Gm ToE Readers! Been a wild week with ALT season indicator now at ATH

Macro: The US economy showed resilience in 2023 with robust GDP growth of 3.3% in Q4 and 6.3% for the full year, surpassing expectations and outpacing China's growth. This was driven by strong consumer spending and employment.

Trends: LRTs, TVL change across L1/L2, ETH season

DeFi: TIA node runners, Modular projects, Lowcap gem, IDO season

Tools: Defi security, Sniping guide, Exposing scammers, LST LRT dashboard

Spicy Drama: Mac cleared the air, Unibot deceptive team

If you have not read the previous week’s highlight, here it is:

Hope you enjoy the content, and feel free to:

Connect with me on Twitter

Join my Telegram Channel

Segmenting the megathread of content into 5 parts:

Macro news

Trending narratives

Defi happenings

Educational resources and tools

Spicy crypto drama

1. Macro News

The US economy showed resilience in 2023 with robust GDP growth of 3.3% in Q4 and 6.3% for the full year, surpassing expectations and outpacing China's growth. This was driven by strong consumer spending and employment.

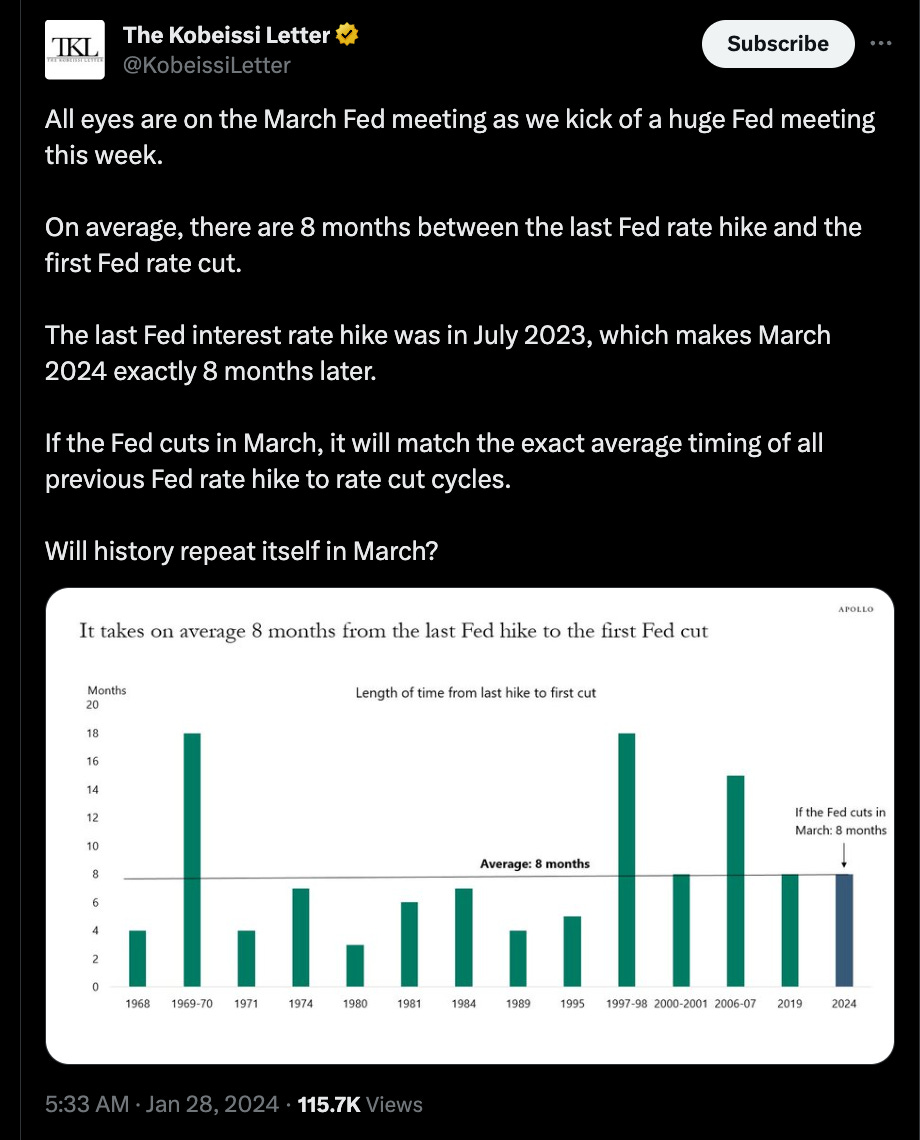

Inflation has cooled in line with the Fed's targets, raising expectations of a potential Fed rate cut in March. However, forecasts suggest economic growth may slow in H1 2024.

