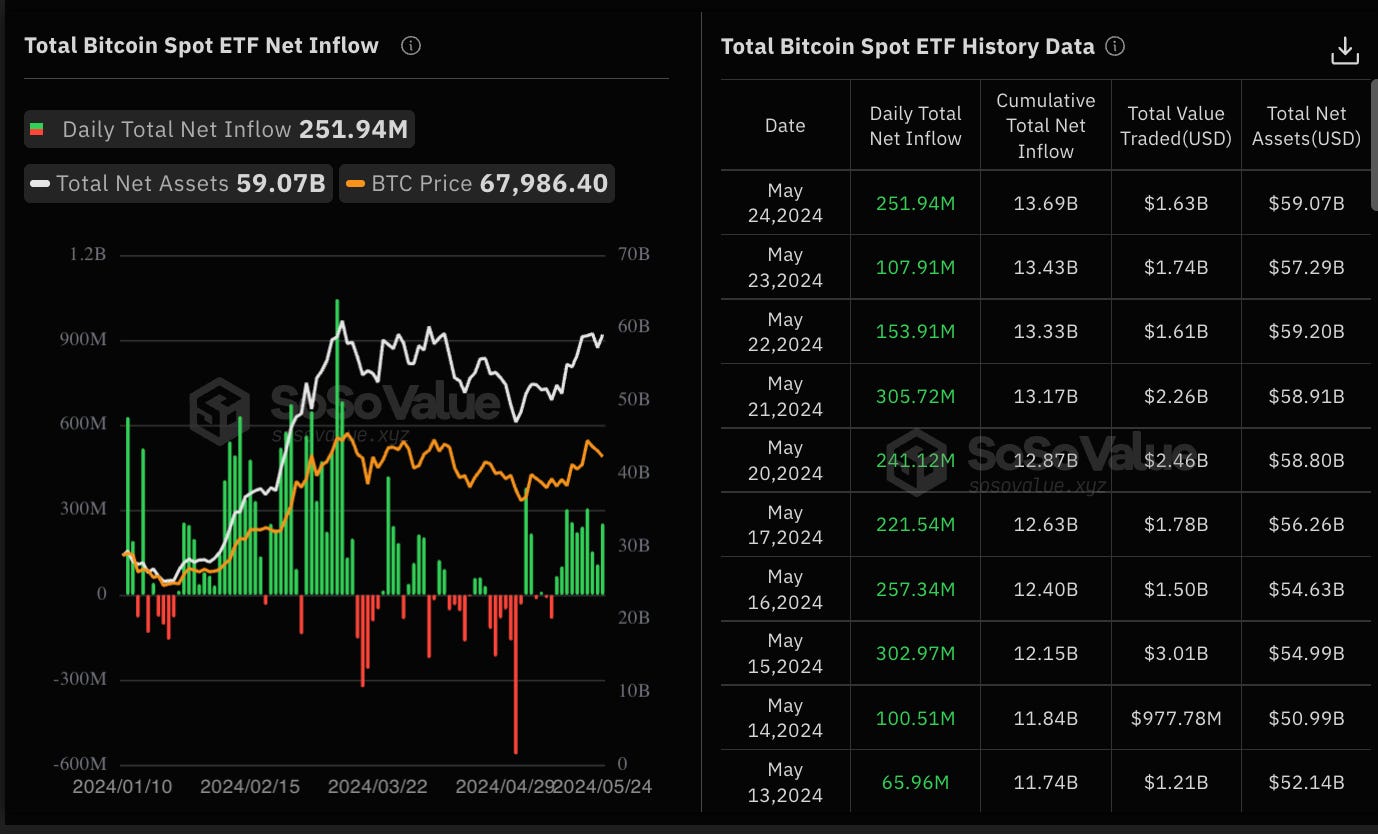

The tides are shifting - ETF approved, and flourishing DeFi (TVL ATH)

$DMT heavily being accumulated by GSR

$FRIEND suffering from huge sell pressure

Lens Protocol building on zkSync ahead of potential $ZKS airdrop

Here are 78 early projects + alpha for the week🧵👇

Weekly Updates

While there may be some short-term volatility around specific events like ETF approvals, the regulatory clarity from FIT21, the sustained DeFi growth, and the constant stream of new projects and innovations suggest the crypto market is maturing and could be poised for more mainstream adoption over the longer term.

The crypto market saw some major developments this past week that could have significant implications moving forward. On the regulatory front, the U.S. House approved the FIT21 crypto bill, which clarifies the roles of the SEC and CFTC in regulating digital assets and largely gives more control to the more crypto-friendly CFTC. This is viewed as a policy win for crypto.

Additionally, the SEC is expected to make a decision soon on approving spot Ethereum ETF applications. If approved, this would be a massive development by allowing wider investor access to Ethereum. However, there are concerns about potential near-term selling pressure if Grayscale's $11 billion Ethereum trust gets converted to an ETF and those holdings get unlocked and sold. That said, the long-term impact is expected to be highly positive by attracting more liquidity, similar to the spot Bitcoin ETFs.

