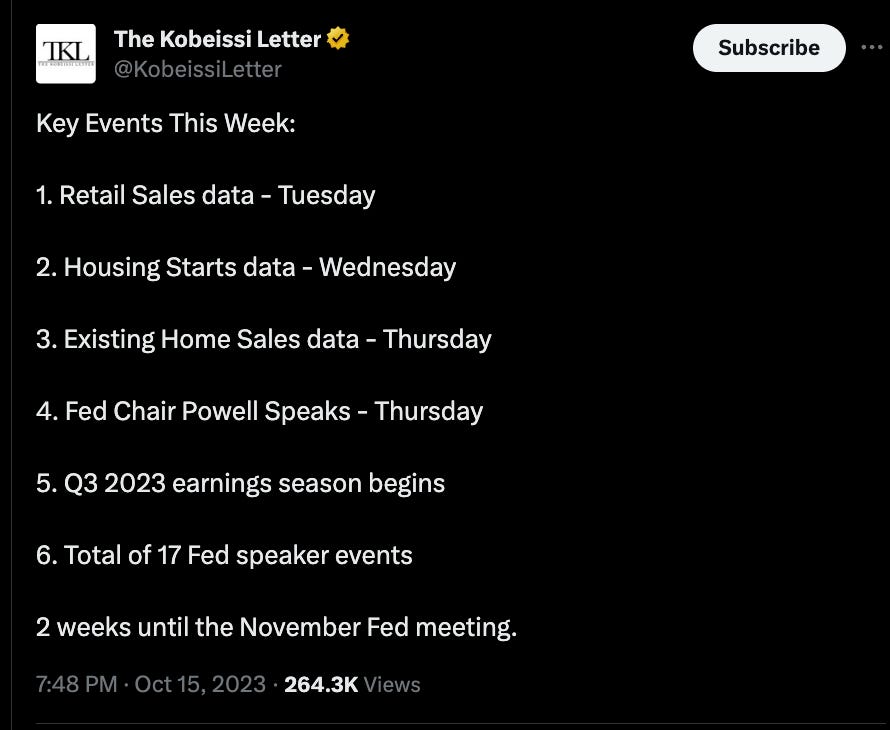

@GameofTrades_ Caution: Recession

@ImNotTheWolf on Coinbase buying BTC spot

@iambullsworth on market overview

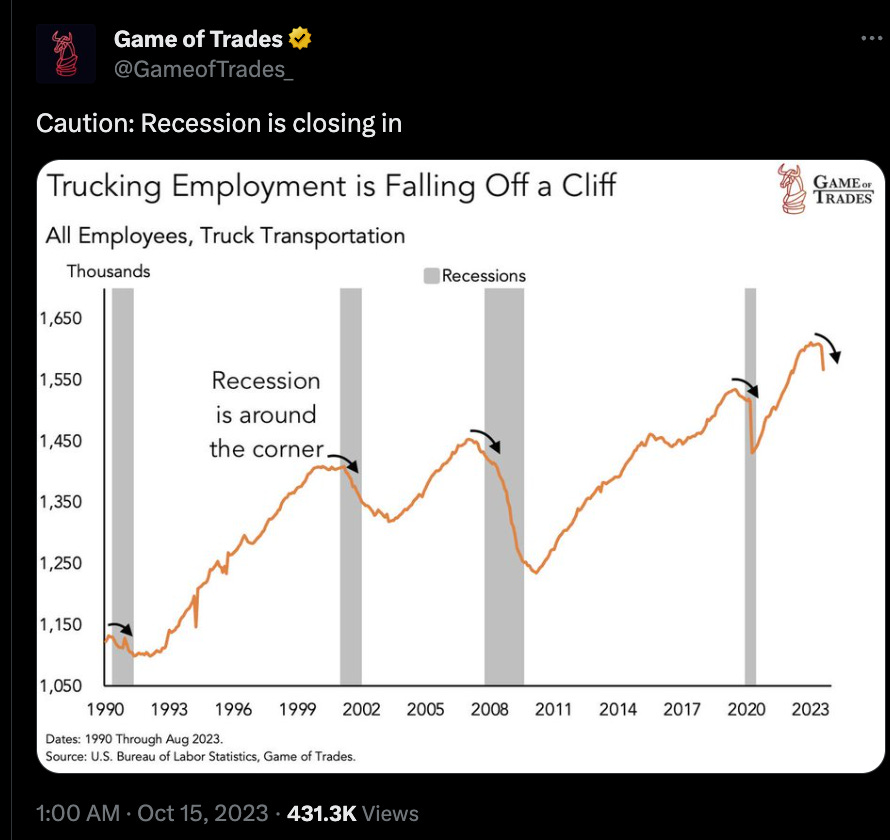

@leilanibabiez on big week

@_FabianHD on base case

2. Trending Narratives

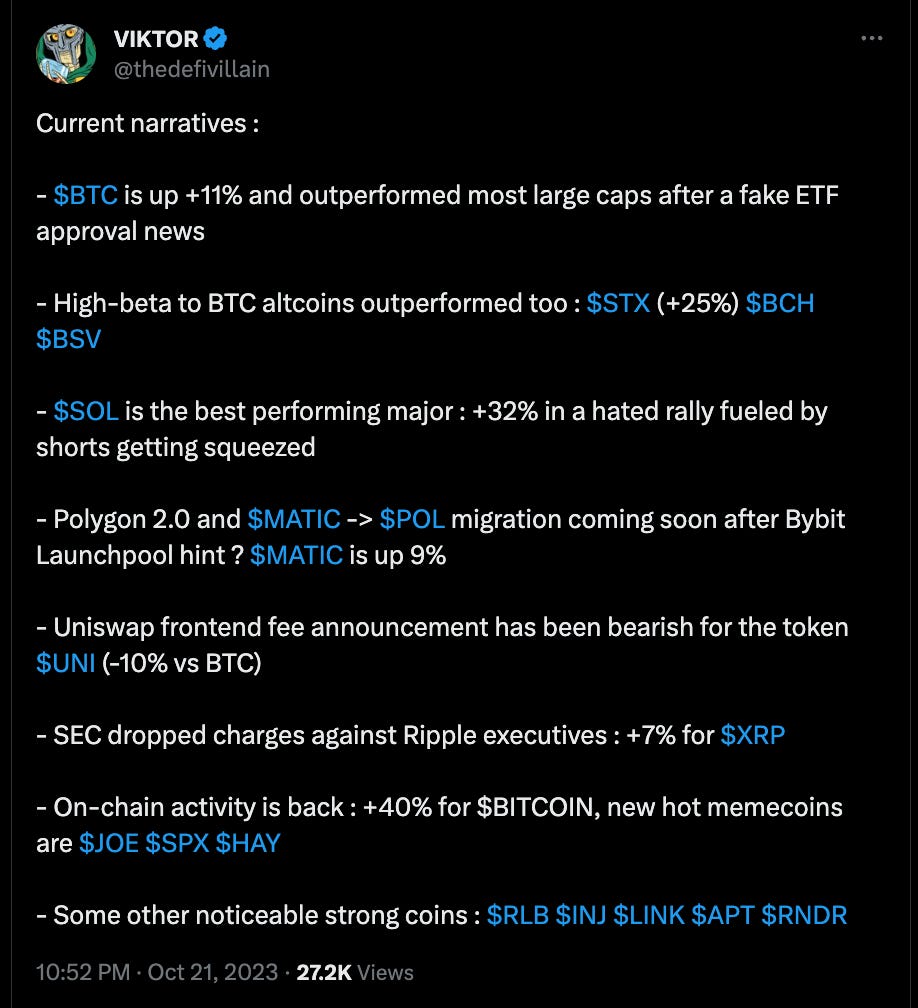

Bitcoin led this week's rally but faced competition from high-beta alts, while memecoins and small caps saw massive pumps.

Bitcoin (BTC) outperformed many altcoins this week, likely due to fake news about a Bitcoin spot ETF approval coming soon. This highlights that the market is anticipating an ETF approval in 2024.

Solana (SOL) was the top performing major coin, up 26% this week. It tends to outperform when the market is bullish, but still faces potential selling pressure from FTX liquidations.

Other top performers were beta-sensitive coins like Bitcoin Cash (BCH) and Stacks (STX) that tend to benefit when Bitcoin rises.

Uniswap (UNI) underperformed after announcing a new interface fee, which does not benefit UNI holders. This highlights UNI's lack of fee capture.

On-chain memecoins and smaller caps saw huge gains this week in the risk-on environment, like Rekt (REKT), Mogul Productions (MOG) and Bitcoin (BITCOIN).

You remain tactically short selected altcoins while being long Bitcoin into the potential ETF catalyst, to hedge. Your favorite short targets are ADA, XLM, WLD, APT, DOT, XRP, SUI.