The ECB maintained interest rates at 4% while signaling a gradual shift in tone towards future rate cuts, likely beginning discussions in March and potential cuts in June if inflation declines continue.

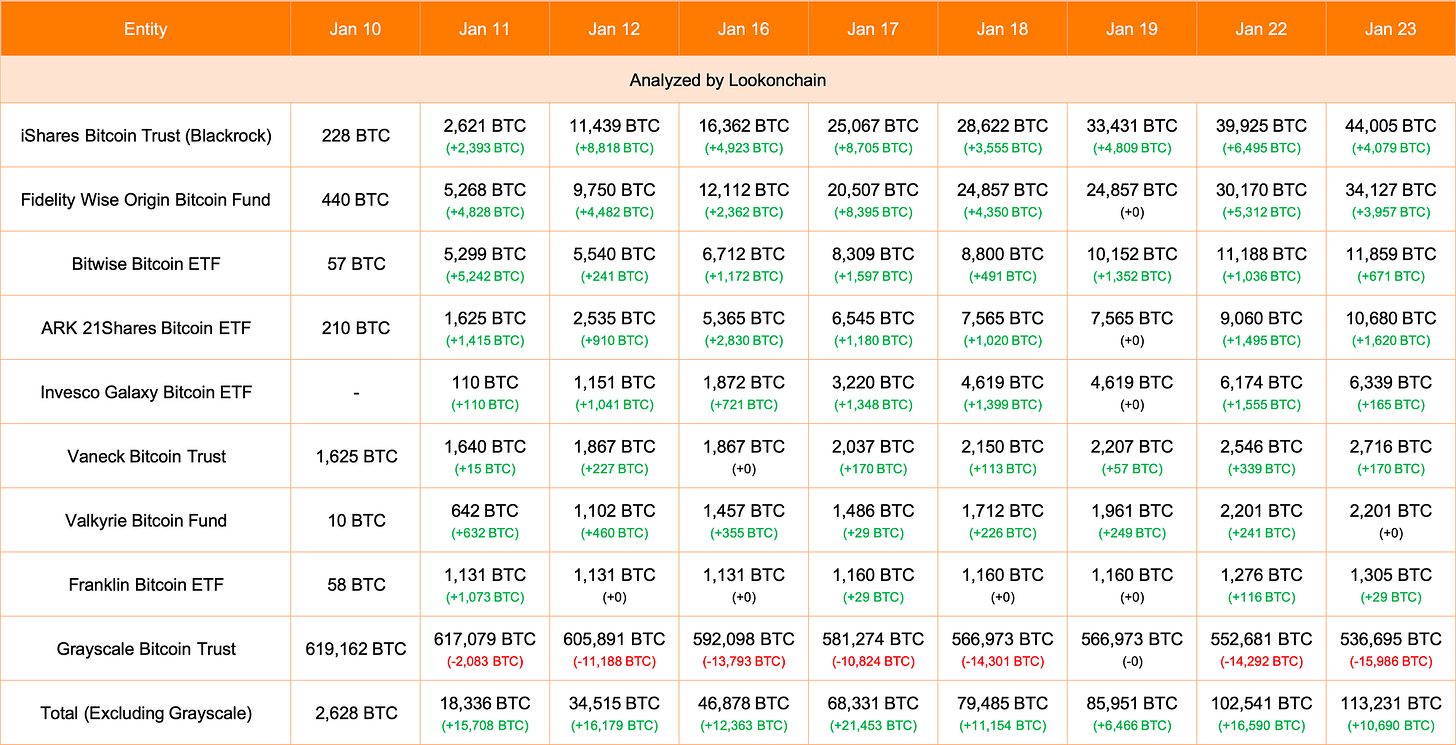

Grayscale reduced its Bitcoin holdings by a significant 15,986 BTC worth $641 million, indicating a major divestment or rebalancing strategy.

