Happy Lunar New Year to ToE readers! What can we expect from this market pump..

Macro markets are showing signs of bullishness but is this sustainable. Crypto is seeing some plays of pumps, could the dumps be round the corner. A variety of narratives are being shared, so keeping on my toes to find some new projects.

25 long list of alpha projects!

Whale wallet hunting

GTX being a joke and Genesis filed for bankruptcy

Let’s get into what happens for the week.

Hope you enjoy the content, and feel free to connect with me on Twitter here.

Segmenting the megathread of content into 5 parts:

Macro news

Trending narratives

Defi happenings

Educational resources and tools

Spicy crypto drama

1. Macro News

What are the markets looking like now; seems like a bull run eh guys! Hold your horses, here are some key takeaway from @CryptoHayes article called Bouncy Castle

Possibly scenarios:

#1 natural bounce off local lows of $16k, price plateau until USD liquidity conditions improve.

#2 market is frontrunning a resumption of Fed USD money printing

-> 2A: No pivot, $BTC price comes down

-> 2B: Pivot happens, start of bull market rally

I have done a summary of it for you here:

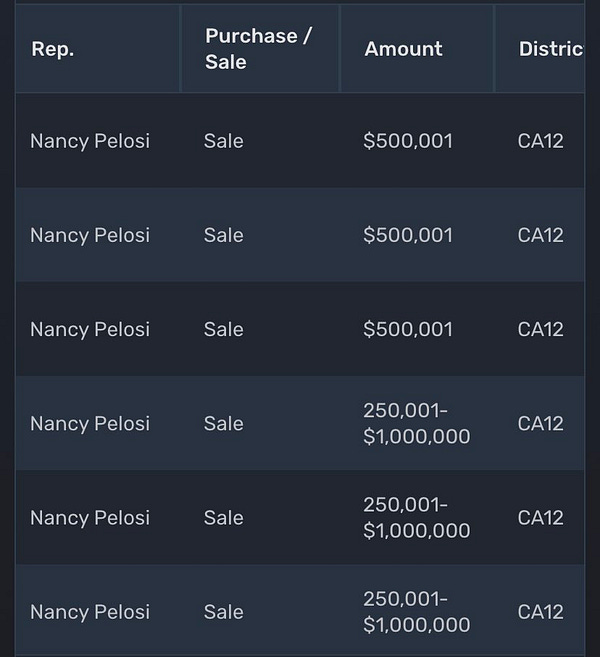

When in doubt follow the politicians? They always seem to know something that we don’t and in one of my previous newsletters, I share how much and which politicians are in profit.

Always DYOR! @DonteCrypto

Thread about the economics of money; how our monetary system and money creation work.

Governments and commercial banks print real-economy money used by us: non-financial private sector agents (e.g. households, corporates); fuelling economic growth.

Central Banks print financial-sector money.

How about the broader macro for crypto?

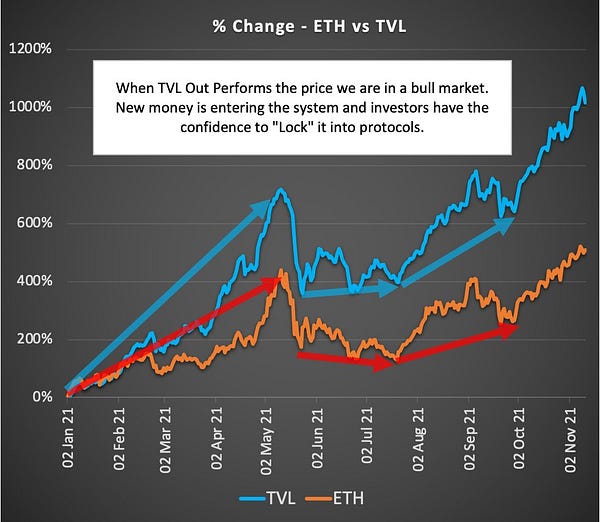

TVL is a frequently used metric and a leading indicator to measure health of the crypto markets.

If TVL is outperforming the price then we are in a Bull market. If TVL is underperforming the price then we are in a Bear market. @PendulumFlow

We could be in a echo bubble phase. But what exactly is a echo bubble? An echo bubble is a post-bubble market rally that results in another, smaller bubble. (from: Investopedia)

We might see a Left Translated cycle:

new ATH before $BTC halving

peaks early and spends more time in a bear phase

@BobLoukas sees an echo bubble as bearish and being a left translated too.

2. Trending Narratives

All of this happened in DeFi last week @TheDeFinvestor

@_FabianHD believes that the Sign-In With Ethereum (EIP-4361) will spur mass adoption. So he plans to Play: Long $ENS Bonus play: Long decentralized wallet providers

@0xkyle__ Weekly Narratives #2 - 16 Jan - 22 Jan, 2023

Solana Summer Ft. Aptos Autumn, Optimism, Stablecoin Summer, App chain thesis, AI Tokens, Liquid Staking / Metaverse Tokens, NFT DeFi,

User-owned casino or "Defi casino" may be an upcoming narrative worth following.

Real innovation with the first crypto-native ETF be created by combining LSD + MEV + DVT + Shared Security @VelvetMilkman

How can you find the best projects around and what to look out for?

If a project ticks all the boxes on the retail narrative, ponzi tokenomics and captures some level of complexity of CT. Then it is a home run + cult leader/gigabrain Its basically convincing the "too good to be true" and gamifying it.