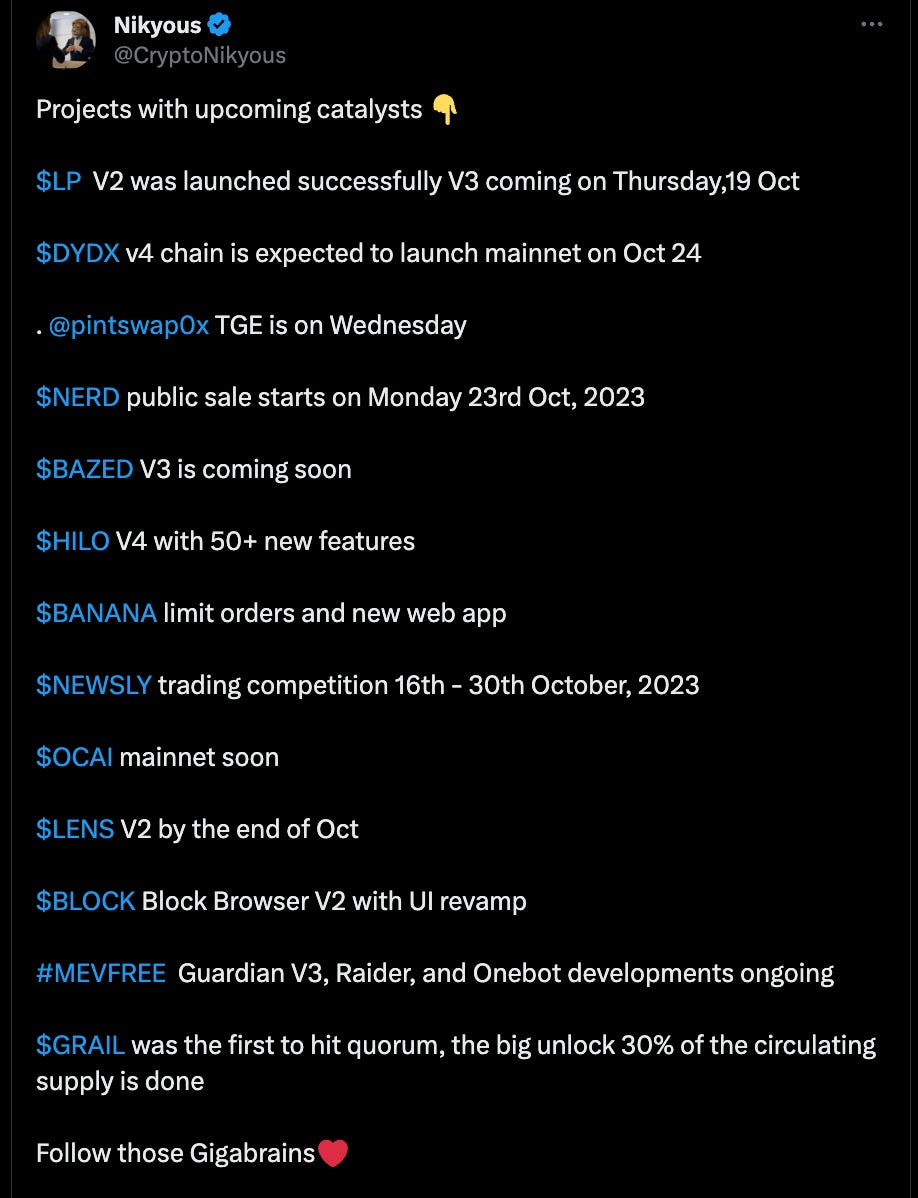

@CryptoNikyous on project catalyst

@ViktorDefi narratives

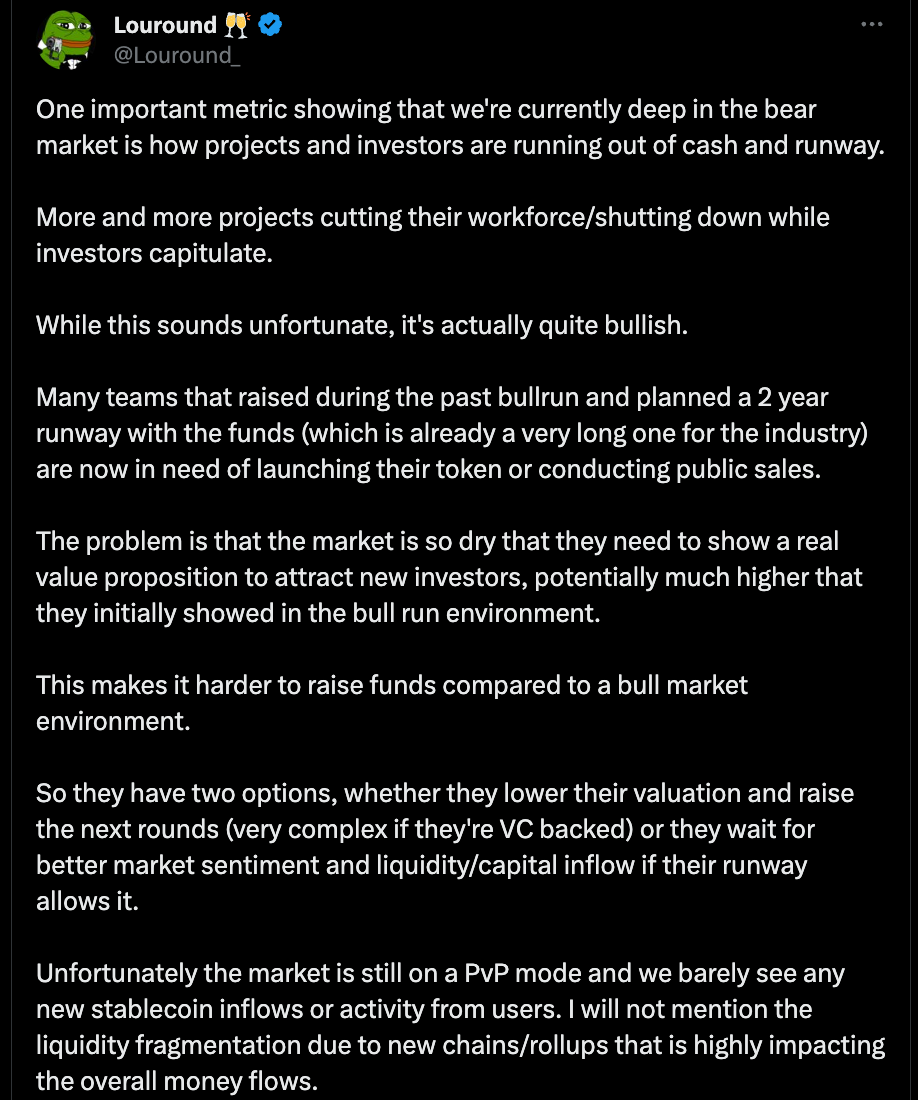

@Louround_ thoughts

@insomniac_ac on cross chain monday

@stacy_muur on RWA narrative

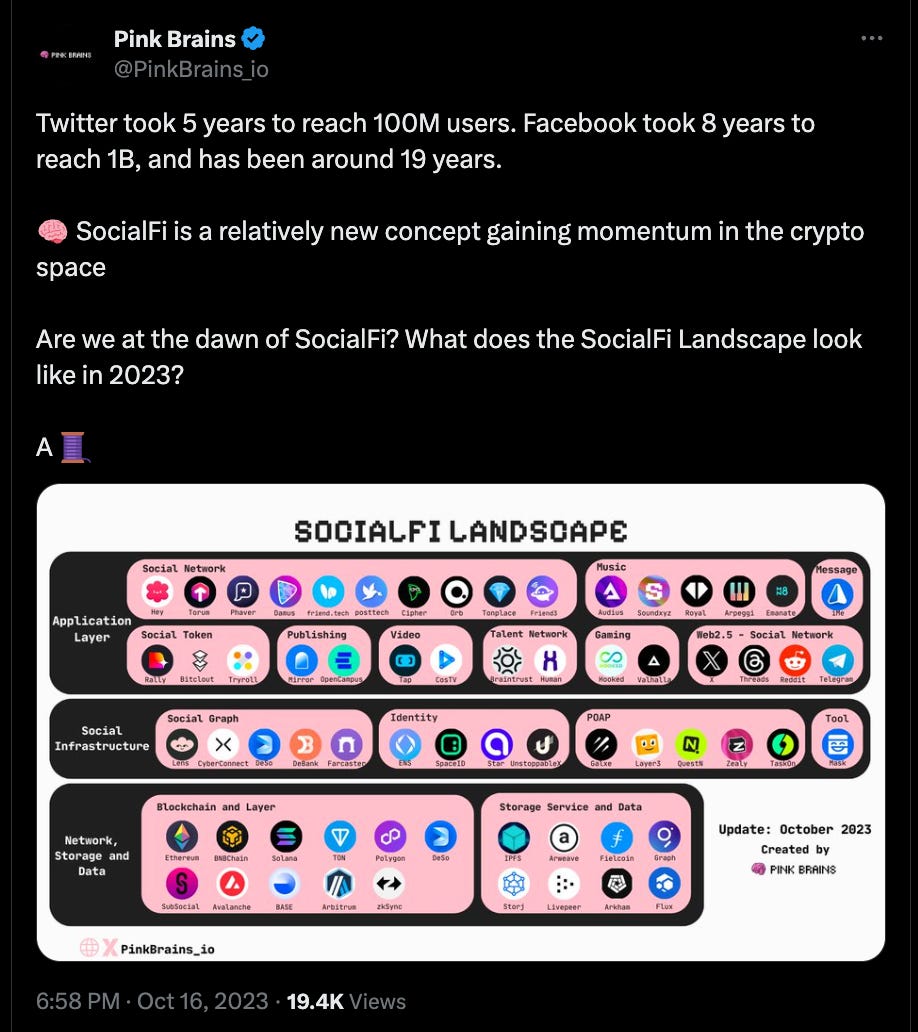

@PinkBrains_io on Socialfi narrative

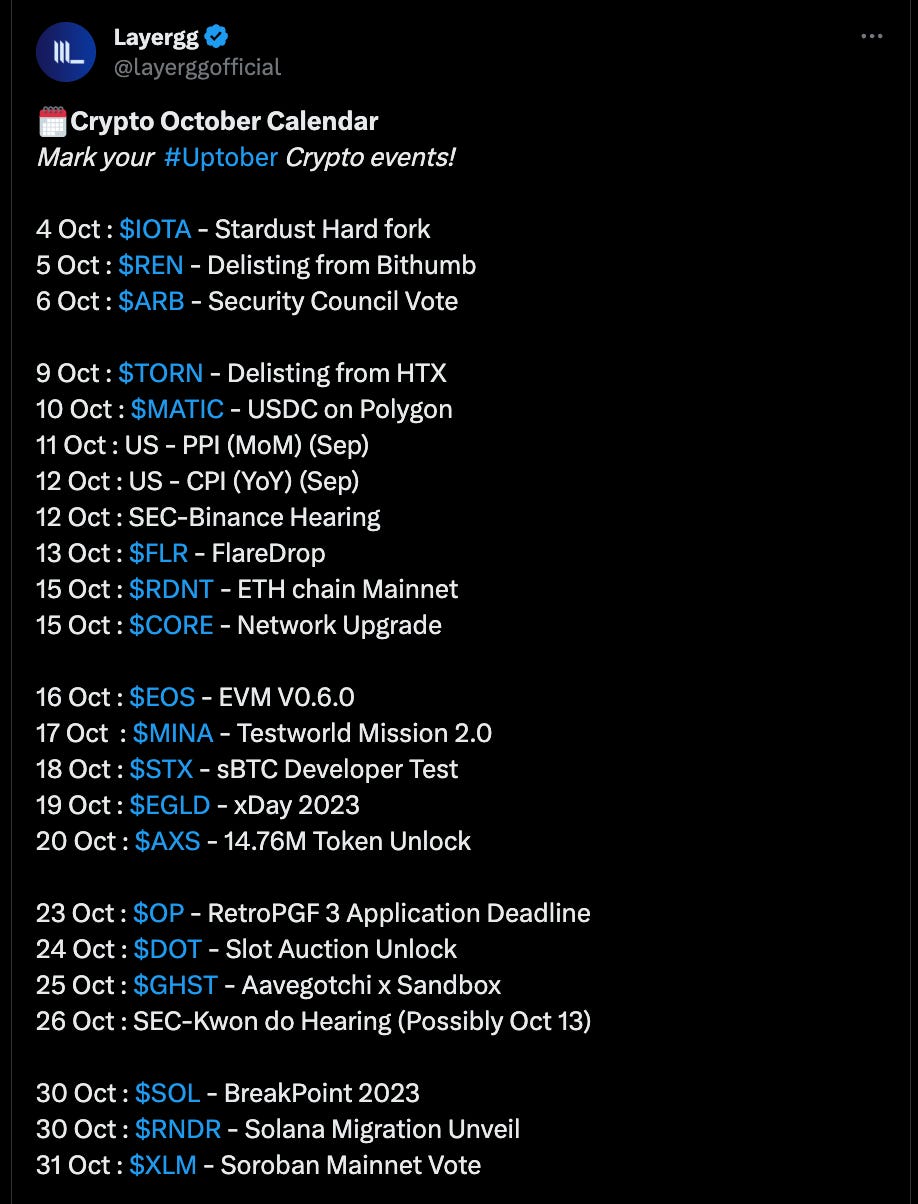

@layerggofficial Oct calendar

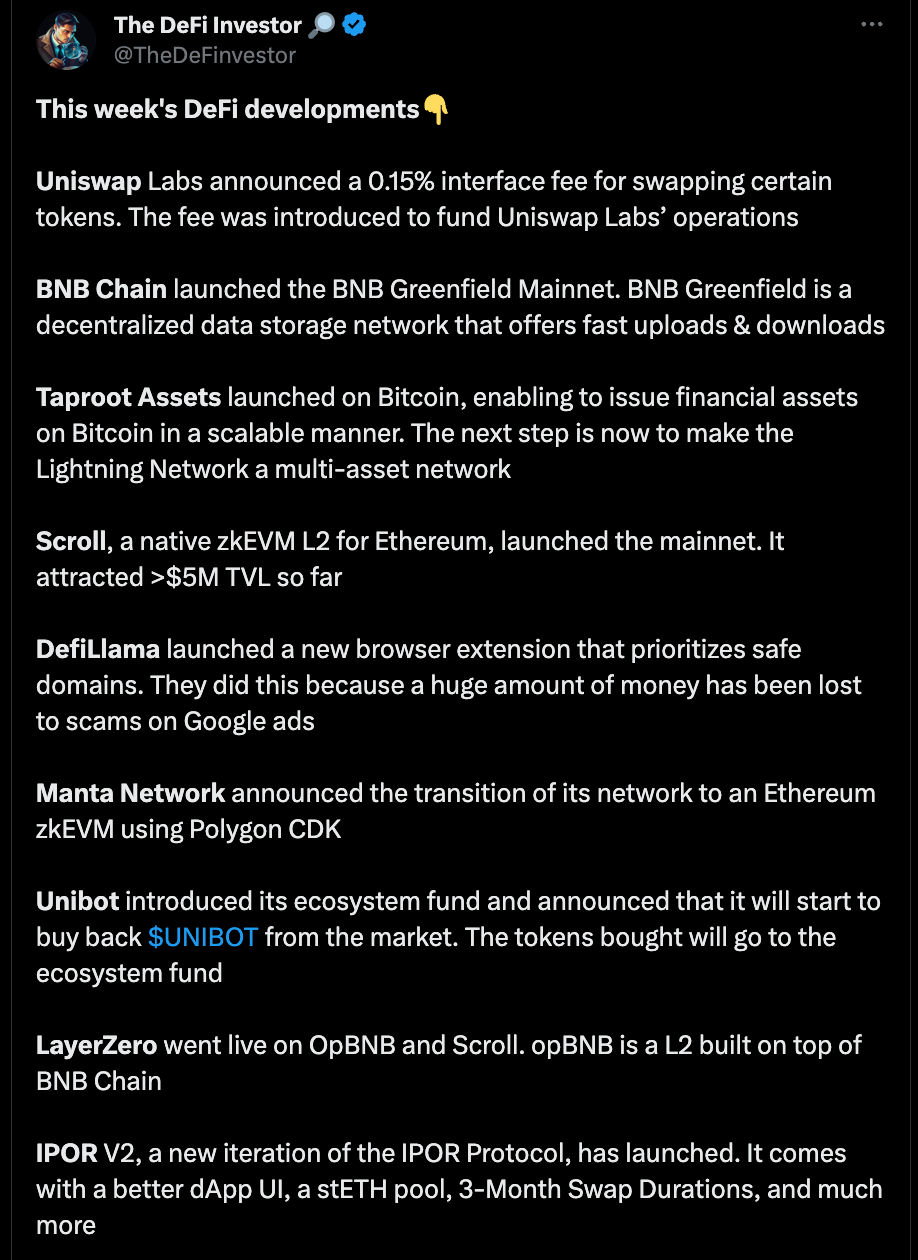

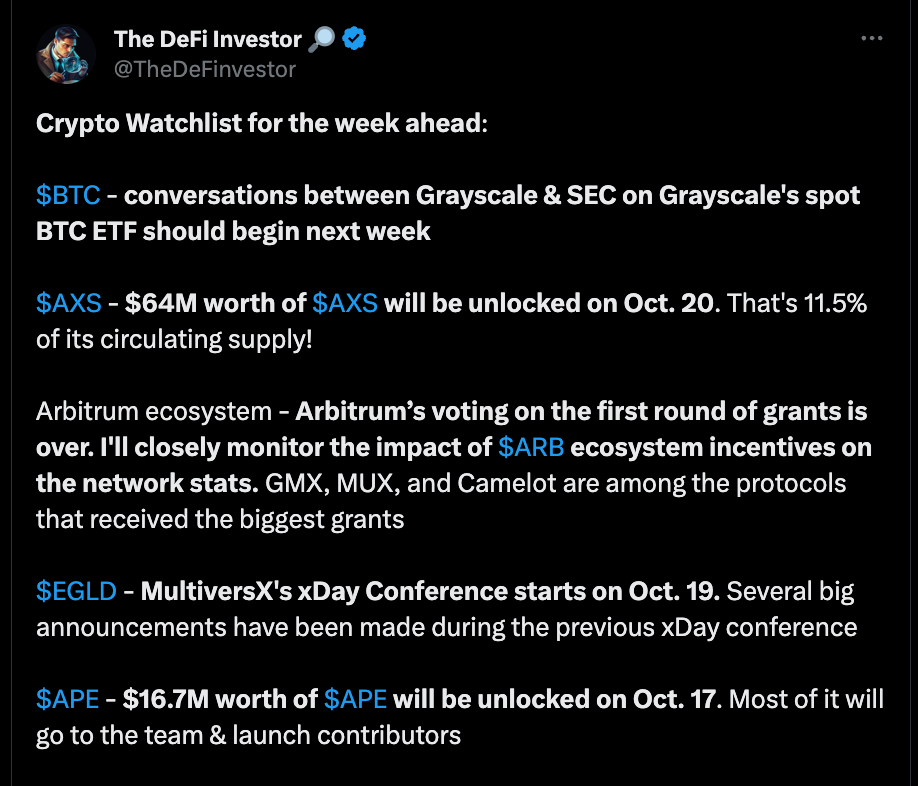

@TheDeFinvestor defi developments

@thedefivillain on current narratives

3. Defi Happenings

@TheDeFinvestor watchlist

@Flowslikeosmo on AVAX projects

@the_smart_ape on BTC

@jake_pahor on Pendle deep dive

@toffee248 finds alpha project

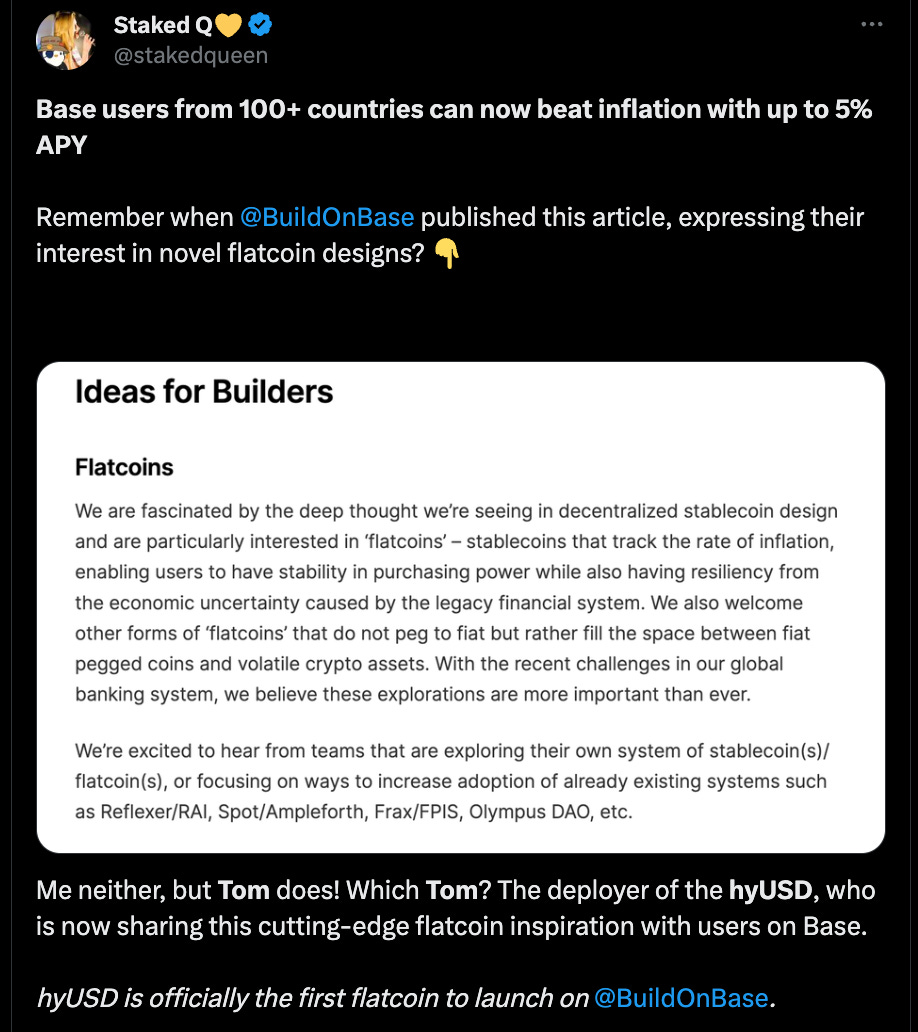