In contrast, 8 Bitcoin ETFs added a total of 10,690 BTC worth $428.6 million on the same day, led by iShares which accumulated 4,079 BTC worth $163.6 million.

The divergence in behavior between Grayscale decreasing and ETFs increasing BTC holdings signals differing strategic approaches and institutional sentiments towards Bitcoin investments at the start of 2024.

Grayscale's sizable reduction might reflect caution or a response to investor redemptions, while ETFs' collective accumulation points to growing confidence and strategic expansion of Bitcoin exposure.

Especially iShares' substantial BTC purchase could positively influence market perception and outlook among investors. However, Grayscale's major decrease may be interpreted with more caution and impact market sentiment.

@arndxt_xo on macro pulse

@ItsAverageJO on BTC thoughts

@KobeissiLetter eyes on March Fed meeting

@charliebilello on $BTC annualized volatility

@SuburbanDrone implosion incoming

@TheCryptoZombie on macro alpha

2. Trending Narratives

@Dynamo_Patrick on hot narratives

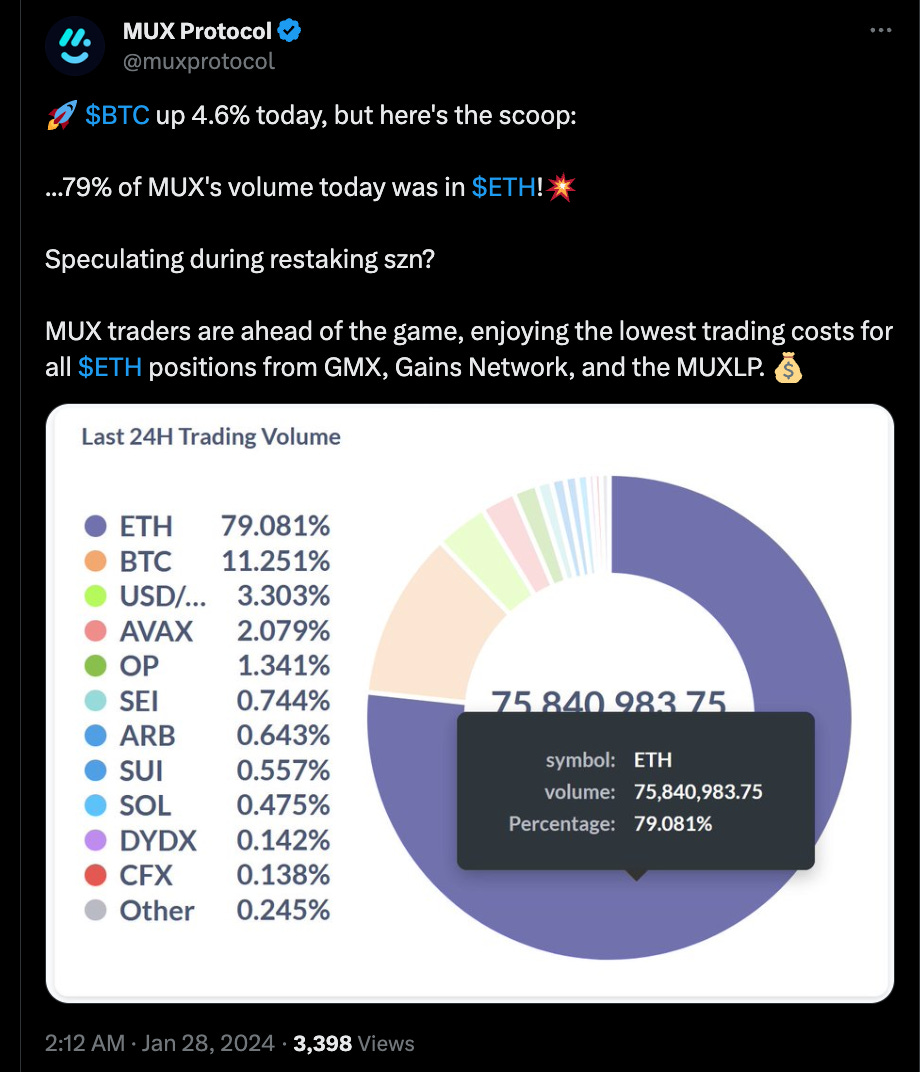

@muxprotocol on $ETH taking over

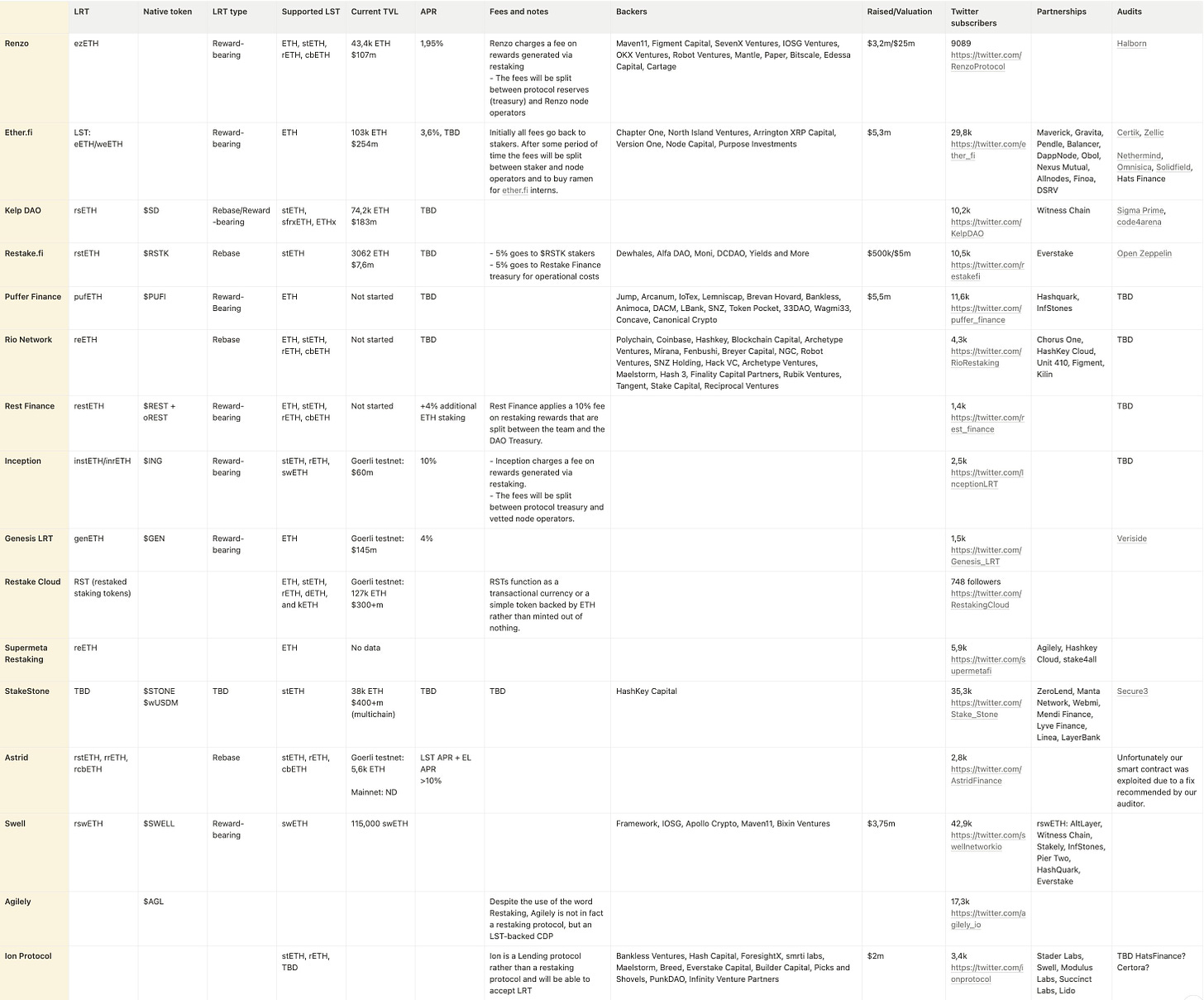