@simiao_li shares his 2023 outlook probably one of the more relevant ones given the time line that we are in. Here is a condensed one version done by @arndxt_xo

@rektdiomedes Polygon Portfolio update

$ETH, $GNS, $AAVE, $CRV, $MATIC, $BIFI, $QI

Strong coin categories @thedefivillain

3. Defi Happenings

Changing up the tone for this section so let me if you like change. It used to be Defi related news at the protocol level and what are the projects about. Now, this section will pack alot of new/alpha protocols, people’s thoughts about certain protocols.

But as always please DYOR. This change up is also because I am also beginnign to see alot of upcomings protocol that are building. And to fit everything in just one newsletter for the week might be too much.

So, here goes….

@MysoFinance improves this "liquidation-centric" design by building Zero-Liquidation loans or quote "DeFi's simplest loan option". @bizyugo

Mirror Trading Platform. Copy the top traders with a single deposit by @GBlueberryClub @monte_xyz

@anthiasxyz does on-chain analytics for all. They continue the work of eGP1 by adding Value at Risk modeling, an in-depth wallet view, and advanced asset/health score filtering for Euler on Anthias.

@JustBetOfficial is here to dominate Betting on @arbitrum @defi_mochi

@Surge_Fi was created to solve the problem DeFi lending protocols due to the lack of reliable and manipulation-resistant price feeds, whether it is just long-tail tokens, LP positions or NFT. @miguelrare

$FOLD looks cheap at $40M FDV @xavana0x

A DEX built on the Arbitrum blockchain. Unleash the power of your assets. Available on Arbitrum Testnet from January 22nd @Accrue_Finance

@PinjamLabs Becoming a true DeFi Liquidity Aggregator. Testnet launched on 18 Jan

Arion Finance is an NFT connected yield-farming and gaming platform with sustainable staking system. Built on #Arbitrum Chain.@arionfinance

Join thier waitlist! VivaLeva is the first leveraged farming service on zkSync. @vivaleverage

ZEXE is soon launching with its unique spot and margin markets, becoming the first Orderbook DEX on #Arbitrum @zexeio

Join the waitilist and follow the link to join in on the fun: https://magpiefi.xyz/waitlist

Factor DAO is a no code vault utilizing any asset to create any type of strategy. One click deposit and passive #realyield generation for investors. The public sale on @CamelotDEX is coming up fast in 5 weeks (announcement soon!).

@Rafi_0x is bullish on $CNC , which has a $21M circulating mcap, $57M FDV, no private salers or VCs to dump, and will launch their Omnipools very soon

@SmileeFinance The first primitive to create Decentralized Volatility Products (DVPs). @blocmatesdotcom

@TrustaLabs Matching on-chain assets with the right users with AI driven sybil detection product. And they raised $3+ million

PvP AMM Synthetic Assets Exchange On @arbitrum @Twinprotocolxyz

$TWIN presale is coming fast…. are you ready???

Resonate facilitates the farming of the issuers leased $GLP principal and transfers ownership of the yields farmable contract (FNFT) which entitles the purchaser to the returns generated during the specified term.

2 week $GLP pool on Resonate.

Beefy: 14% APY

Resonate Upfront: 12.22% APY

Resonate Boosted Yield: 188% APY @RevestFinance

Bunni + Redacted @0xSami_

Undervalued Projects 2023 @corleonescrypto

LP Tokens Liquidity Hub | Yield maximisation for LP tokens @RoeFinance

@landxfinance is a project that is actually farming defi yield on REAL land @RiddlerDeFi

@Mirai_Protocol Holding the $MIRAI token gives you the equivalent of a great dividend.

Mirai is a lending platform built on Polygon #zkEVM which guarantees a faster and cheaper way of using #Ethereum without sacrificing security & decentralization.

4. Educational resources and tools

@tapioca_dao is an omnichain money market. It uses: twAML stands for Time Weighted Average Magnitude Lock.

What is twAML by @tapioca_dao?

twAML stands for Time Weighted Average Magnitude Lock. A mechanism design that seeks to promote economic growth while avoiding the well-known pitfalls of liquidity mining programs

Its an improvement from OHM's (3,3) game theory one more step by creating a Subgame Perfect Nash Equilibrium (SPNE) system. OHM did not achieve SPNE as when rewards become huge, people deviate from (3,3).

OHM achieves only NE but not SPNE.

TWAML mechanism: When the lock time is seen as too long to receive a reward level perceived as equitable, the system will decrease the lock time required to receive an equitable reward until the allocative efficiency is reached again.

Superb thread if you want to learn more about options and how Uniswap v3 is analogous to options. @charlie_defi

@DeFiMinty list of FREE analysis tools you can use to upgrade your Crypto research.

To find Alpha you need to know exactly how This list of 18 tweets & resources will turn you into a pro: @crypto_linn

@0xFlips shared a bunch of whale wallets

A thread of good content in the comment section consolidated by @defiprincess_

@smolmooner shares The ULTIMATE alfa hunting/ crypto gem discovery Bootcamp.

Explorers are unreadable, bubblemaps provide visual analytics and heres how tou can use it to analyse @crypthoem

Discover the new generation of CT threadooors sub 10K accounts that consistently spits Alpha @Slappjakke

@CJCJCJCJ_ analyses a list of the top 10 + 1 wallets on @DeBankDeFi to see what they're up to!

5. Spicy Crypto Drama

@BrettHarrison88 shares his experience at FTX and why he left

@GarlamWON making fun of GTX

Su and Kyle are raising to launch a new exchange called GTX @fintechfrank

@j_austincain shares @Reddit’s blueprint for web2 -> web3 community building

Genesis Global Capital, LLC (Genesis) filed for bankruptcy @cameron

Genesis bankruptcy is going to reveal the entire crypto leverage cycle. @alphaketchum

Appreciate your donation or tipping if you liked this newsletter!