@stakedqueen on flatcoin on Base

@Swixyswixxx on Redacted

@CryptoNikyous on new tokens

@twindoges new gems

@TheDeFiPlug on OKX smart copy tradings

@defi_antcrypto on $ROSE

@wacy_time1 on Mixmob invested by big names like Hayes

@Beacon_Early early projects

@Launchpad_Daddy openfabric IDO

@Karamata22 on DePin

@DeFiMinty on Bracket labs

@Prithvir12 on 3 on chain actors

@thecalcguy shares his best yields

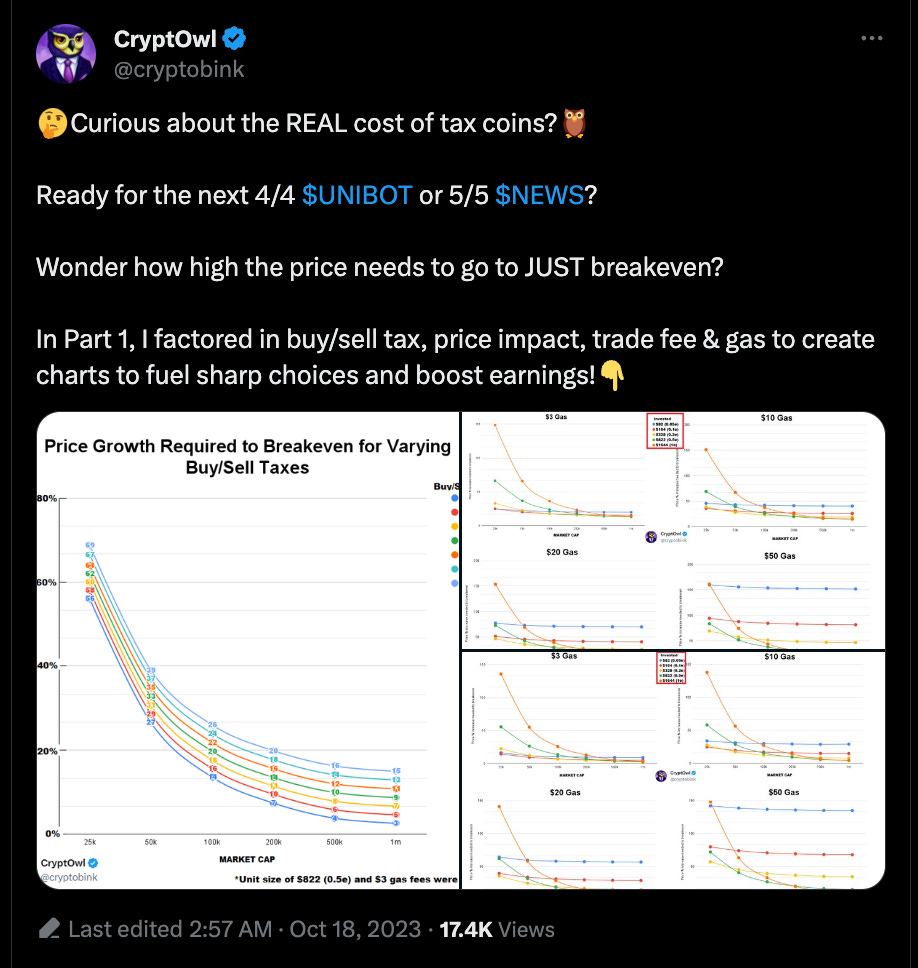

@cryptobink on real cost of your tax coins

@Moomsxxx on Defi options

@ton_blockchain attempting fastest blockchain

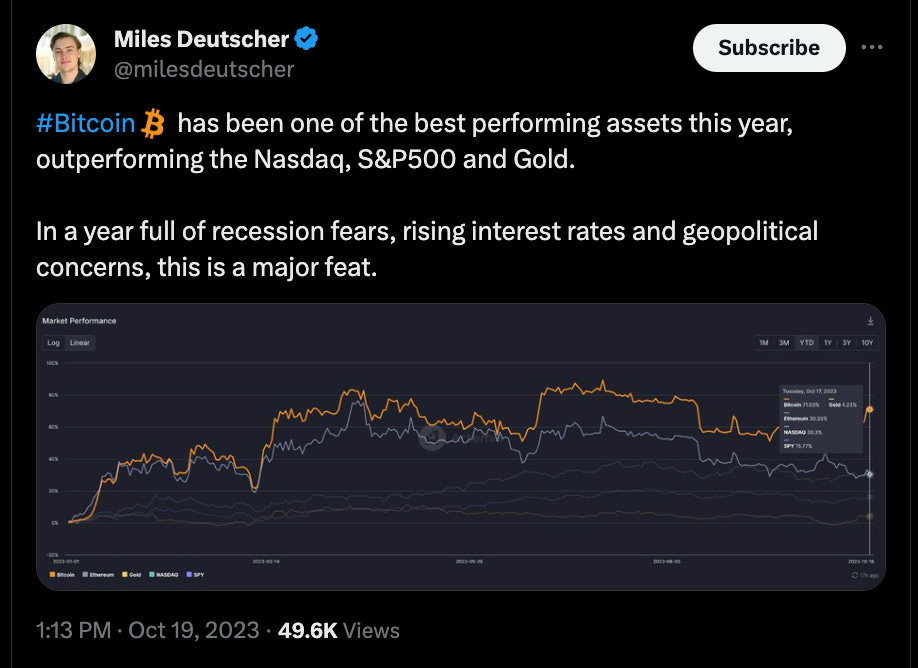

@milesdeutscher $BTC best performing

@matrixthesun on INJ

@ManaMoonNFT on BANANA is the best bot

@CryptoShadowOff bullish on BANANA

@CryptoGods44

