$75M $STRK and $96M $APT unlocks shaking markets

BNB hits ATH, BRETT nears $2B mcap

Mysterious whale dumps $FRIEND - on-chain intel revealed

$ZK airdrop frenzy and 49 new project finds 🧵 👇

Weekly Updates

Token Unlocks:

$75M of STRK (4.9% circulating supply) unlocking June 15, going to investors/early contributors

$96M of APT (2.6% circulating supply) unlocking June 12, mostly to team/early investors

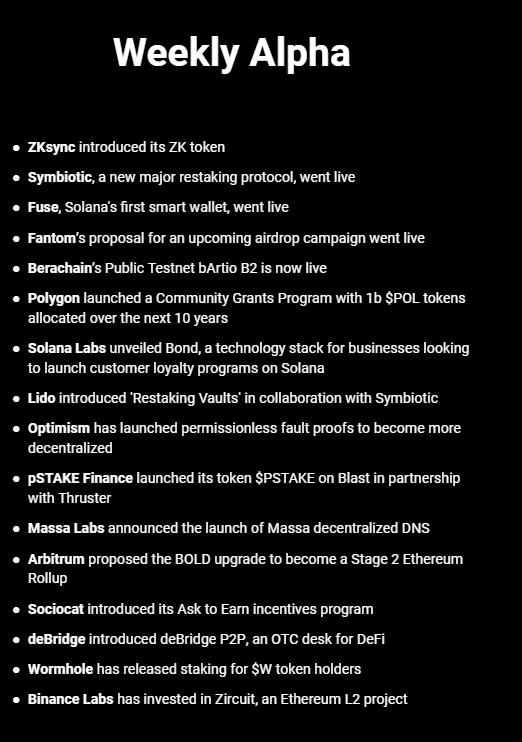

Protocol & Ecosystem Updates:

Metis's Liquid Staking Providers Governance Proposal vote as part of decentralized sequencer upgrade

Fjord Foundry launchpad going live on Solana

Arbitrum ecosystem projects beginning to distribute ARB incentives to users

Everclear (prev Connext) building a "Clearing Layer" to enable seamless cross-chain flows and reduce liquidity fragmentation

Airdrop Opportunities:

Provide ETH or USDC liquidity on Elixir

Mint elxETH by depositing ETH

Supply USDC to DEX liquidity pairs

Points program live until August, low TVL could mean high rewards

Use Rabby Wallet

Offers 10x better UX than Metamask

Launched Season 2 of points program for using the wallet

Pre-sign checks, smooth multichain, and tx simulation

The macro environment remains a key focus, with the CPI data and FOMC meeting likely to drive market sentiment short-term. Rate cuts, whenever they come, could catalyze a major rally.

Meanwhile, the zkSync and $ASI token launches along with the STRK and APT unlocks are important events for those specific projects and their communities.

The Metis upgrade, Fjord Foundry Solana deployment, Arbitrum incentives, and Everclear innovation demonstrate the relentless pace of development happening across L1s/L2s.

Weekly Alpha by @TheDeFinvestor

Narrative Overview

BTC and Overall Market Update

Despite the poor sentiment, especially among altcoin-heavy crypto Twitter, BTC remains close to all-time highs. Notably, there were massive Bitcoin ETF inflows of around $1.8B last week. This, along with BTC's chart, suggests remaining bullish even if choppy consolidation persists in the near-term.

BTC Ecosystem Revival

Bitcoin ecosystem coins were among the week's top performers. Factors likely include BTC dominance rising, the large ETF inflows, and a potential mean reversion after heavy post-halving selloffs.

Stacks (STX) is up 25% in a week, while Ordinals (ORDI), the leading BTC memecoin available on centralized exchanges, has surged 53% since late May. The Runes coins - DOG, PUPS, and WZRD - also saw substantial gains. However, Bitcoin L2s like CORE and MERL have lagged.

BNB Hits New Record High

Binance Coin (BNB) achieved a new all-time high of $720 week, surpassing its prior $690 peak from May 2021. BNB remains well below its BTC-denominated high from December 2022 after outperforming during the bear market. Despite BNB's strength, the anticipated "BSC season" and resurgence of Binance ecosystem alts has not yet materialized.

BRETT Approaches $2B Market Cap

Coinbase's recently launched Base chain is seeing significant activity. BRETT, the leading Base memecoin, is nearing a $2B market cap and has overtaken BONK. However, BRETT's true market value may be lower as its supply is largely controlled by a single entity. Other strong Base performers include BENJI (+400%), TOSHI (+30%), ROOST (+400%) and CHOMP (+180%).

Other Notable Altcoin Moves

KAS gained 40% before the recent pullback

PEOPLE has soared 350% this month, perhaps bolstered by the election year

Privacy coin Monero (XMR) is up 42% since May 1 despite its Binance delisting

Memecoin FLOKI hit a new high of $3.3B market cap, briefly flipping WIF, aided by news of further ecosystem investments

Injective (INJ) jumped nearly 30% this week after a prolonged downtrend

NFT marketplace token SLERF is up 30% with $100M in on-chain liquidity possibly limiting downside

Casino token SHFL doubled this week before retracing half its gains

BANANA is approaching its $52 all-time high, far outperforming bot token rival UNIBOT

Controversial figure Andrew Tate launched the RNT memecoin which spiked to a $100M market cap before settling around $30M, becoming a leading celebrity token alongside Iggy Azalea's MOTHER

The information provided is for educational and informational purposes only. Cryptocurrency markets are highly volatile and risky. Always conduct thorough research and never invest more than you can afford to lose.

Other updates

Major Headlines:

The plans by BlackRock and Citadel to launch a stock exchange in Texas, along with Fidelity tokenizing a fund on JPMorgan's blockchain, show continued institutional interest and adoption of crypto and blockchain tech.

Trump pitching himself as the "crypto president" is an interesting political angle, likely trying to appeal to the crypto voter demographic.

Project Updates:

The Lykke and UwU Lend exploits/incidents totaling over $40M are concerning from a security perspective. Hopefully the root causes are identified and addressed.

Lots of activity around new L1/L2 launches, tokennomics changes, grant programs etc. The space continues to evolve and iterate rapidly.

On-Chain Sleuthing:

The analysis of Machi Big Bro's $FRIEND holdings and recent selling is a great example of using on-chain data to get insights that don't always match the public narratives. Important to track what big players are actually doing with their tokens.

Hot Narratives:

The zkSync airdrop seems to be generating a lot of buzz. The criteria don't seem too restrictive which is good for broad distribution. Price action on the actual token launch will be one to watch.

"Farming" airdrops and incentives like deBridge is popular as always. Have to be careful not to get too caught up in short-term token chasing though.

Cheese Chain is an interesting new "meme L3". While a lot of these meme projects don't pan out long-term, they can generate a lot of hype and trading activity in the short-term.

Market Outlook:

The failure to continue the bullish momentum after peeking above local highs does suggest that the market needs more time to re-accumulate. Staying patient and waiting for decisive moves before jumping in remains prudent.

So in summary - institutional adoption is progressing, lots of project developments of varying quality to monitor, on-chain insights providing an edge, airdrops and meme L3s driving short-term narratives, and an overall market still in a holding pattern after the recent run-up.

Definitely an eventful update that captures a lot of the key things happening across the crypto ecosystem in mid-2024! Let me know if you have any other questions or reactions to the content.

Early Projects

49 early project finds Powered by @arbusai