@DewhalesCapital on LRT protocols

@CryptoKoryo on TVL change

@tombheads on overall narrative and update

3. Defi Happenings

@0xSalazar on modular projects

@HeadblockchainX on Lowcaps

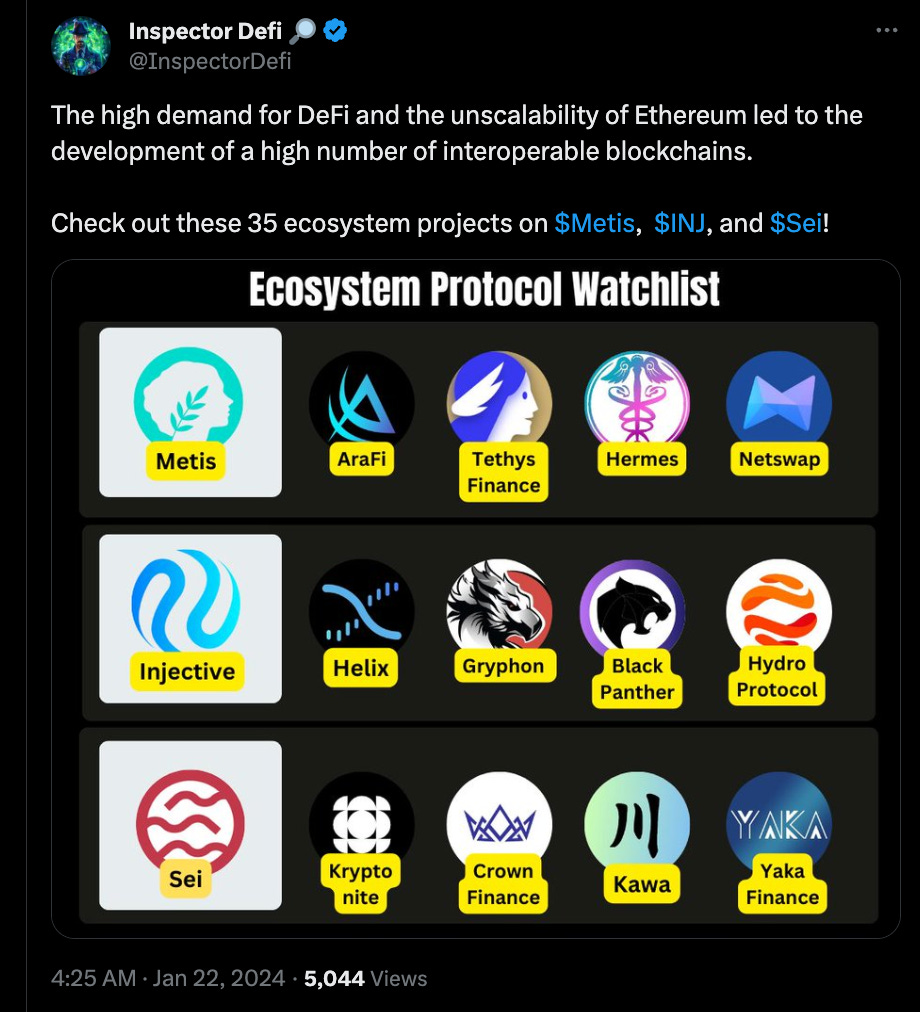

@InspectorDefi on ecosystem watchlist

@the_smart_ape on Eclipse airdrop

@eli5_defi about Flare network

@0xJok9r on guide to staking

@Louround_ on 6 unreleased projects

@marwolwarl about speculation

@hmalviya9 on zk rollups possibility

@0xSleuth_ on LBP strategy

@alphabatcher Top IDO in 2024

@PyroNFT Ponzi $BTC

4. Educational resources and tools

@OxFrancesco_ on Defi safety