1️⃣ Layer 1 (32%)

$KAS

$LOOP

$KOIN

$NEXA

2️⃣ Layer 2 (24%)

$LYUM

$GMX

$OP

$ARB

3️⃣ Tokenization (16%)

$RIO

$LEOX

$NXRA

$BOSON

4️⃣ Artificial Intelligence (12%)

$TAO

$VRA

$ORAI

$RNDR

5️⃣ Privacy (10%)

$ATOR

$ZANO

$ROSE

#0x0

6️⃣ Gaming (6%)

$NAKA

$GFAL

$PYR

$PZP

@Henry_VuQuangDu on $ASCN

@xponentcrisis on friendtech week 10 analysis

@DistilledCrypto gem picks

Thoughts on quality NFT projects on @solana calling it quits from the Bear Market and how to fix it:

-Enforce 10% royalties for creators/founders to enable runway based off community drawn interest. (The community decides the fate of projects. If there are no holders of a project then there is no project. If creators/founders give value, volume will be garnered to take care of monthly expenses. If holders complain or can’t afford to buy into projects to give that team more longevity, they shouldn’t even be buying NFTs in the first place. Or, if that project hasn’t done a well enough job in selling their product, just don’t buy so you don’t get burned out. It’s a projects job to win you over.)

-Future projects to not use mint funds to kickstart their project to prevent being called a rug since people love that term on Solana. (If a project doesn’t have money to begin with before starting, it’s an immeasurable risk to do a project in the first place, especially in a Bear. You will likely be setting yourself up for failure and the holders will lose confidence in NFTs if it happens to them enough times. When the bull comes back, it’s fair play again as the narrative will change.)

-Projects supporting other projects more frequently and more publicly. (Make the community of Solana as a whole support each other. There is no “best project on SOL”, that mentality is almost as bad as the chainist/tribalist mentality. If a blockchain and its projects are going to WAGMI, everyone has to row the same boat, not different boats they call their own.)

-Holders having less expectations of what they hold in their wallet. (The expectations from holders in SOL projects are more difficult to meet than in ETH, ADA and BTC. That takes away the joy of what made web3 special in the first place. Let’s go back to the basics and reset. Kind of what @DeGodsNFT are doing at the moment.)

