The return of the Roaring Kitty made a comeback for $GME and memes

Sonic update created a resurgence of interest for $FTM $S

AI sector is seeing a lot of catalysts: Microsoft invests $2B into AI, Nvida earnings

Featuring 66 early projects for the week 👇🧵

Weekly Updates

Political Landscape

The upcoming US presidential election is bringing crypto into the national political discourse. Former President Donald Trump has taken a pro-crypto stance, stating "I'm good with Crypto. If you're for crypto you better vote for Trump." This contrasts with the Biden administration's previously anti-crypto policies. Over 20% of voters in swing states now consider crypto a key issue. Candidate Robert F. Kennedy Jr. has also voiced support for crypto. As crypto gains mainstream attention, its portrayal in the presidential race could impact market sentiment.

Liquid Restaking Landscape

The liquid staking sector is heating up with new entrants like Symbiotic, a restaking protocol reportedly backed by Lido co-founders and Paradigm. It aims to allow staking of popular non-Ethereum assets alongside ETH. This introduces added competition to established players like Lido and Rocket Pool while giving stakers more choices.

SOL vs ETH Economic Value

In a first, the Solana network generated higher total economic value (transaction fees + MEV revenue) than Ethereum's layer 1 on May 12th. This metric doesn't account for Ethereum's layer 2 roll-ups which have seen rapid growth. Nonetheless, it demonstrates Solana's ability to generate meaningful fee revenue despite low transaction costs.

Weekly alpha by @TheDeFinvestor

Narrative Overview

Ethereum Heading Towards New Lows Against Bitcoin

On the Ethereum front, the ETHBTC pair is heading towards new lows at 0.047 as the deadline for the first spot ETH ETF filings approaches in two weeks. Many market participants expect these filings to be denied, potentially setting the stage for a "buy the news" event. Ethereum itself is currently trading at around $3,122.

AI Tokens Shine Amid Broader Market Sluggishness

While the broader cryptocurrency market remained relatively quiet, AI-focused tokens exhibited strength, possibly fueled by a tweet from Eugene, a prominent trader on the Binance leaderboard. The illiquid market seems to be craving narratives, and such catalysts have had a significant impact. The AI sector remains a top-performing category, with the AI <> Memecoins rotation continuing to be a consistent theme.

Potential catalysts for the AI token rally include NVIDIA's earnings release on May 22, OpenAI's announcement today, and the possible release of GPT-5 this summer. $WLD, the main proxy for OpenAI, was up 30% in May before the announcement, which turned out to be a "sell the news" event, revealing a new version of GPT-4 (GPT-4o) and a desktop app.

$OLAS, related to the AI agent theme, pumped 50% in early May but retraced all gains. A new AI coin, $SPEC, launched last week and is available on Bybit spot and Base. It pumped from $5 to $15 but then retraced back to $10, and with an FDV around $1 billion, some analysts are sidelined on this token.

$RNDR was the best-performing AI coin, being a direct proxy for NVIDIA, while $AR performed well, cementing its place as a leading AI coin. Conversely, the 3 "ASI" coins ($FET, $AGIX, $OCEAN) are losing steam since the merger announcement compared to RNDR, AR, and NEAR.

Memecoins and the Return of 'The Roaring Kitty'

Memecoins had a strong week, with $PEPE leading the pack, trading near its all-time high. Its relative strength is impressive, especially against ETH. However, the consensus around $PEPE is concerning, with many traders now holding long positions.

The return of "The Roaring Kitty" on Twitter led to a 40% premarket pump in $GME, the stock associated with the infamous Reddit-driven short squeeze. The crypto equivalent could be a new memecoin season, but it might be short-lived if Bitcoin experiences a significant sell-off. One standout memecoin this week was $michi, a cat meme coin on Solana, shilled by Ansem, reaching a $250 million market cap.

SocialFi Narrative Gains Traction

Among large-cap cryptocurrencies, $TON (Telegram's coin) seems unstoppable despite its high valuation. $TON can be considered a "SocialFi" coin, a narrative gaining strength in the market.