The total value locked in DeFi hit a two-year high, nearly tripling since October 2022, indicating growing adoption and interest in decentralized finance applications and protocols. This growth coincides with the proliferation of new and innovative DeFi projects across various blockchains.

Weekly alpha by @TheDeFinvestor

Narrative Overview

The Bitcoin rally, Ethereum ETF anticipation and positive regulatory developments provided a bullish backdrop, while gaming, memecoins and certain DeFi tokens also saw strong momentum amid new launches and project-specific news.

Bitcoin and Overall Market:

Bitcoin saw a strong rally, moving from around $62,700 to $70,000 due to two key bullish events:

CPI inflation numbers came in "in-line" with expectations, pushing BTC from $62k to $66k.

News that the state of Wisconsin invested almost $100M in the BlackRock Bitcoin ETF (IBIT).

The breakout on May 15th after the CPI data, with BTC forming a higher high and flipping several key moving averages, was a bullish signal for the short-term.

Increasing Coinbase premium (BTC trading at a higher price on Coinbase than other venues) also signaled institutional buying.

Ethereum ETF Approval:

The SEC was expected to decide on approving or rejecting VanEck's spot Ethereum ETF application by May 26th, which would set the precedent for other applications.

Odds of approval had declined sharply in recent months to under 10%.

A tweet from Eric Balchunas revising the approval likelihood much higher caused ETH to pump 10% in 10 minutes and rally 20% on the day.

ETH beta tokens like ENS, UNI, LDO, ARB, PEPE saw even bigger gains, with some like PENDLE up 50%.

The ETH ETF news also boosted NFT prices for collections like Milady and Remilio.

Gaming and Crypto Hacks:

The gaming sector performed well, with tokens like BEAM, PRIME, CHR, RON, IMX, YGG, ENJ up 25-36%.

A new gaming token NYAN was launched and is valued around $300M fully diluted valuation.

The GALA token was hacked for around $200M temporarily before being returned in a strange incident.

Memecoins and Fantom:

Roaring Kitty's Twitter return pumped meme stocks/coins briefly before fading.

Trader DonAlt shorted some memecoins like WIF and PEPE before closing after the ETH ETF news.

Solana memecoins like PONKE pumped over 2x, while some Ethereum/Base memes surged on the news.

Fantom announced plans to rebrand to Sonic with a new SOL token, raising concerns about dilution.

Other Alts:

LINK pumped 20% on news of a DTCC pilot project but faded after the ETH news.

AI coins outperformed ahead of Nvidia's earnings release.

PYTH had a $1B token unlock leading to volatility around a short squeeze.

New token launches included DRIFT on Solana and NOT on TON Network.

MakerDAO plans regulatory-compliant and decentralized versions of DAI under PureDai and NewStableToken.

Other updates

This market report highlights significant news events, emerging narratives, on-chain activities, and technical analysis perspectives, providing a comprehensive overview of the current crypto landscape.

Key News:

U.S. CPI and Core CPI data came in line with estimates at 3.4% and 3.6% year-over-year respectively.

BlockTower Capital's main hedge fund was hacked.

Circle plans to redomicile to the U.S. ahead of a possible IPO.

Bybit was blacklisted in France.

Genesis was approved to repay creditors billions.

The SEC asked exchanges to update 19B-4 filings on an accelerated basis for spot ETH ETFs.

Major Exploits and Project Updates:

Several DeFi projects like AlexLab, Sonne Finance, pumpdotfun, and Gala Games suffered exploits ranging from $4.3M to $22M.

Lens Protocol introduced Lens Network leveraging zkSync.

Maker DAO announced the launch of its first subDAO called Spark.

LidoFinance co-founders and Paradigm funded Symbiotic, an Eigen Layer competitor.

Mantle proposed introducing cMETH and a new governance token.

zkSync teased a v24 upgrade and potential airdrop.

Emerging Narratives and Trends:

$ETH ETF: The SEC approved Ethereum spot ETFs, leading to a surge in Ethereum's price and increased interest in farming GRAIL on Arbitrum for exposure.

HyperLiquidX continues to innovate with a new BFT consensus engine and permissionless spot listings, attracting memecoins and potential project launches.

Layer 3 narrative gained traction with the launch of SankoCorp's Mainnet ($DMT) and accumulation by market makers like GSR.

On-Chain Sleuthing:

Major influencers like Froyo Fan, Loomdart, and MOMIND were spotted dumping significant amounts of $FRIEND token, potentially due to frustrations with the application.

Price Action and Analysis:

The market saw a strong push and break of the trendline, indicating potential re-accumulation opportunities.

Moving averages have reset and are sloping upwards, suggesting a bullish trend.

However, the current push is considered overextended, and patience is advised before opening new long positions.

A pullback and sideways consolidation are expected before the trend continues.

A complete retracement and break of new lows would invalidate the bullish scenario.

Early Projects

Here are 78 early projects found!

Powered by @arbusai