@DeFiMinty twitter list

@thehiddenmaze on BTC L2

@Pickle_cRypto on altVM

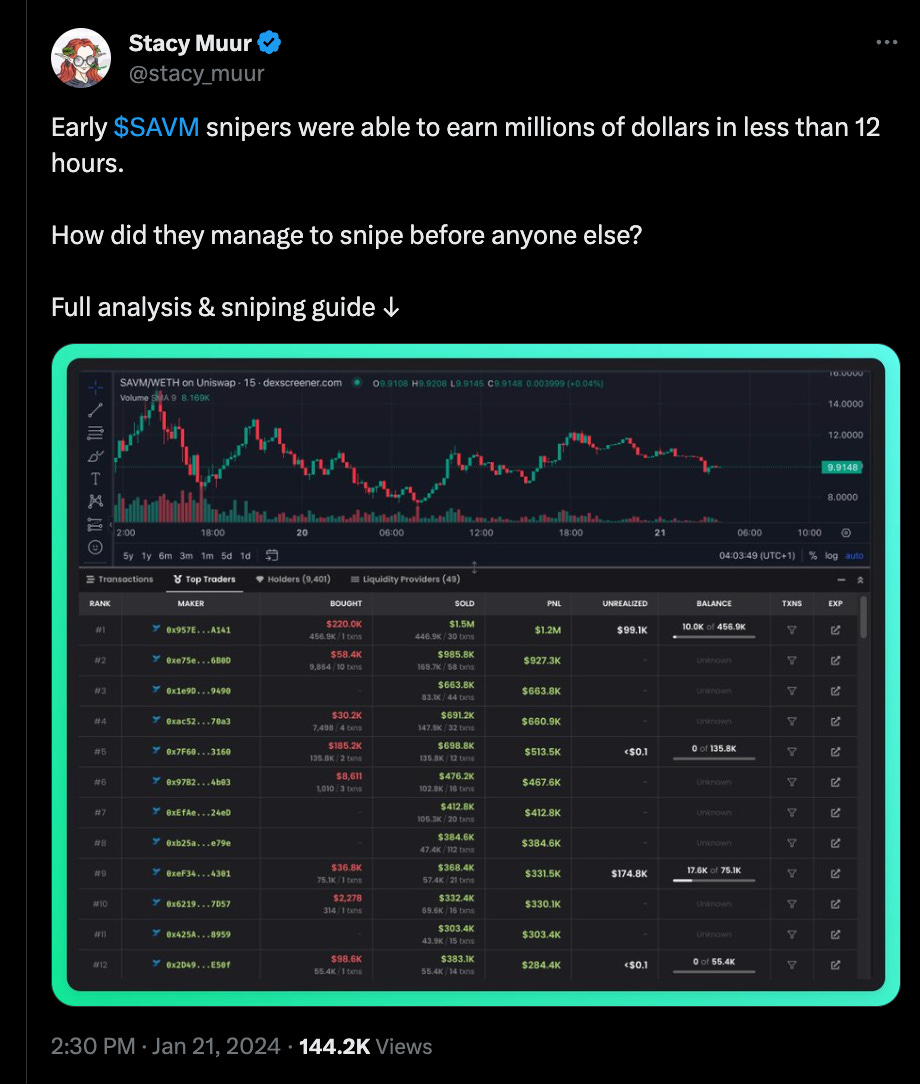

@stacy_muur on sniping guide

@CryptoKoryo on LST LRT dashaboard

@definapkin on Eigen deep dive

@kenodnb on the best threads

@the_smart_ape on TIA node runners

@stacy_muur Exposing scammers

@OKX_Ventures BTC outlook

@PinkBrains_io on defi KOL you should follow

@simpleWhitepapr Eigenlayer improve ETH security

5. Spicy Crypto Drama

@MacnBTC cleared all tbe bad air

@bobtherebuilt on deceptive teams

Twitter: https://twitter.com/arndxt_xo/status/1751641620582379568