-More support from the @SolanaFndn to projects. (Hackathons are important, but the founders/creators that can bring the next million users to the blockchain possess more weight. They must be invested in and supported to showcase confidence to the creators/founders and the holders.)

-Founders/Creators being more upfront and honest from Day1 and beyond for themselves and their holders. (Founders/Creators need to have the heart to say that there is no utility, that it’s just awesome art and that there will be basic community events for holders. Share your financials to create transparency, share your monthly expenses since there is a lack of knowledge on what that is and what means on web3.) I remember when a colleague shilled me his project and I bought in since he stated there would be private access, benefits and opportunities. Since none of that happened, that project is down 80% and that colleague has likely lost a few connections and support due to not being upfront in the first place. Transparency is key and if you can’t give any value or ashamed to admit that, then don’t do a project. Simple.

-Defining the difference between a rug and a failed project for everyone’s sake. (If a project had been giving something of value, trying for over a year and runs out of funds, they are still called rug on Solana? Why? It’s just a failed project. A rug is when the team disappears after a mint or doesn’t put an honest effort to deliver what they said beforehand. The rug/failed project ignorance has to stop as that creates unrealistic expectations for future founders/creators to not even want to start new projects to make the space better. This is a partial reason of why NFTs on Solana are a bit stagnant and most today will be cycled out and replaced in the next bull cycle if this continues .)

Thanks for reading, have a great day and let’s break the status quota together.

4. Educational resources and tools

@DeRonin_ list of jobs

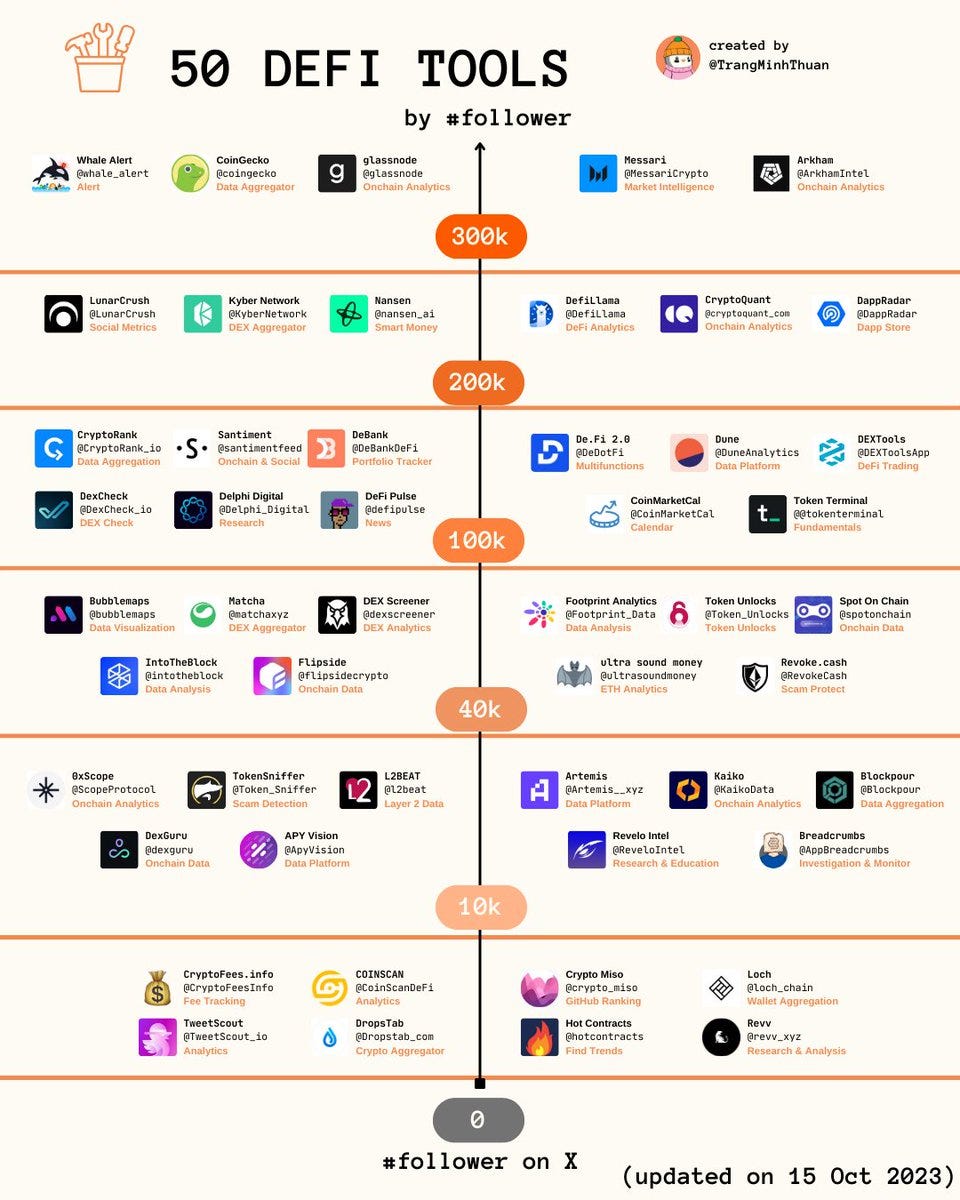

@DeRonin_20 free crypto research tools

@TrangMinhThuan on 50 defi tools

@MajorM111 on 17 tools

@the_smart_ape on 10 websites you need to knoew

@DeFiMinty 20 accounts to follow

5. Spicy Crypto Drama

@S4mmyEth on Ferrari accepting crypto payments

@wacy_time1 on Cointelegraph insider trading

@FortuneMagazine New users on Twitter to start paying