A new SocialFi app, Fantasy Top, is garnering attention. It's a card game featuring crypto influencers, already earning substantial fees ($3 million this week). Other notable SocialFi tokens include $FRIEND, $DEGEN, $OX, and $DMT.

$DEGEN is the main proxy for Farcaster, and Farcaster held its conference, FarCon, this week. $FRIEND had a notable rise to $3 but has since retreated to $2. $OX is associated with Ox.fun, Su Zhu, and Kyle Davies' new perp DEX, embracing the degen spirit with memecoin support as collateral. $OX is launching an L3 on Base and seems like an attractive buy at the current valuation.

Altcoin Market Highlights

Donald Trump hosted an event with NFT card holders, declaring his pro-crypto stance. The $MAGA token pumped 75% after his announcement and remains a potential beneficiary until the elections.

$RUNE is up 11% this week, one of the top performers among the top 100 cryptocurrencies.

Robinhood received a Wells Notice from the SEC, but it didn't significantly impact $HOOD or crypto prices.

A new Ethereum L2 token, $MODE, launched with an FDV below $500 million, indicating a fading L2 premium.

FTX creditors are expected to receive 118% of their losses, though the BTC value is down due to the bottom prices used for calculations.

Other updates

Updates covered major news events, exploits, regulatory actions, new project launches, on-chain activities around farming opportunities and whale wallets, as well as a highlighted narrative around pair trading. The price analysis suggests a waiting game in the current range-bound conditions.

Key News and Updates:

Major news included updates around the FTX bankruptcy case, with creditors expected to receive at least 118% of allowed claims in cash within 60 days. Several institutional players also disclosed Bitcoin ETF holdings.

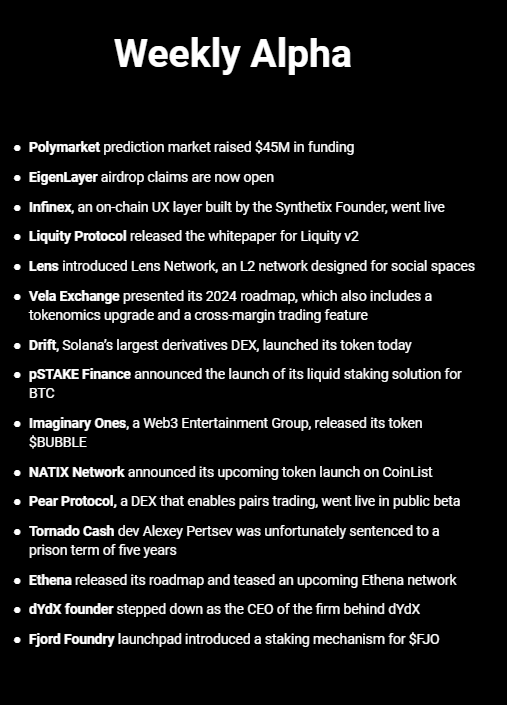

There were several project updates and new project announcements, including Bloom on Blast, Rain & Predy Finance being exploited, Zeta Markets announcing a community airdrop, GMX deploying on Solana, and Ethena Labs releasing its 2024 roadmap.

Regulatory actions included Binance being fined $6M CAD by Canadian regulators for compliance violations, and the Tornado Cash developer Alexey Pertsev receiving a 64-month prison sentence.

On-Chain Analysis:

Ahead of the Blast TGE in June, there was an analysis of the farming opportunities on the Layer 2 platform, including farming $PAC on Wasabi Protocol and providing liquidity on Juice.

There was significant bid wall activity from "Machi Big Brother" on the $FRIEND token, accumulating around 6% of the total supply.

Potential bearish catalysts were identified for the $ENA token due to seed investor unlocks leading to heavy sell pressure.

Hot Narratives:

Pear Protocol, a new DeFi project on Arbitrum enabling on-chain pair trading, was highlighted as an interesting development amidst the choppy market conditions.

Price Action Analysis:

The overall market remained range-bound and boring, with the analyst (Vlad) seeing the current price action as a re-accumulation phase within an uptrend.

The analyst is waiting for a strong push above recent fractal highs and trendline resistance before considering long positions, while a breakdown could signal a larger re-accumulation or distribution phase.

Early Projects

Powered by @arbusai

Twitter: